Summary:

- Apple’s low dividend yield is not a deterrent for holding shares, as it fits into a diversified portfolio and contributes to overall total return.

- Apple’s ecosystem and customer loyalty make it difficult for users to switch to other platforms, ensuring continued growth and revenue.

- The App Store generates significant revenue for Apple, with projected growth and high-profit margins.

Nikada/iStock Unreleased via Getty Images

Overview

As someone that’s built a hybrid portfolio around growth and income, I like to optimize my holdings around a specific criteria. There needs to be a certain level of price appreciation, dividend growth, or income being provided to justify a long term hold. Although Apple (NASDAQ:AAPL) isn’t traditionally favored as a dividend growth stock, I’ve held a position since 2018 and added heavily in 2020.

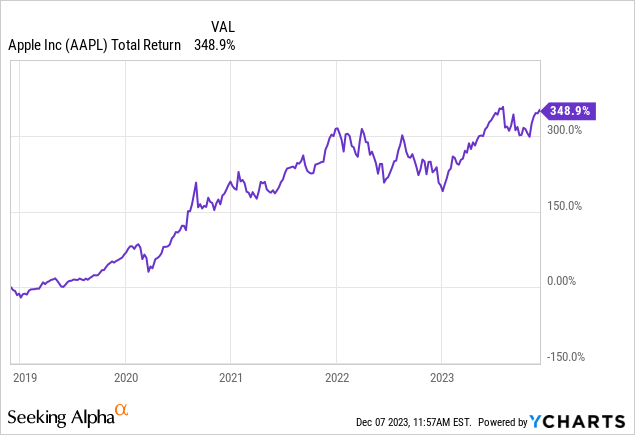

AAPL isn’t commonly known as a “dividend” stock because of its low starting yield of 0.5%. Even with $50,000 invested at today’s level, an earned dividend income of $250 is immaterial and insignificant. To be clear, I obviously get that most people don’t buy into AAPL for the income it provides. In my case, it fits into the greater scheme of my portfolio and helps keep my total return on par with the greater indexes. So as a result, I choose to continue to hold shares as the total return continues to grow. I see a lot of dividend focused investors making the mistake of ignoring high quality companies because of the lack of dividend payouts. Understandably, if you are nearing or are already retired and depend on additional income from your portfolio, this isn’t for you. Over the last 5 year period, your total return from AAPL is approaching 350%.

As a quick overview, here is why I plan to continue holding shares despite the tiny dividend payments the company provides me. The smartphone market continues to grow larger year by year. Alongside this, there are a growing number of people that continue to get sucked into Apple’s ecosystem. Despite any shortcomings from recent earning reports or uncertainty around sales going forward, AAPL has a unique ability to continue making strides. I believe that talks about valuation are rarely ever relevant when it comes to AAPL because we all know the price trades at a premium valuation consistently. Instead, I will reinforce all of the reasons why AAPL has the ability to be relevant, more valuable, and excel a decade from now.

Trapped In An Ecosystem

Apple Inc. has been successful in creating an ecosystem that encourages customer loyalty and keeps users within its grasps. To all you apple fans… has anyone ever tried convincing you to switch to an android phone and become part of a different ecosystem? Android family, have you ever tried to convince anyone to switch from an iPhone? If either of these situations apply, you know exactly the kind of Apple loyalty I am talking about.

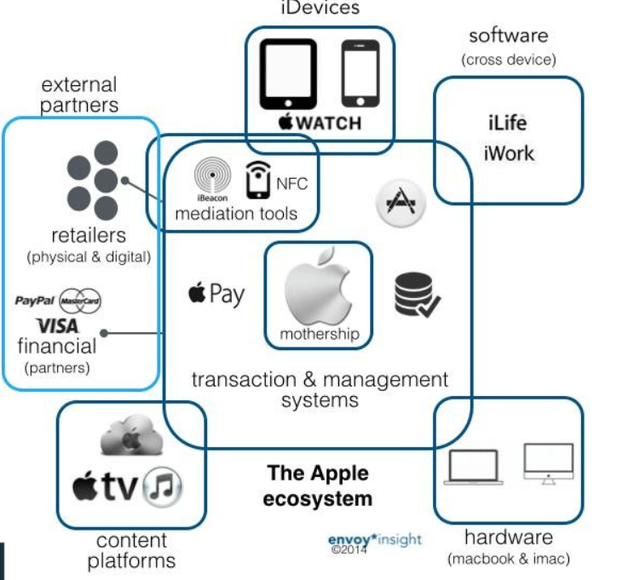

One key factor contributing to their strategy is the seamlessly integrated ecosystem where Apple’s hardware, software, and services work cohesively together. Products like the iPhone, iPad, Mac, Apple Watch, and Apple TV complement and enhance each other’s functionalities. It creates more convenience in our lives which will always be valuable.

Forbes

The interconnectedness of software across all of these devices is another crucial element that will keep their customer base growing. iCloud allows users to sync data, apps, and settings effortlessly, creating a consistent user experience. iMessage allows you to continue a conversation between your computer and phone. These simple conveniences remain to be highly valuable to the average Apple customer. This interconnected ecosystem makes it challenging for users to switch to a different platform without sacrificing these benefits.

I switched over to an Android phone during the pandemic and I can personally attest to this experience. It wasn’t as easy as I thought it would be to transfer over years of data, memories, and apps . I lost some old pictures and memories and I imagine lots of folks avoid the switch for this exact reason. Not only that, the switch took some time to get accustomed to since I had to learn all aspects of the Google / Android ecosystem and make fresh accounts.

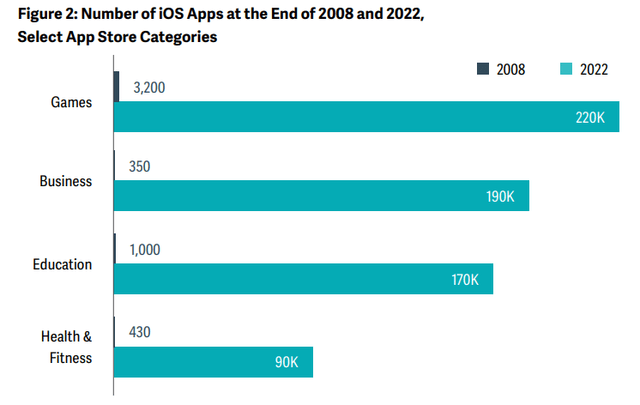

The App Store

There’s an incredible amount of money that flows through the App Store. I think most people take a surface level understanding of Apple’s profitability by relating it strictly to phone sale figures. Over the last 4 year period, the App Store ecosystem demonstrated significant and consistently steady growth. It has averaged a growth of 28% annually. As expected, certain categories experienced substantial growth in 2022 as more people returned to in-person activities, with travel witnessing an 84% increase and ride-hailing services seeing a 45% surge. The point is, the more apps that get placed on the App Store, the higher Apple’s revenue will be.

Apple

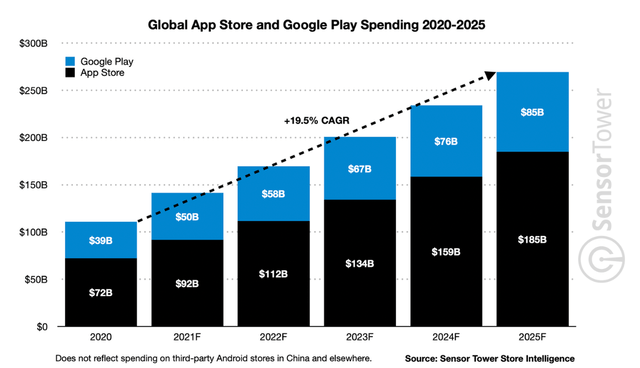

Apple typically takes a 15% to 30% commission on the sales of apps and in-app purchases on the App Store. The exact percentage depends on various factors, such as the type of transaction and the developer’s revenue from the App Store. As per Sensor Tower’s projections, the App Store is anticipated to achieve a compounded annual growth rate of 21% by 2025. In comparison, Google Play is forecasted to undergo a 17% CAGR.

Sensor Tower

In 2022, the App Store ecosystem facilitated over $1.1 trillion in global billings and sales. This marks a significant increase from $868 billion in 2021, $643 billion in 2020, and $519 billion in 2019. Apple only collects commissions on specific transactions within the App Store, such as app purchases, in-app purchases, and in-app subscriptions. In my opinion, developers don’t have many alternative platforms to launch these mobile apps on in order to get to IOS users. So unless something groundbreaking in the industry happens, I think these projections for app listing growth is very likely.

Financials

Apple recently reported their Q4 earnings. During the quarter, AAPL demonstrated double-digit EPS (earnings per share) growth. I saw a lot of people hung up on the decrease in net sales from $90.146 billion to $89.498 billion compared to the same quarter last year. As well as the decrease from $394.328 billion to $383.285 billion for the twelve-month period. However, despite the slight decline, gross margin increased from $38.095 billion to $40.427 billion for the quarter.

These small decreases aren’t much to get worked up about in my opinion as I think a of the performance has been dependent on the odd economic conditions we’ve been in. The fastest rise of interest rates ever, job layoffs, ultra high inflationary periods, and economic uncertainty. In my opinion, it’s a bit unrealistic to expect continued growth from AAPL during this period of time, combined with the fact they haven’t really implemented any ground breaking innovations with their most popular product line, the iPhone.

Operating income grew from $24.8 billion to $27 billion. Earnings per share (EPS) showed an increase from $1.29 to $1.47. The company reported a strong financial position, with total assets of $352.583 billion and total liabilities of $290.437 billion, resulting in shareholders’ equity of $62.146 billion.

Apple’s condensed consolidated statements of cash flows showed a decrease in cash, cash equivalents, and restricted cash from $35.929 billion to $24.977 billion at the beginning of the twelve-month period to $30.737 billion at the end. Operating activities generated $110.543 billion in cash, while investing activities resulted in a cash increase of $3.705 billion. Financing activities used $108.488 billion in cash.

Global Smartphone Market

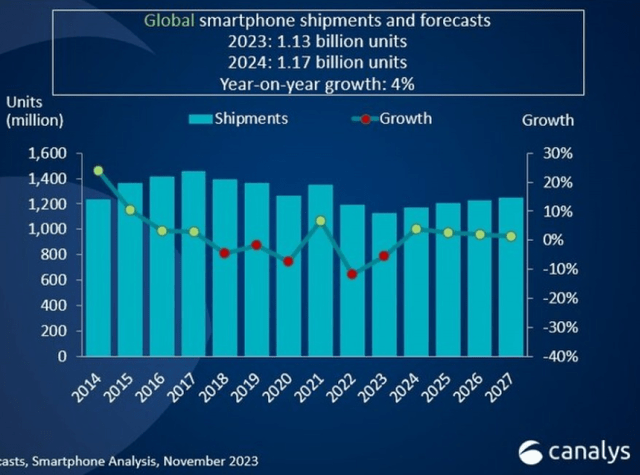

Canalys

The smartphone market is projected to grow at a 4% rate through 2027. The overall estimate for global smartphone shipments in 2023 stands at 1.13 billion, indicating a modest 5% decline compared to the preceding year, 2022. Apple’s product line has become sort of a status symbol around the world. Over 50% of smartphone sales in the USA were iPhones. Although, Android is still the most popular operating system in the world, controlling a global market share of 70%. This means that Apple still has plenty of room to grow their business in other parts of the world.

Forward looking, 2024 estimates forecast 1.17 billion smartphone shipments for the year. Changing consumer spend has proven that globally, people are willing to spend more on their smart phone. Globally, the average customer is willing to spend about $440 on their phone. This is a far way’s off from Apple’s $1,000 iPhone price tag but I think as Apple’s influence grows around the globe, we will see an influx of new customers within their ecosystem. Based on the Canalys research:

- Latin America will experience a 2% growth

- Africa projecting a 3% increase

- The Middle East anticipating a significant 9% increase.

It seems that emerging markets are poised to take center stage in the anticipated growth of 2024. Approximately 33% of all new smartphones in 2024 are expected to be shipped to the Asia Pacific region. This surge is attributed to growing consumer confidence and an improvement in macroeconomic conditions. My guess would be that the iPhone SE and older models may be a bit more popular in these regions outside of the US. Consumer habits are different and the high status iPhone 15 pro isn’t in as much of demand compared to here in the US.

While smartphones are only one piece of AAPL’s business, I like to focus here because it’s the most popular and sees the most sales volume. As telecom infrastructure and affordability becomes more common around the world, I do think we will see continued global growth for AAPL.

Brings Balance To A Dividend Portfolio

As of the latest declared dividend of $0.24/share, the yield still remains a bit shy of 0.50%. The average dividend CAGR over the last 10 year period is 8.47%. I do have some mixed feelings here. With a yield so low below 1%, I feel that the growth story here should be much stronger. At the same time though, I understand that a leading tech company like AAPL is much better off reinvesting the cash into their business or research & development. The payout ratio is extremely conservative at 15.36%. I think The Dividend Collectuh put out a great analysis digging in deeper on Apple’s conservative dividend growth.

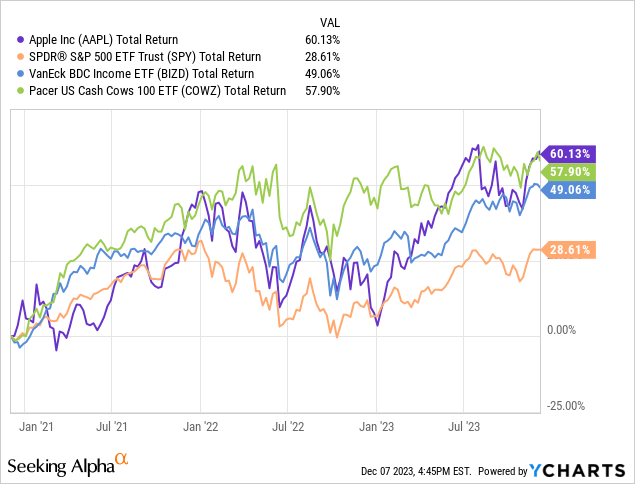

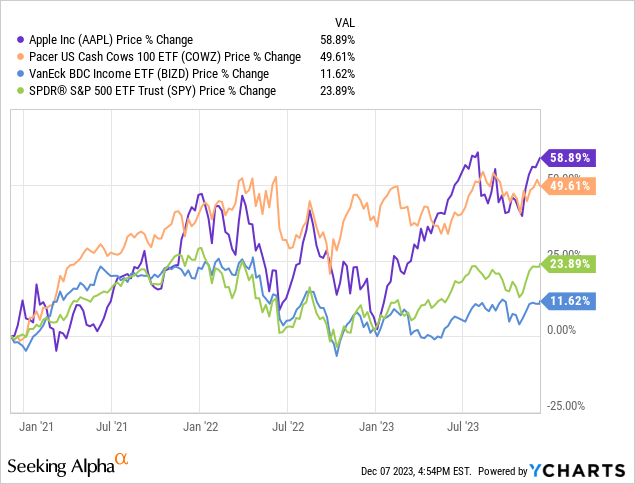

Typically, I like to invest in stocks that have a much higher level of cash flow being distributed out to shareholders. I like to hold a range of ETFs, REITs, Business Development Companies (BDCs), and even closed end funds that can have dividend yields between 5% and 15%. For example, I recently wrote about Pacer US Cash Cows ETF (COWZ) that has achieved a 20% dividend CAGR over the last 5 year period. On the other end of the spectrum, I’ve also written about the VanEck BDC Income ETF (BIZD) that has a starting dividend yield of over 11%.

While these two funds underperform AAPL in total return, they still manage to outpace the S&P 500 (SPY) while also providing a drastically higher level of income. Now, before you storm off to the comments to tell me how this comparison doesn’t make any sense, hear me out.

While you might not be able to make an exact comparison with these entities, I am simply trying to convey how they balance each other out. As previously stated, I see lots of dividend investors focus exclusively on dividend yield. This is usually a result of someone that has tunnel vision focus on creating a stream of passive income, which is something I truly commend. However, I think having a strong company like AAPL in the mix helps add some balance. Looking at the graph below, we can see that the price movement of AAPL far outweighs the high yielding BIZD. The problem with focusing exclusively on higher yielding assets is that a lot of the times, you will experience only a little or no price appreciation.

This is totally fine if your goal is only obtaining income. However, if you like to get the best of both worlds, adding growthier companies with low or zero dividend yields can help your portfolio value widen from your overall cost basis. This is why as a dividend investor, I also hold growthier tech based companies with dividend yield so low that they may as well be nonexistent. Companies such as Microsoft (MSFT), Visa (V), and NVIDIA (NVDA). It’s also why this analysis is based around the different catalysts for growth that Apple will use to gain more global market share.

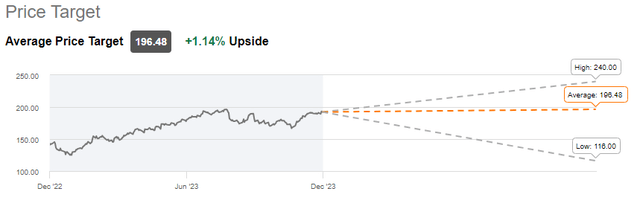

Valuation

Determining a fair stock value has always been tricky for AAPL. The price has always been “over-valued” from most valuation methods. I commonly use the discounted cash flow model but even that would suggest an insane level of over valuation. For reference, we can see how the PE ratio played out over the years.

- In 2015, the PE was about 13x

- In 2018, the PE was about 15x

- Throughout the pandemic, the PE ranged from 24x – 35x

Today, the PE is 31x and I plan to simply dollar cost average my position at these levels. I take a simple approach on my decision to add to AAPL: will this be worth more in 5 years? In the case of AAPL, the answer is probably. Once interest rates come down, consumer spending gets looser, and the overall macro environment gets in better shape, I expect to see apple continue its upward trajectory.

Seeking Alpha

Risks

Apple’s success in the tech industry is not without its inherent risks. One of the primary concerns that the market seems sensitive to is the company’s heavy dependence on iPhone sales. A sudden shift in consumer preferences or a decline in iPhone demand could significantly impact Apple’s financial performance. While growth is projected in other regions of the world, only time will tell if this comes to be true. We see a lot of quality competitors increasing the spend on marketing. For example, Google (GOOGL) has been rapidly growing their market share in the mobile market with their releases of the Google Pixel phone. Their market share doubled over 2023 and it has a lot to do with stand out features such as AI-driven photo & video editing, spam call rejections, call screening, and even a foldable phones. Also, they have a much more affordable segment of phones with their A-series lineup which opens the doors to a wider pool of consumers.

Apple’s premium pricing strategy, while positioning it as a provider of high-end devices and services, becomes a potential risk during economic downturns. Recessions and market downturns are big factors that determine how comfortable people are dishing out premium amounts on these products. I think it’s generally agreed that iPhones have only innovated small amounts of improvements in the last few iterations of their products. Lots of small hardware improvements but nothing that really has changed the landscape of everyday use. Over time, people may get tired of spending money for the same product repackaged and may jump ship to the Android ecosystem.

Takeaway

The decision to hold AAPL goes beyond its nominal dividend income, which may seem inconsequential, considering my diversified investment strategy. While AAPL is not typically viewed as a traditional “dividend” stock, its integral role in my portfolio contributes to maintaining a competitive total return, aligning with broader market indexes.

Apple’s success comes from making a setup where customers stay loyal. Their hardware, software, and services all work together, making it hard for people to switch to something else. The App Store, a big part of Apple’s setup, keeps growing and making a lot of money.

Looking at the money side, Apple’s recent earnings report in Q4 shows that they’re making good profits. The smartphone market is expected to grow, especially in new markets, showing that Apple has room to expand globally.

Keeping Apple is your dividend portfolio isn’t just about getting the dividends; it’s a smart move for a mix of income and growth your investments. Even though the dividend payout right now isn’t high, Apple’s mix of growing and staying steady makes it a good choice for a diverse portfolio.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2024 Long/Short competition, which runs through December 31. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.