Summary:

- Apple is winding down its Project Titan, its electric vehicle project, impacting around 2,000 employees.

- The EV space is highly competitive, with shrinking margins, making it difficult for Apple to maintain its outstanding profitability.

- Apple’s outreach in the automotive industry is already strong through its CarPlay app, which has the potential for monetization and revenue growth.

Ben-Schonewille/iStock via Getty Images

Introduction

A decade of rumors and sneak peeks has come to an end as news came out that Apple (NASDAQ:AAPL) is canceling its Project Titan, the Apple electric car. Around 2,000 employees have been told they will either be redeployed to the Machine Learning and AI unit, while others will be laid off. This will surely impact Apple’s financials almost immediately, leading to savings of roughly $1 billion per year.

Surprisingly, this news has not caught a lot of attention on Seeking Alpha. Moreover, what was once among Seeking Alpha readers’ favorite stocks, seems to be facing several headwinds, with China-related bad news and lagging market sentiment sinking the stock to its lowest levels since May 2023. On top of this, investor confidence was shaken once it was disclosed that Warren Buffett’s Berkshire Hathaway trimmed its stake in Apple by roughly 1%.

In this article, I would like to show why, amidst several concerns around recent flattish growth for Apple, the winding-down of Project Titan should be welcomed as good news by investors.

“A Brutal Space”

First of all, Apple is widely recognized as the manufacturer of the best and most wanted products in their category, be it smartphones, laptops, or other wearable devices. As a result, Apple can only enter a new market if it is confident enough to have developed a top-notch product that outcompetes all its peers.

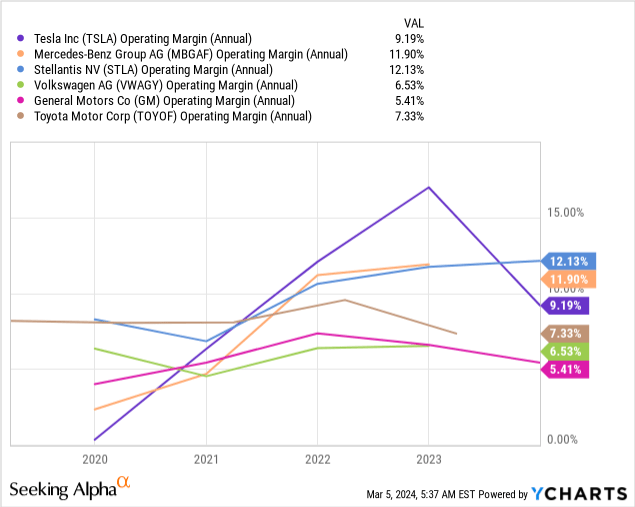

The EV space has been recently defined by Mercedes (OTCPK:MBGAF) as a “pretty brutal space” and I showed how this is the bearer of bad news for companies such as Tesla (TSLA). The list of battery electric vehicles expands month after month and competition is becoming stiff. As a result, Tesla, which has undoubtedly benefited from the first-mover advantage, is seeing its margins shrink rapidly, coming close to those of some legacy automakers.

After seeing its operating margins peak above 15%, the company recently reported operating margins below 10%. Actually, looking at the quarterly breakdown, we see an even worse trend. In Q4 2022, the company still reported operating margins of 16%, in the most recent quarter, it was down to 8.2%, though it improved a bit from the 7.6% reported in Q3 2022.

TSLA Q4 2023 Earnings Presentation

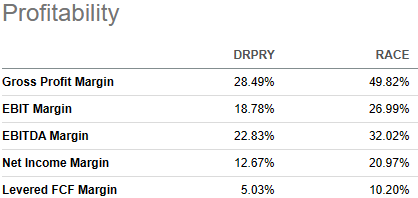

In any case, the battle in this industry is for margins in the low double-digits. There are, however, two exceptions: Ferrari (RACE) and Porsche (OTCPK:DRPRY). Though I don’t consider them direct competitors one against the other, both companies can have above-average margins. This is easy to understand: they sell luxury vehicles. As a result, we have an EBIT margin close to 19% for Porsche and 27% for Ferrari.

Seeking Alpha

So, the question arises: is this industry really interesting for Apple? Could it have been really accretive to Apple’s outstanding profitability?

Apple’s Profitability

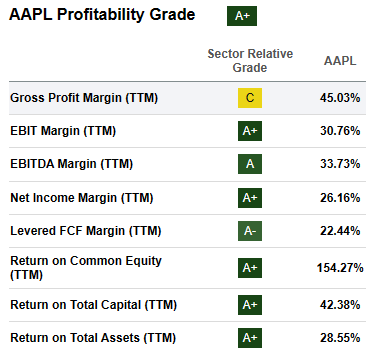

As most investors know, Apple plays in a league of its own when considering its profitability metrics, with only a handful of (usually tech) companies keeping up with these margins.

As we can see from Apple’s profitability grades, we are before a company whose EBIT margin is above 30% and whose ROTC is over 42%.

Seeking Alpha

So, even though rumors were suggesting a price tag of around $100,000 per vehicle, which would have positioned Apple in the same price per vehicle range as Porsche, it would have hardly been possible for the Tim Cook-led company to achieve profits that would have improved its profitability. Even if Apple had been able to sell its electric cars at an EBIT margin of 25%, which is almost as high as Ferrari’s, the company’s overall bottom line would have worsened.

In other words, entering the EV space could have made Apple’s top-line increase significantly, but its outstanding profitability metrics would have been damaged.

True, investors are worried about Apple’s top-line stagnation. But I don’t consider Apple a top-line company as much as other ones. Apple is a free cash flow generating machine. As a result, it needs to invest its capital in endeavors with high foreseeable returns on capital.

Apple Is Already In The Automotive Industry

Even though the dream of an Apple car seems dead, investors should still consider that Apple’s outreach in the Automotive Industry is strong, up to the point some believe every car is already an Apple Car.

Though this may misrepresent a bit the real state of the art of the industry, Apple CarPlay is indeed installed in almost every car, making it a trojan horse into the industry. Through this app, Apple gathers an enormous amount of data, which is key to leveraging the app and monetizing it down the road. So far, it is free. But, as we all know, when an app is free, then the customer is the product.

What investors sometimes overlook is that Apple usually reports its active devices installed base, which surpassed 2.2 billion as of the last earnings report. However, this number considers only the devices Apple directly sells. No real data is showing how many millions of vehicles have CarPlay, but we are not far from the truth if we consider this number to be in the hundreds of millions. So far, this huge penetration into the vehicles of millions of consumers has not yet been fully exploited by Apple. Yet, the next-generation CarPlay should be able to display vehicle and driving information, as Aston Martin and Porsche previewed it. This brings the app to a whole new level because it puts it in touch with the core of every vehicle. Once the app is there, monetizing opportunities open up. Think, for example, at the possibility of paying highway tolls directly through the app, or leveraging the app’s insights into the car to sell services more efficiently.

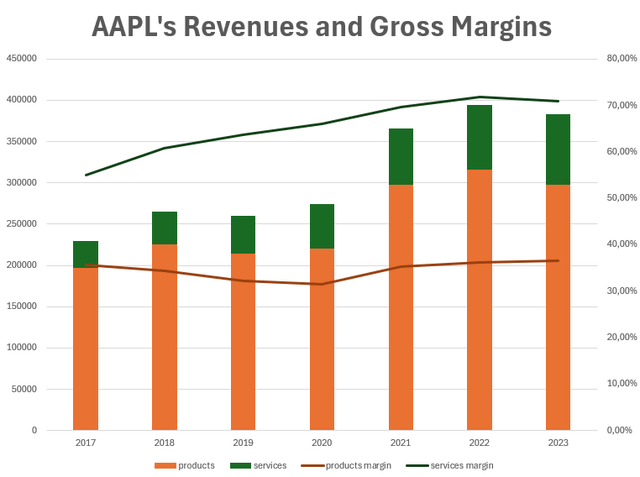

This is the kind of revenue I expect Apple to find and earn. As I show in the chart below, Apple’s growth is mainly linked to its ability to enhance and widen the services it offers. In 2017, Apple made $32.7 billion in services revenue, which was equal to 14.26% of net sales. In 2023, Apple reported $85.2 billion in services sales, accounting for 22.23% of total revenues. Even more important, as the margin lines show, services generate a gross margin above 70%. The growth of this business line is key to Apple’s free cash flow generation strength.

Author, with data from AAPL’s SEC filings

The shift of many workers employed in Project Titan to the Machine Learning Unit not only strengthens the latter, but could also help Apple put together an entirely new stream of service revenues related to the automotive industry. I don’t think the know-how Apple has internally developed on cars will just be thrown out the window since Apple has proven more than once to be highly conservative with its investments and the returns they are expected to produce. I think it should be more helpful for Apple to invest in automotive services, rather than directly manufacturing electric vehicles.

Apple’s Valuation

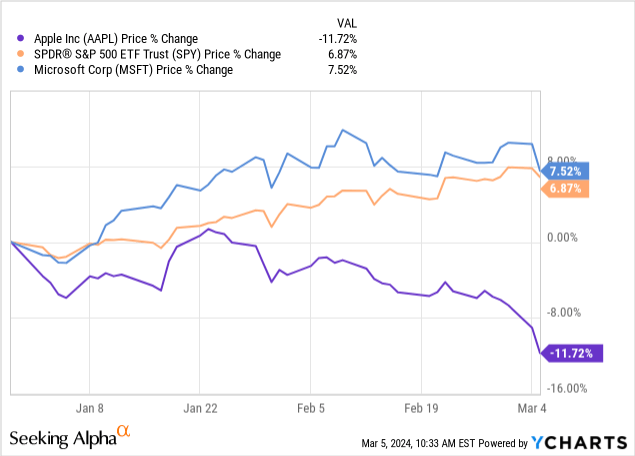

Apple’s investors have suffered from the stock’s underperformance YTD. The general index (SPY) has returned almost 7%, while Apple’s shares are down almost 12%. The market seems to be excited about Microsoft and its AI efforts, pushing this stock up to the point it has become the most valuable company by market cap, overtaking Apple.

And yet, while sentiment around Apple is “dismal”, as Dan Ives said, amid concerns about Apple’s ability to keep up with the AI world and weak iPhone sales in China, there are chances a new buying opportunity is opening up for Apple.

In fact, in about two quarters we should see easier comparables, while the share count continues dropping thanks to Apple’s massive buybacks. Moreover, it is not yet clear how Apple will leverage its machine learning unit. So far, the Cupertino-based company has always tried to come to the market only with best-in-class products, to prevent issues such as the ones Google faced when it hurried up releasing Bard.

Moreover, Apple’s financials will improve this year as Project Titan winds down, freeing up at least $1 billion in FCF.

Finally, although some data are available, it is still not being factored in by analysts as to how impactful a new CarPlay version could be on Apple’s services revenues.

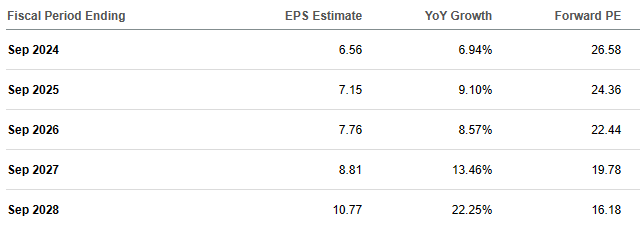

Apple is currently expected to grow its EPS at a high single-digit pace, and these estimates already factor in Apple’s buybacks. As a result, revenue growth estimates are lower and stay between 1% to 5% for the next few years.

Seeking Alpha

But all of this doesn’t take into account Apple’s enhanced possibilities related to CarPlay and other automotive services it could start selling. In addition, these estimates don’t consider Apple’s savings related to the end of Project Titan.

As a result, I expect Apple’s 2024 revenues to come above $388 billion and its EPS to come in higher thanks to the savings we are pretty sure Apple will benefit from.

It is hard to predict what Apple will earn from CarPlay. But I would keep an eye on this in future Apple events. So far, Apple has never invested in a platform without sooner or later monetizing it a lot.

Currently, Apple trades at a fwd PE of 26.6, which is reasonable for a company with such a huge control over an immense installed base. Looking at its FCF yield, we are once again above 4%, which starts to be enticing for a company whose growth may be under scrutiny, but whose free cash flow generation power is still widely admitted.

At $170 per share, I see Apple approaching buying territory, which I would position around $155 per share, which is just below a fwd PE of 24. I am not saying buying Apple now is a complete mistake, since I consider Apple’s ability to expand its revenues and its earnings are still great, thus driving the stock price up once again. However, some extra margin of safety may be needed, especially for investors who can’t withstand some issues and market volatility, which seems to be hitting Apple more than other stocks right now. As a result, my long-term outlook on Apple remains a buy. However, some investors may want to stick to a hold right now and wait for Apple’s shares to come down a bit more.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.