Summary:

- I think Apple is still a buy no matter where we are in the cycle, and I believe shares are undervalued by around -12%.

- Apple just announced another $90 billion in buybacks which should help increase EPS while making each share more valuable as it represents a larger part of the overall company.

- Apple is on track to deliver around $90 billion in net income in the 2023 fiscal year which will help drive innovation within products and services and expansion internationally.

- I remain very bullish on Apple as they are operating at a 24.49% profit margin and a 25.32% FCF yield based on the TTM numbers.

Nikada/iStock Unreleased via Getty Images

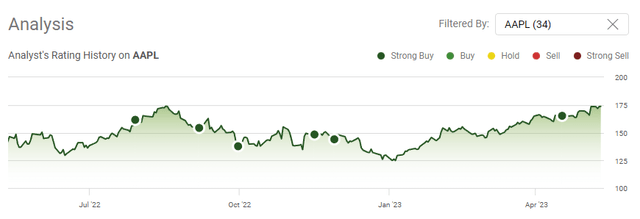

Prior to Apple’s (NASDAQ:AAPL) Q2 earnings, I wrote an article (can be read here) and outlined my thesis as to why I believed shares could reach $180 in 2023. Since the article was published on 4/17/23, AAPL has reported its Q2 earnings, and shares have increased 4.53% to $172.57. AAPL delivered a double beat, generating $1.52 in GAAP EPS (beat by $0.09), and $94.84 billion in revenue ($2 billion beat), while increasing the dividend and announcing an additional buyback program of $90 billion. AAPL once again showed the market why it’s the king of big tech and continues to reward shareholders through the market’s most generous capital allocation program. AAPL may not generate the largest amount of revenue or have the biggest margins in big tech, but it’s the most profitable company in the market while returning the largest amount of capital to shareholders. I believe that shares of AAPL are going higher, new all-time highs will be made in 2023, and we could see AAPL above $200 in 2024.

Apple continues to be the most shareholder-friendly company and returns more capital back to shareholders than any other company.

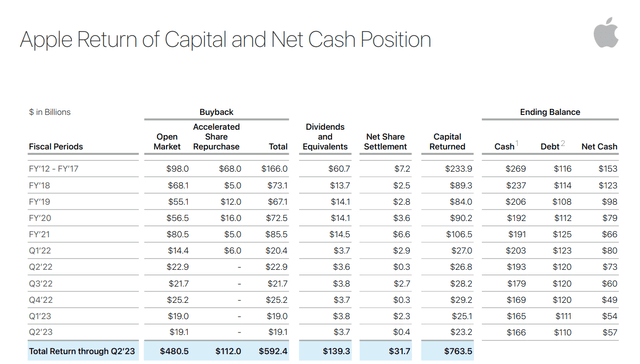

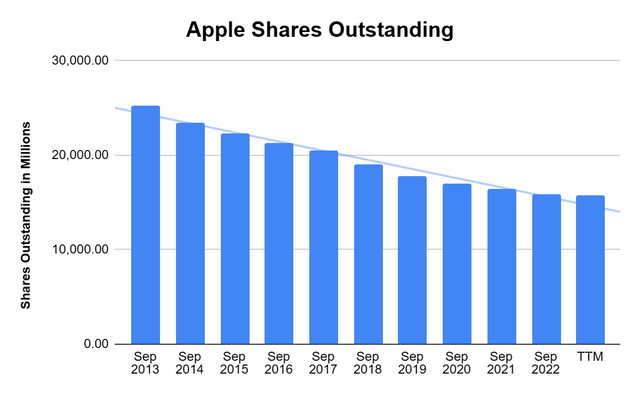

The amount of capital that AAPL returns to shareholders is nothing short of remarkable. In Q2 of 2023, AAPL returned $23.2 billion to shareholders by repurchasing $19.1 billion worth of shares and paying $3.7 billion in dividends. Since AAPL’s 2012 fiscal year, they have repurchased $592.4 billion worth of shares and paid $139.3 billion in dividends. In just over a decade, AAPL has returned $763.5 billion of capital to shareholders, which is more than the current market cap of Meta Platforms (META), Tesla (TSLA), or NVIDIA (NVDA).

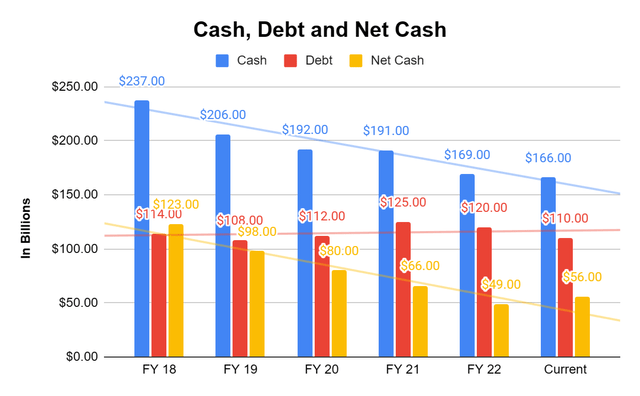

I would disagree for anyone who doesn’t think that a decade of data is enough to establish a trend of AAPL continuing to return tens of billions quarterly to shareholders. AAPL can’t give money away quickly enough. In the 2022 fiscal year, AAPL generated $99.80 billion in net income, which was the largest of any company in the market. After returning $763.5 billion from its war chest over the past decade, AAPL still has $166 billion in cash. AAPL has $110 billion in debt, placing its net cash position at $56 billion. AAPL’s goal has been to reach a net neutral cash position, and after returning 3/4th of a trillion dollars, they are still nowhere close. At this rate, AAPL would need to generate $0 of net income for the next 2 quarters and maintain its current return of capital metrics to come close to this goal. AAPL is the most profitable company in the market and has generated $54.16 billion of net income in the first half of its 2023 fiscal year. Over the past 9 quarters, AAPL has only generated sub $20 billion in net income once, and that was in Q3 of 2022 when they generated $19.44 billion. AAPL has recently confirmed my theory as they announced a new share buyback program of $90 billion.

This latest $90 billion buyback authorization highlights APPL’s future alignment with shareholders. Over the previous 10.5 years, AAPL has repurchased 9.46 billion shares which is equivalent of 37.57% of the shares outstanding at the end of the 2013 fiscal year. If AAPL repurchased $90 billion of shares at an average price of $185 per share over the next several quarters, they would reduce the share count by an additional 486.49 million shares or 3.09%. This will have several positive impacts, including giving each share a larger ownership percentage of AAPL, increasing the amount of revenue and EPS each share represents if the overall revenue and EPS stay flat, artificially increasing EPS as long as earnings from operations don’t decline, and reduce the amount of capital paid in dividends as there are fewer shares.

Steven Fiorillo, Seeking Alpha

Apple’s dividend and why I am ok with a very low yield

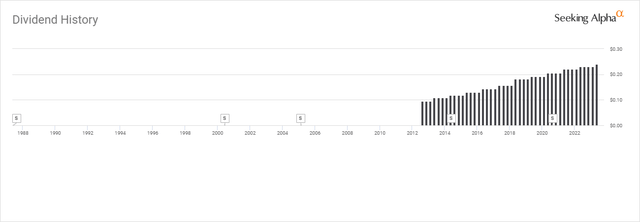

Since AAPL has implemented a dividend program, it’s been a strong dividend growth company regardless of the low yield. Over the past 11 years, AAPL has grown its quarterly dividend by 155.56% from $0.09 to $0.23. Some readers of my articles have discussed how they would like AAPL to increase the dividend yield to become more competitive with other dividend companies in the S&P 500, while others have expressed how they would rather see more capital allocated to the dividend rather than buybacks. As a serial investor in dividend companies, I understand the mindset, but I don’t necessarily agree with the idea of AAPL going gangbusters with the dividend. Here is some math behind what they could do.

In the TTM, AAPL has allocated $85 billion toward buybacks and $15 billion to the dividend. The dividend per share over the TTM was $0.92, so every $15 billion allocated to the dividend would correlate to an additional $0.92 in the annual dividend. Working with these numbers, I will assume that AAPL has allocated the same $100 billion toward capital allocation in the next 12 months as they allocated in the TTM. Before I go any further, I want to say that I am aware AAPL has increased the dividend to $0.96, but since the new dividend hasn’t been paid, and I don’t have the future numbers, I am basing this on the current TTM numbers. AAPL’s dividend of $0.92 was a yield of 0.53% based on the share price of $172.57. If AAPL was to reallocate $30 billion and increase the split to $55 billion for buybacks and $45 billion for the dividend, AAPL’s dividend would increase to $2.76 per share, which would be a yield of 1.6%. If AAPL went further and flipped the allocation and distributed $40 billion toward buybacks and $60 billion toward the dividend, AAPL’s dividend would increase to $3.68 per share which would be a yield of 2.13%.

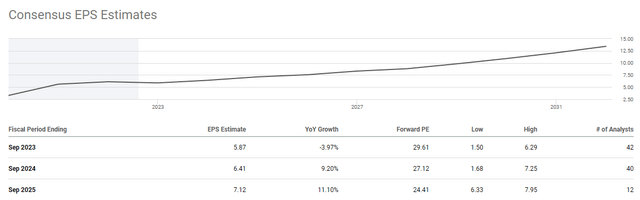

I am not investing in AAPL as a dividend play or even a dividend growth story. I am not sure how many investors look at AAPL as either of these. I look at the small dividend as an added bonus. Personally, I would rather AAPL allocate the lion’s share of their capital allocations toward buybacks. I feel that investors are better served in this case, with AAPL buying back as many shares as possible and doing everything they can to increase EPS. AAPL is the most profitable company in the market, and I think most people would be investing in AAPL for capital appreciation. For AAPL to continue leading the way, it’s imperative that they generate EPS growth. The analyst community has 2023’s EPS at $5.87, then increasing to $6.41 in 2024 and to $7.12 in 2025. AAPL’s forward P/E goes from 29.61 in 2023 down to 24.41 in 2025. The more AAPL can grow its profits organically the more earnings they generate, and the more shares they buy back, the less shares its earnings from operations get distributed across. This could lead to many future earnings beats, and enhance the potential for future capital appreciation. While I love dividends, AAPL is a long-term capital appreciation play for me, and I would rather them utilize most of the capital earmarked for their return of capital program toward buybacks. AAPL is also the largest component of many index funds, such as the SPDR S&P 500 ETF Trust (SPY) at 7.45%. AAPL’s future capital appreciation is critical for many funds, and this is another reason why I would rather see AAPL do everything it can to increase EPS and have an attractive P/E instead of juicing up the dividend.

In the face of economic uncertainty, AAPL is going strong and this is a company I want to own through thick and thin

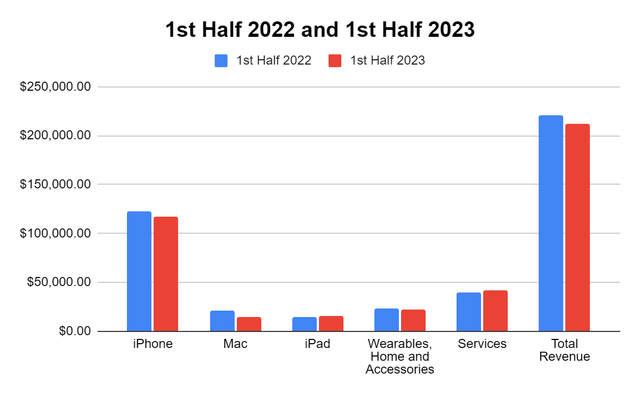

No matter what the economic environment is, AAPL has been resilient, as its customer base is second to none. It would be hard to argue that the past year has been an easy operating environment, and while this is improving in some areas, others are tightening as rising rates have increased the cost of capital. AAPL has generated $211.99 billion in revenue throughout the first half of its fiscal year. AAPL’s total revenue generated compared to 2022 over this period is only off by -4.17%, which is nothing to complain about, considering they have produced $92.31 billion in gross profit and $54.16 billion in net income. AAPL is operating at a 43.54% gross profit margin and a 25.55% profit margin. AAPL has an incredible ecosystem that allows it to deliver no matter what the impediments are. AAPL generated $40.16 billion in net income across Q3 and Q4 2022. If AAPL mimics this in 2023, it will produce $94.32 billion in net income, and if they generate $35 billion in net income over Q3 and Q4, their 2023 net income would total $89.16 billion. This is remarkable, and AAPL continues to invest in its future, which could mimic the previous decade.

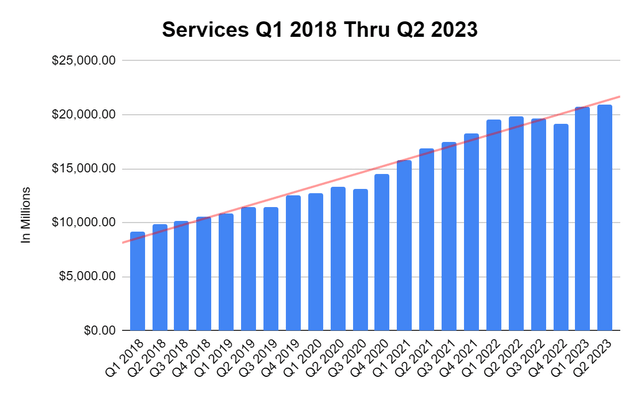

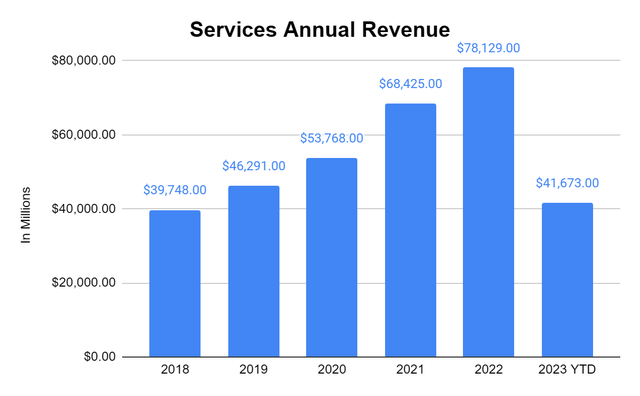

Services continue to grow and are something that many are looking right past. Since Q2 of 2018, Services has increased its quarterly revenue by $11.06 billion or 112.25%. In the TTM, services have generated $80.47 billion in revenue, and in the first half of AAPL’s 2023 fiscal year, Services has already generated 53.39% of 2022’s total revenue. There are a lot of things to be bullish about, including India, AAPL’s headset, and updated products. Services is on track to reach $100 billion in revenue by 2026, and the main thing to remember is this is reoccurring revenue. This is why Services are so important to me, as it diversifies AAPL’s revenue stream away from hardware. In less than a decade, AAPL has built a business segment from the ground up that is approaching $100 billion of reoccurring revenue, and this segment has the potential to continue growing throughout the decade.

Steven Fiorillo, Apple Steven Fiorillo, Apple

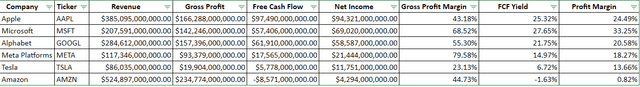

No matter what, AAPL is a company I want to own through thick and thin. I compared AAPL to Microsoft (MSFT), Meta Platforms (META), Alphabet (GOOGL), Amazon (AMZN), and Tesla (TSLA). AAPL may not generate the most revenue or have the largest margins, but in my opinion, it’s the best company of the group, and I think it’s undervalued.

Steven Fiorillo, Seeking Alpha

In the TTM, AAPL has generated the 2nd largest amount of revenue, and the 2nd largest amount of gross profit, but they produce the largest amount of free cash flow (FCF) and net income. These are all phenomenal businesses, and I am shocked at MSFT’s margins as they operate at a 68.52% gross profit margin, a 33.25% profit margin, and have an FCF yield of 27.65%, but AAPL has still produced an additional $25 billion in net income compared to MSFT over the TTM. AAPL has generated $385 billion in revenue and operated at a 43.18% gross profit margin, producing $166.29 billion in gross profit. AAPL has driven $97.49 billion in FCF and $94.32 billion in net income from its revenues and operates at a 24.49% profit margin and 25.32% FCF yield. Personally, other companies may have more upside potential, but I stand behind my comments that AAPL is the best business in the group due to its profitability.

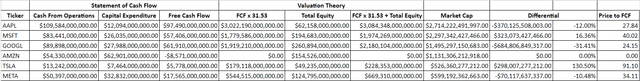

Steven Fiorillo, Seeking Alpha

There isn’t a perfect way to value companies, so I have come up with a methodology that I use as a baseline. I take the total equity on the books and combine it with a multiple of FCF to determine what I think the company is worth. Then I look at the current market cap and determine if its overvalued or not. How I arrive at that multiple on FCF can vary, depending on what type of analysis I am looking at.

For this, I am just using big tech, and I added TSLA because they are valued as a big tech company. Normally I will take the average that these companies trade at to FCF and use that as my baseline multiple. In this case, AMZN has negative FCF, and TSLA trades at a price to FCF multiple of 91.10x, so I excluded that as I consider it an anomaly. AAPL trades at a Price to FCF of 27.84x, MSFT 40.02x, GOOGL 24.15x, and META 34.11x. The average price to FCF of these four companies is 31.53x.

When I multiply AAPL’s FCF by 31.53x I get $3.02 trillion. Then I add their total equity to $3.02 trillion and come up with a fair market value of $3.08 trillion which is right around their all-time highs. Based on this valuation theory, AAPL is trading at roughly a -12% discount. GOOGL looks like the most undervalued company in the group at a discount of -31.41%.

Conclusion

I would buy AAPL whenever an opportunity presents itself as I feel this is the best company in the market. Today I think shares are undervalued by -12%, and there are a lot of future opportunities for AAPL to increase revenue and profits over the years. AAPL should generate around $90 billion in profits for 2023 and will continue to buy back shares while investing in India and developing new products. The additional buyback program will help reduce its share count and could set AAPL up for many future earnings beats. When the market turns, I believe AAPL will be a frontrunner, and more capital will pour into it from the sidelines directly, and indirectly from ETFs and mutual funds. I think AAPL will reach around $180 in 2023 and surpass $200 in 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN, GOOGL, META, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.