High-Quality Dividend Growth Near 52-Week Lows: Apple Is Attractive

Summary:

- A list of high-quality dividend growth stocks trading near 52-week lows is evaluated based on Historical and Future Fair values.

- Apple appears to be near fair value, and trading near 52-week lows could be at a favorable entry point for long-term investment.

- The current risks facing Apple appear to be well managed, and the fundamental business is well positioned for continued growth.

- Bristol Myers Squibb and Cisco also appear to be attractive investment opportunities based on their historical and future fair values, as well as analyst estimates.

Justin Sullivan/Getty Images News

Introduction and Background

The market, as a whole, continues to appear to be overvalued, and it has been hard to find good opportunities to put my capital to work at valuations that I am comfortable with. I am not necessarily a deep value investor, but I also don’t like to feel like I am drastically over-paying. Even though it has been more challenging, I have been finding some stocks that appear attractive. Maintaining a watch list of around 100 high-quality dividend growth stocks that I regularly value helps to identify opportunities when they do arise.

On top of regularly calculating fair values for my watchlist, one of my favorite ways to look for value in this high-quality dividend growth space is to screen for those stocks trading near 52-week lows. I decided to filter my watchlist by companies that are trading at less than 30% of their 52-week range (52-week low being 0% and 52-week high being 100%).

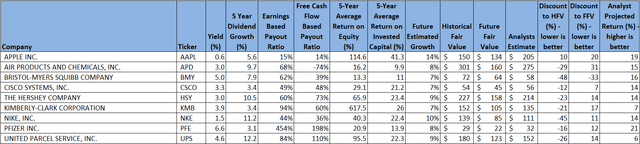

Using this first pass criteria, we will be looking at the following list of companies:

Finbox, Seeking Alpha, Author’s Analysis

Fair Value Estimation

As I’ve described in previous articles, I like to calculate a fair value in two ways, using a Historical fair value estimation, and a Future fair value estimation. The Historical Fair Value is simply based on historical valuations. I compare 5-year average: dividend yield, P/E ratio, Shiller P/E ratio, P/Book, and P/FCF to the current values and calculate a composite value based on the historical averages. This gives an estimate of the value assuming the stock continues to perform as it has historically. I also want to understand how the stock is likely to perform in the future so utilize the Finbox fair value calculated from their modeling, a Cap10 valuation model, FCF Payback Time valuation model, and 10-year earnings rate of return valuation model to determine a composite Future Fair Value estimate.

I also gather a composite target price from multiple analysts including Reuters, Morningstar, Value Line, Finbox, Morgan Stanley, and Argus. I like to see how the current price compares to analyst estimates as another data point, and as a sanity check to my own estimates.

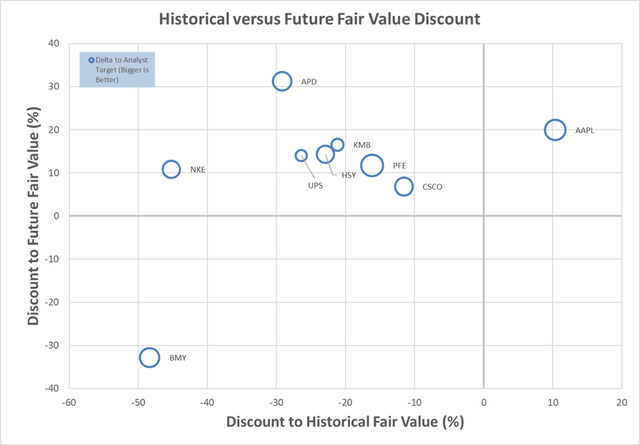

Plotting three variables on one plot is tricky but using a bubble plot allows us to visualize three variables by plotting the Historical fair value versus the Future Fair Value on a standard x-y chart, and then use bubbles to represent the size of discount relative to analyst estimates.

Author calculation of Historical and Future Fair Value, analyst estimates

This chart is insightful once you understand how to interpret it. What we are looking for are stocks that are trading at a discount to both the Historical Fair Value and the Future Fair Value. So, those stocks that are farther to the left, and farther to the bottom, are potentially the stocks trading at the largest discount to fair value. This would be the bottom left quadrant of the graph. Additionally, those stocks with the biggest bubbles are the stocks that are trading at the largest discount to analyst estimates, so in theory, stocks in the lower left quadrant that also have large bubbles, should be decent candidates for investment.

The chart suggests that Bristol Myers Squibb (BMY) appears to be very attractive from a Historical Fair Value and Future Fair Value perspective, as well as having potential based on analyst estimates. Additionally, Cisco (CSCO) appears to be trading at a good discount to Historical Fair Value, while being close to Future Fair Value, with upside based on analyst estimates.

I own all the stocks in the list / chart except for Kimberly-Clark (KMB). I have recently added to my positions in Hershey (HSY) at $188 and in Nike (NKE) at $92. I already have a full position in Bristol-Myers and am close to adding to my position in Cisco with a target around $47.

If you are interested, I have relatively recent articles that are still relevant for Nike, Bristol-Myers, and Pfizer. These will provide my views of strategy, valuation, and long-term investment.

I mentioned above that I am not necessarily a deep value investor. Along those lines, I have been invested in Apple (NASDAQ:AAPL) since 2015. I have added to my position a few times, but not since 2020. It has been one of my best overall investments, and I regularly watch for opportunities to add further to my position. The valuation never quite seems right for me to pull the trigger, but this is a good example of valuation not always being the entire predictor of success. With Apple now trading close to its 52-week lows, and within about 10% of its Historical Fair Valuation, my question is, should I add to my position in this very high-quality, popular stock? So, let’s dig in to see what we learn.

Apple Analysis

Let’s start with the basics. AAPL has a 5-year average Return on Equity of 115%, with its most recent ROE of 154%. The 5-year average Return on Invested Capital is 41% and its most recent ROIC is 58%. There are several things I look for here. First, these are truly stellar numbers. There is a reason that this company is so popular as an investment, and successful. Second, the most recent numbers are above the 5-year averages. This is at least one indicator that the business is not in decline. Third, there is a gap between ROE and ROIC, which does suggest that the company may be using leverage as part of its returns. This is a well-known fact in AAPL’s case, however, as we’ll see, the use of leverage has been prudent, and likely also been accretive to investor returns. Finally, when we compare the Weighted Average Cost of Capital (around 9%) to the ROIC, it shows that there is a lot of margin for growth and returns.

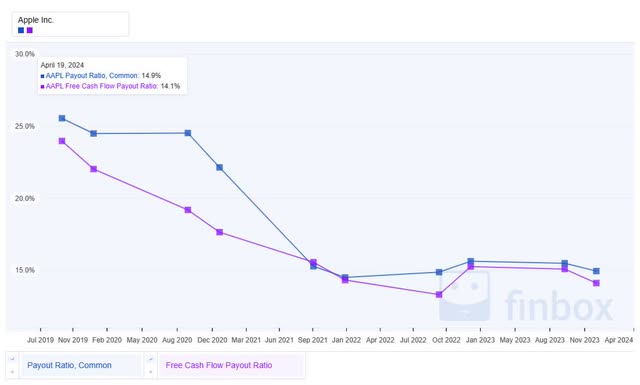

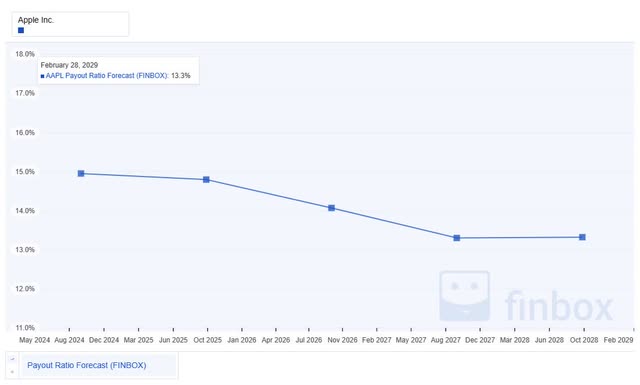

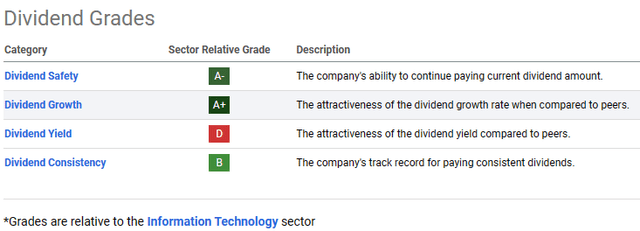

From a dividend perspective, the earnings-based dividend payout ratio of 15% and free-cash-flow-based dividend payout ratio of 14% are both excellent. They have paid a growing dividend for around 12 years now. For all that the payout ratios appear to offer a lot of flexibility for growth, the dividend growth has been very conservative (around 6%) and that is on top of a low starting yield (around 0.6%). So, AAPL is more of a total return play, than pure dividend growth play. Morningstar rates AAPL as wide moat, with exemplary capital management, and currently has a 3-star valuation rating.

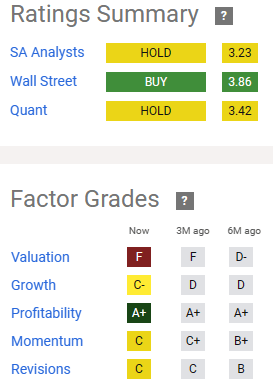

Seeking Alpha makes available a summary of ratings, as well as factor grades. These make for another nice, first pass filter for investment timing.

Seeking Alpha

Starting with the top stop-light chart – I would say AAPL is somewhere between a strong Hold and weak Buy rating.

The Factor Grades are relative, and therefore very dependent on the peer comparisons. To me, the overall grades around C suggest fair value, and there might be a tradeoff between it being one of the most profitable companies in the comparison, with one of the worst from a relative valuation perspective. The question remains, is it worth paying up for potential quality?

Apple Historical Analysis

Before we dig deeper into the growth, I do like to look where things have been in the past. I think we realize that past performance can be somewhat indicative of the quality of the company. Obviously, it’s important to understand the key drivers for that past performance, to see if you believe anything has changed that could impact that. So, let’s start with how AAPL has performed for shareholders in the past:

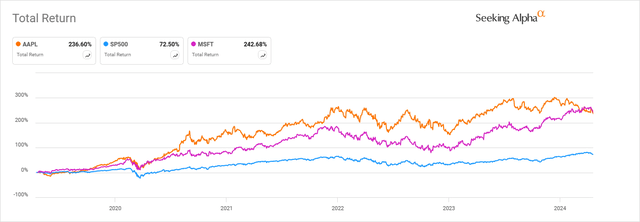

First, AAPL has performed very well compared to the S&P 500 over the past 5 years. I also threw Microsoft onto the comparison, not because it is a direct peer, but because the subscription and services-based business models are important to both, they are both mature tech companies, that are still considered leaders, and they are also two of the highest quality, most influential companies in the tech space. AAPL had outperformed MSFT for many years. However, the gap has now closed.

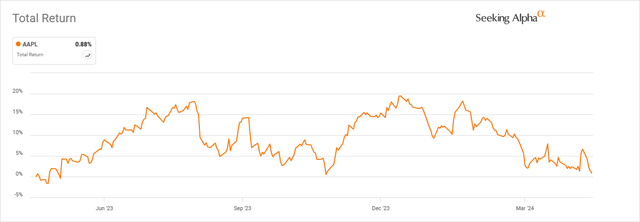

One other thing I do find interesting, let’s look at the price chart for AAPL for just the past year.

Obviously, the stock has seen some ups and downs the past year, but it is back to about where it was a year ago. Aligning to the proximity to 52-week low, has this resulted in a more attractive valuation, or is this an indication of potential decline?

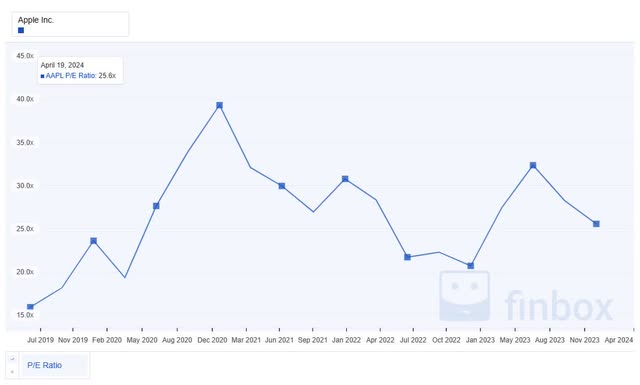

Let’s now see if valuations have improved relative to history with the decline in price, or if we are seeing overall degradation. Let’s reference P/E and yield for this.

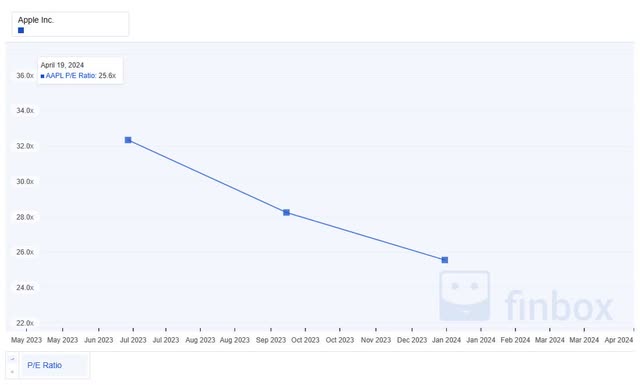

From a 5-year P/E perspective, AAPL is not quite back to where it was, and is trading right around the 5-year average of 26.

Looking at it for just the past year though, it does look like valuations have improved relative to the start of the year, so the price decline has not seen a deterioration in fundamentals yet, just an improvement in valuation. From a P/E perspective, it seems like AAPL is likely close to fair value.

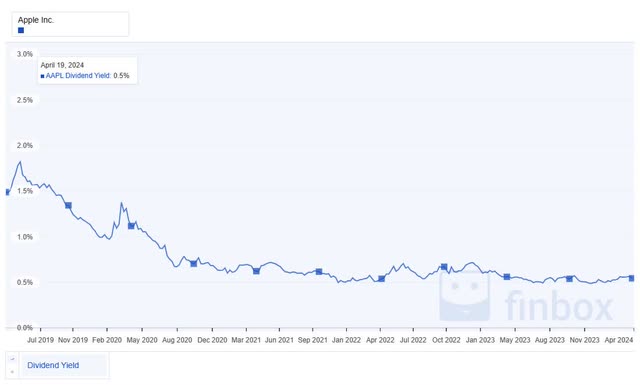

From a Yield perspective, it is still trading below the 5-year average of around 0.8%, but about flat to a year ago. So, the yield suggests, at best, fair value.

For me, a key takeaway from the historical analysis to this point is that there does not seem to be evidence of decline. The valuations have improved relative to earlier pricing, but the underlying performance does not seem to be deteriorating.

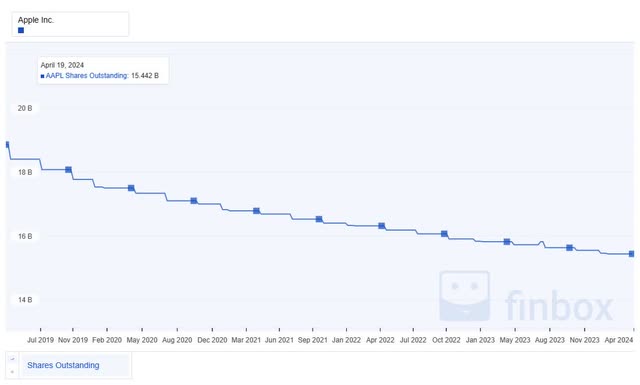

AAPL continues to aggressively buy back shares. There is always an argument to be had for timing of buybacks, however, a company that routinely buys back shares inherently takes advantage of dollar cost averaging. Compared to other companies that buy back a lot of shares, but effectively just offset equity compensation, AAPL’s buybacks are clearly reducing shares outstanding. I also like aggressive buybacks in that they make the dividend more sustainable, can be a lever for more dividend growth, and also are a safety net that can be used in the case of financial trouble, before dividends need to be cut.

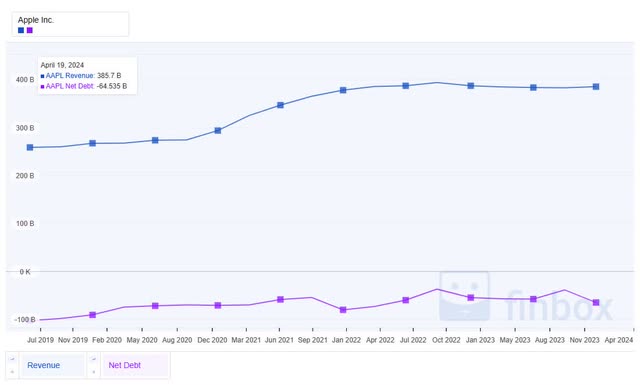

AAPL has a very strong financial position, and is one of the largest, most financially stable companies in the world, with a negative net debt position. The cash on hand is large enough to buy out many large companies, and yet, AAPL tends to show a lot of restraint from an acquisition perspective.

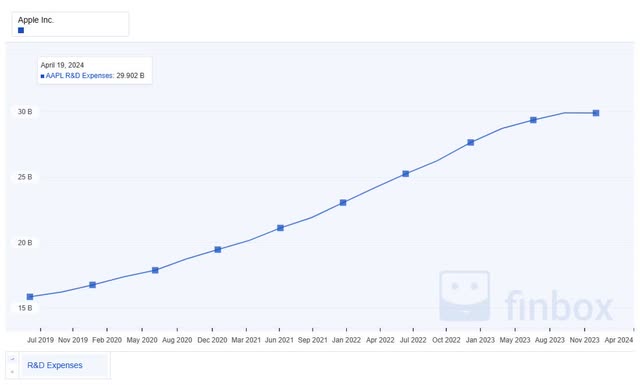

For a technology company, that at times doubles as a large growth company, another important consideration is R&D investment. Obviously, successful companies have many ways to use their profits, including buybacks and dividends. They can also acquire other companies, but something I like to see from my high-quality companies is reinvestment. Especially when the ROIC is so high, attractive reinvestment back into the business is one of the best investments in my opinion. AAPL has been increasing R&D consistently.

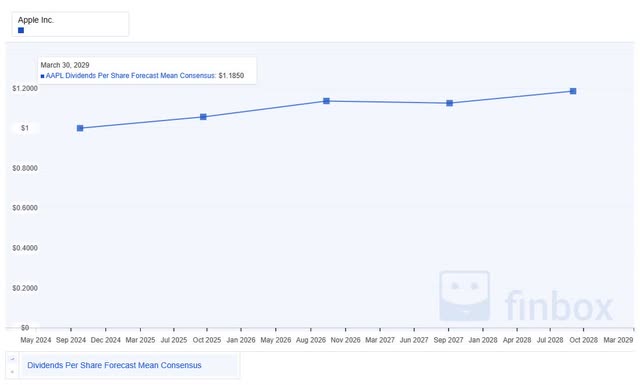

AAPL has paid a growing dividend for around 12 years and has historically demonstrated conservative, but consistent dividend growth.

The earnings and free cash flow-based payout ratios are very healthy and have improved over time. Based on free-cash-flow, which is how dividends are paid, it looks like a higher level of growth could be managed. At a minimum, this gives us a lot of confidence that the dividend is sustainable.

Apple Future Analysis

What has happened in the past is obviously one thing, where the company is headed in the future is the real question, especially when it comes to companies that play in the technology and growth departments.

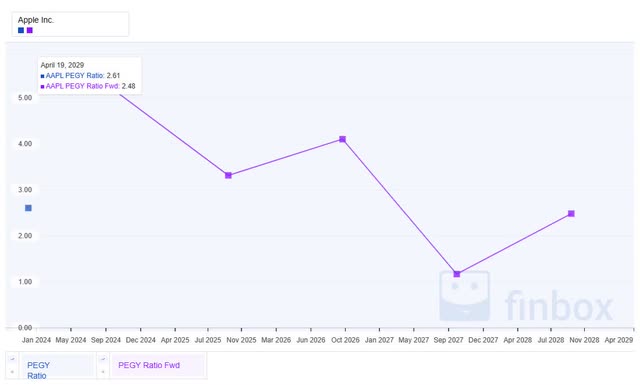

Looking to the future, maybe the decline in price isn’t about what is currently happening, but what is yet to happen – is this an indicator of decline to come? If we look at the current PEGY ratio compared to future projections, we do see a potential problem. The ratio right now is not very attractive, at around 2.6, but the near-future ratio looks much worse. A real slowdown in earnings growth and yield is expected. Hence, the current valuation may be fair, but perhaps the near future valuation may not be.

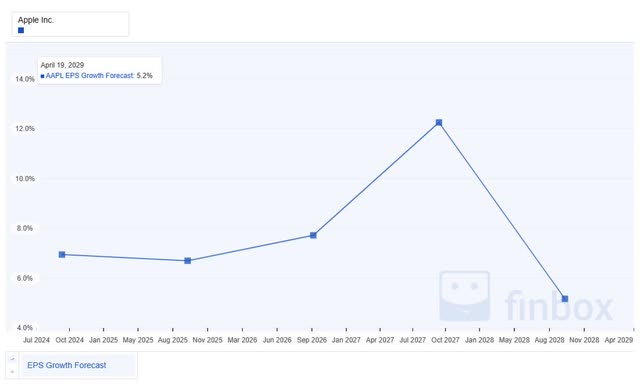

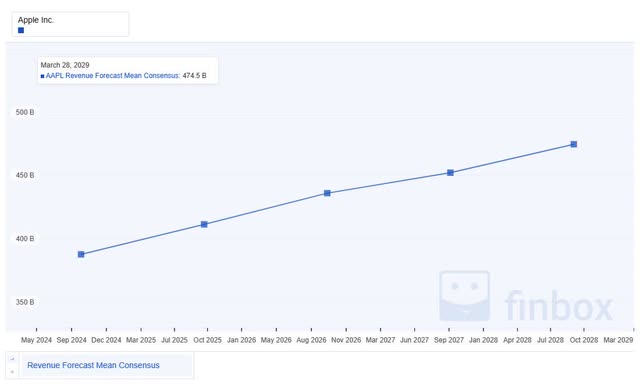

From a future earnings per share growth forecast, things don’t look that bad, with growth projections in the upper single digits. Growth may not be explosive, but it’s still there.

Looking at the past predictions for future growth do start to show the problem with the PEGY ratio, and potentially help explain the price declines. Whereas future growth has been projected to be mid-single digit, past growth has been expected to be low double-digit. This degradation in growth expectations hurts future valuations and market sentiment.

My own estimate for AAPL’s forward growth is around 14%. I derive this from a combination of various growth projections and growth models. My estimate is obviously higher than current analyst estimates, and if correct, could indicate that the lower valuation is attractive, as opposed to being a value trap.

For a dividend growth investor, understanding future dividend growth potential is also important, especially in as much as it is sustainable. Here are the long-term dividend growth projections for AAPL. The forecast growth looks consistent. Again, an investment in AAPL, especially at the current yield is a long-term dividend growth play, and realistically, is more focused on total return than pure dividend growth. However, as we’ve shown, the potential is there for much more aggressive dividend growth in the future.

The future projections for payout ratio show a lot of margin for growth, or safety and sustainability.

Since EPS is not a full indicator of growth, the other thing to tie out is revenue. Revenue is expected to continue on a healthy growth projection, in a stable way.

The Seeking Alpha Dividend Grades show the potential in this investment, with strong relative scores for safety, growth, and consistency – all things we like to see. We know the yield is low.

Risk

Let’s end our journey with a brief discussion on risk. As I think about continuing and adding to my investment in AAPL, it really comes down to three things: competition, geopolitical, and antitrust.

From a competitive perspective, given the high ROE and ROIC, there is a lot of hungry competition. In smartphones, many of the Chinese companies are becoming much more competitive, and with some of the nationalistic politics currently at large, Chinese consumers are increasingly adopting local alternatives, pressuring this important source of revenue. AAPL has other strong competition worldwide, and recently lost its standing as top smartphone maker to Samsung. A decline in phone sales not only impacts that business division, but also impacts future potential subscriptions and services revenues.

Geopolitics are tough to avoid these days with companies threatening to ban each other’s hardware and software, international companies that are dependent on those markets could pay the price. Cook has been playing both sides of this risk by working closely with China, even through government bans in Chinese agencies, and also looking beyond China for manufacturing resiliency, as well as market growth, expanding in India, and looking to Indonesia and Vietnam.

The antitrust issues are significant and could be especially damaging to the services side of the business. However, history has shown many times over that the market reaction to these threats is often greater than the actual impact. Microsoft is a good historical case study, having to make certain concessions to avoid antitrust, but largely maintaining their strong market position that continues to prevail today. I believe that as long as AAPL continues to produce compelling products that people want to buy, people will tend to continue to use AAPL subscriptions and services, even if there are other options available. I also believe that AAPL is proactively managing this risk through concessions they’ve made to payments within the marketplace, as well as right to repair, which may actually drive incremental new business.

From a financial and quality perspective, there does not appear to be much risk here. AAPL is rated AA+ by S&P, Aaa by Moody’s, and the Value Line Financial Strength rating is A++. As we discussed previously, Morningstar rates it as Wide Moat with Exemplary Capital Management. This is one of the most financially strong companies in the market, in size and quality.

Summary

AAPL is a very high-quality company and has been an exceptional investment for me for many years now. Though the current Historical and Future Fair valuations are not overly attractive, I do believe that it is coming back into fair valuation range. Analysts also project upside to the current price. AAPL does not go on sale very often, though I also believe that it may be falling out of favor. There are some risks, but I also believe the company is managing those risks well. With the stock trading near 52-week lows, and close to the same price as a year ago, with no obvious degradation to this point in the business, I think there is opportunity here.

I am not good at predicting what will happen in the short term, and with earnings coming up in a few weeks, there is always risk with buying into earnings. However, given my long-term focus, I am going to likely dip my toe again around $165. If it goes down further from there, I will likely take the opportunity to average down. Lacking a lot of attractive valuation options in the market right now, buying high-quality, at fair value seems like a good strategy for me.

Based on the initial analysis in the article, I also believe that Bristol Myers Squibb is currently very attractively valued and will be keeping a close eye on Cisco as well.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, APD, BMY, CSCO, HSY, NKE, PFE, UPS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.