Summary:

- In this year’s annual Berkshire Hathaway letter, CEO Warren Buffett wrote that, “At Berkshire, there will be no finish line.”

- Greg Abel apparently will succeed Buffett as CEO when the time comes.

- But I do not anticipate any changes in the investment and risk-control philosophy.

- I see Apple continuing to be a cornerstone of Berkshire’s equity portfolio for years to come.

pcess609/iStock via Getty Images

Thesis

The annual letter that Warren Buffett writes for his Berkshire Hathaway Inc. (NYSE:BRK.A, NYSE:BRK.B) (“BRK”) shareholders (and this author is one of them) has long become a market event – and for good reasons, in my view. Particularly during uncertain times like what we are going through now, his thoughts (admittedly, many of them are repetitions over the years) on taxes, basic accounting principles, and a long-term view are especially timely.

The main thesis of this article is straightforward. I will only focus on one line Buffett wrote in the recent letter, which says that “at Berkshire, there will be no finish line.” And I will elaborate on its implications as I see to BRK itself and also its largest equity holding, Apple Inc. (NASDAQ:AAPL). A bit of context for the now famous “no finish line” slogan. Greg Abel, CEO of Berkshire Hathaway Energy, is named to succeed Buffett as CEO of BRK at the 2021 annual meeting. And in the remainder of this article, I will explain why I do not anticipate any changes in the investment and risk-control philosophy at Berkshire Hathaway after the transition. More specifically,

- I will explain why the new CEO will continue the same principles that Buffett has practiced during his long tenure in terms of risk control and also the investment philosophy of making concentrated bets for the long term.

- I will then analyze how these principles apply to both BRK itself and its AAPL holdings as specific examples.

- You will see that making concentrated bets on stocks like BRK or AAPL actually lowers risks. My results show that concentrated investment in BRK or AAPL is less risky than owning the overall market.

No finish line

The following quotes from the annual letter probably provide the best context to the “no finish line” comment. The highlights were added by me:

As for the future, Berkshire will always hold a boatload of cash and U.S. Treasury bills along with a wide array of businesses. We will also avoid behavior that could result in any uncomfortable cash needs at inconvenient times, including financial panics and unprecedented insurance losses. Our CEO will always be the Chief Risk Officer – a task it is irresponsible to delegate. Additionally, our future CEOs will have a significant part of their net worth in Berkshire shares, bought with their own money. And yes, our shareholders will continue to save and prosper by retaining earnings.

And in the next two sections, I will elaborate on: A) the implications of the “boatload of cash” for BRK and its AAPL holdings; and B) the implications in terms of risk control in the long term.

Boatload of cash

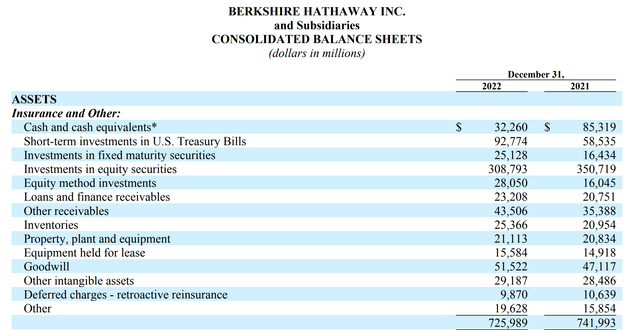

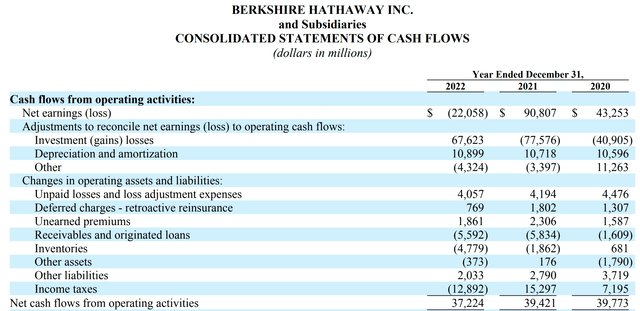

According to its most recent 10-K filing (see next chart below), BRK currently holds a total of $32.2B of cash and cash equivalents, $92.7B, and of Short-term investments in U.S. Treasury Bills. These two items alone added up to a total of $124.9B of cash or equivalent. And its total cash position is a bit higher, about $128.9B, according to Seeking Alpha data. In any case, it is no exaggeration to call it a “boatload.” As of this writing, BRK has an average of 2.20 billion shares equivalent to Class B shares outstanding. Thus, the cash position translates into about $58 per share.

We all know that the biggest asset on the BRK balance sheet is its equity investment portfolio, valued at $308.8B as of the latest 10-K filing. As of this writing, according to data taken from dataroma, the portfolio’s market value has slightly shrunk to $299B due to market correction in the equity market since the filing.

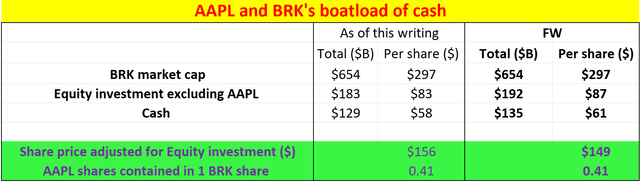

Based on the above numbers together, the next two charts show my analysis of the impacts of such a boatload of cash on BRK itself and also its AAPL holdings. The major takeaways and assumptions are:

- As shown in the first table, excluding all equity investments except AAPL and cash, BRK’s market capitalization adjusts to about $342B (equivalent to $156 per share).

- This implies that if you were to purchase BRK shares at today’s market price and then immediately liquidate all its cash and other equity investments except AAPL, you would be paying about $156 per BRK share.

Author based on BRK 10-K filing data

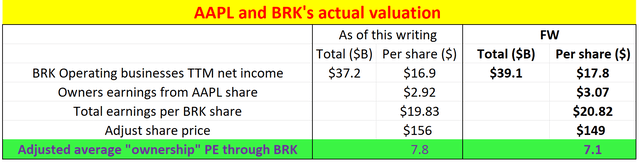

The second table below shows what you are actually getting for the $156 you paid. Of course, you would have acquired all its AAPL shares, a total of 895.13 million shares as of this writing, translating into 0.41 AAPL shares “contained” in each BRK.B share. On top of that, you would have also acquired all of BRK’s operating segments, with operating cash flow totaling $37.2B in 2022 (see the last chart in this section), the lowest level in the past 3 years.

Even using the conservative $37.2B as the earning power of these segments, the net results would be an operating income of $16.9 per BRK share. Then we need to add the earning power from the 0.41 AAPL shares contained in each BRK share. My estimated Owner’s Earnings for each AAPL share is about $2.92 for 2022 (see my earlier article for details). The total is $19.83 per BRK share, as shown.

So, based on these numbers, the average “ownership P/E” of the BRK-AAPL combo, as shown in the last row of the table, is only about 7.8x as of this writing. And, if you assume a 5% annual growth rate (not a horrible assumption considering the treasury bill now is yielding about 4% already), the FW “ownership P/E” would be only 7.1x.

With these multiples, I do not see why Greg Abel would want to do anything differently from what Buffett has been doing, which includes continued buybacks of BRK shares, keep holding the AAPL shares, and even adding more here and there.

Author based on BRK 10-K filing data BRK 10-K filing data

Concentrated bets and risk control

Another cornerstone of Buffett’s approach is of course concentration. Some investors, including some of the members in our marketplace services, worry that BRK is overly exposed to AAPL and/or that as investors, we would be overly exposed to AAPL if we hold both BRK and AAPL.

Here I want to argue the opposite – which is also what Buffett has been arguing and practicing with great success for decades. If you know what you are doing, concentration helps to lower risks.

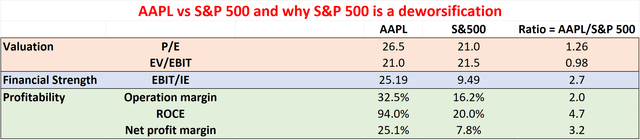

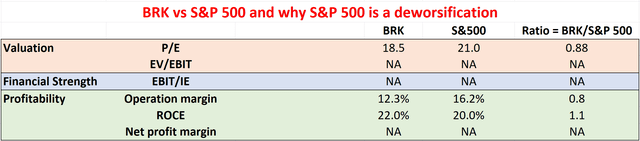

Even if you disagree with all of my above analysis, the following commonly-quoted GAAP metrics already paint a pretty clear picture in my view. The first table demonstrates that AAPL’s valuation (based on GAAP P/E) is only slightly higher than the overall market, but its financial strength and profitability are far superior. And the second chart shows the same picture for BRK, except in this case its GAAP P/E is also at a discount compared to the S&P 500. And in my view, the GAAP P/E dramatically overestimates its P/E given its unique balance sheet structure.

All told, my view is that owning the overall market actually represents a “deworsification.” And I would assume Greg Abel would keep making similar concentrated bets and clearly delineate diversification from “deworsification.”

Author based on Apple 10-K filing and Yahoo data Author based on Apple 10-K filing and Yahoo data

Risks and final thoughts

Being two of the most popular stocks on Seeking Alpha, risks associated with AAPL and BRK have been thoroughly discussed in other Seeking Alpha articles already (including some of my own past articles). And here I am not going to repeat these risks anymore, ranging from macroeconomic risks to competition risks. Here, I will only focus more on the risks specific to the approach I used above to evaluate AAPL and BRK’s “ownership P/E”. A few risks and uncertainties that you should bear in mind:

- My analysis is subject to uncertainties due to fluctuations in the book value of BRK. Its exact book value depends on overall market conditions, both the bond and stock markets (also the commodity market to a lesser degree). The numbers I used in this analysis, even though the latest reported numbers, could have already become outdated.

- This analysis assumes that you can liquidate all of BRK’s cash position and equity investments except AAPL at the current market value. This is of course only a thought experiment. Liquidating hundreds of billions of assets (either stocks or bonds) could create a force large enough to change market prices.

- And finally, a good part of BRK’s cash is tied up in its insurance float and may not be entirely liquid. However, it is reasonable to consider cash as an asset in valuation. As shown in the quote upfront, Buffett has stated (once again) that BRK’s float is designed to avoid “any uncomfortable cash needs at inconvenient times, including financial panics and unprecedented insurance losses”. My estimate is that a cash position of around $30 billion should be able to cover the float comfortably. And it is very unlikely that the entire cash position would ever be required to cover insurance needs. This would slightly increase the ownership P/E, but not significantly.

To wrap up, I do not anticipate any changes in the investment and risk-control philosophy when the time comes for Greg Abel to take over the CEO position at Berkshire Hathaway Inc. And this article presents my thoughts on the implications to BRK itself and its largest equity holding, Apple Inc. (which represents about a quarter of its book value). My conclusion is that I do not see why Greg Abel would want to deviate from the course Buffett has charted, i.e., to continue repurchasing BRK shares, holding the AAPL shares, and even adding more.

Disclosure: I/we have a beneficial long position in the shares of AAPL, BRK.B either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.