Summary:

- Without delving into the details, Apple’s financial performance may appear solid, with consistent improvements in profitability.

- However, the company’s brand power remains its sole growth driver, as it secures pricing power in its Services segment.

- Meanwhile, in FY 2024 so far, the Products segment has shown a decline across all categories, and the company’s latest innovative product represents a significant strategic misstep.

- Despite Apple’s high profitability, the stock is overvalued with a fair value around $2.3 trillion, significantly lower than its current market cap.

PhillDanze

Investment thesis

My previous bearish thesis about Apple’s stock (NASDAQ:AAPL) did not age well as it returned around 15% to investors since early June. I still believe that innovation in the company stagnates, and the recent iPhone 16 event was another reason to remain cautious.

The company’s current FYs revenue is expected by consensus to be lower than two years ago, which is another warning sign. Competition in China continues intensifying, and the only reason for optimism is expanding profitability. But readers should understand that Services profitability is the only driver here fueled by Apple’s massive brand power. The company’s aggressive policy in recent years around subscription fees and relationships with vendors cannot last infinitely as there are apparent antitrust constraints. The valuation analysis suggests that a massive optimism is priced in. All in all, I believe that AAPL is a “Strong Sell” at current valuation.

Recent developments

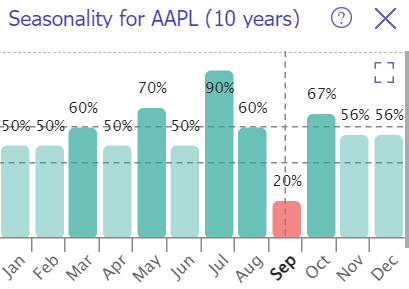

We all know that September is the weakest month for the U.S. stock market, and Apple is not an exception. According to the below bar chart, September is by far the weakest month for AAPL. Therefore, we can expect AAPL to close the current month in red.

TrendSpider

On the other hand, seasonality is the least significant problem for Apple’s investors. What is more important is that the company’s revenue growth is stagnating and the only profitability driver during previous few quarters were Apple’s immense pricing power and strong brand. However, Apple’s rapidly deteriorating market share in China suggests that pricing and brand powers are not infinite.

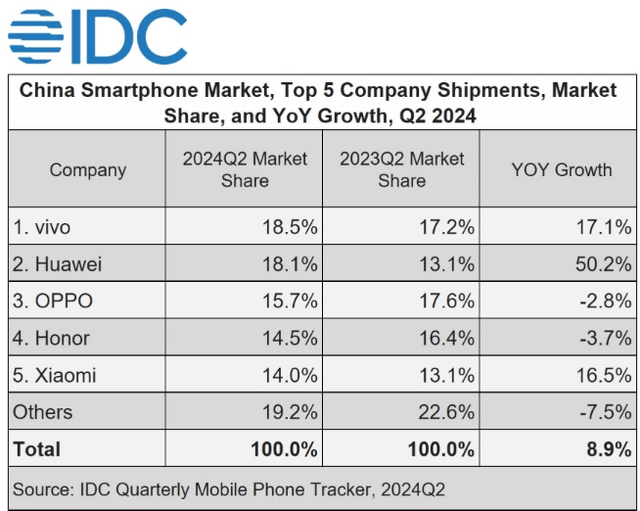

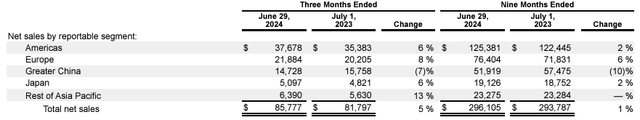

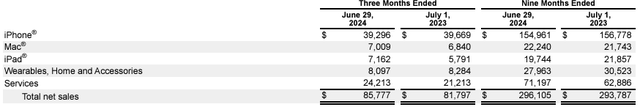

Apple was the number one smartphone vendor in China in 2023 with a 17.3% market share. However, according to IDC, AAPL was not even among top five in Q2 2024. This is a crucial adverse development because Apple generates around 18% of its sales in China. Sales in China dropped by notable 10% for the first nine months of FY2024. Growth in the Americas and Europe outweighed decline in China’s sales. However, it is uncertain whether Apple’s two largest markets will be able to cover the decline in China for longer. Reasons for my cautiousness is the ongoing largest war in Europe since the WWII, and a steadily climbing unemployment rate in the U.S. Potential recession of the world’s largest economy is still not off the table, and JPMorgan (JPM) believes that the probability of a recession by the end of 2025 is as high as 45%.

It is crucial to highlight that developments around the iPhone and other products appear to be unfavorable not only in China. For the first nine months of the FY 2024 sales of all Products decreased. The only revenue growth driver for Apple in fiscal 2024 is Services so far.

When I say that Apple will not be able to infinitely exercise its pricing power, it is not just my personal opinion. The company certainly faces antitrust constraints as it was sued by the Department of Justice for antitrust violations three times over the last fourteen years. Antitrust risks in Europe are also high, the company was hit with a €2 billion antitrust fine in 2024. Apart from antitrust risks, the company’s final legal challenge against an order from the European Commission to repay €13 billion in back taxes to Ireland was rejected.

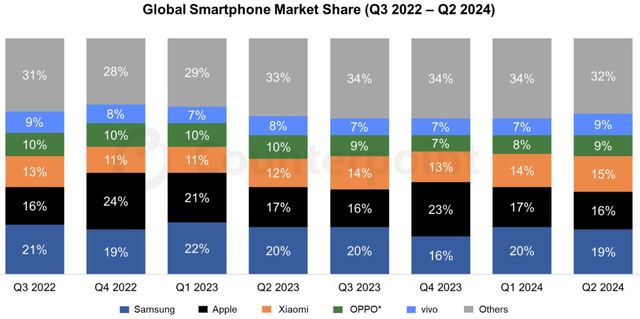

Therefore, to ensure sustainable shareholders’ value growth, it will likely be insufficient to rely only on growth in Services revenue. Additional aggressive increases in Services fees will highly likely lead to more Antitrust scrutiny, which is not sustainable from the shareholders’ value standpoint. With that being said, the iPhone still remains extremely important in driving growth. But the picture does not look good when we look at the global smartphone market dynamic over the last eight quarters. The below chart suggests that Apple’s global market share is melting down if compared on a YoY basis. The company’s global market share decreased from 21% to 17% in Q1 2024 on a YoY basis. The decline was not that sharp in Q2 2024, but it still was a decrease from 17% to 16% YoY. This trend is a warning for Apple’s investors as the company’s flagship product is highly likely losing its competitive edge.

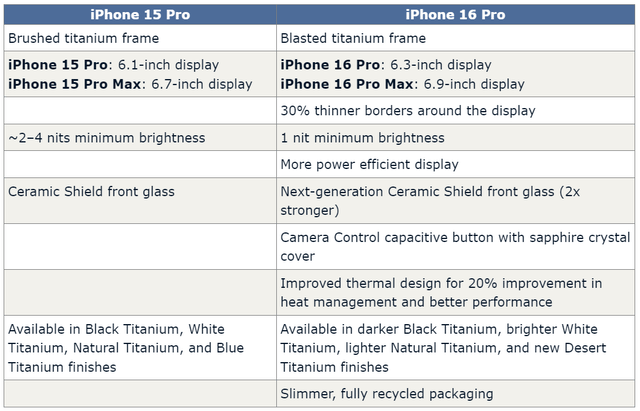

The recent iPhone 16 event also did not add optimism. Upgrades to the high-end Pro model are certainly incremental if we look at the head-to-head comparison with the previous model. According to this comparison, there are no revolutionary upgrades in the new model that makes it worth upgrading unless someone uses the iPhone as a professional tool and these incremental capabilities related to photos and videos might be crucial only to professionals. At the same time, Huawei releases a three-way foldable phone.

The latest ‘revolutionary’ product that Apple released was an expensive Vision Pro headset, but it did not become a banger. The device is unlikely to achieve 500,000 units sold in 2024, according to IDC. The company is working on a cheaper version, which is a highly likely a sign of poor strategic decision making. I think that the management failed in market research and pricing strategy.

The iPhone initially appealed to a broad audience with a more accessible price, and only after reaching dominance in the market the company started to offer a high-end iPhone Pro version. With almost a $4,000 selling price, the Vision Pro targets a niche high-end market. This approach may have underestimated the importance of first establishing a strong market presence with a mass-market product. I think that this was the result of the management’s overconfidence in the power of Apple’s brand. By not offering a more affordable version initially, Apple has missed a larger addressable market to build a user base that could later be upsold to premium versions. The fact that Apple plans to release a cheaper version just a year after the flagship version was released suggests that the company was unable to accurately gauge consumer demand and adapt its strategy accordingly.

To conclude, it appears that Apple’s recent financial successes was achieved more due to the brand loyalty and strong pricing power. However, pricing power cannot be exercised infinitely as there are apparent antitrust constraints. Moreover, losing positions in China and failure of the Vision Pro suggests that Apple’s brand strength is also steadily deteriorating.

Valuation update

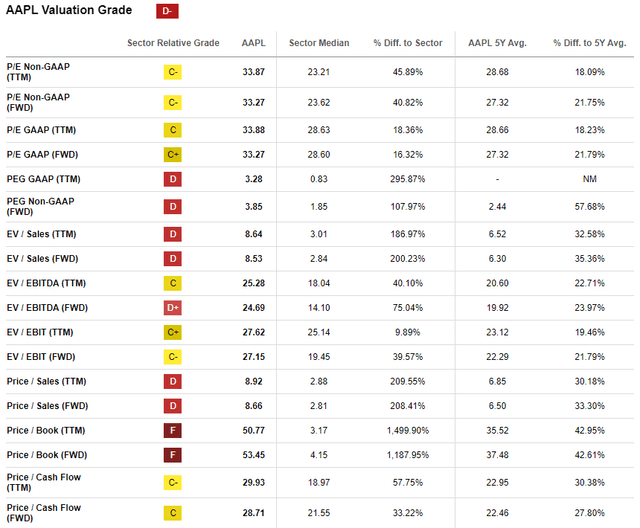

The company’s valuation ratios are significantly higher than the sector median, but it is fair considering AAPL’s unparalleled scale and profitability. On the other hand, the picture does not look fair when we compare AAPL’s current valuation ratios with historical averages. From this perspective, the stock looks significantly overvalued, as its multiples are higher than the last five years’ averages across the board.

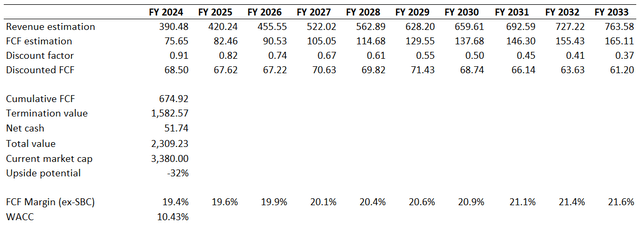

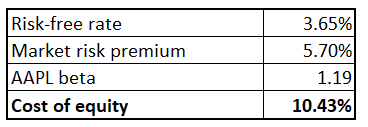

I need to figure out AAPL’s cost of equity, which will be the discount rate for my DCF model. Based on the capital-asset pricing model [CAPM], Apple’s cost of equity is 10.43%. All variables for the CAPM formula are easily available on the internet.

Author’s calculations

Consensus estimates project an 8% revenue CAGR for Apple, which is an aggressive assumption considering Apple’s scale. The TTM FCF margin ex-SBC is 19.4%. Due to Apple’s brand strength and the company’s ability to exercise pricing power in Services, I incorporated a 25 basis points yearly FCF improvement.

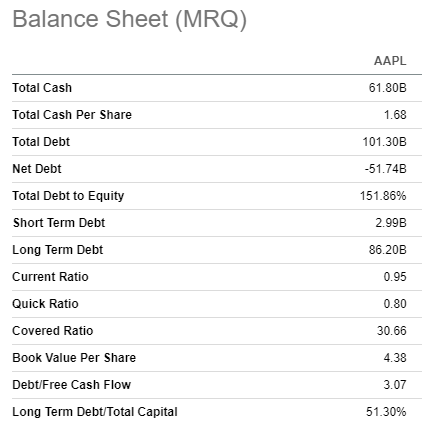

Even if I add Apple’s net cash position to my fair value calculations, the stock is still significantly overvalued. The business’s fair value is around $2.3 trillion, around a trillion lower compared to the current market cap.

TrendSpider

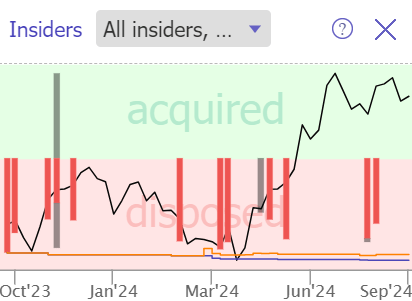

Another indication that the stock is highly likely overvalued is that investors were only selling the stock over the last twelve months. I cannot say that insider sales were aggressive, but the fact that insiders were not buying for several months speak volumes.

Risks update

Betting against one of the most successful companies of the 21st century is extremely risky. Apple has vast financial resources to hire the best people and brightest engineers who will be able to deliver a new jaw-dropping product. Vision Pro’s failure suggests that there is a creativity crisis in Apple, but for one of the largest companies in the world, there is always a probability to make a stellar comeback.

Seeking Alpha

Moreover, Apple boasts a fortress financial position with a massive $60 billion cash pile. With such ample liquidity the company can not only invest additional billions in R&D, but also initiate massive buyback programs. The stock market is a voting machine in the short run. This means that the share price significantly depends on noisy headlines and sentiment. Therefore, announcing a new massive buyback package will highly likely boost the share price.

Bottom line

To conclude, Apple is certainly a “Strong Sell” with its current valuation. A 32% premium over the fair value appears to be a very good selling opportunity, especially for the company that uses its past successes [brand power] to drive the EPS growth. Such a strategy is not sustainable, especially in the modern world of fierce technological competition.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.