Summary:

- Apple was the second biggest revenue generating brand in India in 2022, second only to Samsung as it gained 18% of the total value of smartphone shipments.

- Services remain a long-term opportunity for the company to monetize its installed base of over 2 billion active devices.

- In addition, the company’s strong financials will only become more attractive in the event of a recession.

Justin Sullivan

Royston Roche, Tech Insider Network Analyst, contributed to this article.

The smartphone market continues to be hit hard in Q1, with prices down 20% and shipments down 13%, according to Canalys. Despite double-digit decline across the industry, Apple (NASDAQ:AAPL) delivered marginal growth on its iPhone sales at +1.5%. According to Counterpoint Research, Apple grew smartphone shipments by 1 million year-over-year from 59 million in Q1 2022 to 58 million in Q1 2023. The decline of 1.7% was better than the 14% decline for the global smartphone market.

According to Apple’s management, the reason the company was able to overcome smartphone weakness was due to sales in the emerging markets. The company’s CFO, Luca Maestri, said in the earnings call,

“We set March quarter records in several developed and emerging markets with India, Indonesia, Turkey and the UAE doubling on a year-over-year basis.”

Within the emerging markets, India is a primary focus for Apple due to a growing middle class. According to a survey from a non-profit, the middle-class population has grown from 14% in 2004-05 to 31% in 2020-21. Tim Cook also points to the fact that the country is at a tipping point.

There are a lot of people coming into the middle class, and I really feel that India is at a tipping point, and it’s great to be there.”

Although Apple does not break down India sales figures, Bloomberg News reported that sales grew by 46% YoY to about $6 billion for the trailing twelve months ending March 2023. According to a Wedbush analyst,

Apple is now aggressively looking at India from both a production and retail expansion over the coming years that the firm believes will be a strategic poker move for Cupertino that could ramp annual revenue to $20 billion by 2025 in India.”

Tim Cook recently visited India in April and opened two company-owned retail stores. Apple was the second biggest revenue generating brand in India in 2022, second only to Samsung as it gained 18% of the total value of smartphone shipments, according to research firm Counterpoint.

The company also plans to make India a manufacturing hub and this move is seen as the company’s efforts to rely less on China. JP Morgan mentioned in its research note last year that the company plans to produce 25% of all iPhones from India by 2025. However, it could take a few more years to reach the 25% level. According to Bloomberg News, the company now produces 7% of total iPhones from India and this is up from 1% in 2021.

Apple supplier Foxconn announced recently that the company plans to invest $500 million to set up a manufacturing plant in India. It had also announced in March that it received approval from another state in India for a $968 million investment. Similarly, Foxconn has plans to expand its existing manufacturing plants in India.

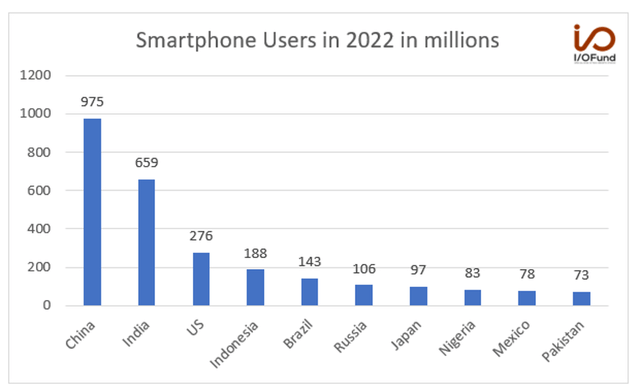

There are 2 billion Apple devices active in the world and there are 659 million smartphone users in India, compared to 975 million in China and 276 million in the United States. With India being second place, it makes sense that Tim Cook is focused here.

According to Morgan Stanley analyst Erik Woodring,

“The firm’s 2023 revenue and EPS forecast increased by 1% and 3%, respectively, post-earnings and while the firm calls out iPhone 15 and an AR/VR headset as the next catalysts, it adds “don’t sleep” on the emerging markets and India story at Apple.”

Apple’s Brand Needs a Catalyst

Warren Buffett was recently asked why he is invested in Apple and his reply was:

If you’re an Apple user and somebody offers you $10,000, but the only proviso is they’ll take away your iPhone and you’ll never be able to buy another, you’re not going to take it. If they tell you if you buy another Ford car, they’ll give you $10,000 not to do that, you’ll take the $10,000 and you’ll buy a Chevy instead.”

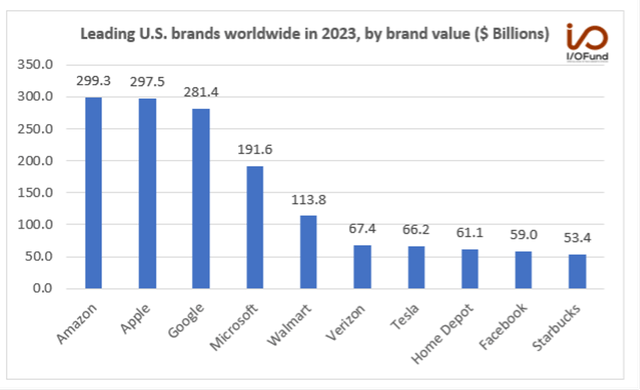

Not surprisingly, Apple is one of the world’s most valuable brands, rivaled only by Amazon and Google.

Despite this strong brand, the next chapter for Apple has been slow to materialize. As seen below, wearables have not become the “next big thing” for Apple with $8 billion or so in revenue per quarter. Emerging markets are promising, yet at the $20 billion per year or $5 billion per quarter, Apple will struggle to move the needle for some time by relying on this strategy alone.

Earlier this month, we published an article “Apple’s Stock in Focus: More Profitable Than Banks” where we stated:

Investors looking for the “next big thing” will point toward companies like Stripe, Sofi or Square as the leading fintech stocks. Meanwhile, the next big thing to disrupt the financial sector may be sitting in plain sight. Apple grew its cash trove through legendary design and hardware, yet how Apple chooses to leverage its enormous reserve of cash may be what writes the next chapter for the world’s most valuable company.”

Services remain a long-term opportunity for the company to monetize its installed base of over 2 billion active devices. Apple recently launched a new high-yield savings account that offers a 4.15% interest rate, which is 10 times higher than the United States national average and 415 times higher than what Chase or Bank of America offers at 0.01%. Apple is also lending from its balance sheet for the first time ever through Apple Pay’s Buy Now and Pay Later product.

To illustrate how effective Apple’s move into finance tech has become, the cornerstone product, Apple Pay, currently has 75 percent adoption among iPhone users. This is up from 10% in 2016. In addition to taking on banks, Apple is also competing with Mastercard and Visa with features that allow merchants to use iPhones and iPads to send and receive payments. The long-term goal is to replace wallets with iPhones.

Spotlight on Earnings

For some time now, Apple has been a value stock. We discussed this when we stated:

While comparing to other popular value stocks like Walmart, Apple is trading at a slightly higher forward P/E ratio of 23 compared to Walmart’s 19. However, the company’s net profit margin of 25.71% is very good compared to Walmart’s 1.45%.

Similarly, Apple has an excellent free cash flow margin of 26.37% compared to Walmart’s negative free cash flow margin of -5.15%. This helps illustrate why Apple’s stock has held up well as investors are able to participate in the most cash efficient company of all time while also participating in the company’s future innovation cycle.”

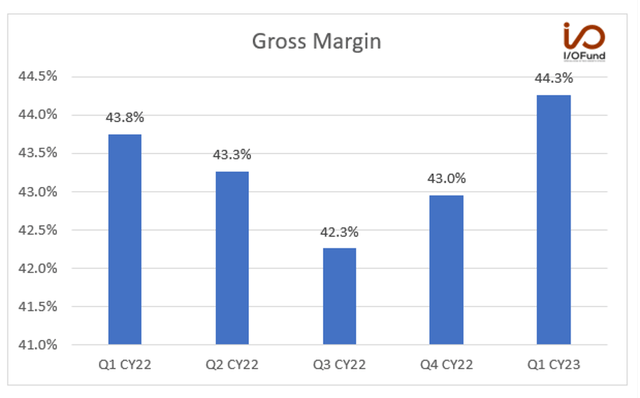

The most recent earnings results continue to prove that Apple’s management team is strong on efficiency. Despite revenue declining by (2.5%) YoY to $94.84B, the gross margin improved from 43.8% to 44.3% in the most recent quarter, up 50 basis points due to cost savings and a favorable mix from Services. The free cash flow margin remained solid at 27% compared to 26.4% in the same period last year. The board also authorized an additional $90 billion share repurchase and increased the quarterly dividend by 4% to $0.24 per share.

Operating income declined by (5.5%) and net income declined by (3.4%) YoY to $24.2 billion. EPS of $1.52 remained unchanged from the same period last year, and notably, the company beat EPS estimates by 6.4%.

As stated, iPhone sales were up +1.5% to $51.3 billion. Mac revenue declined by (31%) YoY to $7.2 billion. This was due to a strong comp with M1 MacBooks sales from last year and a weaker consumer. iPad declined (13%) YoY to $6.7 billion. Wearables declined (0.6%) to $8.8 billion.

Services grew 5.5% YoY to $20.9 billion.

Paid subscriptions of 975 million, was up 18.2% YoY. This segment is important as there is a higher gross margin of 71% compared to 36.7% for products.

Management’s directional insights for the June quarter were soft with foreign exchange negatively impacting growth by about 4%. The company’s CFO, Luca Maestri, said in the earnings call,

We expect our June quarter year-over-year revenue performance to be similar to the March quarter, assuming that the macroeconomic outlook does not worsen from what we are projecting today for the current quarter. Foreign exchange will continue to be a headwind and we expect a negative year-over-year impact of nearly four percentage points.”

Analysts expect revenue to decline by (1.1%) YoY to $82.03 billion.

Where Can Apple Stock Go from Here?

There are two scenarios we are tracking for Apple based on the current price information:

The blue count suggests that we are in a long and drawn-out correction that will ultimately be targeting new lows. If Apple stays below $181.50 and then breaks below $150.50, the odds that this scenario is playing out will become very high. If this plays out, we will look towards the blue target box for a major low.

The red count suggests that the January low for Apple was a major one. This will put us in the final push in the large uptrend that began in 2009. If Apple can break above $181.50, we can see a final push to the upper red target box between $192 – $210.

Apple is currently under the major resistance zone between $176.25 and $181.50. Based on the relative weakness in most markets right now – small caps, industrials, materials, financials, transportation, the Dow Jones, as well as many global markets – we are expecting volatility to return sometime in early June. If Apple fails to punch through the $181.50 resistance before the market pulls back, it will need to hold the $160 – $150.50 range in order to allow for this final swing into the red target zone above. Below $150.50 and the top will be in for Apple, as the odds will greatly increase that we will be testing Apple’s January lows.

Conclusion

My firm does not own Apple at the moment, yet given its enormous brand value and high install base, it’s a company we track closely. In addition, the company’s strong financials will only become more attractive in the event of a recession. For our purposes, my firm would want to see Services materialize as a leading Fintech play, and we would want to wait for the price action outlined above to play out before buying this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AAPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out Tech Insider Network

Check out Tech Insider Network

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our audited 3-year results of 47% prove we are a top-performing tech portfolio. This compares to popular tech ETFs at negative 46% and the Nasdaq at 19%.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services includes an automated hedge, portfolio of 10+ positions, broad market analysis, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.