Summary:

- Apple is nearing a $3 trillion market cap, but its overvaluation and risks to its narrative could lead to a stock correction.

- Despite efforts to grow services and diversify revenue, Apple’s growth and margins remain similar to a decade ago, and external risks such as China and App Store regulations pose threats.

- I rate Apple a “Sell,” there are better investment opportunities elsewhere.

XiXinXing

Introduction

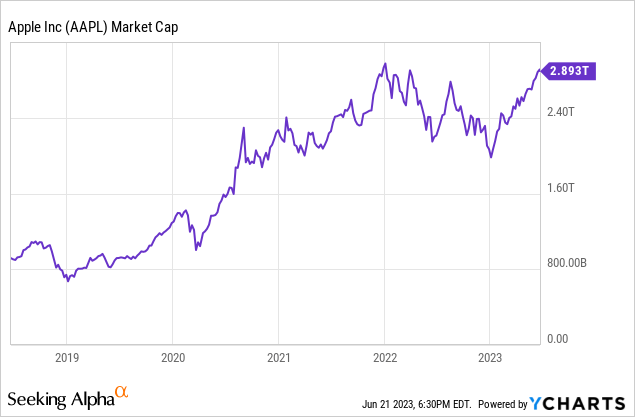

Standing at a $2.9 trillion market cap, Apple Inc. (NASDAQ:AAPL) is nearly set to become the first-ever company to reach a $3 trillion market cap. This comes after they were the first company to hit the coveted $1T and $2T levels.

After its share price struggled in 2022, Apple’s stock has been off to the races so far in 2023, boosted by a flight to quality, and/or the upcoming launch of the freshly announced Apple Vision Pro.

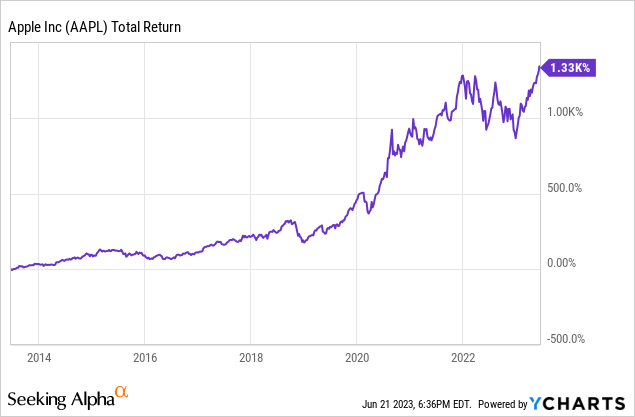

Whatever the reason, undoubtedly, over the past 5 years, Apple has been one of the strongest-performing investments investors could have chosen.

For a company long known as just a smartphone maker, this impeccable return probably surprised many, myself included. But its stock price has continued to blast away, rewarding the many Apple shareholders.

Can this last forever? Well, clearly it cannot… companies can only outgrow GDP for so long, otherwise they would become the entire economy. That’s just an economic reality.

So the real question is then: when will Apple’s share price growth slow down, and by how much?

While I am no advocate of market timing, I am also pragmatic in terms of my capital allocation, choosing to reallocate some capital from my best-performing stocks to underperformers, which is why I’ve put together this bearish piece on Apple, as I believe now is a good time to lock in gains.

Context: The Importance of a Narrative

Before I get to why I am bearish on Apple, I think it’s worthwhile to discuss how they’ve got to where they are today.

Apple is a company with a storied history. Its near failure and the creation of the iPhone are worthy of an article just on their own. But that is not the purpose of this article. For now, I’m going to assume you are familiar, at least at a high level, with Apple’s early history.

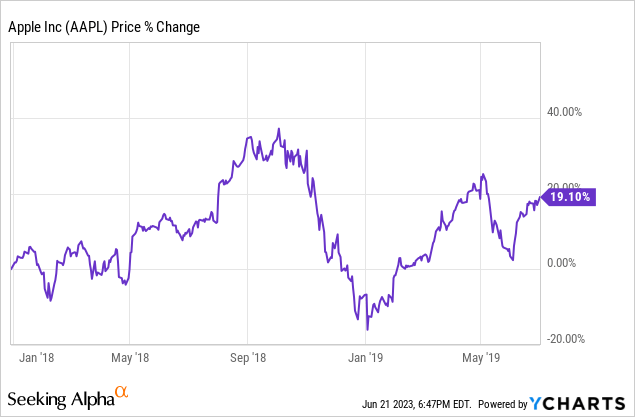

What I want to shift your attention to specifically is the 2018 to the mid-2019 time period. For reference, here’s how Apple’s share price performed in that time period:

As many long-term shareholders will remember, in Q4 of 2018 Apple’s share price took an absolute shellacking.

But why? The narrative had changed.

Sure, people were continuing to buy iPhones, but that growth was slowing and they were being perceived as a one-trick pony company where the bulk of its revenues came from just one product, the iPhone.

In the long term, companies trade on fundamentals, but in the short to medium term, it’s the story, the narrative, which matters most.

In 2018 the narrative shifted from a story of secular growth to a company at its peak with no room left to grow. Or, for those who were more bearish, the narrative was that Apple was at the start of becoming the next BlackBerry (BB), or the next Sony Walkman (SONY).

While we can laugh at the naysayers now, it’s important to avoid arrogance. After all, no company in the history of consumer electronics has had the success Apple has. Historically, consumer electronics companies have waned in popularity over time, and Apple has been the rare exception to that rule.

Services: A “Game Changer”

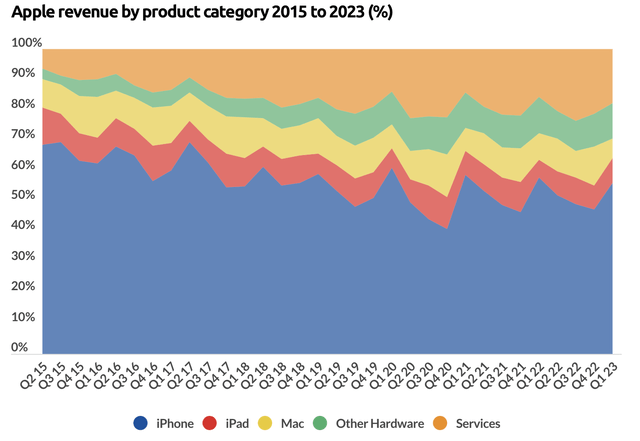

After the selloff, things began to change at Apple investors pushed Apple to diversify its revenue sources so that’s just what Apple did. Sure, they continued to launch new physical products including Phones, Headphones, Watches, Computers, and Tablets, but they also pushed heavily into digital services.

In a few short years, Apple launched subscription services for TV, Music, Games, and News…. just to name a few. They then included these revenues inside of its “services” segment.

But they didn’t stop there, they also monetized its huge customer base more effectively than ever before by capitalizing on growing in-app purchases and subscriptions made on its app store. The results speak for themself:

Apple Revenue by product category (Business of Apps (company data))

Clearly, the strategy paid off for Apple, as they were able to rapidly diversify revenues away from the iPhone and were subsequently rewarded by investors with a premium multiple.

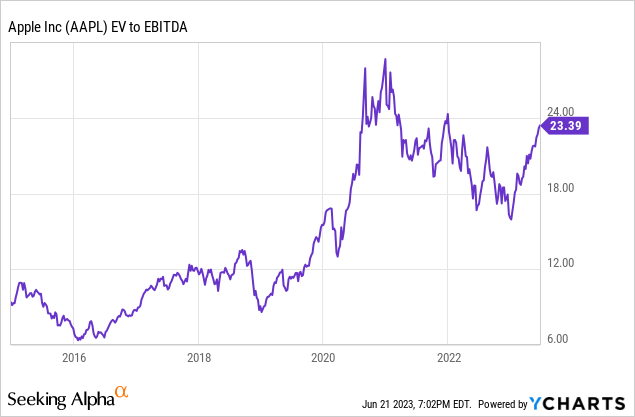

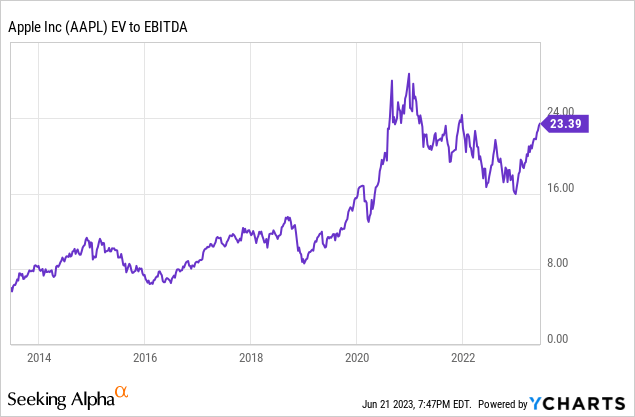

After their push towards services, Apple’s EV To EBITDA multiple grew from 10-12x to over 20x in just a few short years. Wow! Talk about multiple expansion.

Not So Fast

While possibly great for prior shareholders looking to sell, it’s my view that at a 23x multiple, buyers today should expect more modest returns going forward.

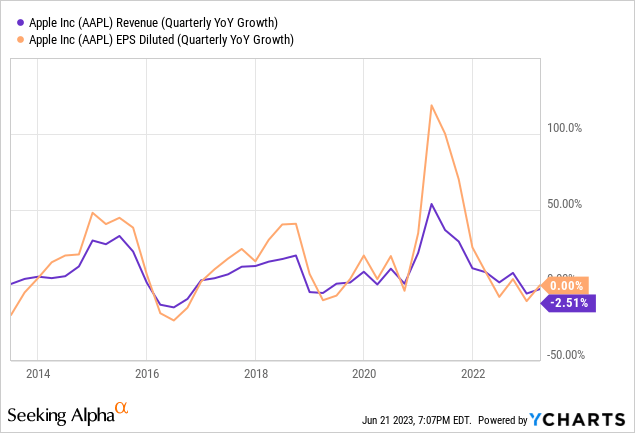

With such a huge increase to the multiple, one might similarly expect a hugely improved business. And while the growth of the services category is positive, it’s not revolutionary, maybe not a “game changer” after all, at least if revenue/EPS growth and margins are any indication.

Over the past decade, Apple’s growth has been quite cyclical, toggling between periods of high growth (new product launches) and stagnation. While innovations such as the Apple Vision Pro and the long-expected Apple Car could boost revenue growth in the future, I’m skeptical that either will result in a changed long-term growth story for the company, they are just the next hot item.

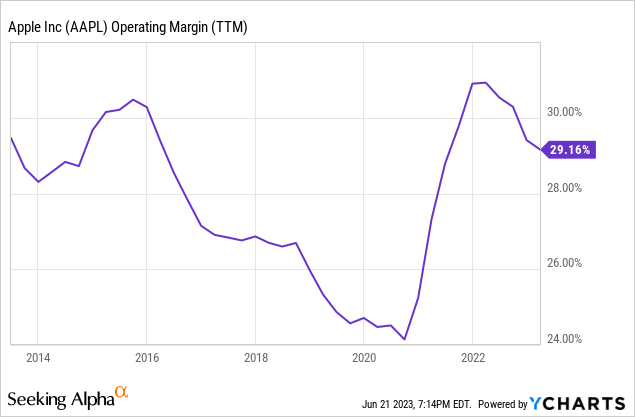

The operating margin tells a similarly depressing story, despite all the efforts to grow services, margins remain where they were prior to all that investment.

From my perspective the narrative has changed investors are focused on services, AI, the Apple Car, and the Apple Vision Pro, but the fundamentals of the business are somewhat similar to where things were a decade ago.

Risks to the Narrative

Since so much of Apple’s returns were driven by multiple expansion it stands that a changing narrative could just as easily wipe away much of the return. As an illustration, if shares were trading at the EV to EBITDA multiples they did in 2017-2018 shares could drop as much as 50%! Given the slowing growth and maturity of the business model, I see that as a real possibility.

Other risks that face Apple include the growing threat of China which Apple relies heavily upon for assembly. Should China move to forcibly reintegrate Taiwan, regardless of a U.S. military response, I feel that Apple would be one of the first casualties given the strong leverage China has over them vis-à-vis supply chain reliance. As hawks garner more support both in China, and the U.S., I expect this risk to increase over time.

The third large risk I see for Apple is the App Store. Apple’s “toll-road model” whereby they take a large cut of developer sales as pure profit seems to be at risk. As phones have become the computers of the modern age, I expect more countries to move in a similar fashion to countries like South Korea whereby Apple is forced to allow third-party payment options. Third-party app stores and payment services pose a huge risk to Apple’s growing services segment. I speculate that Big-Tech hawk Lina Khan would be sympathetic to similar restrictions being imposed in the U.S. given her track record of going after big tech companies (the Microsoft and Activision deal, for example).

Risks to the Bear Thesis

Markets can remain irrational longer than you can remain solvent.

-John Keynes

While I am confident that Apple is overvalued, I am less confident about the timing of any correction. In the market there I see two forces working against any correction and helping to support Apple’s current valuation. The AI-induced bull market, and Fed’s expected end to rate hikes (expectation for rate cuts).

Following the widespread notoriety and adoption of ChatGPT a tech rally has broken out helping to lift nearly all tech stocks, including Apple. As animal spirits seem to be back in the market, shorts are at a relative disadvantage in battling the bulls.

Further supporting Apple’s stock price is the feds slowing the pace of rate hikes as inflation continues to come down. Should inflation come down to sufficiently low enough levels the Fed is likely to begin cutting interest rates, which serve as gravity to stock prices.

Because of the AI bull market, and the Fed timing, the exact moment the narrative will change is very difficult to predict, that said, I do believe the narrative will change eventually.

Conclusion

Comparing Apple’s valuation to other companies doesn’t make much sense to me. There is truly one Apple, no other company comes close. While there are no true peers, we do have a history as a guide: from the recent lows made in early 2019 Apple’s EV to EBITDA multiple expanded from 8x to 16x just before COVID struck, it’s only more recently that Apple’s multiple has expanded to 23x. Because of that, I believe it’s entirely reasonable that Apple could reapproach that pre-covid level of 16x once again.

A 16x multiple would imply a share price of $126, which is a ways away from today’s price of $184. In short Apple’s valuation is just far too stretched.

I rate Apple Inc. stock a “Sell.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in AAPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.