Summary:

- Apple sold 45.6 million smartphones in 3Q 2024, with a 6% year-over-year increase, but its market share shrank to 16%.

- Rising sales in India compensated for falling sales in China, but the average revenue per customer dropped to ~$860 (-7% y/y).

- Apple’s financial results show stable revenue in the Mac segment, rapid recovery in the iPad segment, and increasing competition in the wearable devices market.

- We are assigning the HOLD rating for the shares. The target price is $223 per share.

ozgurdonmaz

Investment thesis

Demand in the global market of devices continued to bounce back. Apple (NASDAQ:AAPL) (AAPL:CA) sold 45.6 mln smartphones (+6% y/y) in 3Q 2024, while the total smartphone market climbed by 12% y/y to 288.9 mln units. Apple’s share of the smartphone market shrank to 16%, down 1 pp from a year earlier. Falling sales in China were compensated by rising sales in India. But in the Indian market, iPhone is considered an expensive brand, so the compensation caused the average revenue per customer to drop to ~$860 (-7% y/y).

Last quarter, as we wrote in our previous article, Apple also lost share in the smartphone market: in Q2 2024, Apple Inc. sold 48.7 million smartphones (-16% YoY), while the total smartphone market grew by 10% YoY to 296 million units. The rating is HOLD.

Smartphone market

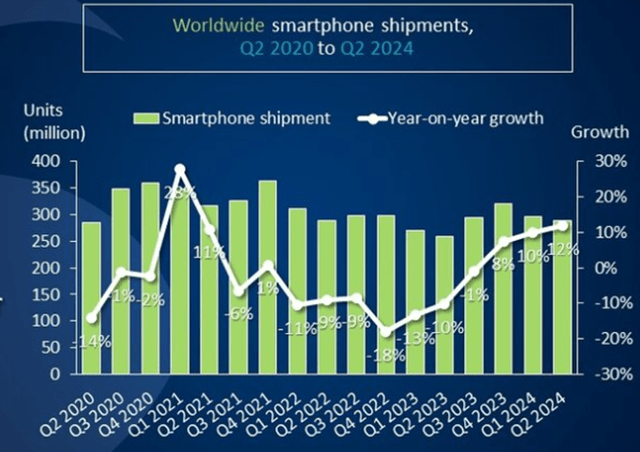

Total smartphone shipments climbed by 12% y/y to 288.9 mln units in 2Q 2024 (3Q 2024 for Apple).

Apple’s sales totaled 45.6 mln smartphones (+6% y/y), and Apple’s share of the smartphone market shrank to 16% from 17% in 2Q 2023 (3Q 2023 for Apple).

Developing countries in Asia, Latin America, Africa and the Middle East continue to be the main growth driver for the smartphone market. Physical sales there expanded by 10% to 20% y/y in 2Q 2024. However, in terms of money, the main markets for Apple are the US, China and Europe. Total smartphone sales climbed by 5% y/y in the US, 14% y/y in Europe, and 6% y/y in China. Even so, Apple continued to lose market share in China, yielding it to local manufacturers. Apple’s market share in China fell to 15.5% from 17.4% a year earlier, while physical sales declined by 6%.

Luxury smartphone brands – Apple and Samsung – are being helped by the market recovery in the US and Europe, as old inventories have been sold out and stores have started to vigorously rebuild them before the new holiday season. In the second half of 2024, major brands will be looking to ramp up shipments of smartphones that have GenAI onboard. In the near future, this will be the main factor that will influence sales of any particular brand.

At a developer conference, Apple unveiled its own Apple Intelligence, which it plans to embed into smartphones and Siri to improve understanding of natural language. In addition, Apple entered into a partnership with OpenAI and will embed ChatGPT into its devices. According to insiders, the partnership with OpenAI is not for profit, meaning that Apple will not pay OpenAI for using ChatGPT. Instead of payment, OpenAI will get access to Apple’s large customer base and will likely sell them mini-apps that are embedded in ChatGPT – transactions for which Apple will earn a 30% commission.

We expect that Apple, by integrating with OpenAI, will regain market share more quickly, especially in the US and EU. In developed countries, Apple competes mainly with Samsung, whose AI is weaker than ChatGPT. Apple will not have this advantage in the Chinese market, where the US tech giant will use Baidu’s AI, which levels the playing field for local suppliers.

We are also seeing consumer spending in the US and Europe actually exceeding disposable income, which is gradually depleting built-up savings and squeezing demand for durable goods.

As a result, despite the rapid market recovery in the first half of the year, we are maintaining our forecast for smartphone shipments for the full year of 2024 at 1.2 bln units (+5% y/y) and at 1.26 bln units (+5% y/y) for 2025.

Considering the integration between Apple and OpenAI, we are raising the forecast for iPhone’s market share from 19% (-0.9 pp) to 19.6% (-0.3 pp) for 2024, and from 19.3% (+0.3 pp) to 21.1% (+1.5 pp) for 2025.

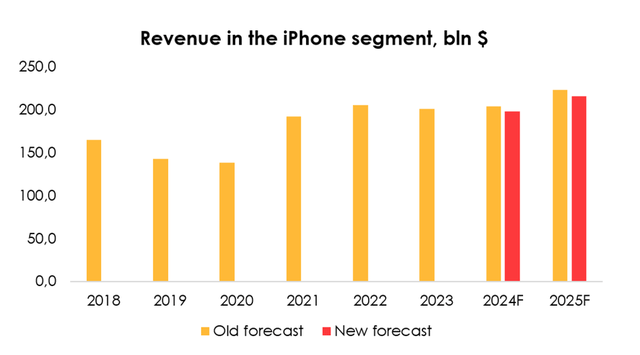

Falling sales in China were compensated by rising sales in India. But in the Indian market, iPhone is considered an expensive brand, so the compensation caused the average revenue per customer to drop to ~$860 (-7% y/y).

As a result, we are lowering the projected average revenue per one iPhone from $935 (+3% y/y) to $886 (-2% y/y) for 2024, and from $982 (+5% y/y) to $884 (-0.2% y/y) for 2025.

Given all the changes, we are cutting the forecast for Apple’s revenue from $203.6 bln (+1% y/y) to $198 bln (-1% y/y) for 2024, and from $223 bln (+10% y/y) to $215.6 bln (+9% y/y) for 2025.

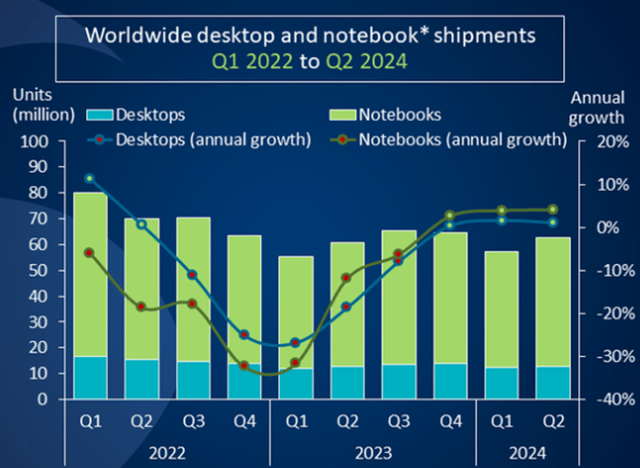

Apple’s other segments

The Mac segment delivers stable financial results. Revenue in the segment totaled $7 bln (+2% y/y). The company sold 5.5 mln Macs, up 6% from a year earlier. Average revenue per device slid by 2% y/y. Apple’s market share in the PC segment edged up slightly to 8.8% (+0.2 pp y/y). The global PC market continued to rebound at a moderate pace. Total PC shipments climbed by 3.4% y/y to 62.8 mln units.

The iPad segment started to recover rapidly. Revenue in the segment totaled $7.2 bln (+24% y/y). We attribute this to the release of the new iPad 2024 in May 2024. The new version of the iPad is far superior to previous versions and is powered by the revolutionary M4 chip. The tablet also contains an NPU Neural Engine, making it suitable for widespread use of AI apps.

Revenue from wearable devices, which include Apple Vision Pro, totaled $8.1 bln, down 2% y/y. Apple faces rapidly increasing competition in the smartwatch and wireless headphone market from Chinese rivals and the Nothing brand, which have improved a lot in terms of technology and design over the past year.

The company plans to sell the Vision Pro in 8 more countries, including China and Japan. A new OS – VisionOS2 – has been announced for the Vision Pro. It will use machine learning for creating spatial photos and feature new hand gestures. For the time being, Apple Vision Pro can be described as an experimental model, which draws demand mainly from companies that are trying to test it and adapt it to their own needs.

The company’s services revenue came in at $24.2 bln, up 14% from a year earlier.

Apple’s financial results

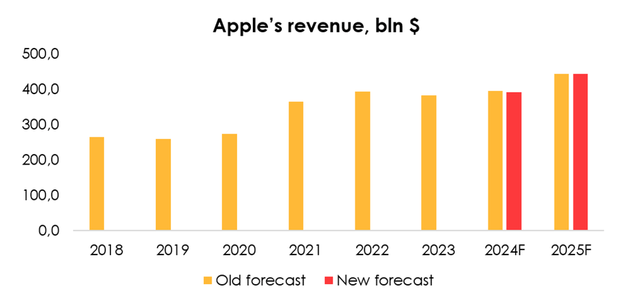

We are lowering the forecast for Apple’s revenue from $395.6 bln (+3% y/y) to $391.3 bln (+2% y/y) for 2024, and from $444.7 bln (+12% y/y) to $443.8 bln (+13% y/y) for 2025 due to expectations of weaker smartphone sales, even though that is partially mitigated by higher forecasts for sales in the iPad and services segments.

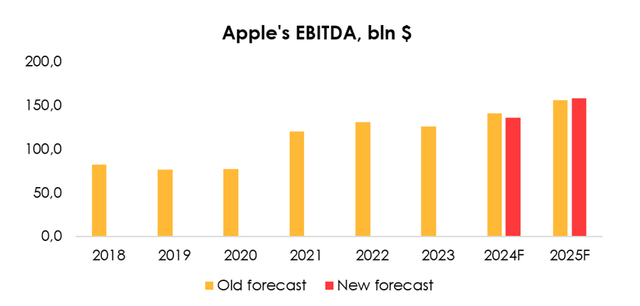

We are lowering the EBITDA forecast from $140.7 bln (+12% y/y) to $135.5 bln (+8% y/y) for 2024 due to the reduced revenue forecast and higher costs of parts for the company’s devices and slightly raising it from $155.8 bln (+15% y/y) to $157.7 bln (+16% y/y) for 2025 due to rapid growth in Apple’s marginal services segment, which will offset the reduction in the company’s device revenue forecast.

Valuation

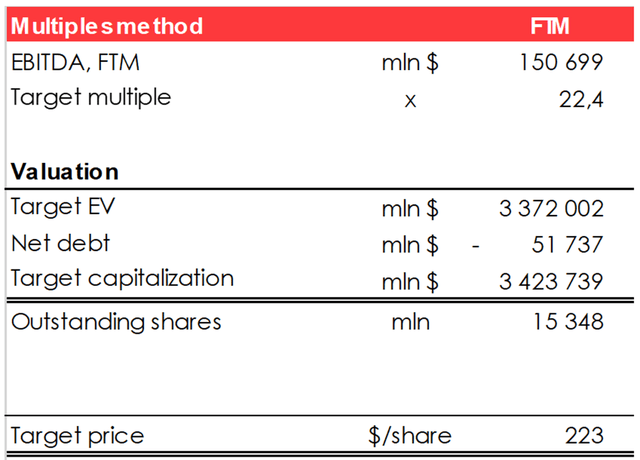

We are raising the target price of the shares from $171 to $223 due to:

- the increase in the target multiple for Apple from 17.5x to 22.4x;

- the reduced EBITDA forecast for 2024 and 2025;

- the increase of net debt from ($58) to ($52) bln;

- the decrease of the number of diluted outstanding shares from 15.5 bln to 15.4 bln;

- the shift of the FTM valuation period.

We are assigning a HOLD rating to the stock.

Conclusion

Apple is a high-tech company that is busy developing its own ecosystem. However, the recent trends in the smartphone market significantly limit its growth potential. We believe the company is trading close to fair value. The rating is HOLD.

To manage your positions, we recommend following Apple’s earnings releases and market updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.