Summary:

- Apple Inc. CEO Tim Cook’s announcements have triggered buy signals for the company’s stock.

- The new iPad and upcoming AI news are expected to contribute to Apple’s positive performance.

- Despite slow revenue growth, investors still chase Apple’s free cash flow and buybacks, although Warren Buffett has sold some of his position.

Ridofranz/iStock via Getty Images

CEO Tim Cook pulled out all stops for Apple Inc. (NASDAQ:AAPL) earnings and triggered blue, vertical line, Buy Signals shown on both the daily and weekly reports below. Both the short term and longer-term signals are targeting a test of resistance at $190.

The rollout of the new, super thin, iPad will help to feed the continued good news. Then there is the promise of AI news coming soon. Finally, the rollout of the iPhone 16 just to keep the dream alive that AAPL is still a growth company. For the last year, it has not grown revenues very much. Investors love its enormous free cash flow and buybacks, but Warren Buffett just sold some of his AAPL position and opted to use it as a source of funds. He still has an enormous position in AAPL and fantastic gains.

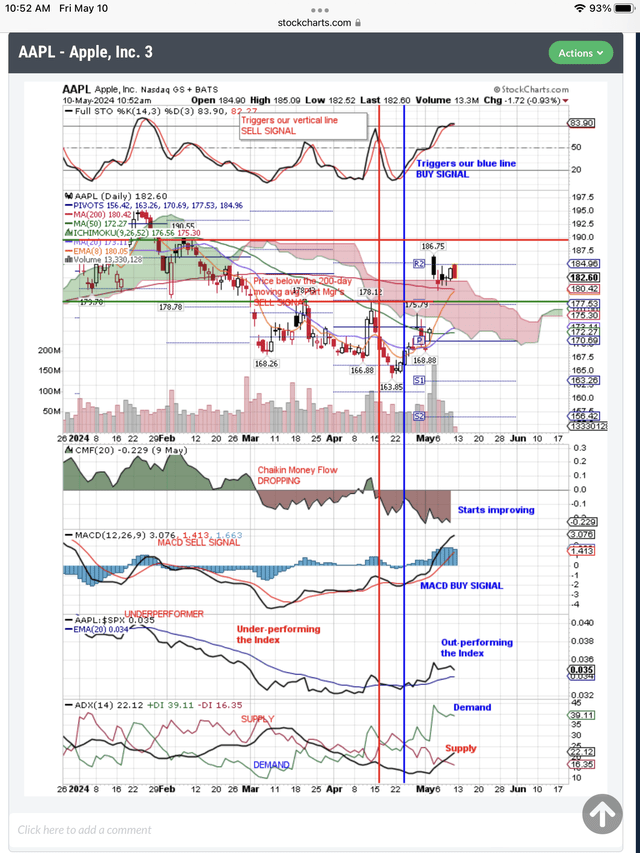

Here is the daily chart, and we have drawn our vertical, blue line Buy Signal triggered by the Full Stochastic signal at the top of the chart:

AAPL daily chart Buy Signal before AAPL earnings announcements (StockCharts.com)

As you can see on the above daily chart, other signals are confirming the blue line Buy Signal. Chaikin Money Flow, or CMF, is turning up and a change in direction is important. The MACD crossover, Buy Signal, occurs near the blue line. Likewise, AAPL switches from under-performer to out-performing the Index near the blue line. Also, the ADX signal at the bottom of the chart shows Demand crossing over the dropping Supply line and happening near the blue line Buy Signal.

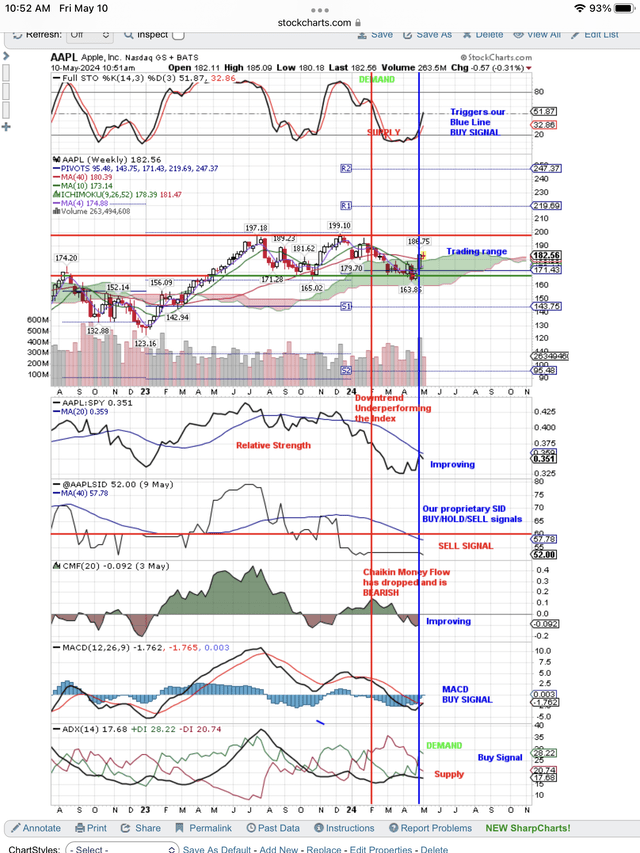

Now let’s turn to the longer-term weekly chart Buy Signal, which indicates the gap up on the daily chart may not be filled short term. Instead, the positive news on AAPL could continue to take the price higher to $200. Here is our weekly chart with the signal at the top triggering our vertical, blue line Buy Signal:

AAPL weekly chart Buy Signal targeting top of trading range at $190 (StockCharts.com)

You can see the positive signals on the above chart, especially the MACD and ADX Buy Signals. However, there are some caveats, namely our proprietary SID Sell Signal which uses both fundamentals and technicals. Our SID signal has a fundamental bias against overvalued stocks.

We do our due diligence by checking our SID signal with Seeking Alpha’s quant scores. SA quant grades give AAPL an “F” grade for Valuation. This confirms our own fundamental read on AAPL. In addition, SA gives AAPL a “D+” for Growth. This is a deadly combination. An “A” for Growth and a poor grade for Valuation would be typical for aggressive growth stocks.

AAPL is not aggressive growth, but a blue chip. SA gives AAPL an “A+” for profitability and a B- for Revisions, which is typical for blue chips that have good earnings but no aggressive growth. However, blue chips should not earn an “F” for Valuation, and that is the big problem for AAPL, especially if the market turns from bull to bear.

Meanwhile, let’s enjoy the technical Buy Signals on the chart and AAPL’s attempted move to the top of the trading range.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AAPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

To understand completely our fundamental and technical approach to making money in the stock market read my book “Successful Stock Signals” published by Wiley. This is the method that I taught to professional portfolio managers on Wall St. and now I share these secrets with you with 50 stock picking programs picking winners every day. You receive our daily email of stocks with Buy Signals before the market opens.