Summary:

- Concerns around Apple Inc. stock have been piling up lately, from the perception that it is falling behind in the AI race, to the growth and profitability of its App Store.

- But there is a powerful and favorable trend playing out for Apple that could help it tackle all three of these concerns.

- If Apple continues its winning streak in this particular arena, it is conducive to stronger recurring revenue and profit growth going forward.

Justin Sullivan

Concerns around Apple Inc. (NASDAQ:AAPL) stock have been piling up lately. In the previous article, I had downgraded Apple stock to a “hold,” given the risks around its App Store revenue amid the European Commission’s Digital Markets Act, as well as the growing tensions in China.

The tech giant’s lack of AI-related announcements is also concerning the market, and investors are also eager to see how the company’s new Apple Vision Pro finds its product market fit.

Though amid all the concerns, investors are overlooking a growing opportunity for Apple, which is the enterprise market. The tech giant’s products are increasingly being used in the commercial space, which opens new growth avenues that could improve Apple’s recurring revenue and profitability going forward. Though the stock remains expensive, hence re-iterating the “hold” rating.

Apple’s enterprise opportunity

Bring Your Own Device [BYOD] policies have been gaining prevalence over the past several years amid the pandemic, with a 2021 bitglass/ Forcepoint report revealing that “82% of organizations actively enable BYOD to at least some extent.”

Apple CEO Tim Cook proclaimed on the Apple’s Q1 2024 Earnings Call that this trend has been a boon for Apple, claiming that employees across the world are increasingly choosing the tech giant’s devices for work:

“what has happened over the last several years is that, employees are in a position in many companies to choose their own technology that is the best for them. And so, it sort of took some of the central command from the traditional company and decentralized the decision-making. That is a huge advantage for Apple, because there’s a lot of people out there that want to use a Mac. They’re using a Mac at home. They’d like to use one in the office as well. iPad has also benefited from that.

…

we continue to see many business customers leverage Apple products to improve productivity and drive innovation. Target recently added the latest M3 MacBook Pro to their existing deployment of thousands of Mac’s, enabling employees across various departments to do their best work. In emerging markets, Zoho, a leading technology company headquartered in India, offers its 15,000 plus global employees a choice of devices, with 80% of their workforce using iPhone for work and nearly two-thirds of them choosing Mac as their primary computer.”

By 2021, Apple’s enterprise market share was estimated to have reached 23% in the U.S., according to International Data Corporation [IDC]. For context, it was 17% in 2019. More recent enterprise market share data is unfortunately not available yet.

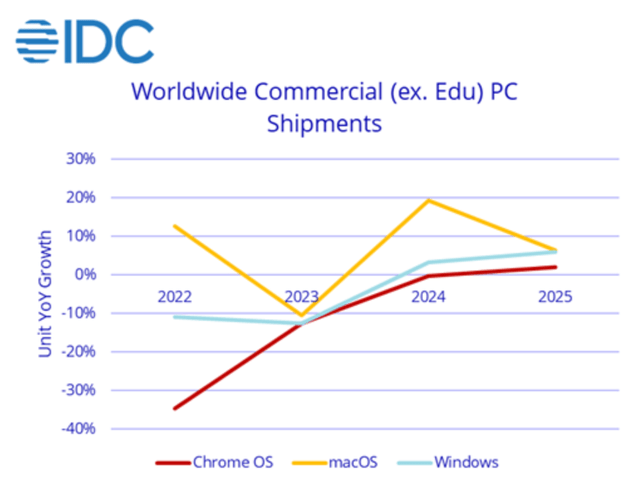

Although last year IDC had estimated that the number of MacOS-based devices for enterprise use across the world would grow by 20% between 2023 and 2024, as per IDC’s Worldwide Commercial PC Shipments chart below.

International Data Corporation

Apple’s timely and savvy move to power the Mac devices with their own chips is also an important factor to consider. Macs with the M-Series silicon were introduced in 2020, which have yielded great performance advancements over Macs powered by Intel chips.

In fact, upon the launch of its first generation M1 chip back in November 2020, Apple proclaimed improvements like faster CPU/ GPU performance and longer battery life. But more importantly, the M1 delivered “15x faster machine learning.”

This “machine learning” (Apple’s term for Artificial Intelligence) performance advancement is particularly beneficial amid the AI revolution.

Apple is now onto its third generation “M3” chip, and is touting even greater performance advancements for professional workers:

“With MacBook Pro with M3…

Spreadsheet performance in Microsoft Excel is up to 3.5x faster than the 13‑inch MacBook Pro with [Intel] Core i7, and up to 40 percent faster than the 13‑inch MacBook Pro with M1.”

The Cupertino-based giant is indeed pushing into the enterprise segment with these proclamations.

Apple’s experience developing its own chip that deeply integrates with its other hardware components, operating system and native software services should prove valuable as it strives to build AI computers and increasingly take market share from competitors amid the generative AI revolution.

Ryan Reith, the group vice president of IDC’s Worldwide Mobile and Consumer Device Trackers, noted that:

“These days it’s hard to have a conversation that doesn’t involve AI and where and how to invest…Commercial PCs will remain interesting for years to come with technology advances adding an extra element to decision making, but it’s important to remember that [Microsoft] Windows 10 end of support comes in 2025 and this will drive commercial refresh regardless of whether companies are waiting on more advanced PCs or just needing to update an aging installed base. It seems clear that Apple sees an opportunity to continue its growth in the commercial segment and this will be an angle to watch closely going forward.”

Indeed, Windows 10 (Microsoft’s (MSFT) operating system) will reach end of support in October 2025, requiring organizations to upgrade to Windows 11.

This creates an attractive opportunity for Apple to lure enterprises into migrating to Apple hardware/ MacOS as the CTOs and IT departments across organizations plan and refresh their IT infrastructure for the AI revolution.

Note that this does not just include desktops/ laptops for work, but also smartphones and tablets (depending on the industry and type of work). Apple’s suite of multiple form factors for hardware devices (including iPhones, iPads, MacBooks, iMacs) augments the value proposition of using Apple hardware and software operating systems for enterprises’ main IT infrastructure, as it eases cross-device working for employees.

On the other hand, while Microsoft currently dominates the PC operating system market, it has failed to build a competitive smartphone and mobile operating system over the years, undermining its ability to offer a comprehensive software ecosystem that integrates across multiple form factors the way Apple has built.

Given Apple’s dominant market share of 61% in the U.S. smartphone market, Apple has the opportunity to leverage the popularity of its smartphone for personal use to also encourage people to use them for professional use, by building in more “business-specific” uses cases into device.

For instance, in a previous article, we had discussed Apple’s savvy move to enable payment acceptance technology on iPhones, making its easer for small business owners to accept payments in physical stores without having to purchase Point-Of-Sale devices from Square/ Block (SQ) or Shopify (SHOP).

This creates a great entry point for Apple earlier on in businesses’ growth stages, and opens up the opportunity for cross-selling other hardware devices as these businesses grow into bigger enterprises, pulling them into the Apple ecosystem. In fact, on the Q2 2023 Apple earnings call, CEO Tim Cook had shared that:

“In small business, we see an increasing number of customers relying on Apple hardware, software and services to power their businesses forward, from accepting payments on iPhone, to tracking inventory on Mac or iPad, to managing employee devices with Apple Business Essentials.”

As Apple’s presence in the business world grows, it is certainly a strength it can leverage amid the AI revolution as corporations seek to refresh their IT infrastructure.

Although in order to optimally capitalize on the opportunity ahead, Apple will need to introduce worthwhile AI capabilities through its hardware and software to successfully lure enterprises into its ecosystem.

Apple’s software opportunities in the enterprise

We already touched upon Apple’s advantage from using proprietary silicon, whereby its years of experience in designing its own “Neural Engine” and “accelerators in the CPU and GPU to boost on-device machine learning” should position the company well to innovate hardware for generative AI-driven use cases.

Additionally, the tech giant will also need to prove its ability to build generative AI-powered software for professional use cases. The most obvious would be its own large language model to advance Siri’s capabilities in helping businesses and employees work more efficiently and productively inside Apple’s operating systems, in order to compete against Microsoft’s Copilot for Windows OS and Office 365 apps.

Aside from such intelligent assistants that will become ubiquitous across all tech platforms, Apple will also need to introduce other types of generative AI-powered software that is specific to professional use cases, in order to enhance the stickiness of the Apple ecosystem across the corporate world.

The company already offers its own suite of productivity apps (e.g., Pages, Numbers, etc.) that come pre-installed on Apple devices and compete against Microsoft’s Office 365 suite and Google Workspace apps. However, Apple’s apps are currently not up to the standard compared to these competitors’ offerings, with Microsoft and Google still dominating the office productivity software market.

If Apple wants to continue gaining market share in the enterprise market, enhancing its professional software services overall (not just office productivity software) could prove key to staying competitive. In fact, offering new enterprise-specific software services could potentially even open up an entirely new stream of recurring ‘Services’ revenue for the tech giant.

Aside from Apple’s opportunities with its own professional software apps, the increasing use of Apple hardware across enterprises should also induce more and more third-party app developers to build generative AI-powered software services specifically for the MacOS and iOS operating systems.

A growing installed base in the corporate world indeed opens up new addressable market opportunities across various industries for software developers, and creates new sources of commission revenue for Apple.

In turn, the growing availability of professional software services on the Apple App Store should also continuously augment the value proposition of Apple hardware for enterprise-use, potentially encouraging even more businesses to migrate to MacOS/iOS-based IT infrastructure, thereby creating a virtuous network effect.

Although speaking of the App Store, Apple has recently been forced to comply with the EU’s new Digital Markets Act, allowing for third-party app stores to operate within Apple’s ecosystem, and undermining Apple’s ability to monetize third-party apps through its controversial 30% commission rate.

Apple’s alternate fee structure in response to the DMA is now also being looked into by the European Commission to assess compliance, with various developers claiming that Apple’s alternative way of charging developers is even worse than its traditional fee structure for the App store.

Furthermore, these regulatory issues could spread to more regions around the world as governments crack down on Apple’s market power through the App Store.

The prospect of Apple monetizing third-party apps at a lower rate than its traditional 30% commission rate around the world certainly undermines “Services” revenue growth going forward.

Nonetheless, at the same time, there is a growing opportunity for Apple to tap into the Enterprise Software Market, which is expected to grow to $724.7 billion by 2030, as Apple hardware is increasingly used in the corporate world.

Apple Vision Pro in the enterprise

Amid the intensifying tensions between Apple and third-party developers regarding its controversial App Store fee structures, there had been growing concerns among investors that the tech giant would struggle to attract developers to build apps for its new Apple Vision Pro.

But those worries have been allayed as developers made over 1.5 million iOS and iPad apps compatible with the Apple Vision Pro, allowing for cross-device experiences. And even more importantly, over 1,000 apps have been built specifically for the spatial computing device. This is testament to Apple’s brand power, as developers don’t want to miss out on this new avenue to access Apple’s loyal customer base.

Although it is now becoming well-accepted that the bigger opportunity for such AR/VR headsets lies in the enterprise space rather than the consumer market. This is likely to be especially true for the Apple Vision Pro, at least over the near-term, as its price starts from $3,500. Simultaneously, Meta platforms is also striving to push aggressively into the enterprise space with its line of Quest devices.

Given Apple’s increasing market share in the enterprise space with its traditional devices like MacBooks and iMacs, the titan from Cupertino has the opportunity to cross-sell its headsets to enterprises as it can integrate with its other form factors that customers are already using.

Hence, Apple is better positioned than Meta to capitalize on the headsets market opportunity in the enterprise space from this perspective. Although the wide difference in price, with Meta’s latest Quest device selling for $500, will also certainly play a role in enterprise adoption.

But the point is, the growing presence of Apple devices in the corporate world should benefit the competitiveness of Apple Vision Pro in the enterprise market. And again, software will play a crucial role in enhancing the value proposition of its headsets. The tech behemoth already boasts a wide range of business-oriented apps on the App Store, and Apple will undoubtedly support developers to make these apps compatible for the spatial computing device.

In fact, on Apple’s Q1 2024 Earnings Call, CEO Tim Cook proclaimed that:

With the upcoming launch of Apple Vision Pro, we are seeing strong excitement in Enterprise. Leading organizations across many industries such as Walmart, Nike, Vanguard, Stryker, Bloomberg, and SAP have started leveraging and investing in Apple Vision Pro as their new platform to bring innovative spatial computing experiences to their customers and employees. From everyday productivity to collaborative product design to immersive training, we cannot wait to see the amazing things our enterprise customers will create in the months and years to come.

…

There are firms that are doing collaboration — design collaboration apps. There are field service applications. Really all over the map, there are applications that are for control center, command center kind of things. SAP has really gotten behind it and, of course, SAP is in so many of companies. I think there will be a great opportunity for us in Enterprise, and we couldn’t be more excited about where things are right now.

The initial adoption of the Apple Vision Pro across these large corporations and the productivity apps being built by software firms like SAP further buoy Apple’s opportunities in the enterprise space.

Risks

Microsoft’s Copilot: You could bet your bottom dollar that Microsoft will leverage the capabilities and stickiness of its new AI assistant “Copilot” to keep enterprise customers entangled within its own Windows ecosystem.

The software giant has already imbedded “Copilot” in its Windows 11 operating system, and has also been introducing it in Windows 10. Its strategy is to get customers accustomed to asking Copilot to complete various tasks for knowledge workers, and then leveraging the habitual use to encourage enterprises to upgrade to Windows 11.

Note that the operating system is often sold as part of the Microsoft 365 bundle, which combines the Windows OS with the Office 365 suite (Word, Excel, etc.), as well as additional security and management services. Microsoft will surely facilitate integrated benefits of using Copilot across its bundled portfolio of services to tie customers into its ecosystem.

If enterprise customers indeed become highly dependent on Microsoft Copilot, it could undermine Apple’s ability to encourage these organizations to migrate to Apple-based IT infrastructure, especially given the fact that the Cupertino-based giant has still not introduced its own AI assistant for enterprises to consider in comparison to Copilot.

Apple Vision Pro uptake: Despite the incredible capabilities of the spatial computing device, there have been complaints from initial users of discomfort, headaches and eye strain from using the headset.

Furthermore, despite the growing number of professional software apps on the Vision Pro, it is still not clear how the device would enable greater productivity compared to traditional means of working, as per a report:

Another common complaint is the Vision Pro doesn’t offer enough productivity relative to the price. One user noted on Threads that looking at Figma screens made them feel dizzy but that the device also wasn’t applicable to their work. Another engineer wrote on the social media platform X that the “coding experience failed to convince [him]” and focusing issues caused headaches.

…

“Several file types simply aren’t supported on the Vision Pro. I also can’t see how creating a slide in the VP would be less energy than doing so w/ mouse and keyboard”

Now these individual experiences may not be completely reflective of broader usage trends. Moreover, this is still the first-generation edition of the headset device. Apple will certainly strive to improve the user experience over its next iterations to try and address the health-related complaints.

Nonetheless, for the time being, the Vision Pro remains a solution looking for a problem to solve. If initial corporate adopters don’t see worthwhile improvements in productivity or quality of work outputs through their employees utilizing these headsets, it could curb the rate at which enterprises invest in this technology going forward, and potentially also discourage third-party software developers from building apps specifically for the Vision Pro.

All these factors could undermine the return on investment Apple sees for its Vision Pro venture.

Apple Financial Performance & Valuation

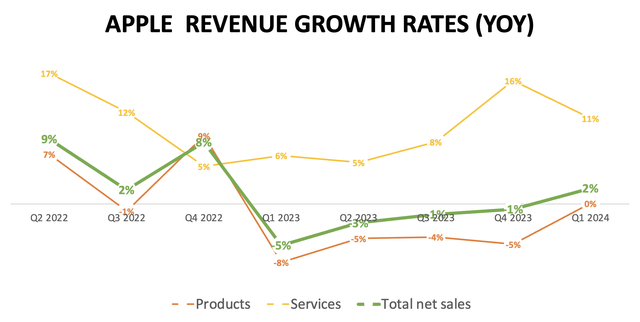

After four straight quarters of revenue decline, Apple finally delivered revenue growth last quarter, albeit at a mediocre rate of 2%.

Nexus, data compiled from company filings

There was no year-over-year revenue growth in Product sales, with last quarter’s revenue growth being led by the Services segment.

Apple is still primarily a hardware-led company, with “Products” accounting for around 75% to 80% of total revenue last year (fluctuating on a quarterly basis).

And the main source of this revenue remains the iPhone, accounting for 53% of the company’s total revenue over the last 12 months.

Apple’s lackluster hardware revenue growth stems from consumers holding onto to their devices for longer periods of time, as the cost of upgrading has continued to increase over the years, without proportional advancements in features.

A report from Consumer Intelligence Research Partners found that in the United States:

“61 per cent…of iPhone buyers held onto their previous iPhone for two years or more, compared to only 43 per cent of Android owners. … 29 per cent of iPhone owners retained their previous device for three years or more, while only 21 per cent of Android owners could make the same claim.”

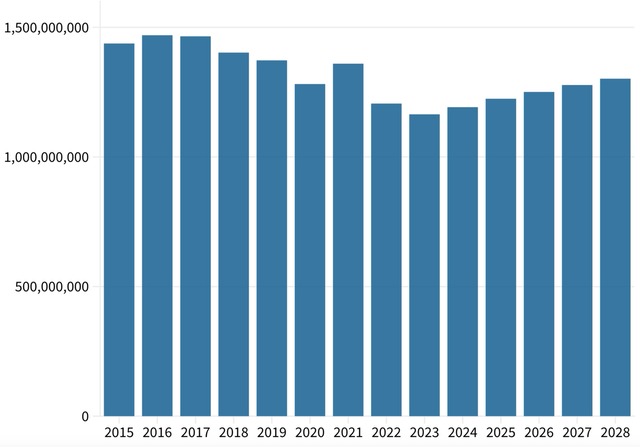

Now with the AI revolution in full swing, IDC is projecting a new sales growth cycle for the entire smartphone market starting in 2024, after years of sales growth declines.

Global Smartphone Units Sold and Projected (International Data Corporation )

With rivals like Samsung and China’s Honor already boasting new AI-powered features in their latest smartphones, all eyes are now on Apple to beef up its next iPhone with worthwhile generative AI capabilities to drive a new upgrade cycle and re-accelerate revenue growth.

Now while the AI revolution could encourage consumers to finally trade in their old devices for potential new “AI iPhones” to make optimal use of new generative AI software services with on-device processing, the real opportunity resides in the enterprise space.

Once individual consumers purchase an “AI iPhone,” they are likely to continue holding onto their devices for 2-3 years, unless Apple is able to offer significantly better capabilities in the sequential editions, with customers having to continuously upgrade to take optimal advantage of new “killer apps” in the AI era. If not, consumers are likely to wait a few years before upgrading again.

On the other hand, enterprises are constantly in a race to stay competitive, and want to ensure their employees stay equipped with high-performance tech devices. And this is why Apple’s growing market share in the enterprise space is such a bullish development, because organizations are more likely to engage in frequent upgrade cycles than individual consumers in order to achieve continuous productivity gains.

Now in order to actually encourage regular upgrades in the commercial space, Apple will need to sequentially deliver significant processing improvements for its next-generation M4 and M5 chips in its Macs, and the A-series chips in its iPhones.

As long as Apple can convince its enterprise customers that its latest edition devices are crucial for optimal processing of generative AI workloads that result in substantial productivity gains with worthwhile returns on investments, we could see more frequent upgrade cycles conducive to recurring revenue for Apple on the hardware side, translating into high-quality revenue and profit growth for investors.

Apple’s growing presence in the enterprise market offers promising growth prospects in the AI revolution. And these growth prospects are further buoyed by Apple’s opportunities on the software side.

The growth of Apple’s “Services” segment has resulted in profit margin expansion over the years as software tends to be a higher margin business, with the company-wide net profit margin currently around 25%.

As discussed earlier, Apple’s growing installed base in the enterprise market also opens up new opportunities for Apple to capitalize on the enterprise software market.

Whether that is through introducing its own professional software apps for corporate employees, or collecting commission fees on third-party app revenues, the opportunity is certainly massive, and would drive further profit margin expansion.

And again, software services sold to enterprises would offer higher-quality recurring revenue than the services currently sold to individual consumers (e.g., Apple TV+, Apple Music, etc.), as once organizations and employees become accustomed to using certain professional services as part of their day-to-day work processes, they are more likely to stick to the services over long periods of time.

The overarching point is, amid all the hype around AI on the consumer electronics side, investors should not overlook Apple’s opportunities in the enterprise market, which offers great avenues for capitalizing on the generative AI revolution.

Now let’s talk about Apple stock’s valuation. Apple currently trades at a forward P/E of around 26x, which is in line with its 5-year average.

Although forward P/E does not take into consideration the pace at which earnings are expected to grow going forward. That is why the forward Price-Earnings-Growth [PEG] ratio is a better metric for assessing valuation, which divides a stock’s forward P/E multiple by the projected EPS growth rate over a certain period of time.

Essentially, stocks with higher expected growth rates should trade at higher forward P/E multiples than those with lower future earnings growth rates.

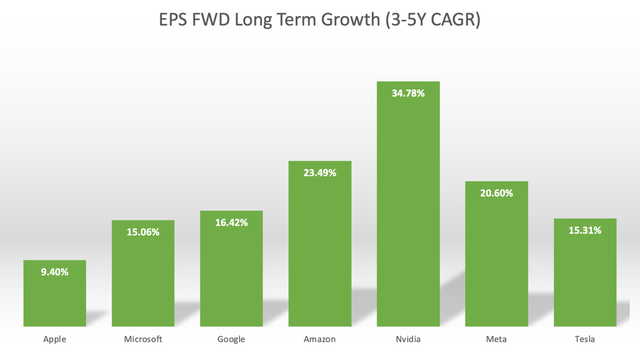

The chart below compares the EPS FWD Long Term Growth (3-5Y CAGR) of Apple stock against the other Magnificent 7 stocks.

Nexus, data compiled from Seeking Alpha

Apple has the lowest projected earnings growth rate of the mega-cap AI stocks.

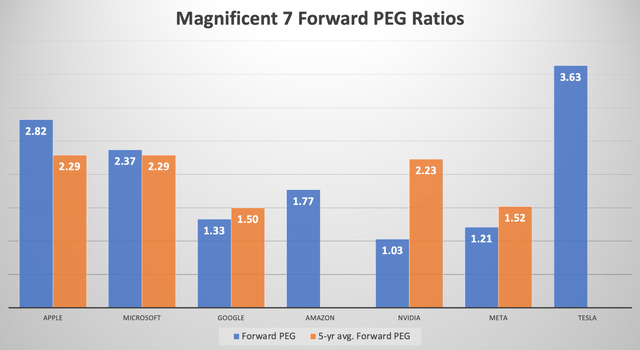

Now using these estimated EPS growth rates to calculate the forward PEG ratios, we find that Apple currently trades at a Forward PEG of 2.80, well above its 5-year average of 2.28.

Not only is the stock very expensive relative to its historical Forward PEG multiple, but also more expensive than the other Magnificent 7 stocks.

Note: 5yr average Forward PEG for Amazon and Tesla stock are unavailable (Nexus, data compiled from Seeking Alpha)

A Forward PEG ratio of 1 would imply that a stock is trading at fair value. Though beloved tech stocks rarely tend to trade at fair value, as the market tends to assign a premium to such stocks based on factors like the quality of a company’s executive team and market size position.

Barring Tesla (TSLA) stock, Apple is the most expensive Magnificent 7 tech stock.

Now given that the AI revolution is arguably perceived to be greater than the internet revolution, it is understandable why a mega-cap tech stock like Apple would trade at a higher PEG ratio than its own 5-year average, as AI is expected to boost growth potential going forward.

However, most of the other Magnificent 7 tech stocks are either trading roughly in-line or well below their 5-year average Forward PEG multiples, despite the promise of AI-driven growth.

Now given that Apple has the lowest EPS FWD Long Term Growth (3-5Y CAGR) estimate of 9.40%, while simultaneously possessing one of the highest Forward PEG ratios of the Magnificent 7 stocks, the stock is too expensive to buy at these levels.

Now part of the reason why Apple has the lowest projected EPS growth rate is because Apple is yet to reveal its AI growth strategy to the market. At the next developer conference in June, the tech giant is expected to reveal details about new AI features and capabilities through its suite of hardware products and software services.

If these announcements can indeed offer more visible and materializable AI-driven growth opportunities, then it could lift its projected EPS growth rate closer to the growth estimates of the other Magnificent 7 stocks.

Though at a Forward PEG of 2.82, the market is already pricing in AI-driven earnings growth potential, leaving little room for stock price upside upon the announcement of new features. In fact, if Apple’s announcements turn out to be underwhelming, the stock price is more vulnerable to downside risk given the high valuation multiple the security carries.

Apple stock trading at or below its 5-year average Forward PEG of 2.28, similar to how most of the other Magnificent 7 stocks are trading relative to their own historical valuations, would make the stock a bit more appealing. This would imply a Forward P/E of:

Forward PEG x Projected EPS growth rate = Forward P/E multiple

2.28 x 9.40% = 21.4x

That would be around 20% cheaper than its current Forward P/E multiple of 26.83x, implying a stock price of around $140.

Now the perception of fair value for the stock price could indeed rise as new revelations of the company’s AI-centric growth strategies lift the projected EPS growth rate.

But then again, even if Apple stock trades closer to its 5yr average Forward PEG, if other Magnificent 7 stocks continue to trade significantly below their 5yr average Forward PEG multiples, those securities could potentially offer more appealing investment opportunities to gain exposure to the AI revolution.

At current valuations, Apple Inc. stock remains a “hold.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.