Summary:

- We remain hold-rated on Apple.

- We expect Apple to be stuck on a bumpy road to recovery due to the macroeconomic slowdown but see positive signs of inventory corrections in PC and smartphone markets underway.

- Apple’s PC shipments are down roughly 40% in 1Q23 – signaling a continued demand slump in 1H23.

- We’re more constructive on Apple’s upcoming Worldwide Developers Conference in early June as the company is rumored to launch its mixed reality device.

- Still, we see more near-term pain for the stock and recommend investors wait on the sidelines for a rebound in 2H23.

Nikada/iStock Unreleased via Getty Images

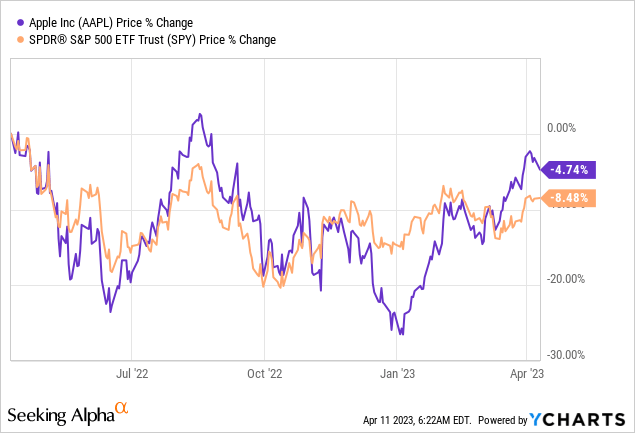

We continue to be hold-rated on Apple (NASDAQ:AAPL). We expect the company to be stuck on a bumpy road to recovery. We downgraded AAPL stock from a buy to a hold in mid-September based on our belief that the company would not be immune to the macroeconomic slowdown. The stock is down roughly 5% over the past year, outperforming the S&P 500, down around 9% during the same period. Still, we believe it’s too early to regard Apple as a safe haven among the mega-cap tech stocks. In 1H23, we expect weaker consumer spending and a more cost-cautious environment to persist with signs of a looming recession. We believe Apple will have a rough first half of the year due to the demand slump but are more constructive on a meaningful rebound in 2H23 as inventory correction takes place.

The following graph outlines Apple’s stock performance over the past year compared to the S&P 500.

Seeking Alpha

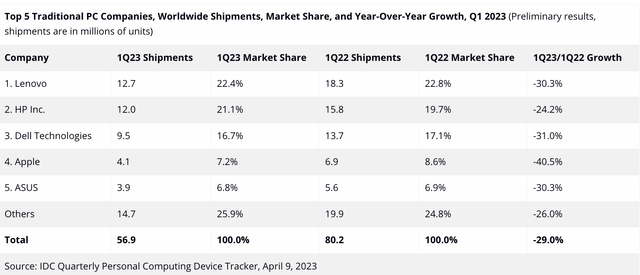

Apple’s primary revenue stream is its iPhone shipments, accounting for roughly 56% of total net sales in 1Q23; our previous bear thesis was driven by our concern over the negative impact of Apple concentrating production in the Chinese factory, Foxconn. Now, we’re more constructive on Apple diversifying production toward India. Still, we expect Apple’s growth to continue to be gated toward 2H23 as macroeconomic headwinds pressure discretionary spending for Apple’s high-end products. We’re specifically concerned about Apple’s computer shipments that fell 40.5% Y/Y in 1Q23. We believe the PC market is undergoing a correction due to the contraction in consumer demand from pandemic levels. The stock price remains volatile in the near term. We recommend investors wait on the sidelines for inventory correction cycles to balance out demand-supply dynamics before investing in the stock.

Consumer demand slump & correction

Apple’s PC shipments dropped significantly in 1Q23; we expect the drop is part of the broader contraction of the PC market- so it’s not entirely unexpected. We expect the PC TAM to shrink this year by 10-18% compared to 2022 due to the consumer weakness spilling into enterprise client. IDC released its Worldwide Quarterly Personal Computing Device Tracker report stating that PC shipments dropped 29% Y/Y. The five largest PC makers felt the grunt of weaker consumer spending this quarter alongside Apple; HP (HPQ), Dell (DELL), ASUS, and Lenovo all saw double-digit drops in Q1 shipments. Still, Apple suffered the biggest decline in the group. The following graph outlines the global PC shipments in 1Q23.

IDC Worldwide Quarterly Personal Computing Device Tracker report

Apple’s PC market share dropped to 7.2% in 1Q23, compared to 8.6% in 1Q22. At the same time, Lenovo’s market share dropped only slightly from 22.8% a year ago to 22.4% in 1Q23. HP’s market share rose to 21.1% from 19.7% a year ago. We expect Apple to be under pressure toward 2H23 as the market works through high levels of inventory piled up from pandemic-led demand and faces a weaker spending environment. Apple’s smartphone shipments are also in a challenging situation during 1H23. Apple’s net sales from the iPhone category were down to $65,755M compared to $71,628M a year ago. We believe this is partly due to supply-chain issues in Apple’s largest iPhone manufacturing factory, Foxconn. Still, we expect macroeconomic headwinds also play a role; we expect the smartphone TAM to contract this year by 2.5% to 1.21-1.18B.

We believe Apple stock will drop in the near term due to macroeconomic headwinds pressuring demand. Yet, we’re seeing a change in narrative for the PC and smartphone markets; we believe the lower shipments in 1Q23 aren’t necessarily bad news for the mid-to-long term. We expect the lower shipments to indicate that inventory correction cycles are underway; we believe this will accelerate market recovery toward the end of the year. Hence, we expect a broader market correction to balance supply-demand dynamics towards 1H24 and end the demand slump. We’ll continue to monitor Apple and the broader PC and smartphone markets to upgrade the stock when demand bottoms to get ahead of the rebound curve.

Coming soon: Mixed reality device

On a more positive note, Apple’s Worldwide Developers Conference will be held later this year in June, where we expect Apple will finally show off its AR/VR headset. Apple’s long-rumored AR/VR headset is expected to have next-generation display tech, “12 tracking cameras that feed information to two 8K displays in front of user’s eyes,” and may potentially feature LiDAR sensors. We expect Apple’s headset will likely compete with Meta Platform’s (META) Meta Quest 2 and Sony’s PSVR 2. We’re constructive on Apple’s venture into the virtual reality space, with the VR market expected to grow at a CAGR of 15% between 2022-2030. Still, we’re cautious about getting too excited too early; the headset is already rumored to have suffered a number of delays in the past. According to some reports, Apple’s industrial design team “warned against releasing the headset- claiming it wasn’t ready” but were overruled by executives, Operations Chief Jeff Williams and CEO Tim Cook. We’re also worried about the AR/VR headset’s pricing, with rumors that the headset may cost as much as $3,000. We’ll continue to monitor the event to see how the AR/VR headset performs amid the current macroeconomic backdrop.

Valuation

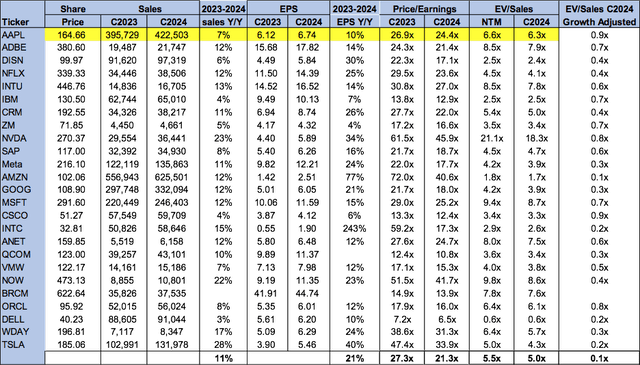

Apple is relatively expensive, trading above the peer group average. On a P/E basis, the stock is trading at 24.4x C2024 EPS $6.74 compared to the peer group average of 21.3x. The stock is trading at 6.3x EV/C2024 Sales versus the peer group average of 5.0x.

The following table outlines Apple’s valuation in comparison to the peer group.

Word on Wall Street

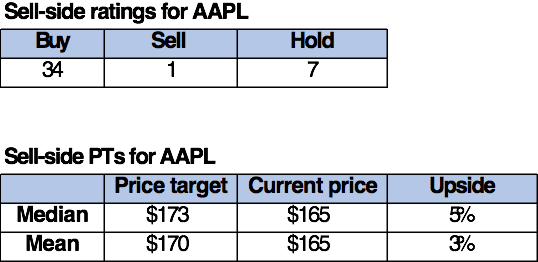

Wall Street is bullish on AAPL stock. Of the 42 analysts covering the stock, 34 are buy-rated, seven are hold-rated, and the remaining are sell-rated.

TechStockPros

What to do with the stock

We remain hold-rated on Apple. We see near-term pain for Apple due to weaker PC and smartphone demand levels. However, we believe Apple is on the path to recovery; we expect PC and smartphone demand to rebound more meaningfully toward the end of the year due to inventory corrections. We’re also constructive on Apple’s WWDC event to be held in June and the potential release of the long-awaited AR/VR headset. We recommend investors hold their shares and wait for more attractive entry points into the stock toward 1H24.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.