Summary:

- We reevaluate the Apple Inc. risk calculus as its P/E ratio approaches 30x and analyze two alternative approaches to add/own its shares.

- First, there is nothing wrong with simply waiting. I believe a price correction to the ~$170 level is possible given Apple’s historical volatility.

- Secondly, owning Apple shares indirectly through Berkshire Hathaway stock offers a few advantages, too.

- The top advantages in my mind include a lower ownership P/E and the potential for tax-efficient double-compounding.

Justin Sullivan

AAPL: the search for an alternative way

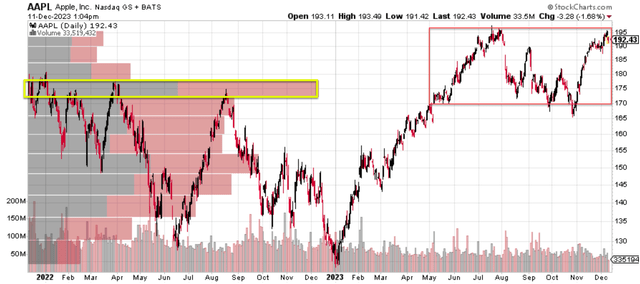

Readers following my writings must know that I have been a stubborn supporter of Apple Inc. (NASDAQ:AAPL). I have arguing for a bull case on the stock for years. In my view, many (if not all) of the issues that the market feared in the past have been temporary. Warren Buffett and his Berkshire Hathaway Inc. (BRK.B) positions have been good reminders to ignore these issues and focus on the long term (see the chart below for an example).

However, the trouble with a correct bull thesis is that it eventually defeats itself. As price rallies, valuation expands, and the risk calculus changes. Specific to AAPL, I feel now it is at a point where its risk calculus needs to be reevaluated. As repeatedly argued in my earlier writing, any P/E near or below ~25x is attractive for AAPL, whose ROCE (return on capital employed) is nearly 100%. The reasoning is quite simple and involves only napkin math. With such ROCE, a 5% investment rate would fuel 5% organic growth (100% ROCE * 5% reinvestment rate). A ~25x P/E provides ~4% of earnings yield. Consider AAPL’s capital-light model, the true owners’ earning yield must be higher than 4% (say 5%). Thus, the total return in the long term is close to 10%, far better than the overall market’s penitential.

Now, with AAPL’s P/E pushing towards 30x (29.9x as of this writing), repeating the above simple math begins to show results that can feel off-putting to me. So it naturally leads to the question of what to do if you want to hold it (or even add more of it). I’ve considered a variety of possibilities, ranging from simply buying more to the use of options (especially LEAP options). Each approach would be a full-length article and inevitably involves digression into technical details outside AAPL (such as tax implications and options). Thus, in this article, I will focus on two simpler ideas: waiting, and holding it indirectly via BRK.B.

Waiting

This is the most boring, yet effective, method in my view. In our experience, the stock market is a place where investors trade patients for profits (and pay money to learn to be patient).

At its current price level, it seems hopeless that we would be able to grab Apple shares at 25x P/E or lower. However, judging by its historical volatility (see the red box in the next chart below), I think it is totally possible that its prices revisit the $170 level, which would translate into an FWD P/E of ~25.9x under current consensus estimates. Furthermore, a price range of around $170~$175 also happens to be where the heaviest trading volume has been recently (as highlighted by the yellow box below), further adding to the odds for its price to revisit this price range.

Tax-efficient double-compounding via Berkshire

The second approach involves owning AAPL shares via Berkshire Hathaway stock. This approach offers two crucial advantages, at least in my view.

First, owning AAPL shares via BRK reduces what I call the “ownership P/E.” The details were discussed in an earlier article. The gist is that due to the special capital structure of BRK, the nominal P/E based on its accounting EPS makes little sense to me. I analyzed BRK by a SOTP approach (sum of the parts) to delineate its operating income from its equity portfolio (where AAPL is the largest position). The results show that the effective P/E I can own AAPL shares this way is cheaper than its market P/E. Of course, how much cheaper (or whether it is cheaper) will depend on the multiple you assume for BRK’s operating income. And I will leave you to make the judgment there.

Second and more importantly, holding AAPL shares via BRK allows us to enjoy double-compounding in a very tax-efficient way. It is a mouthful, so allow me to elaborate.

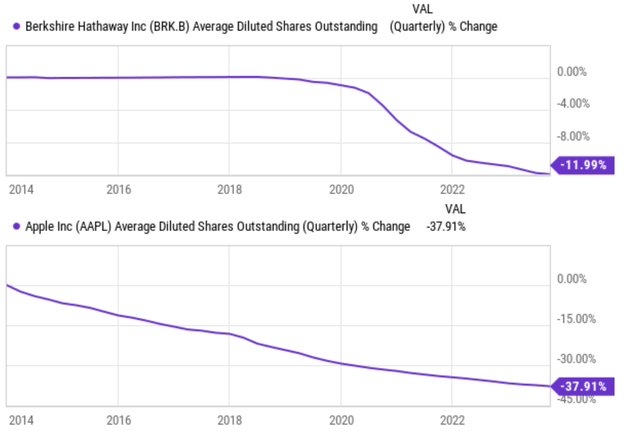

Both AAPL and BRK have been regular buyers of their own shares. In the case of BRK, it has been doing so quite aggressively since 2018 as seen from the top panel of the following chart. To wit, its equivalent B shares count has shrunk by almost 12% since then. AAPL has an even longer and more aggressive history of buying back its own shares, as seen in the bottom panel. Its average diluted share count has been in continuous decline over the 10 years, with a whooping cumulative reduction of almost 38%.

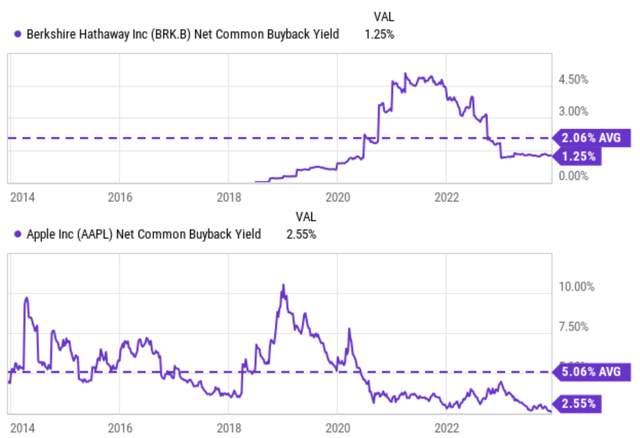

Such buybacks translate into a net common buyback yield on average of 2.06% for BRK and more than 5% for APPL, respectively. So I kept telling investors who are against BRK and AAPL because of their lack of or low dividend yields that they are missing the bigger picture. Investors need to focus on the total yield, which includes both cash dividend yield AND buyback yield. In both cases, the buyback yield is far more than the cash dividend yield. Furthermore, I myself always prefer buybacks over cash dividends because of the tax efficiency.

What do I mean by double-compounding?

After addressing the tax efficiency, let me elaborate on what I mean by double compounding. I am sure we all understand the power of compounding already. But the BRK-AAPL combo offers something even more powerful as BOTH of them shrink their share counts. Buffett already recognized this and commented in the 2021 shareholder letter (edited with emphases added by me):

Apple – our runner-up Giant as measured by its yearend market value – is a different sort of holding. Here, our ownership is a mere 5.55%, up from 5.39% a year earlier. That increase sounds like small potatoes. But consider that each 0.1% of Apple’s 2021 earnings amounted to $100 million. We spent no Berkshire funds to gain our accretion. Apple’s repurchases did the job. It’s important to understand that only dividends from Apple are counted in the GAAP earnings Berkshire reports – and last year, Apple paid us $785 million of those. Yet our “share” of Apple’s earnings amounted to a staggering $5.6 billion. Much of what the company retained was used to repurchase Apple shares, an act we applaud.

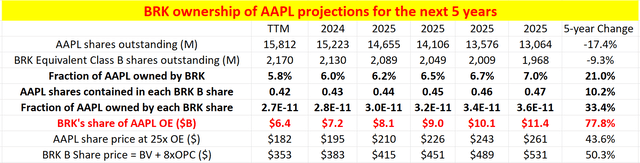

Buffett himself probably never bothered to project what would happen if what he commented above keeps going for a few more years. So, I did it here. The table below shows my projection of how much AAPL I’d own via each BRK.B share in 5 years given the current rate of repurchases. The estimates were based on some simple assumptions and the key assumptions are:

- Both AAPL and BRK keep spending a constant percentage of their OCF (operating cash flow) buying back their own shares. The perchance I assumed was the average in recent years: 78% for AAPL and 68% for BRK.

- I assumed both grow their profits at 8% CAGR to be consistent with consensus estimates.

- I assumed an average buyback price of 20x OPC for AAPL. For BRK, the average buyback price was assumed to be 8xOPC plus its book value following the SOTP model I mentioned earlier.

- Finally, I also assumed BRK will hold its current 915M AAPL shares unchanged.

Of course, you can (and should) tweak these assumptions and form your own projections. The numbers may change but the key point will remain. And the key point is that double buybacks are even more potent than the sum of two separate buybacks. Put differently, if both AAPL and BRK reduce their share count by 1% each, the benefit is more than 2%. It is just a simple math fact about compounding.

As some reflections for this basic fact, a few observations from my projection:

- AAPL’s share count would be reduced by 17.4% in this model and BRK’s by 9.3% in 5 years. Yet, the fraction of AAPL shares owned in each BRK.B share would increase by a whopping 33.4%, far more than the sum of 17.4% and 9.3%.

- Even more strikingly, by that time, BRK’s claim to AAPL’s OE (owner’s earnings) would have increased by almost 78% compared to now. I suppose the more proper name for this magic is triple compounding. It is the combined effects of the double buybacks plus the earnings growth of AAPL.

Risks and final thoughts

Risks generic to AAPL (or BRK) have been the topic of many other SA articles. Thus, I see little point in repeating them here. Instead, I will focus on some of the issues involved with my own method used in this article.

As pointed out throughout the article, readers should take my numbers with a grain of salt because of the various assumptions I made in my projections. But again, changing the parameters would not change the essence of the thesis in my view. However, there are things that could change the essence of the thesis and a buyback tax would be one of them. Currently, the tax rate on stock buybacks is 1%. The issue of buyback tax is a rather hot topic – both politically and economically for many powerful/wealthy people. President Biden has recently proposed a much higher buyback tax of 4%. Such drastically higher rates might change the fundamental economics of share buybacks.

To conclude, with the Apple Inc. P/E pushing towards 30x, its potential return potential inevitably retreats in tandem. If you are a momentum trader who believes the higher the prices, the better the return potential is, I am sorry that you’ve read the wrong article. The thesis of this article is to caution readers of the increasing valuation risks for Apple Inc. stock and also offer some alternative ideas. Besides the simplest and most boring idea of waiting, I see owning AAPL shares indirectly via BRK as a viable alternative. According to my model, this approach offers both a lower ownership P/E and more potent compounding with tax efficiency.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, BRK.B either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.