Summary:

- Apple Inc.’s financial position remains strong with high profitability and efficient use of capital.

- Revenue growth has been stagnant, particularly in China, and the company’s products are not as groundbreaking as before.

- The company’s valuation suggests it is currently overvalued, and there may be an opportunity to buy at a lower price in the future.

Nikada

Introduction

I wanted to revisit Apple Inc. (NASDAQ:AAPL) after its lackluster performance YTD, and to see how it has performed over the last year. The company is as strong as ever when it comes to profitability, while a lot of uncertainty looms around its ability to retain and grow revenues, however, this negative sentiment may bring the share price down closer to my price target (“PT”), and if the long thesis is intact at that time, I will be starting a position for the long haul. But for now, I am still on the sidelines.

Since the first time I covered the company, its share price has declined around 11% and is underperforming most of the Mag 7 companies. Let’s go through its performance over the last year.

Briefly on Financial Performance

As of Q1 2024, ended 30th December ’23, the company had around $73B in cash and marketable securities, against $95B in long-term debt. That is not a worrisome amount of debt for a company that recently was at around $3T market capitalization. Other income/(expense), which, I assume, has the interest expense accounted for came at -$50m for the three months ended December 31st ´23, while EBIT was just over $40B, so it is safe to say, the company is at no risk of insolvency due to its $100B of debt. It looks like AAPL’s financial position is as strong as ever, flush with cash and outstanding operating performance.

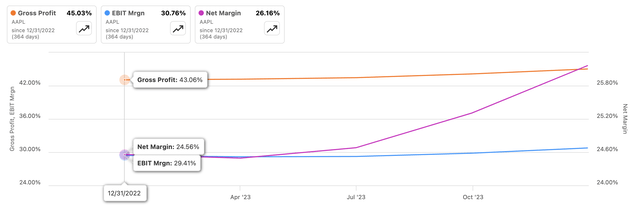

Now, let’s look at how the company’s other financial metrics fared throughout 2023, starting with its margins.

We can see that over the last calendar year, the company saw margins improving across the board, which is no small feat for a company of this size, with the highest improvements seen in gross margins, which came in at around 200bps higher in one year.

Margins (SA)

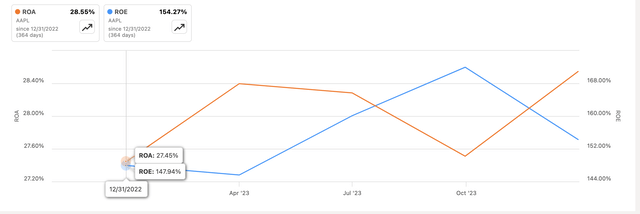

Unsurprisingly, the company still boasts amazing returns on assets and equity, which tells me that the management is doing a great job at utilizing the company’s assets and shareholder capital. With such a strong bottom line, it is hard to beat these returns.

ROA and ROE (SA)

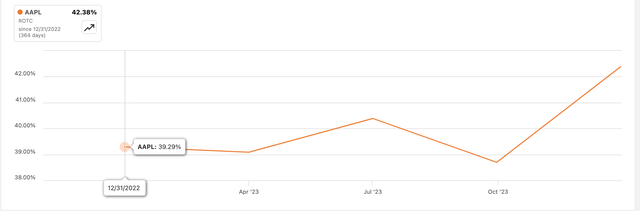

Furthermore, the company has one of the highest ROTC numbers out there and is very consistent. This tells us that the management is using the capital available very efficiently and can generate very high returns on every dollar it invests. We can also observe that in the latest quarter, the company saw its ROTC increase by 3.7%, which is probably due to the company’s release of new products. Moreover, this tells us that the company’s competitive advantage is alive and well, and the company is not losing its moat, but it is still increasing. That kind of strength is worth a premium in my opinion.

ROTC (SA)

So, in terms of efficiency and profitability, the company has not been in a better position since 2012 when we look at the company’s EBIT and Net margins, while gross margins have been at their best since 1990.

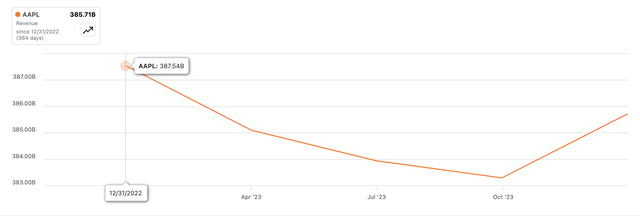

Looking at the company’s revenues over the last calendar year, we can see that revenue has not been trending in the right direction, and only had a boost in sales after releasing the new products during Q1 ’24, which ended December 31st ’23, right for the holiday season. This quarter is usually the strongest for the company, and if we compare the December quarter with the same quarter last year, we can see a slight boost in sales of around 2%, which is not very impressive, however, when the company reaches sales past $100b mark, it is rather hard to improve it further. I wouldn’t mind if the company’s top line growth remains low, as long as it can continue to improve efficiency and profitability, as I believe that is the way the company can still create value for shareholders.

Revenues (SA)

Overall, I can see the company still improving quite a bit. It will be much harder to see any large improvements given its size. However, even small incremental improvements to margins will lead to billions of dollars of savings, which will trickle down to its already robust bottom line. The company’s balance sheet is very strong, and its efficiency and profitability metrics are some of the best I have seen, which in my opinion demands less margin of safety to its fair value calculation, which I will cover in the later section.

Comments on the Outlook

Apple is down around 11% YTD as of writing this article and has vastly underperformed most of the so-called Magnificent 7, except Tesla, Inc. (TSLA) and Alphabet Inc. (GOOG), (GOOGL) to an extent (which I recently did a cover on as I believe it to be underappreciated). So, why such returns so far this year? The total revenue for the year was lower y/y, as all but one region saw y/y declines in sales.

The big reason for underperformance is the decline in sales in China, which is their 3rd largest region behind the Americas and Europe. The company’s market share in China continues to be affected by tough competition from domestic phone makers like Huawei, and the more budget option Vivo. The market share of the iPhone in China slipped to 16%, while the aforementioned domestic phone makers took the top two spots. According to a report done by Counterpoint, iPhone sales in the region dropped a whopping 24% in the first six weeks of 2024, which may mean that the worst is not behind us yet.

The next earnings are going to show lower sales numbers yet again, and I think not just for the Chinese region, but overall. It will certainly not be able to compete with the previous quarter as the end of the year quarter always performs the best.

We can see that the company has been struggling to grow in all regions over the past year. The products are not as groundbreaking as they used to be. The new M chips haven’t changed the landscape since M1 and the performance improvements are not as obvious going from M2 to M3, when going from an intel-based chip to M1 was a game changer.

I think another major reason the company has been lagging behind in terms of performance is the company hardly jumped on the AI hype train. All the Mag 7 companies are prolific in AI efforts, while Apple has been chugging behind them, and it begs the question is it too late to catch up now? The company’s Siri assistant has been left behind when compared to Google Assistant and Alexa. I have all three and Siri is unused all the time. It seems that the company is taking quite a different approach to AI than its peers, putting focus on user experience rather than pure AI play like many of the competitors attempting to do.

This makes sense to me. The company’s products are easy to use and don’t require much setting up. iPhone and MacBook are very easy to use because it is made for the masses who look for simple UI and UX, so further improving this with smart AI implementations will make the user experience even smoother than it already is. I recently switched to a MacBook Air, and I couldn’t be happier with how easy it was to set it up, and how easy it is to navigate, and that’s coming from a person who has been a Windows user all his life.

Just as a side note, Tim Cook used the term “AI” only 5 times in the Q4 earnings call and only twice in the latest one. You need to say it at least 35 times so that the share price rallies 10%. I jest of course.

The recent scrapping of its “iCar” project and shifting resources to AI is a sign that the company is taking ML/AI more seriously. However, is it a little too late? Probably not, but it sure is going to take a while to catch up going forward.

Another negative I could see from the company’s products is the new Apple Vision Pro. The reception of the headset has been mixed. Some reports suggest that even the diehard fans of the company have been returning the headsets due to headaches, no killer app that would justify the purchase, or are very heavy and uncomfortable, and not worth the price point. On the other hand, there are articles like this that say the refunds are not something that is out of the ordinary and are in line with “not-Pro iPhone levels.” The headset has a very polarizing reception, so take these with a grain of salt. I would like to hear how the headset is going to do in the next couple of quarters. I’m sure over time, the headset will come down in cost and to be honest, I don’t know if VR/AR ever be widely adopted.

Valuation

It’s been a while since I did a discounted cash flow (“DCF”) valuation for the company, so I went ahead and updated some inputs and my assumptions changed slightly from before.

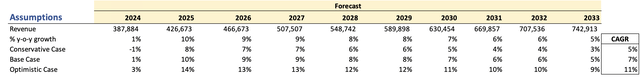

For revenues, I went with around 7% CAGR for the next decade, which I don’t think is too ambitious, given the technological advances, and if AAPL doesn’t drop the ball on innovating. I could see the company’s revenues doubling in the next decade. Also, my estimates are not too far off from analysts. To cover my bases, I went ahead and modeled a more optimistic outcome and a more conservative one. Below are those estimates, and their respective CAGRs.

Revenue Assumptions (Author)

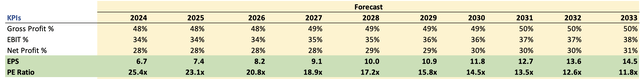

In terms of margins and EPS, I assumed slight improvements in gross margins over time of around 200bps, which is quite conservative in my opinion, given the fact that the company managed to improve by that much over a year. Below are those estimates.

Margins and EPS assumptions (SA)

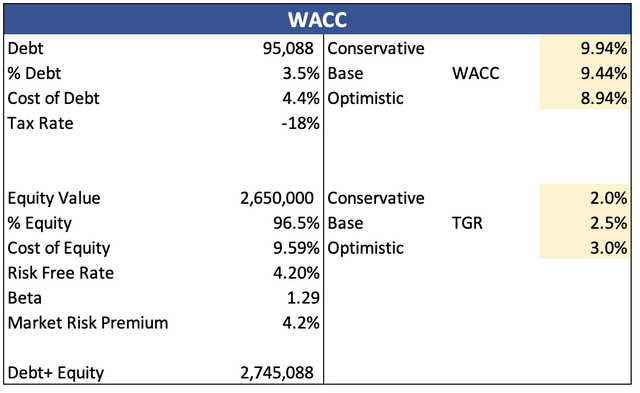

For the DCF model, I went with the company’s WACC of around 9.4%, with the breakdown of how I came to the number below, and a 2.5% terminal growth rate, as I would like to see the company growing at the target U.S. inflation rate on average.

WACC Calculation (Author)

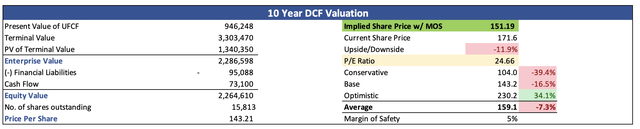

Furthermore, as I mentioned earlier, the company’s high ROTC demands higher premiums on its shares. Therefore, I went with an additional 5% discount instead of my usual 15%-25% on the final fair value calculation. With that said, AAPL’s intrinsic value is around $151 a share, which means the company is still trading at a premium to its fair value.

Intrinsic Value (Author)

Closing Comments

So, it looks like even after such underperformance, Apple Inc. is still not a buy for me. Even with what I could probably assume are quite optimistic revenue estimates and lenient inputs, the company is overvalued and wouldn’t be a good time to start a position.

However, I think there will be an opportunity to start a position in a company that should be in everyone’s core portfolio because the China worries and general declines in revenue may persist a little longer, which will certainly bring down the stock price further, and when I get the notification that my price alert has been hit, I will be the first one to finally jump on board at a reasonable price for the long haul. Unless the company’s revenues and profitability plummet, then even if my PT is hit, I will have to re-assess to see if the long thesis is still intact.

If Apple Inc. cannot find ways to keep growing, I would like to see it giving back to shareholders via a dividend increase or further share repurchases, as it is a better use of resources than hoarding all of that cash. I’m sure that will attract quite a few investors.

Until then, I’ll keep sitting on the sidelines and check in once in a while to see how Apple Inc.’s share price is behaving over the next couple of quarters, as I am sure there will be a lot of volatility and uncertainty.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.