Summary:

- I feel the risks associated with Apple are piling up, while markets act like they were still ignoring potentially substantial headwinds.

- I see major risks coming from the Google/AAPL DoJ trial, and the basket of risks associated with Apple’s position in China.

- Cumulatively, and depending on the severity of the headwinds, I see about 10-15% downside risk to Apple’s EPS in 2024/2025.

- Overall, I believe it would be wise for investors to take some chips off the table, reducing exposure to Apple stock.

Wirestock

Apple (NASDAQ:AAPL) is a fantastic company; and the market knows it. One major argument for Apple is certainly related to the company’s (perceived) low-risk commercial position in consumer tech, driven by exceptional customer engagement on a strong love brand. However, investors should also consider that because of Apple’s size, the firm is an obvious target for large macro players, including both entities in the U.S. (DoJ), as well as sovereign governments offshore, notably China.

Lately I feel the risks associated with Apple are piling up at a record pace, while markets act like they were still ignoring potentially substantial headwinds. Specifically, I see major risks coming from (i) the Google/AAPL DoJ trial, which may cut Apple out from billions of Traffic Acquisition Costs [TAC] payments, and (ii) the basket of risks associated with Apple’s position in China, where I see Apple poised to lose some market share over the next 12-36 months.

Overall, I believe it would be wise for investors to take some chips off the table, reducing exposure to Apple stock. The argument, I believe, is especially valid reflecting on Apple’s rich valuation — trading at a EV/EBIT of approximately x24.

The DoJ vs. Google/AAPL Risk

Let’s start with the Google/AAPL DoJ trial, covering the TAC relationship Google sustains with Apple. For context, the TAC relationship relates to search/ application agreements that Google has with Apple and other phone OEMs according to which Google pays fees to OEMs to render Google the default search engine on its devices. The lawsuit, which processed the first hearing on Tuesday, 12th September, asserts that Google’s search agreements with OEMs such as Apple are anti-competitive and infringe upon antitrust regulations, mostly because they are exclusive.

Within this context, the DOJ has alleged that Google pays approximately $10 billion annually to maintain its default search engine status across numerous devices and browsers. However, while precise figures remain undisclosed, further investigation suggests that this amount might be significantly higher, potentially reaching 2-3 times the DOJ’s estimate, with around $18 billion directed solely to Apple.

Although it’s difficult to speculate on the outcome of this trial, the risk to such a profitable, multi-billion revenue stream for Apple is undeniable. Specifically, and estimating that Apple’s TAC receipts flow almost directly to the company’s bottom-line, I estimate that Apple’s EPS may face an 8-12% headwind, if the trial rules in favor of the DoJ.

On a related note, investors should also consider that Apple itself may face an antitrust showdown vs. the DoJ, specifically relating to the company’s Apple store position and business model. In that context, I would like to point out that Apple has already attracted strong criticism from Elon Musk (Twitter/ X), as well Spotify (SPOT). In fact, Spotify recently cut off subscription payments through the App Store.

The China Risk Is Major

Huawei Poised To Reclaim Some Market Share

Giving some background, the Apple vs. Huawei battle has been raging since at least 2015 when Apple led market share for the premium phone segment in China. Over the next four years, Huawei took share from Apple and grew to almost 40% of the market in 2019, with Apple’s share contracting to about 6%. Then, the US banned domestic companies from working with Huawei which denied it access to Android and made it impossible for Huawei to ship phones with 5G capabilities. This effectively made Apple the only real player in high-end Chinese smartphones (Samsung has no presence here). Consequently, Apple’s share in premium phone segment increased to above 45% in 2022, while Huawei was slightly above 10%.

Now, however, Huawei is pushing to take market share back. Recently, the company presented the Mate 60 Pro, which addresses some of the hardware concerns that previously forced Huawei out of the high-end smartphone market in 2019. Notably, the new Huawei Mate 60 Pro is equipped with a quad-camera setup that includes a 108-megapixel primary sensor, a 50-megapixel ultra-wide-angle lens, a 12-megapixel periscope telephoto lens, and a 3D ToF sensor; moreover, the phone’s camera system includes features like 10x optical zoom, 100x digital zoom, and 8K video recording. In addition, the new Huawei phone also features a 6.8-inch OLED display, an under-display fingerprint sensor, a 5nm processor, and 12GB of RAM and 512GB of storage.

Reflecting on these specifications, the most worrying aspect for Apple investors is, in my opinion, that close to 90% of Huawei’s technology is reportedly sourced in China, rendering the success of Huawei independent of the U.S. vs. China technology war, while Apple remains strongly exposed.

Personally, given the stickiness of the iPhone ecosystem, I would rule out that Huawei’s market share in China would see a complete reversion to levels observed in 2019. However, I would also argue that some reversion should be expected — especially if the Chinese government starts to more aggressively favor local-made technology. Specifically, the Chinese Communist Party’s recently instructed government officials not to use iPhones or any foreign products for work.

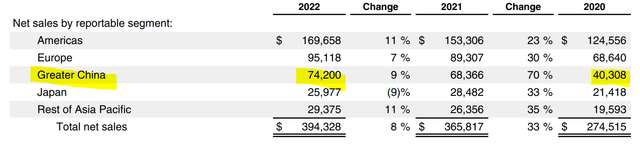

With that frame of reference, investors should consider that China accounts for approximately 20% of Apple’s total revenues. And while the impact of the China risk on Apple’s financials would depend on the severity of the risk materialized, already a 5-10% market share loss would translate into a $12-15 billion revenue headwind, which may reduce EPS by about 3-4% depending on Apple’s operating jaws.

Apple Annual Report 2022

Supply Chain Disruptions

Connected to the China risk, there is not only a demand problem, but also a material supply chain risk. In the latest 10K, Apple states:

Substantially all of the Company’s manufacturing is performed in whole or in part by outsourcing partners located primarily in Asia, including China mainland, India, Japan, South Korea, Taiwan and Vietnam, and a significant concentration of this manufacturing is currently performed by a small number of outsourcing partners, often in single locations.

Now, while precise figures remain undisclosed, for the iPhone, it is estimated that approximately 90% of the hardware is sourced in Asia, most of which is either directly or indirectly connected to China. Accordingly, if the U.S. vs. China tensions were to escalate further, the imposition of tariffs, sanctions, and other trade restrictions could materially impact not only Apple’s business model through supply chain operations, but also the company’s financials through tax-related considerations, as tariffs have the adverse effect of increasing the overall cost of Apple’s products.

Rich Valuation: Relative Investing

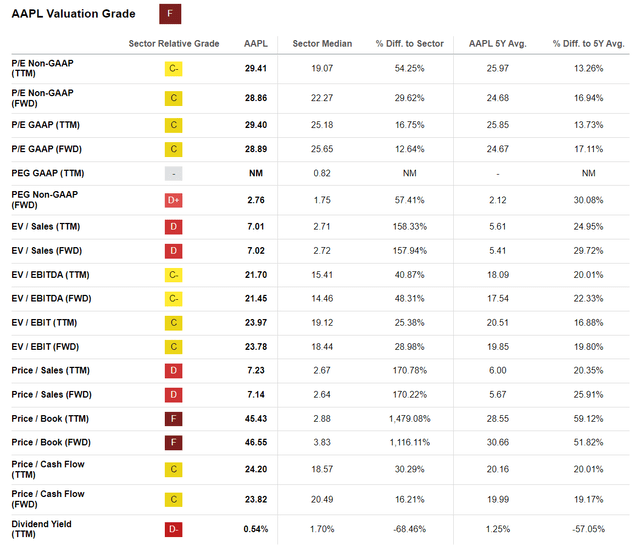

Apple’s risk exposure relating to the DoJ and China would be less concerning if AAPL stock would not be trading at such a rich valuation. According to data compiled by Seeking Alpha, AAPL shares are currently valued at a FY 2024E EV/Sales of 7x and an EV/EBIT of 24x, suggesting a premium to respective industry median valuation for the IT sector of 160% and 30%, accordingly. That said, investors should consider that these multiples are broadly benchmarked against a sector that has seen a 40% YTD share price appreciation (Nasdaq 100 (QQQ)). Thus, Apple may be considered “expensive” in a sector that is already optimistically priced.

Seeking Alpha

Conclusion

On a short to mid-term basis, I support the thesis of reducing exposure to AAPL shares – anchored on the risk considerations outlined in this article, specifically relating to the Google/Apple TAC DoJ trial and China. While estimating the EPS impact on Apple for the discussed headwinds is difficult, and clouded by insufficient disclosures, I estimate about 10-15% downside risk to Apple’s EPS in 2024/ 2025. At the same time, I am not able to recognize any balancing considerations that may give Apple’s EPS an upside of equal size. Recommend “Underweight”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.