Summary:

- Apple represents more than 40% of Berkshire’s stock portfolio, and it’s possible that it never sell its shares.

- There are three reasons why you should consider holding your shares for many years. Once understood, investors might discover that it is rational not to sell.

- We calculate the intrinsic value using the discounted cash flow method.

- We rate the stock as a hold.

Scott Olson

We rate Apple (NASDAQ:AAPL) stock as a hold, considering it a high-quality company with some interesting future catalysts such as the AI opportunities, the AR/VR products, and the further development of its services business unit. Nevertheless, this is not good enough information to understand why a super investor like Warren Buffett might not ever sell his Apple shares. Most bearish analysts totally underestimate the potential long-term appreciation of the stock, overlooking the great quality of the management under Tim Cook’s tenure, its long-term orientation, its focus on being more socially responsible, and its credible strategy to reinforce engagement with its already loyal consumers. In this article, we will explore the company from Buffett’s standpoint to show what really matters for a long-term investor and why an investor should keep his Apple shares even when they seem to be at a fair value or even overvalued, particularly if they were acquired at a very good price in the past. In this sense, we will calculate the Apple’s intrinsic value to see the potential for capital appreciation.

In addition, we need to point out that Buffett uses different investing strategies within the value investing philosophy, but we will focus only on his long-term buy-and-hold strategy since the stocks associated with that strategy are the ones that have the biggest weight within the Berkshire (BRK.A) (BRK.B) stock portfolio.

There are two reasons and a “hidden” reason that might encourage Berkshire to not sell Apple ever

Reason 1: a very particular moat

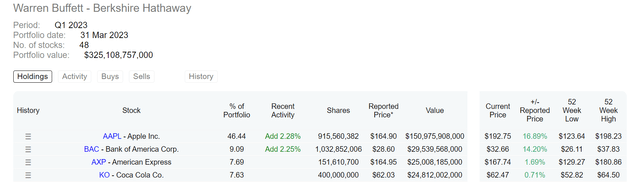

The four most important positions in Berkshire’s stock portfolio have something in common. As per Dataroma:

The one factor in common among the four largest positions in Berkshire is that their competitive advantages revolve around the brands of these four companies. In other words, these companies have high customer loyalty among customers who feel a strong attachment, even emotionally, to their respective brands. This enables these companies to enjoy significant pricing power, which makes their business models very resilient in very hard scenarios. The king of this kind of moat is clearly Apple, according to Kantar:

However, the question would be why Berkshire does not hold other stocks like Google (GOOGL), Microsoft (MSFT), or Amazon (AMZN) as the most important positions in its stock portfolio, as all of them are part of the top five most valuable brands in the world after Apple. To understand this, we know that Buffett loves a concentrated portfolio; in other words, he likes to put more money in a few stocks where he has the highest conviction.

Buffett clarifies this strategy:

You only have to do a very few things right in your life so long as you don’t do too many things wrong.

In addition, he likes to not only concentrate his portfolio but also be concentrated in those few stocks that make him feel very comfortable. Most likely, he has already assessed all the FAAMNG stocks previously, and he might have noticed that only Apple has that kind of moat associated with the brand. Companies like Microsoft, Google, Amazon, or Meta have other kinds of moats more associated with their networks, where their clients have no other option even if they do not love their brands. Berkshire holds Amazon, but that position barely represents 0.34% of the entire portfolio, and, apparently, the stock will not represent a top holding in the future.

For instance, I am using Microsoft products not because I love its brand but because I haven’t found another provider that offers better products. The same thing happens with Alphabet: I like very much YouTube and Google Search, but I am not using them because of the brand. In fact, if there is another company in the future that offers more appealing products than Alphabet, I would not hesitate to leave Google.

Buffett praises companies like Microsoft, Alphabet, Amazon, and Meta, but he didn’t buy those stocks, at least not as part of their top holdings, like in the case of Amazon. Even when Buffett mentioned in 2017 that he regretted not buying Alphabet or more Amazon shares in the past, he did not buy any of them in 2020 or 2021, when both stocks were relatively cheap at the beginning of COVID-19 in 2020 and under the interest rate hikes in 2021, to turn them into Berkshire’s top positions.

In our view, companies like Microsoft, Alphabet, Amazon, or Meta have strong moats, but apparently, in Buffett’s view, their moats are not associated with their brands; thus, it’s way more difficult for him to imagine their business models’ situation in the very long term.

We think that Buffett likes to picture the company in the very long term, so a moat associated with the company’s brand would enable him to be rather protected from future disruption. Imagine a scenario where Samsung develops a technology that allows the user to have a hologram on his phone. Apple’s users would not switch immediately to Samsung; they would wait for Apple to develop a similar or even better technology without any pressure on deadlines. That kind of loyalty is unparalleled.

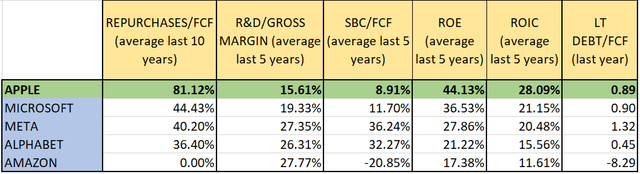

We identify the factors that Buffett usually focuses on while assessing a company; of course, there are additional qualitative factors, but the following ratios could be a first impression of the company he is studying:

Looking at the table above, we notice that Apple is the best business in terms of the variables usually evaluated by Buffett. Buffett might have noticed that not only does Apple have the kind of moat he loves, but the company also excels in different aspects of value creation and capital allocation.

Apple is the company with the highest ratio of repurchases over free cash flow (FCF), which can be seen in the first column; this indicates that Apple is the company that allocates the highest proportion of its enormous annual FCF to reward its long-term investors through share buybacks. We might think that all that money deployed for share buybacks could be used for other purposes, but Tim Cook has done an amazing job turning Apple into a very efficient company, so all that money for share buybacks is the money that is remaining after subtracting relatively low capital requirements.

This high efficiency could be noticed when we see that Apple has the lowest ratio of R&D to gross margins among its peers while being the most innovative company, according to the Boston Consulting Group. Most people would think that a lower ratio of R&D to gross margin indicates a company that does not invest sufficiently in innovation and might be seen behind its peers; clearly, that’s not the case with Apple.

In addition, Apple is the company with the lowest ratio of stock-based compensation (SBC) over FCF, which means that Apple is the company with the least dilution. A high proportion of the SBC/FCF could be seen as a sign that the company is issuing more new shares to reward its employees at the expense of diluting its shareholders. Under this perspective, Apple is the company with the strongest shareholder orientation and the least dilution.

The Return of Equity (ROE) and Return on Invested Capital (ROIC) show us evidence that Apple is the company with the highest returns among its peers for each dollar reinvested in its business. Not only that, the company does not require much debt to deliver all that value, as could be seen by the ratio of long-term debt over FCF in the last column of the table.

It seems that Apple is a dream company for Buffett, as he points out how important it is to own a business with a very strong moat, the strongest shareholder orientation, the highest returns on equity, low financial leverage, and the highest efficiency.

Now, we understand when Buffett says:

Apple happens to be better business than any we own

Growth

Most bearish analysts focus only on this variable to give sell recommendations for Apple stock when the price reaches certain levels. It’s not a surprise that consensus estimates estimate revenue growth of 6 or 7% compound annual growth rate (CAGR) in the next few years for Apple, whereas its US big tech counterparts used to deliver double-digit growth. Nevertheless, high revenue growth does not necessarily mean higher stock appreciation in the long term.

We need to take into account that Apple has a combination of factors that are very hard to replicate by other companies, such as its strong share buybacks, the high efficiency of its operations, its strong pricing power associated with the extreme loyalty of its customers, its strong shareholder orientation, probably more than any other company, and its strong brand reputation, which ends up compensating for relatively low revenue growth year by year as important value generators of future stock appreciation.

Pricing power

This is another frequently overlooked variable by bearish analysts, but it’s a very important factor. In recession scenarios where revenue growth might suffer, the pricing power of the company might cushion that effect by increasing free cash flow. According to Counterpoint, Apple controls around 80% of the operating profits of the global smartphone industry, showing us how strong that pricing power is within the smartphone industry.

Reason 2: The management

Tim Cook has been responsible for the well-executed capital allocation of the company, the continuous reinforcement of Apple’s ecosystem over the years, which strengthens Apple’s pricing power, and the development of projects related to social responsibility that put the name Apple on another level. The last factor reinforces Apple’s reputation, which is an extremely important aspect for Buffett. He has repeated it so many times in his annual shareholder meetings:

It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.

In the book “Tim Cook: The genius who took Apple to the next level by Leander Kahney, we can notice Tim Cook’s long-term vision about the reputation of Apple in different socially responsible projects, such as the pressure Apple puts on its main suppliers, Foxconn among them, to improve the working conditions of their workers and the necessity to gradually increase the number of components that are more environmentally friendly within Apple’s devices.

Another important aspect in which Tim Cook has secured Apple’s reputation and brand is data protection. Apple’s brand is frequently associated with the protection of users privacy, which attracts more new customers who were using devices from other brands.

As per the last call for Q2 2023, Tim Cook mentioned the socially responsible projects in which Apple is involved:

To better understand how our work intersects with our values, look no further than what we’re doing for the environment. We just celebrated Earth Day in April, and during that month, Apple announced that its global manufacturing partners now support over 13 gigawatts of renewable energy, a nearly 30% increase in just the last year. This translates to 17.4 million metric tons of avoided carbon emissions, the equivalent of removing nearly 3.8 million cars from the road. We’re all investing up to an additional $200 million in our Restore Fund, which is designed to support innovative, scalable, nature based carbon removal projects, with the goal of removing 1 million metric tons of carbon every year. These are just the latest steps on our journey toward our 2030 goal to be carbon neutral across our supply chain and lifecycle of our devices.

Last month, we announced our plans to have all Apple design batteries include 100% certified recycled cobalt by 2025, and we remain committed to one day using only recycled and renewable materials in our products. We have a deep sense of mission here at Apple.

In other words, Apple’s users not only love the brand, but they might also feel that they are contributing to taking care of the environment and encouraging the usage of more renewable energy while their data is better protected under Apple’s ecosystem. Adding the design of the devices, the interconnection among the different devices, and the more advanced innovations, Apple appears to offer the best of both worlds for its users and for an investor like Warren Buffett.

A hidden reason why you should keep your shares

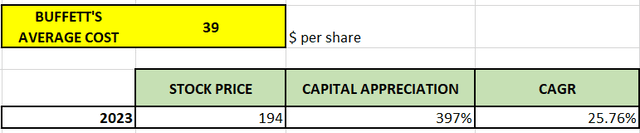

Let’s see an example to understand why you should keep your shares, particularly if you bought them at a low price. Buffett has bought his Apple shares since 2016, when the stock Price was around $25 per share adjusted for the split in 2020, and he has been adding more throughout the years. Taking all the shares purchased at different prices from Dataroma, we can estimate Buffett’s average cost at $39 per share.

Taking the current stock price of around $194 per share, Buffett has earned a total capital appreciation of 397% and a 25.76% CAGR since he invested in Apple for the first time in 2016, when there was lots of uncertainty about the company’s prospects. The market was not considering the strong loyalty of its users to the brand, but Buffett noticed that and bought shares when the stock was trading at a PER of around 10x.

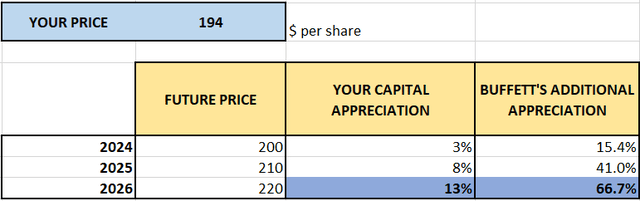

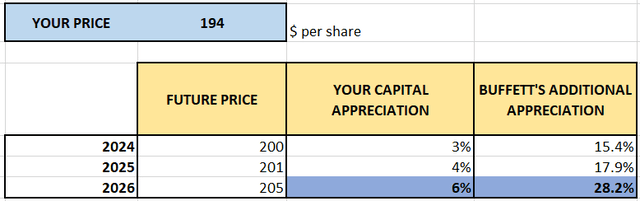

Now, we’ll assume that you are a new investor who bought Apple shares at $194 per share. Imagine that you’ll hold your shares, and the price will have a rather poor performance in the next three years, reaching $220 per share until 2026.

A poor performance of the stock price in 3 years can be seen in the table above. If the stock reaches $200 in 2024, your total capital appreciation would be only 3%; if the stock reaches $210 in 2025, your total capital appreciation would be only 8%; and if the stock reaches $220 in 2026, your total capital appreciation would be only 13%.

In 2026, at a price of $220, your returns will be only 4.28% CAGR, which is not attractive just because the price you paid is not a cheap one. However, we may notice that the capital appreciation for Buffett’s investment in Apple was completely different during the same period. Whereas you only get 13% capital appreciation as of 2026, Buffett gets 66.7% additional appreciation in the same period.

We could assume an even worse scenario when the stock price performance is even poorer than before:

In this scenario, the stock price will reach only $205 in 2026, which means that your total capital appreciation is only 6% in 3 years given your cost of $194. To the contrary, Buffett got a very decent capital appreciation of 28.2% in the same period, even with poorer stock performance in that period. The compounding effect is what explains Buffett’s excellent additional capital appreciation; this factor was also used by Buffett in his bets on American Express (AXP) and Coca-Cola (KO) to earn exponential returns over time at a very low stock price.

To calculate Buffett’s additional capital appreciation for 2026, we used the following formula:

Additional capital appreciation 2026 (respecting 2023) = Capital appreciation as of 2026 (respecting 2016) + Capital appreciation as of 2023 (respecting 2016)

The main lesson here is that even in scenarios where the stock price might perform poorly in the next few years, Buffett and most investors who have a very low average cost of their shares would earn a very decent capital appreciation of their shares just by holding them for years, and this is because they have a relatively low average cost. In this example, Buffett has an average cost of only $39, while your average cost in this example is $194, assuming you are a new investor.

New investors might buy Apple stock at $194, but they would need to buy more if there was any future drop in the stock price. Old investors might decide not to sell any shares, which is the best strategy with this stock.

Valuation

According to SA, using different multiples, Apple appears to be expensive compared to its main comparables. It’s possible that these higher multiples are explained because Apple is a better company than its peers; thus, we need to find another way to calculate its fair value.

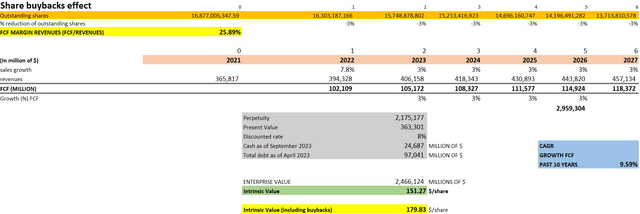

As we think that Apple should be held for many years, and given the predictability of its business model, we’ll use the discounted cash flow (DCF) method. We assume the following:

- Outstanding number of shares as of 2022: 16,303,187,166

- A reduction of the outstanding number of shares per year of -3% given that the average reduction was similar in the last 2 years after the split in 2020.

- FCF/revenues: 25.89% in the next few years. This is the average of the last 13 years.

- Revenue growth: 3% (consensus estimates 6 and 7% annual growth).

- Growth of FCF perpetuity: 4% annual (last 10 years, growth of FCF was 9.59% CAGR).

- Cash on hand from Q2 fiscal year 2023: $24,687 million

- Total debt for Q2 fiscal year 2023: $97,041 million

- Discounted rate: 8%, which we use to assume in high-quality companies

To calculate the perpetuity, which is a critical number in our model, we need to calculate the present value (PV) of all the FCFs beyond the year 2027 using the formula:

PV FCFs beyond 2027 =118,372/(discounted rate – g) = 2,959,304

where 118,372 is the first term of the sequence beyond 2027, which is the FCF in 2027, and g is the annual growth of the FCF in perpetuity in that sequence. Then, we need to calculate another present value of 2,959,304 that is located in 2026 to bring it back to 2023:

Perpetuity = 2,959,304/(1+discounted rate)^4 = 2,175,177

To calculate the Enterprise value, we use the next formula:

Enterprise value = PV FCFs (2023-2026)+ Perpetuity – Debt+ Cash

To find the intrinsic value, we divide the enterprise value by the outstanding number of shares in 2027 in order to partially incorporate a lower number of outstanding shares, resulting in a fair value of $179.83 per share.

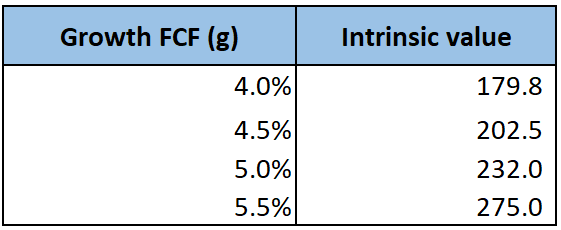

To have a better picture of the future of Apple’s intrinsic value, we want to make a simple sensitivity analysis changing the growth of FCF (g):

Author

Even when we get an intrinsic value of $179.8 per share, we consider it a very conservative target price since we assumed a future annual growth of FCF of 4%. However, in the last 13 years, Apple has been able to grow its FCF to 9.59% CAGR; therefore, it’s feasible for the company to achieve higher growth than 4% of its FCF as there are lots of opportunities associated with developing new profitable services such as “buy now, pay later” apps, services related to Apple Card and Apple Pay, future developments of AR and VR products, which are not even considered in our calculation, the development of services related to AI, where the company has launched more than 600 new job positions related to generative AI, etc.

There are lots of opportunities for Apple to take advantage of the more than 2 billion active devices globally. Looking at the table above, we may notice that by pushing up the growth of FCF to very attainable levels, the intrinsic value might reach $232 or even $275 per share in the long term.

Risks

Like every other stock, Apple might be subject to certain risks; we’ll focus on the most important ones. For example, we could imagine that the geopolitical tensions between China and the US might be a risk, as in terms of consumption and production, China is a very important source of revenues, manufacturing, and logistics. In addition, the tension between these two countries resulted in an increase in tariffs for imports in China, which increased costs for many industries and affected the manufacturing costs for Apple’s suppliers.

However, these risks are mitigated since Tim Cook maintains an excellent relationship with the Chinese government, as was noticed in March 2023 when Tim Cook met China’s minister of commerce, Wang Wentao, in China. Both parts know how important they are for each other, so it’s in the best interest of China to offer Apple the best place for its investments in the country. With respect to the higher manufacturing costs, Apple has amazing pricing power to offset them, at least partially.

In addition, Tim Cook is reducing the concentration of the manufacturing process in China and expanding its operations in India.

In my view, a bigger risk is when Tim Cook has to leave Apple. He is 62 years old, and he said that he will not stay another 10 years in the company, which means that he could retire between 2025 and 2028. There are several names on Apple’s executive team that could take over the CEO position in the future, and all of them seem to have the ability to keep Apple in a strong position. Even Tim Cook could be part of that future election, so that reduces the chances of a wrong selection.

Final Thoughts

We think that Apple exhibits a combination of intrinsic characteristics that contribute significantly to its long-term appreciation. This confuses most bear analysts since they only focus on the quarterly revenue growth as the only source of value generation, so whenever the revenue growth faces some challenges or unexpected bad results, they give a sell recommendation, overlooking other important factors that we mentioned in this article and that are also very important as future value generators in the long term.

We hold Apple stock at $114 per share, representing an important weight in our portfolio; we feel very comfortable with that average cost, and we are not planning to add more shares at the current prices or to sell any shares for several years. We took advantage of building our position during two crashes of the stock market: in March 2020 at the beginning of COVID 19, and in the fall of the stock markets in 2021 and 2022 when the FED started increasing interest rates.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.