Summary:

- Apple’s partnership with Google on generative AI is a significant announcement that excited investors.

- Microsoft’s partnership with OpenAI has been successful, lifting near-term monetization drivers.

- Apple’s collaboration with Google has given buyers confidence in its AI inflection and could be a game changer.

- I explain why my previous caution on Apple’s lack of AI clarity and weakness in China has panned out.

- With Apple getting ready to ride its AI hype, I see AAPL potentially bottoming at the current levels. Upgrade to Buy.

ozgurdonmaz

The Apple-Google Generative AI Partnership

The most significant announcement that an Apple (NASDAQ:AAPL) investor has likely been waiting for, as Bloomberg first reported Apple’s potential partnership with Google (GOOGL) (GOOG) on generative AI. Investors are excited about the latest developments, although questions must still be asked whether Apple has a definitive strategy against its big tech peers. In my previous Apple update, I cautioned that the uncertainties over China and AI could return to haunt Apple investors. That thesis has panned out as AAPL has markedly underperformed the S&P 500 (SP500) since then.

Microsoft’s (MSFT) partnership with OpenAI has reaped immense rewards, allowing the Redmond company to broaden Microsoft’s Copilot AI across its product suites. As a result, it has already lifted the prospects of near-term monetization, including in its security products. Therefore, I believe it has been instrumental in Azure gaining share against its peers, justifying Microsoft’s significant investments in OpenAI early on.

Google has struggled to bring its Gemini LLM to fruition, hobbled by the recent faux pas surrounding the launch of its advanced LLM. Therefore, Apple’s potential partnership could be somewhat of a saving grace but also potentially lucrative. The licensing opportunity has likely given the market sufficient confidence that even Apple CEO Tim Cook thinks the Mountain View-headquartered company will get it right eventually. While that remains a distinct possibility, I believe Cook also likely viewed an opportunity to license Google’s AI model at a discount, given Google’s challenges. Google will likely jump at the opportunity to access Apple’s 2.2B installed base, helping it to gain wider adoption and scale its model better.

Apple Could See A Marked Growth Inflection

Deepwater Asset Management indicated that Apple could see a 6% increase in revenue based on a “15% subscription rate for personalized AI.” However, Apple might have to weather headwinds on its prized net income margins, “representing a loss of approximately 130 basis points.” While it isn’t expected to be significant for now, investors will likely be cagey about Apple’s AI grand scheme, which is expected to be unveiled at the June WWDC. Therefore, we will likely better understand Apple’s CapEx spending projections to cater to its generative AI ambitions in three months. As a result, the cancellation of Project Titan (Apple Car) makes even more sense now, allowing Cook to reallocate resources and talent to work on Apple’s AI transformation.

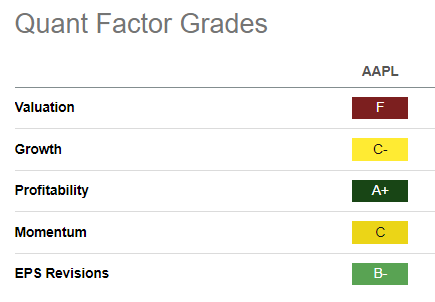

AAPL Quant Grades (Seeking Alpha)

I gleaned that the market has likely marked down Apple’s AI opportunities, as it doesn’t expect near-term monetization. As a result, the market is likely concerned whether Apple’s expensive valuation premium (“F” valuation grade) still justifies its tepid growth prospects (“C-” growth grade).

Analysts’ estimates suggest Apple could report revenue growth of 1.3% in FY24 before a further recovery in FY25 with a 6.3% uptick. Apple can still participate in the growth of the AI desktop/notebook refresh if it can prove the robustness of its AI strategies. While the recent bearish sentiments on AAPL are likely linked to its unclear AI strategies and weakness in Apple’s China sales, AAPL buying sentiment seems to be recovering.

Consequently, I have confidence that Apple’s possible partnership with Google suggests that the Cupertino company is exploring all possibilities. Apple also “quietly” released its MM1 research paper, underscoring its advancements in multimodal AI models.

Apple is looking to advance its ambitions into on-device AI, which is fundamental to its approach to having “AI solutions integrated into its platforms.” As a result, it helps to leverage Apple’s “superior mobile chips and memory architecture.” The acquisition of DarwinAI justifies a move in this direction, given DarwinAI’s focus on creating efficient AI models that can operate on-device. Therefore, Apple has attempted to merge Google Gemini LLM’s capabilities with its on-device AI solutions to outmaneuver Qualcomm (QCOM) and Microsoft in the AI consumer era. It remains to be seen whether Apple’s anticipated AI inflection can be successful. However, Wedbush views the partnership as a “potential game changer” for Apple’s iPhone 16 launch.

Is AAPL Stock A Buy, Sell, Or Hold?

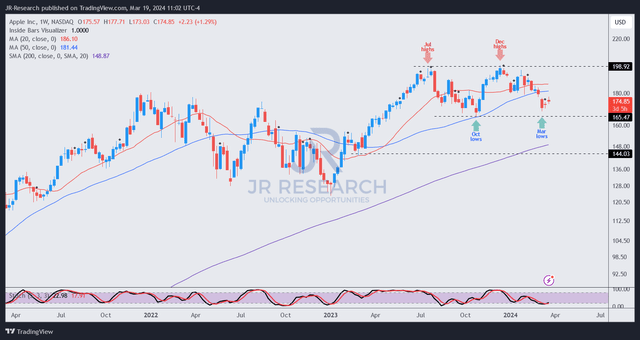

AAPL price chart (weekly, medium-term, adjusted for dividends) (TradingView)

As seen above, AAPL’s price action suggests a possible medium-term bottom bolstered by the support level above the $165 zone. If AAPL buyers can regain buying momentum at the current levels, we could see AAPL maintain its uptrend bias and potentially re-test the $200 level before a decisive breakout.

While AAPL’s expensive valuation remains a key concern, I assessed that the market seems confident that Cook and his team will engineer an effective AI strategy.

Apple’s collaboration with Google has likely afforded buyers confidence in its AI inflection, helping AAPL consolidate constructively over the next few weeks.

With my previous caution playing out accordingly, I assessed it timely for me to consider upgrading my thesis as Apple embarks on its ambitious AI transformation in 2024.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!