Summary:

- Apple Inc. is set to report FQ2 2023 earnings after the close on May 4.

- The tech giant is forecast to report some dire numbers, with both revenues and EPS falling 5% YoY.

- Apple stock remains extremely expensive, trading at 28x FY23 EPS targets with limited growth forecast, and this is a company that historically hits very close to analyst targets.

gremlin/E+ via Getty Images

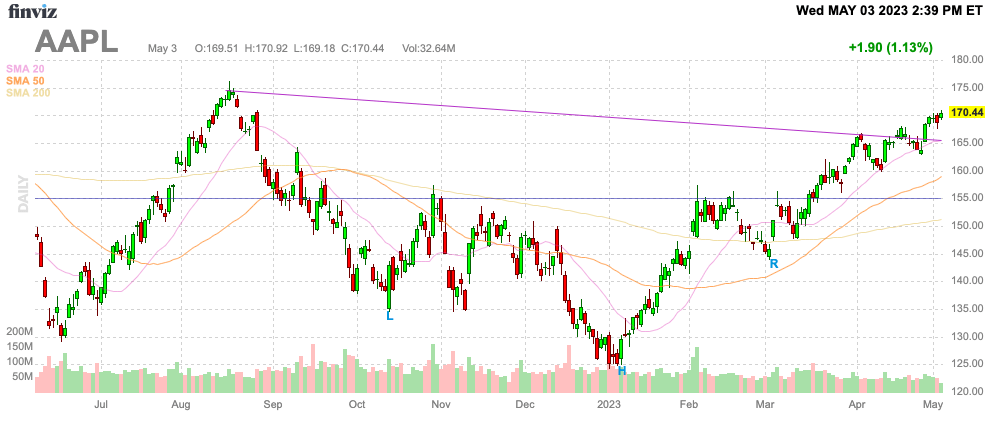

When Apple Inc. (NASDAQ:AAPL) reports earnings tomorrow, the biggest risk to the investment story is the tech giant hitting the expected analyst targets. Outside of the wild Covid period where technology demand was pulled forward, Apple tends to report very close to analyst forecasts. My investment thesis remains Bearish on the stock due to the stretched valuation for a company with limited growth prospects and trading near all-time highs.

Source: Finviz

Hitting Expectations

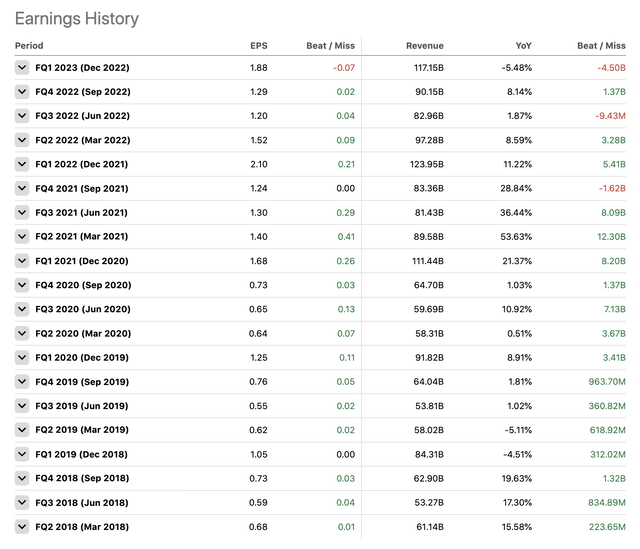

When Apple reports on May 4 after the market close, investors don’t actually want the tech giant to match consensus analyst estimates. The company has a huge history of immaterially beating analyst estimates.

Analysts forecast Apple to report the following numbers for FQ2’23:

- Consensus EPS Estimates: $1.43, down 6%

- Consensus Revenue Estimates: $92.84B, down 5%.

Apple currently trades at 28x FY23 EPS estimates, so investors clearly aren’t prepared for the March quarter report to show a 5% decline in EPS from last FQ2. The problem here is that the tech giant very much has a history of reporting around the consensus estimates.

Going back the 2 years (8 quarters) prior to Covid in Q1 2020, Apple beat EPS in all but one quarter. The combined EPS beat was only $0.28. The average EPS beat was less than $0.03.

Lately, Apple has actually missed consensus analyst revenue targets in 3 of the last 6 quarters. If anything, analysts have become too aggressive on targets following the massive Covid technology demand pull forwards.

So if Apple hits expectations, or the normal $0.03 beat, the company will only earn $1.46 per share in FQ2’23. Apple earned $1.52 last FQ2, suggesting the base case scenario is an annual decline.

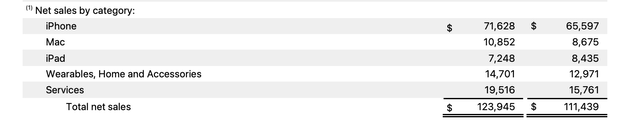

Clearly, the biggest risk to the investment story is that Apple actually repeats the recent trend of missing estimates, or at the least, reverts back to historical norms of a controlled beat. Looking back at FQ2’22 numbers:

Source: Apple FQ2’22 earnings release

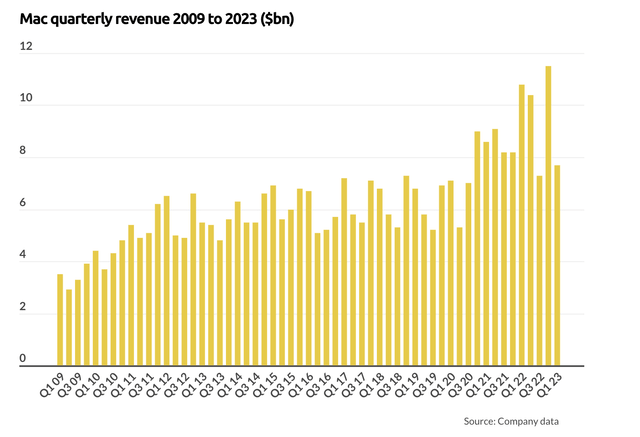

The biggest hit Apple faces in the current quarter is that Mac revenue is set to plunge. IDC reported that Mac sales slipped by 42% during the March quarter which would lead to the $10.85 billion in sales last FQ2 dipping by $4.56 billion to only $6.29 billion.

Based on the below chart of Mac quarterly revenue from BusinessofApps, Apple saw a massive boost in sales in 2021 followed by an extra boost in 2022, with the December quarterly sales of $11.5 billion setting a quarterly record. The odd part is that Apple traditionally didn’t see a holiday boost for the Mac.

From 2019 to 2022, annual sales surged from just below $25 billion to $40 billion. While Apple released Macs with the new M-series chips starting in last 2020, the market most likely wrongly assumed a lot of the sales boost beginning with the start of 2021 was related to the new chip.

In essence, the Mac segment averaged $6 billion in quarterly sales prior to Covid. The March quarter number is only a return to normal trends, not a dip to irrational levels where a snapback rally should be expected.

Low Expectations

In the past, our research has constantly talked about the weak analyst forecasts for the years ahead. If an investor wants to buy Apple near all-time highs, one has to expect the tech giant to leap past these meager growth estimates.

As highlighted above, analysts have historically hit their forecasts on Apple, with a tendency lately to overestimate the numbers. One should 100% take these numbers as close to reality.

How much would one want to pay for Apple with a $6 EPS target? The stock now trades at 26x FY24 EPS targets of $6.58 when the estimate is for EPS growth over the next 4 years ranging between no growth with a maximum growth target of 10%.

The amazing part is this constant disconnect with the stock market. Analysts are relatively accurate on Apple over time, yet investors appear to assume the numbers are wildly conservative.

Takeaway

The key investor takeaway is that Apple Inc. stock is likely to print a weak March quarter, and the market shouldn’t like the numbers with the stock trading at nearly $170. The worst-case scenario for shareholders is for the tech giant to match numbers, since the stock is priced for substantial earnings beats.

Investors should continue using Apple Inc. trading close to all-time highs as an opportunity to unload the stock at a premium.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.