Summary:

- Apple Inc. has doubled its revenue and improved its annual EPS in the past decade, relying on strong brand loyalty and premiumization trends.

- Despite a revenue dip in Q4 2023, Apple showed a 13% YoY increase in EPS and sustained solid iPhone sales.

- Apple’s long-term prospects remain robust, with promising expansion in service revenue and growth in China and India.

Wirestock

Apple Inc. (NASDAQ:AAPL) has sparked debate recently, with some people criticizing its premium valuation relative to its stagnant revenue, increased competition, and perceived innovation lull post-Steve Jobs. However, let’s take a step back and consider the broader picture. In the past decade, Apple has doubled its revenue, increased EPS results for ten consecutive years, and made tactful ventures into thriving markets such as China and India, which have been bolstered by a surging middle class, better distribution, and premiumization trends. As the most valuable company in the U.S. since 2011, Apple has leveraged its top-tier brand, increased prices, ensured robust cash flow, and invested in services and emerging markets. Remarkably, investors have witnessed an 859.09% return in the last decade. The story of Apple is much more than just numbers; it’s a tale of calculated strategic moves and financial successes.

Ten-year stock trend (SeekingAlpha.com)

Despite a revenue dip in fiscal Q4 2023, Apple showcased a 13% YoY increase in EPS and sustained a solid 43% global market share in smartphone sales. With the promising expansion of service revenue and prospective growth in China and India, the company indicates long-term growth potential. While cautious of headwinds impacting market sentiment due to a weaker holiday sales forecast, long-term investors might find this the opportune moment to leverage this dip.

Apple’s diverse product and services revenue

Apple has solidified its position as the top-ranking U.S. public company in terms of market cap since 2011, amassing revenue globally through its diverse range of products and services. In June 2023, it became the first U.S. company to hit a market cap of $3 trillion. Apple’s biggest asset remains its brand, which is considered the most valuable in the world for a second year in a row, according to Kantar’s brand report 2023. This has allowed the company a premium pricing strategy and increased customer loyalty across various products and services, although the iPhone remains its largest revenue contributor. We can see the revenue breakdown by product category over the years, dominated by iPhone sales, although over the years, its services revenue has played a growing importance and helped improve gross profit margins.

Revenue by product category (Statista.com)

Growth driver – Services

In the latest FY 2023 report, services exhibited a substantial double-digit revenue surge, up by 16%. Major contributors to this revenue stream include AppleCare warranties, iCloud Storage, App Store, Apple Music and advertising. Services experienced multiple price hikes which positively impacted revenue growth. The discernible decline in product revenue from the previous year is offset by an improved gross profit margin, evident in the slightly reduced FY2023 gross margin.

FY 2024 versus FY 2023 Business segments (Sec.gov)

In FY2023, Macs experienced a notable sales decline of 33.9% year over year, dropping from $11.5 billion to $7.6 billion. However, it’s important to note that Macs tend to follow a cyclical purchasing pattern, often bought in bulk when the economy is thriving. Predictions indicate a potential upturn as the PC industry is poised for recovery, which could positively impact Mac sales in the coming times.

Growth driver – PC industry recovery

The Mac portfolio is strategically positioned to leverage the PC industry’s anticipated recovery. Goldman Sachs anticipates a 6% growth in industry shipments in 2023 and a subsequent 4% growth in 2025. Apple’s recent launch included the MacBook Pro, iMac, and a range of M3 chips, specifically targeting professional users. The 14-inch MacBook Pro starts at $1,599, its 16-inch counterpart at $2,499, and the new iMac, featuring the M3 chip series, begins at $1,299. While some models will be available next week, others are set to ship in late November. We can expect this to positively impact revenue in the next quarters.

Growth driver – Emerging markets

Apple is strategically targeting growing markets like China and India, aiming to tap into their expanding middle-class populations and embracing premium trends supported by better product distribution in these smartphone-rich regions. In recent years, Apple’s market share in India has shown impressive growth, jumping from 1% in 2019 to an expected 6% by the end of 2023. Additionally, the company has set an ambitious goal to relocate over 18% of its global iPhone production to India by 2025, up from the current 7%. Furthermore it has opened its first-ever retail locations in India. Apple is also investing in China, significantly expanding its network of retail stores. With a three-decade-long presence in China and 56 established retail outlets in the Greater China region, Apple appears ready to seize the potential growth in these flourishing markets. Impressively, Apple claimed the top four selling phones in urban China last year, indicating a strong foothold in this high-demand market.

Sales 2023 versus 2022 by geographies (Sec.gov)

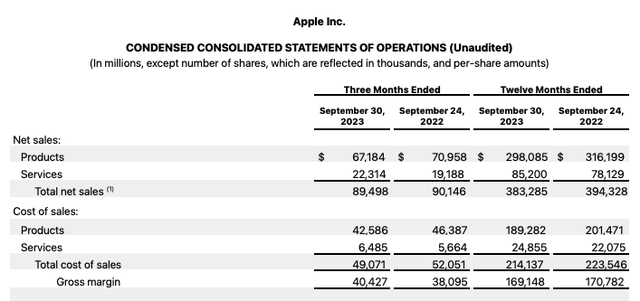

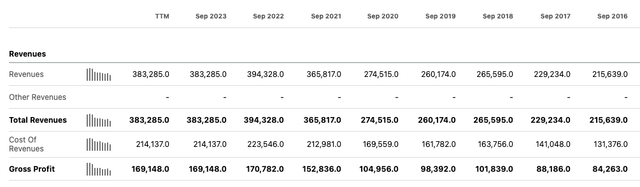

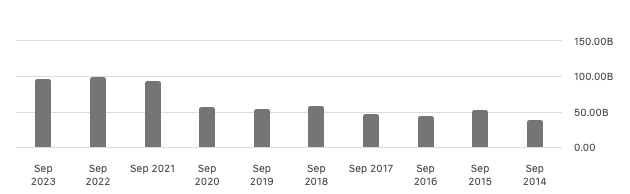

Financial highlights

Although Apple has faced criticism for maintaining relatively flat revenue over three years, it’s essential to acknowledge the enormity of the company’s financial stature, generating a substantial $383 billion in revenue. Moreover, its gross profit margin has notably improved, resulting in a delivery of $169 billion in gross profit.

Annual revenue and gross profit (SeekingAlpha.com)

The company surpassed annual EPS expectations by $0.06, reaching $6.13. Over the last eleven financial years, the company consistently exceeded and elevated its annual EPS expectations.

Annual EPS results (SeekingAlpha.com)

Examining the company’s net income shows a positive and consistently upward trend over the last decade, despite a year-on-year decline in the most recent FY2023 results, where the company reported $94.76 billion.

Annual net income (SeekingAlpha.com)

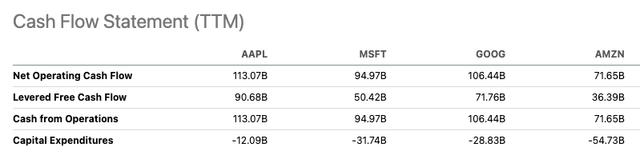

A significant strength of the company lies in its capacity to generate robust cash flow. While observing the levered free cash flow, it reveals a year-on-year decline, yet it remains notably higher than that of some of the largest US-based companies like Microsoft (MSFT), Alphabet/Google (GOOG), and Amazon (AMZN).

Annual levered free cash flow (SeekingAlpha.com) Cash flow versus peers (SeekingAlpha.com)

Reviewing the balance sheet, Apple concluded the quarter with an impressive $162 billion in cash and marketable securities. Despite increasing commercial paper by $2 billion, the total debt amounted to $111 billion, leaving a net cash reserve of $51 billion at the quarter’s close. Notably, Apple’s EPS growth is significantly bolstered by its share repurchase program. Over the past year, the company bought back a substantial $77.5 billion of its stock, leading to a near 3% reduction in the total share count. Essentially, these share repurchases substantially fortified Apple’s EPS growth by nearly three percentage points.

Valuation

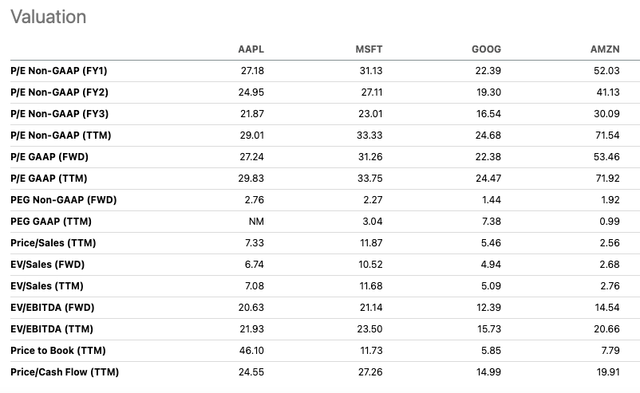

Apple’s current trading standing is below its average price target of $196.7, supported by a resounding 4.0 Buy rating by 45 Wall Street analysts. The valuation, although higher than the ten-year average, bears significance against the uncertain consumer landscape. Despite this, the company continues to generate substantial free cash flow, presenting a solid, unthreatened aspect of its operations. In the last five years, Apple has consistently outperformed its peers, boasting a remarkable reward of 242.34%. Notably, its stock’s FWD price-to-earnings ratio, standing at 27.24, offers a more appealing prospect compared to some competitors, with only Google’s lower at 22.39. Beyond these metrics, Apple’s most significant asset is its brand, evident through the sheer scale of its sales and the profound impact it holds on a global scale. The unwavering loyalty of its customer base instils confidence in its future revenue prospects.

Five-year price return versus peers (SeekingAlpha.com) Relative peer valuation (SeekingAlpha.com)

Risks

Apple’s recent Q4 2023 earnings demonstrated robust performance despite enduring challenges in sustaining demand for its iPhones, iPads, and Macs amidst market saturation and global competition. Geopolitical disruptions like last year’s iPhone production issues, stemming from COVID lockdowns in China, emphasize the international impact on growth potential. Furthermore competitive threats, particularly from rivals like Huawei in China, risk eroding Apple’s market dominance, especially with their competitive pricing. A diminishing appeal in Apple’s brand might spell trouble for the company’s iconic status in the future.

Final thoughts

Apple provokes a whirlwind of opinions among investors. While some harbor concerns about its revenue and innovation, the company’s unwavering brand strength and consistent cash flow remain undeniable. Notably, despite a Q4 2023 revenue decline, Apple achieved a commendable 13% increase in EPS and maintains a solid 43% share in the global smartphone market. Its trajectory in service revenue and promising prospects in growing markets like China and India paint a positive picture for long-term revenue growth.

With current slight stock value downturns due to soft holiday sales projections, long-term investors might find this an opportune moment. Therefore, I recommend adopting a bullish outlook on this tech giant.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.