Summary:

- Warren Buffett’s Berkshire Hathaway has reduced its Apple holdings by 67.23%, selling approximately $118BN worth of shares, likely influenced by tax considerations and valuation concerns.

- Despite strong fundamentals and growth in services, Apple’s valuation appears high, with an Operating P/E Ratio of 27.76x and a PEG Ratio around 3.47x.

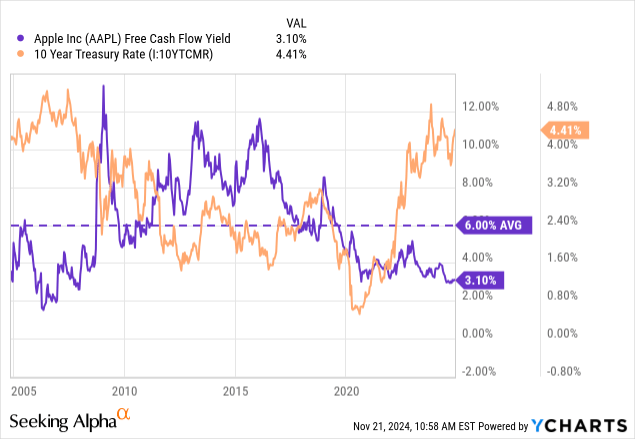

- Apple’s Free Cash Flow Yield is at its lowest in 20 years, making it less attractive compared to risk-free returns like the 10-Year TIPS Yield.

- Additional risks include geopolitical tensions with China, macroeconomic headwinds, and uncertainties around Tim Cook’s succession plan.

SuikaArt/iStock Editorial via Getty Images

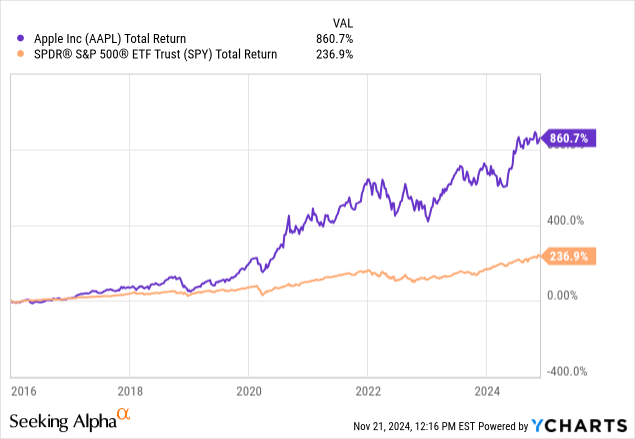

In our last report on Apple (NASDAQ:AAPL), we alluded to the fact that we were wrong in some respects when we rated Apple a “Hold” and upgraded the stock to a “Strong Buy” despite the fact that it is already trading at a high valuation.

Recently, Berkshire Hathaway (BRK.A) (BRK.B) has finally started to reduce a large part of its Apple position, which we think investors should take note of. As such, we’ve analyzed what Berkshire’s Apple sales mean for investors, highlighting some key developments that were evident in the company’s recent fourth-quarter results, as well as Apple’s outlook for the rest of the year. In addition, we assessed some overlooked key valuation metrics and other macroeconomic and geopolitical risks Apple may face, which overall led us to downgrade Apple to Sell.

Berkshire Is Trimming Its Apple Position

Although Apple shares have remained fairly resilient as Warren Buffett’s Berkshire Hathaway unwinds a significant portion of its holdings, we believe that when the Oracle of Omaha talks, investors should take note.

The company sold off a significant portion of its Apple holdings, which stood at 915.56 million shares in the second quarter of 2023 and has recently been reduced to 300 million. While we don’t have exact details on how much these shares were sold for, we can get a very accurate approximation by taking the weighted average price during each quarter and the number of shares sold during that particular quarter. According to our estimates, Berkshire has sold approximately $118BN worth of shares at a weighted average of $191.60 over the past four quarters, representing a total reduction of 67.23% of its stock holdings.

StockCircle

Before we look at Apple’s valuation, which is the main reason we think Apple should have a “Sell” rating, we want to explain why Berkshire may have also sold shares due to tax implications. Looking at Berkshire’s cost basis for Apple, it is quite remarkable that they bought most of their shares in 2016-2018 when Apple was trading around $25-$45, with their approximate cost basis being around $35 per share. This means that the 615.56 million shares Berkshire recently disposed of were probably bought for around $21.54BN. If we subtract this from the estimated proceeds of $118BN, we would be looking at $96.46BN in capital gains.

If we take this $96.46BN of capital gains and apply the current corporate tax rate of 21% plus a state tax rate of 5.50% for Nebraska, Berkshire can be expected to pay $25.56BN on these proceeds. However, it is important to note that the current tax rate of 21% is quite low compared to history and especially mild given the macroeconomic outlook and the debt situation of the U.S. government. Buffett touched on this fact at the 2024 Berkshire annual meeting, saying that this tax rate was 35% not too long ago and was 52% in the past and that he thinks that “something has to give,” citing fiscal policy.

At a corporate tax rate of 35% plus a state tax rate of 5.50%, the proceeds of $96.46BN would equate to about $39.07BN in taxes, which is a significant difference of $13.50BN. In a sense, we see Berkshire receiving estimated proceeds of $92.45BN with the current tax policy versus only $78.95BN at a higher rate, a 17.1% difference that should certainly be kept in mind when considering how Berkshire looks at Apple’s valuation.

Fundamentals & Future Growth

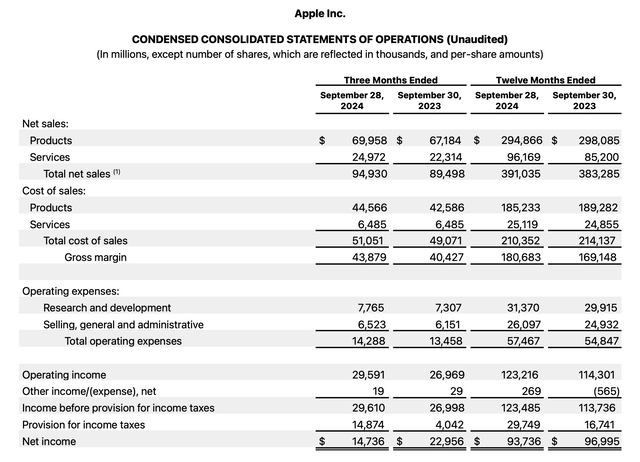

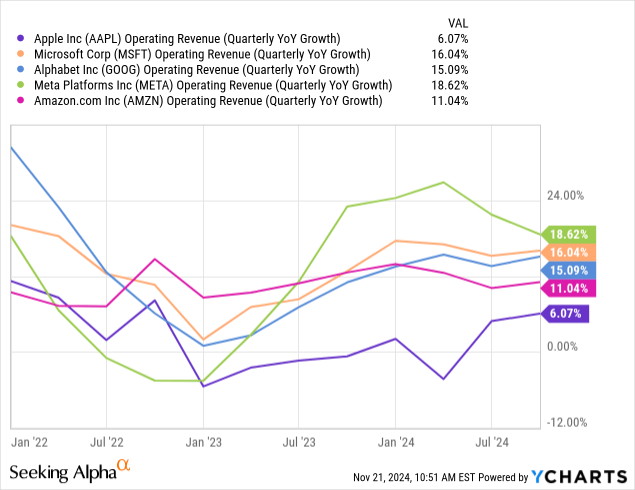

Apple’s underlying fundamentals actually remain quite strong and continued their upward trend with their most recent fourth quarter results. Total sales were up 6% year-on-year, driven primarily by growth in services, which posted record sales in most categories at 12% year-on-year. Product sales also grew decently by just over 4% year-on-year.

The services category, now approaching a run rate of $100 billion, includes things like advertising, AppleCare, cloud services, digital content such as Apple TV+, App Store revenue, Apple Music, Apple Pay and others. During the earnings call, management said that in this segment, recurring revenue is growing faster than transactional revenue, contributing to what we would see as more “sticky revenue” growth. Gross margin leverage was certainly evident in services this quarter as well, with revenue growth while cost of sales remained exactly the same. Services gross margins increased from 70.94% in the same period last year to 74.03% in the fourth quarter.

Apple IR

Product gross margins remained relatively flat year-on-year, falling about 31 basis points to 36.30%. Above all, this improved the company’s gross margin to a whopping 46.2%, continuing its upward trend. Operating expenses as a percentage of total sales remained virtually flat at 15.05%, meaning that the increase in gross margin ended up being primarily reflected in the bottom line results, showing a higher operating income of $29.59BN.

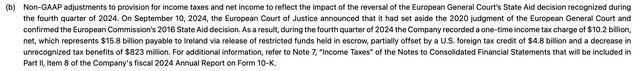

Although net income fell on paper from $22.96BN to $14.74BN in the fourth quarter on a year-over-year basis, investors should note that this was largely due to a one-time tax charge of $10.25BN. This was due to a negative state aid decision by the European Commission in 2016, which received an additional ruling from the European Court of Justice in 2020, but was eventually overruled in September of this year.

Apple IR

Moreover, in the underlying results by segment and geography, we see that much of the revenue growth can be attributed to revenue growth in the Rest of Asia/Pacific segment, as well as Europe and Japan. We do note that this Europe segment includes emerging markets such as Turkey and the Middle East such as the UAE. Together with growth in markets such as India, this is a sign to us that emerging markets are beginning to make a meaningful contribution to overall revenue growth.

By segment, iPhone sales grew 6% year-on-year, while the Mac segment grew 2% year-on-year and the iPad segment also grew 8% year-on-year. The only segment that showed a slowdown/decline seems to be wearables, although positive prospects may be on the horizon with the launch of AirPods 4 and Apple Watch 10 in late September. On the other hand, we see that the launch of the Vision Pro earlier this year apparently did not contribute substantially enough to offset the slowdown among the other products in the segment.

Apple IR

The Greater China segment perhaps performed better than we expected, with revenue remaining virtually flat year-on-year despite some huge macroeconomic and competitive headwinds. In addition, the outlook for the next quarter was more or less in line with expectations, as the company’s overall revenue is expected to grow in low-to-mid single digits year-on-year, thanks largely to services revenue, which is expected to grow in double digits at the same pace as in fiscal 2024.

Still, the question remains as to where the main engines of growth for Apple will come from in the future, as most of the catalysts are expected to contribute only low-to-mid-single-digit growth for the foreseeable future. These include the rollout of iPhone 16, the new M4 platform with the iMac and Mac Mini, new Apple Home devices, growth in services and emerging markets and Apple Intelligence. And while these developments are somewhat significant, we don’t see anything like a new platform or device contributing to serious growth in the future and driving Apple’s growth back to the high single digits.

Valuation Concerns

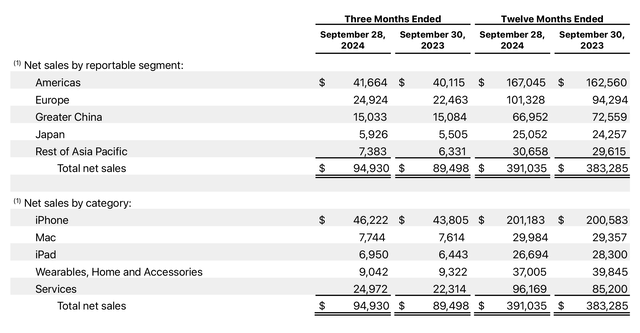

This brings us to our concerns about Apple’s valuation, because if the outlook is for Apple to grow at low to mid-single digits, then we think the valuation should also reflect this fact.

For the 12 months ended September, operating income was $123.22BN compared to Apple’s market cap which at the time of writing is $3.42T. This translates into an Operating P/E ratio of 27.76x, which we will use as a proxy for the P/E ratio in the future as Apple’s recent tax implications are excluded, and gives a more positive outlook for Apple to give them the benefit of the doubt.

Plotting this ratio of 27.76x against low-to-mid-single-digit revenue growth, which we believe would result in an optimistic 8% operating income growth due to operational improvements/leverage, would mean that Apple’s PEG ratio is roughly around 3.47x, well above the ideal ratio of 1x. In our opinion, Apple would have to show growth of at least more than 14% to justify the current multiple. At that point, Apple would have a PEG ratio of less than 2x.

We would even go so far as to say that Apple is not only the most expensive the company has been in nearly 20 years in terms of the multiple at which it trades, but also the most expensive in 20 years on a relative basis to the bond market.

For this, we turn to a very important metric that we don’t often see analysts use, which is the Free Cash Flow Yield and compare it to either the 10-Year Treasury Yield or the 10-Year TIPS Yield/ Breakeven Yield. The Free Cash Flow Yield is simply obtained by the inverse of the Free Cash Flow multiple and, in our opinion, gives investors a good indication of what the dividend yield would look like if all Free Cash Flow, as defined by Cash From Operations minus CapEx, were passed on to investors.

Here we see that not only is Apple’s Free Cash Flow Yield at its lowest level in about 20 years, but it is much higher compared to when the 10-year yield was lower during ZIRP.

And it is especially important to note that the last time this free cash flow return was this low in the early 2000s, it was during a period of intense growth in both top-line and bottom-line results. For example, we are talking about the launch of the first iMac in 1998, the first MacBook in 2006 and the first iPhone released in 2007. During these periods, it was not unusual to see bottom-line growth in excess of 30% and sometimes even triple-digit growth.

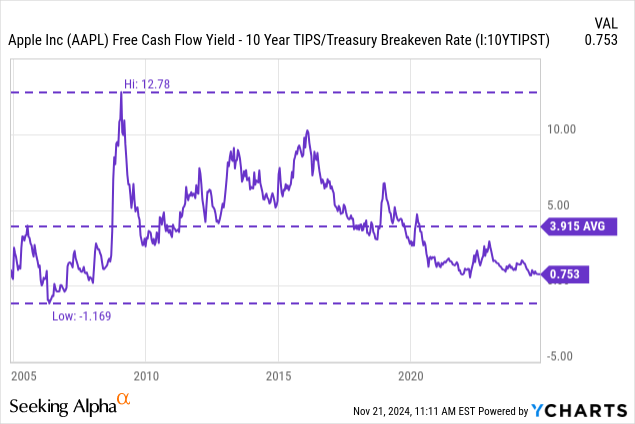

The most useful measure we see here is comparing Apple’s free cash flow return to the TIPS return/Breakeven return, which is the 10-year return adjusted for inflation and is one of the best approximations of what the risk-free return would be for a 10-year investment period. This yield is currently at 0.75%, which is far from the 3.92% average over the past 20 years and the high single-digit yield we saw in 2016 when Berkshire first started buying the stock.

From one perspective, for us, Apple is a perfectly managed company with an intense moat. Even from a financial perspective, Apple is tremendously well managed and uses virtually all the FCF it generates to give back to shareholders in the form of share repurchases. On a trailing-12-month basis (TTM), Apple generated $108.81BN in FCF and returned $100.39BN in share repurchases plus $15.23BN in dividends. Moreover, Apple follows a conservative CapEx path compared to other Hyperscalers that pay high prices for AI hardware, which also appeals to us since we expect an AI hardware overbuild in the near future.

But on the other hand, the valuation simply remains far too high, at least for its current prospects and growth prospects. As for Berkshire, we also did some internal calculations on the tax implications discussed earlier, and we think that the potential tax increase of $13.50BN on $118BN of shares at a corporate tax rate of 35% would contribute only slightly to the valuation concerns. We calculated this potential tax increase would lower the bar to sell Apple from a valuation perspective from an exemplificative P/E ratio of 33.5x to 30x, meaning that valuation concerns are still likely to outweigh the tax implications for Berkshire.

Additional Risks To Consider

Finally, there are some additional risks we think investors should consider with Apple, in addition to valuation, related to macroeconomic and geopolitical concerns.

On a geopolitical level, the United States still faces tensions with China, especially over issues such as Taiwan. Apple still relies heavily on hardware manufacturing from China and the supply of chips by Taiwan Semiconductor (TSM). Interestingly, Berkshire once started a position in Taiwan Semiconductor in the third quarter of 2022, but in a move very uncharacteristic of Buffett, he immediately sold the stake in the next two quarters. He pointed out this fact at one of the Berkshire Annual Meetings by saying that:

Taiwan Semiconductor is one of the best managed companies and important companies in the world. And I think you will be able to say the same thing 5 or 10 or 20 years from now. I don’t like its location, and reevaluated that. (Berkshire Hathaway 2023 Annual Meeting)

The answer basically boiled down to the fact that he would rather find the same kind of competitive companies in the United States and that he did not like the location. He also mentioned that he thought the capital deployed in Japan was better than in Taiwan. Personally, we believe this is a sign that the risk of future China conflict with Taiwan is not as unspeakable as some believe. Furthermore, Apple generates a large portion of its revenue in the Greater China region, which amounted to $15.03 billion in the fourth quarter alone.

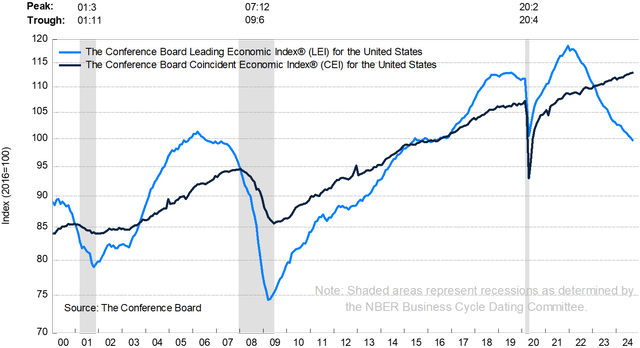

Even without a conflict, China is facing macroeconomic headwinds, which we believe is also true for the US. Speaking of which, many leading indicators have continued to deteriorate if you look at the Conference Board data, which points to a recession. The yield curve, which had been inverted for two years, has also recently turned positive again, which in the past has always been a sign of an impending recession.

The Conference Board

In addition, there are still risks relating to the succession plan for Tim Cook, who has done an outstanding job in managing the company and developing the innovations introduced by Steve Jobs, which brought the company to be the most valuable company in the world for quite some time.

The Bottom Line

Apple is currently an example for us of what happens when a perfect company becomes priced for perfection and perhaps even beyond. We personally continue to use the Apple Silicon product line for our work, including the iPhone and the M3 Max for Mac, along with a variety of other products from the Apple ecosystem.

From personal experience, we are still seeing Apple products being adopted in Europe, for example by users switching to the iPhone, and we cannot deny the huge moat Apple offers. Nevertheless, we personally believe that Apple is trading at a valuation that is too high for its current growth prospects and relative to risk-free rates, and echo Warren Buffett’s view to sell much of the stock that Berkshire bought in 2016-2018. As things stand, we rate Apple a “Sell”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.