Summary:

- Apple Inc.’s less than stellar FY23 Q1 earnings report seems to have gone unnoticed by investors.

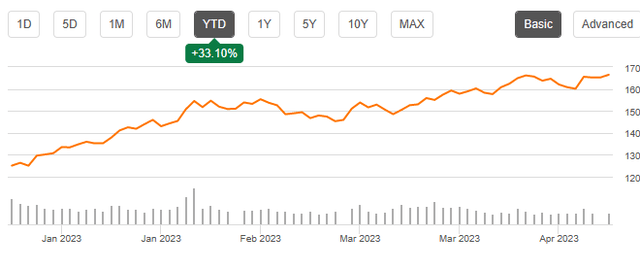

- A rally in Apple Inc. shares since January 2023 has seen the share prices increase over 34%, with current prices hovering around the $168 mark.

- An even more pessimistic macro-outlook combined with weak expectations for Q2 earnings means significant uncertainty clouds valuations.

- Apple Inc. shares seem intrinsically overvalued by around 15%.

- Long-term profitability expectations are unchanged, but there is little short-term upside. Apple Inc. still warrants a HOLD rating.

EKIN KIZILKAYA

Investment Thesis

Apple Inc. (NASDAQ:AAPL) has provided investors with significant returns for a good part of the last decade.

Their ability to maintain a strong operating and net margin even in the most difficult of economic environments highlights just how powerful the company has become in the tech industry.

However, the recent YTD rally of 34% has left Apple’s shares trading at incredibly high valuations. The headwinds currently facing the company combined with a generally difficult macroeconomic environment means that significant uncertainty clouds the future for Apple.

Therefore, I am conducting a pre Q2 FY23 update to Apple to best assess the company’s suitability from a value-oriented perspective.

Company Background

Apple is an American MNC headquartered in Cupertino, California. It is currently the largest technology company in the world (by revenue). The economic and social influence their brand has generated over the past two decades has resulted in an incredibly loyal consumer base and desirable corporate image.

Most of Apple’s revenue arises from their physical technology sales, with primary sales coming from their iPhone line-up, Mac personal computer range, or from the host of other technological accessories such as smartwatches the brand pursues. All of Apple’s products occupy the luxury end of personal technological devices.

The company has the highest valuation of any company currently being publicly traded. Their current market cap of around $2.61T is truly incomprehensible and most definitely not supported by intrinsic value calculations.

Economic Moat – Pre Q2 FY23 Update

I conducted a full in-depth analysis of Apple’s economic moat back in February 2023 which I still believe holds validity in today’s market environment. For a full analysis, check out that article here: “Apple: The Right Company At The Wrong Price.”

Nonetheless, I will conduct a quick update here to sum up the company’s core business model along with the changes that have affected Apple’s key moatiness drivers.

Apple hosts an incredibly broad moat when compared to most other personal electronic device manufacturers. The primary drivers for their moat is their incredibly valuable brand image, extensive proprietary product ecosystem and the innovative nature of their products.

The company is the market leader when it comes to luxury personal technology devices. Their ability to combine high-quality physical devices with an outstandingly intuitive user interface has allowed the company to create products which customers aspire to own.

Apple complements these products with a large portfolio of Apple-specific auxiliary services such as Apple Music, Apple TV, Apple Card and now, their ultimate collection package named Apple One.

The features these services provide help Apple enhance the eco-system effect of their brand which makes it significantly more difficult (both physically and psychologically) for consumers to switch to competing products.

Interestingly, Bank of America has recently commented upon Samsung’s proposed search engine switch from Google to Microsoft Corporation’s (MSFT) Bing as being something Apple should aim to replicate. If Apple were to switch it’s default search engine to Bing, the company could renegotiate traffic acquisition costs with Microsoft to create a more lucrative deal than with Google.

Analyst Wamsi Mohan estimates that Apple receives approximately $20B from Alphabet Inc. (GOOG) to use Google as their default search engine. I believe a deal with Microsoft could double if not triple that sum.

Apple Card has also seen significant developments with the firm endeavoring deeper into the fintech environment with the launch of a high-yield savings account from Goldman Sachs. The provision of a 4.15% yielding savings account with no minimum deposits, no minimum balance requirements could significantly get more individuals involved in the Apple ecosystem purely from a monetary perspective.

The provision of such a savings account illustrates Apple’s desire to further increase their presence in the lives of everyday consumers. This ties in with the increased focus Apple has placed on the software services accompanying their core electronic devices and suggests management is continuing to pursue this business strategy moving forwards.

Apple has also launched Apple Music Classical, a standalone app dedicated to providing listeners with an unrivalled selection of classical music accompanied with a rich metadata library for each song. The service is free to existing Apple Music subscribers and allows for spatial audio to be used which should increase the quality of the listening experience.

Apple’s continued focus on increasing switching costs for consumers by providing more Apple exclusive services seems to be working. I believe the proposed switch to Bing from Google, combined with the launch of their high-yield savings account and Apple Music Classical all act to slightly increase the moatiness of the company’s services division.

The tech giant’s recent expansion into the Indian market seems like a strategically sound move with the aim of harnessing the immense growth potential present in this emerging market. The opening of the first two Apple stores in the country – both in Mumbai and Delhi – should help Apple to increase their currently anemic smartphone market share of around 5%.

A potential weakness in this strategy however lies in the pricing of their hardware products. India is a particularly value-oriented tech market with lower-cost models often seeing significantly greater sales for manufacturers than their flagship devices. This could mean Apple’s products are unattainable for many due to the absolutely premium price point.

Overall, I believe this geographic expansion is a good way for Apple to potentially increase their economic moat, especially as the company has begun manufacturing more of their products in the nation. However, I think assigning any economic moatiness to this expansion at current time is too uncertain.

Some weakness seems to be brewing in Apple’s hardware sales, with reported sales of their core revenue drivers slowing. Both iPhone and Mac sales have taken a hit in 2023, with these slowing sales figures expected to negatively impact Apple’s Q2 results.

Mac sales have been particularly hard hit, with shipments having fallen over 40.5% in Q1 of 2023. Notably, these figures are much worse than many Windows PC counterparts.

While some consumers may be waiting for the expected release of Apple’s new Macs equipped with M3 processors, a more likely reason for this huge drop in sales is the decreasing disposable income consumers have to spend on luxury goods such as Apple products.

I believe these struggles signal a weak Q2 earnings report which could see investor sentiment sour for the company. It also suggests Apple’s moatiness in the hardware division is not as bulletproof as many investors expected.

When considering the company as a whole, it is clear Apple still possesses an unrivalled brand image which permits the firm to charge consumers significant premiums for their products. The company is also laser focused on creating high-quality products which provide consumers with superior user-experience both through ecosystem benefits and through excellent hardware.

However, while their software solutions continue to drive an increased economic moat for the firm, the weaker than expected hardware sales results suggest the company is not as immune to global economic trends as many investors expected.

I still rate Apple as having a very wide economic moat, but one that should be carefully monitored moving forwards in FY23, especially if trading on a short horizon.

Financial Situation – Pre Q2 FY23 Update

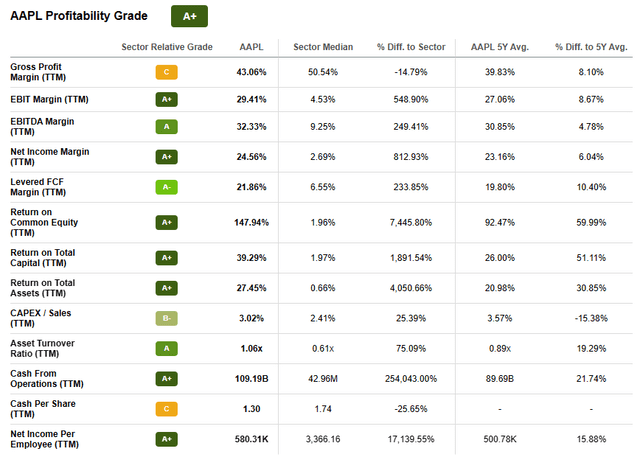

Seeking Alpha | AAPL | Profitability

I conducted a more detailed financial analysis in my original article.

Nonetheless, the truth remains that Apple continues to be a highly profitable company. Their profit-generating abilities in the long-term still seem solid, although FY23 may prove difficult due to the significant macroeconomic headwinds in the form of an expected recession on the horizon.

Their consistent EBITDA margins of 33% combined with a 5Y average ROIC of 34% is incredibly impressive. Strong pricing power has allowed the company to generate 10Y average gross margins of almost 40% with an average net margin for the same time period of 20%.

Apple’s long-term profitability and growth potential remains unchanged.

FY23 Q1 results did show a YoY decrease in revenues of 5% down to a total sum of $117.2B. This quarterly decrease is the result of a challenging macroeconomic environment resulting in product shortages (such as the iPhone Pro series) and COGS increases.

The company’s CEO Tim Cook was also quick to point out that Apple actually increased total company revenue on a constant currency basis. In this quarter, the company had to endure an FX impact of almost -800 basis points.

Luckily, in the same quarter Apple managed to set an all-time revenue record of $20.8B being generated by their Services business. Their continued focus on becoming not only a hardware manufacturer, but a digital multimedia and holistic service provider allows the firm to significantly diversify their revenue streams in relation to key rivals.

While Apple’s EPS of $1.88 in Q1 FY23 missed out on consensus estimates by 2.7%, the afore-mentioned impact significant FX headwinds had on revenues is mostly to blame.

Of course, it is important to note that FY22 total net sales were down $6B to just $117B compared to $123B in FY21. This was a result of softening sales in all their regions of operations compounded by an unfortunate 7.7% decrease in net product sales.

The expected mid 2023 economic slowdown will undoubtedly hurt Apple’s margins and sales figures as consumers have less to spend on luxury goods. Therefore, I take a more bearish view to short-term future for Apple from an earnings perspective. I expected Q2 results to be weaker than anticipated.

Still, I don’t believe investors are going to be hurt much by Apple’s profitability in the future thanks to their robust economic moat and strong business model. The key issue currently facing shareholders is their excessive valuation.

Valuation – Pre Q2 FY23 Update

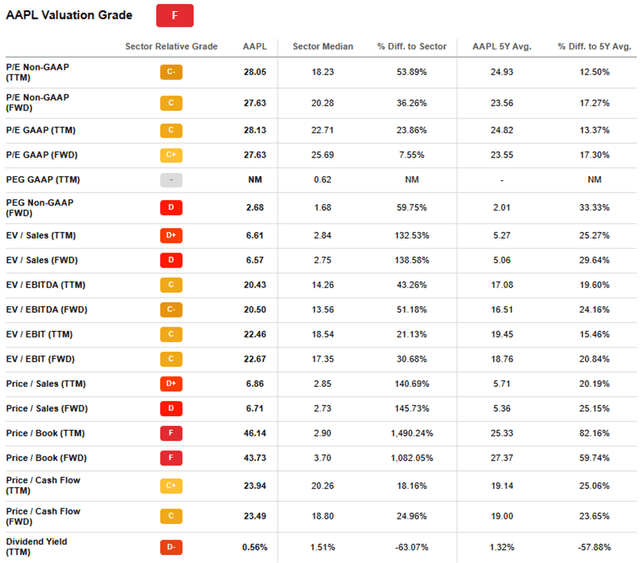

Seeking Alpha | AAPL | Valuation

Seeking Alpha’s Quant has assigned Apple with an “F” valuation rating. Unfortunately, I am still inclined to agree with this assessment as it represents a fair evaluation of Apple’s current share price when considered against traditional valuation metrics.

The firm is currently trading at an even higher P/E GAAP ratio of 28.13 and a P/CF ratio of 23.49 compared to early Q1 FY23. When considered against a FWD Price/Book ratio of 43.73 and an EV/Sales FWD of 6.57, it is clear that the current share price represents a significant intrinsic overvaluation of the firm.

Seeking Alpha | AAPL | Summary

From an absolute perspective, Apple shares have risen almost 34% since January 2023. This has occurred on the heels of Apple’s worst quarterly fiscal report since 2020 and thus seems irrational from a more objective perspective.

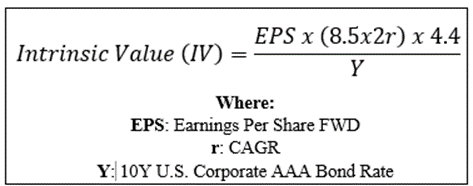

By accomplishing a simple financial valuation based on the calculation below and using the estimated 2023 EPS of $5.98 a realistic r value of 0.09 (9%) and the current Moody’s Seasoned AAA Corporate Bond Yield, we can derive a base-case IV for Apple of $151.6.

The Value Corner

When using this realistic CAGR value for r, Apple appears to be overvalued by 10%. By using a more pessimistic worst-case 2023 growth estimate CAGR value of 0.07 (7%), share are valued at around the $128.7 mark, 30% lower than currently.

Therefore, I believe Apple is currently sitting somewhere between slightly to moderately overvalued. Both it’s absolute comparison to historic share prices combined with an intrinsic value calculation suggest the company’s shares are trading at a tangible premium to their real value.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. I believe share prices will fall as the market corrects for the significant overvaluation currently taking place. Thereafter, much depends on the prevailing macroeconomic conditions and the ability of the US and Global economies to achieve a soft landing on inflation to ensure the technology sector avoids a significant gulley.

In the long term (2-4 years) I fully expect their position as a leader in the industry to become even stronger. Their unique product offerings combined with the undoubtable branding power places little doubt in my mind over the almost undoubtable returns the company should be able to provide to shareholders.

Therefore, it is almost impossible to argue that the current share price would leave any tangible room for value investors to become involved with the stock. While the firm has supported a historic overvaluation, the risk associated with investing in a company which fails to exhibit any real undervaluation is significant.

Risks Facing Apple – Q2 FY23 Update

Apple still faces the same risks of increased competition within the market, failed execution of products along with the negative social sentiment arising from anti-repair tactics. However, the company also faces the very real short-term risk of falling consumer discretionary income.

If consumers have less to spend on luxury goods, Apple’s core revenue driving product categories such as the iPhone, iPad and Mac line-ups will see declining sales and popularity. This could definitely hurt FY23 results thus potentially leading to a pronounced market correction in the firm’s share prices.

This very real threat should not be underestimated given how hard it is to predict how markets will react to certain events. While the impacts of the U.S. banking crisis seem to have been relatively mute in wider equities markets, the underlying market fundamentals suggest a recession is very likely in 2023.

Summary

Apple has had an incredibly impressive history from an investor standpoint. Their robust, premium business model, excellent operational efficiency and iconic brand reputation have allowed the company to become a true profit generation powerhouse. There really is a reason the firm boasts the highest valuation of any company in the world.

Unfortunately, the huge YTD rally has left shares trading at a fundamentally irrational price point with little room for further growth. Both absolute and intrinsic valuation methods suggest shares are materially overvalued thus making building a position from any form of value perspective impossible.

Even from a growth point of view, little room and probability exists for Apple to achieve any tangible success in 2023 due to the significantly unfavorable macroeconomic conditions.

While Apple has had a history of trading a relative premium to its intrinsic value, current prices are truly exaggerated.

As a short-term investment, I believe there is too much volatility particularly exposing investors to downside potential. However, in the long-term I still fully believe their undeniable position as a market leader places Apple firmly in position to generate great shareholder value.

This warrants a reiteration of my HOLD rating as, while long-term value generation has not been compromised, short-term headwinds are too great to justify building a position in Apple Inc.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.