Summary:

- Apple Inc. stock has shown increased volatility lately due to extended company-specific woes, particularly in the face of rising competition in China.

- The company’s March quarter revenue declines continue to highlight risks of persistent market share loss in its key iPhone and Mac segments, despite an impending PC and smartphone recovery.

- Apple’s uncertain AI strategy and lack of growth initiatives also poses risks to its valuation outlook.

- With continued uncertainties to its fundamental prospects, the confidence stemming from Apple’s approved buybacks is likely to wear off soon.

ozgurdonmaz

Apple Inc. (NASDAQ:AAPL) has shown increased volatility this year. In addition to investors rotating in and out of haven trades amid the ongoing AI frenzy, Apple also faces company-specific woes that have been weighing on its valuation prospects. Yet, the March quarter double beat, albeit a low bar to clear, was further boosted by the board’s authorization of an additional $110 billion in share buybacks. This has sent the stock surging in post-market trading, despite low expectations, and management’s modest commentary for the current period’s outlook.

Although the stock has surpassed its peak valuation twice, it has failed to sustain a $3+ trillion market cap. This is consistent with our previous concerns that Apple lacks the growth and profitability profile to sustain such a lofty premium over its megacap peers. And the ballooning headwinds facing its business over the past year – particularly in China, the largest smartphone market in the world – further clouds the potential for any near-term respite.

Now with some of Apple’s highly anticipated projects either already online (e.g., Vision Pro) or out of the picture altogether (e.g., Apple Car), visibility into Apple’s outlook has become more uncertain than ever. On one hand, the Vision Pro’s blockbuster debut has since calmed, with limited expectations for the segment to become a major growth contributor anytime soon. Meanwhile, on the other hand, the cancellation of the long-awaited Apple Car project eliminates a key host device category for further monetization of its expansive ecosystem of offerings.

Yet, Apple’s balance sheet strength remains a tool at its disposal. We view Apple’s continued employment of generous share buybacks as a critical tool for the stock in weathering the near-term headwinds facing its underlying fundamental outlook. But the durability of its valuation premium at current levels remains at risk, nonetheless, given the lack of support from favorable returns on growth investments.

Looking ahead, the next big thing for Apple in reinforcing its sustained long-term growth outlook could be AI. Markets currently expect a significant update on Apple’s AI strategy coming in June at its annual WWDC event. Yet, management’s previous skepticism about the nascent technology has likely resulted in a costly and increasingly difficult game of catch-up ahead. Recent speculation that Apple is engaging with potential partners for the roll-out of its on-device generative AI capabilities also suggests its inferiority in the increasingly heated AI race – particularly among its megacap peers. Taken together, we see limited firepower at Apple for a sustained recovery towards all-time highs in the near-term, with impending risks still skewed to the downside.

A Look Back At Apple’s Uneventful Quarter

Apple revenue fell -4% y/y during the March quarter to $90.8 billion, which compares to repeatedly reduced consensus estimates of $90.6 billion. Despite the slight outperformance, Apple’s latest result continues to highlight woes in stemming market share loss to competitors. In addition to declining iPhone sales, dragged primarily by tepid demand in China, the lack of sequential reacceleration in Mac sales following the M3 MacBook Air refresh in March remains concerning, in our opinion.

Specifically, iPhone revenue fell by -10% y/y and -34% q/q during the March quarter – its worst performance since the onset of the pandemic. Despite tempered expectations given the typical seasonality drop-off and a difficult PY comp due to pent-up demand at the time for iPhone 14, the segment’s decline during the March quarter highlights intensifying pressure from ongoing macroeconomic uncertainties and intensifying competition – particularly in China, which accounts for almost a fifth of Apple sales.

China iPhone sales have been pressured in the face of persistent and ballooning headwinds, spanning macro-driven demand weakness, geopolitical implications, and intensifying competition. Specifically, smartphone sales in the world’s largest market for said devices fell -7% y/y this year through mid-February, while Apple iPhone sales fell the most by -24% y/y over the same period. The end of quarter tally, whereby Apple iPhone sales fell -19% y/y, highlights the extended headwinds that the company faces in the region – especially with resurrected demand for Huawei’s at 67% y/y volume growth driven by the Mate 60 Pro. Local uptake of iPhones has also been thwarted by an official call from Beijing for public agencies to restrict usage of foreign devices, citing national security concerns.

Despite a rare offer of promotional discounts in the region during the Lunar New Year holiday and International Women’s Day celebrations, Apple has failed to mitigate stiffening demand headwinds. And there is little Apple can do to drive an immediate reversal of sentiment for its devices in the region. Slowing demand is likely to persist in the region over the near-term. This is corroborated by signs of ballooning inventory for the iPhone 15. Specifically, Chinese buyers can access the iPhone 15 from authorized resellers on trusted sites such as Alibaba’s Tmall (BABA) and JD.com (JD) discounted by as much as $185 (RMB 1,340), with existing inventory for fast and free shipping. This far outpaces the previous discount of $70 on direct purchases from Apple earlier this year.

Not only is it concerning that Apple is increasingly relying on promotions to push volumes in China, but it also risks backfiring and deterring purchases in the region as consumers wait for better pricing. This is similar to an ongoing trend in the Chinese EV market, where an extended price war is now pushing consumers to the sidelines as they bet on even bigger discounts as the year progresses.

The dour outlook pairs with a slowing upgrade cycle in Apple’s home market as well. Specifically, U.S. smartphone shipments fell -10% y/y earlier this year, as consumers lament on limited performance upgrades between generations with added pressure from tightening financial conditions. As such, we expect the iPhone demand slump to persist in the near-term. This is also consistent with weaker-than-expected growth recently observed across key players of the device’s supply chain, which typically precedes anticipation for slow end-market uptake.

What’s Next?

Visibility into Apple’s forward outlook is gradually decreasing, especially after Apple cancelled the long-awaited car project following a tepid launch year for the Vision Pro. There is also limited information on Apple’s plans in generative AI – a key growth and multiple expansion driver that has generously benefited its megacap peers over the past year.

Admittedly, Apple’s recent write-off of its car and next-generation smartwatch screen projects could potentially augur one-time cost headwinds in the near-term. However, the development potentially frees up resources for other immediately realizable growth initiatives, such as AI investments. Reduced capex deployed towards speculative projects could also bode favorably for Apple’s checkbook in the near-term, which has been growing at a decelerating rate. This contrasts megacap peers like Amazon (AMZN), which sits on a ballooning “cash pile”.

For now, robust cash flows at Apple will continue to support its generous capital returns program, which consists of share buybacks to buoy the stock. But this strategy remains inferior to value appreciation driven by favorable returns on growth investments – an area of growing weakness for Apple, which accordingly suggests reduced durability to its valuation premium at current levels.

Apple’s Uncertain AI Strategy

Looking ahead, much will depend on how Apple plans to integrate generative AI capabilities into its vast ecosystem and capture relevant TAM expansion opportunities. This represents a key near-term lever for driving growth across both of Apple’s key devices segment and high margin services segment, and enables valuation multiple expansion.

The upcoming WWDC event in June will be a tell-tale. Apple is expected to reveal its AI strategy at its annual developer’s conference – more than a year after its megacap peers have ramped up their respective direct forays in the nascent technology for consumer end-markets. This includes potential detail on Apple’s efforts in developing its proprietary large language model, which has allegedly been kept under wraps. For now, Apple has only hinted that the annual event this year will be “Absolutely Incredible,” which potentially points to updates on its AI strategy. Management has also continued to stay mum when prodded by analysts about its AI strategy during the latest earnings update.

As discussed in a previous coverage, Apple’s integration of its proprietary LLM into Siri could become a competitive advantage and potential threat to some of industry’s key players, including Google Search (GOOG, GOOGL). A generative Siri could potentially disrupt a key source of traffic to Google Search and reinforce engagement within Apple’s very own ecosystem. This would inadvertently unlock the potential for new, high-margin revenue sources for Apple, such as search advertising and premium subscriptions.

However, this extent of an upgrade is largely expected to stay on the back burner for now. Apple appears to be taking the slow path when it comes to generative AI, with its proprietary model likely to underpin back-end capabilities on its devices rather than consumer-focused generative AI solutions. This is consistent with recent reports that Apple has been in engaging with prospective partners for the roll-out of its on-device generative AI capabilities, including the potential integration of Google’s Gemini model.

Although Apple has long relied on external partnerships to optimize customer experience without sacrificing its leadership, we believe increased dependence on external partnerships for generative AI capabilities could represent a multiple compression risk for the stock. Specifically, generative AI is viewed as a transformational technology that will disrupt the status quo. This differs from secular technologies like digital search and mobile apps, which have been less pervasive when compared to generative AI integration. Falling behind in the generative AI race – or worse, over relying on external developments – would be costly for Apple, as it risks diminishing the appeal of its seamlessly integrated ecosystem of devices and services. It would also suggest Apple’s inferiority in generative AI developments that are critical to its ecosystem’s technological relevance, dimming its competitive advantage and moat.

Despite Apple’s currently massive devices installed base, the lack of AI integration introduces incremental risks of market share loss to competitors. This includes potential inferiority to Samsung (OTCPK:SSNLF) and other Android smartphones that have been swift to adopt AI-enabled edge solutions.

Beyond LLMs

In addition to being a laggard in the adoption of proprietary generative AI solutions for its ecosystem, Apple has also struggled with enabling differentiating performance and efficiency gains in next-generation in-house silicon. This is consistent with the limited support observed from the M3 MacBook Air refresh in March on Mac segment performance in the previous period.

Apple appears to be on an inferior PC recovery trajectory in the near-term, as it lacks incremental cyclical tailwinds such as the emergence of AI-enabled workstations and the Windows 11 refresh. Industry currently forecasts AI-enabled PCs to reach as many as 50 million units and represent up to a fifth of total shipments later this year.

This makes us believe that it would be prudent for Apple to deliver an in-house silicon capable of delivering AI capabilities on edge platforms to reinforce its competitive advantage in the next-generation PC upgrade cycle. Although Apple’s upcoming A18 chip for iPhones is expected to feature a neural processing unit (“NPU”), a built-in AI accelerator, the extent of relevant upgrades for the M-series silicon for Macs remain uncertain.

Recent reports are expecting Apple to revamp its entire Mac line-up with next-generation AI-integrated M4 processors in the near-term, but an exact timeline remains unconfirmed. The M4 roll-out is likely to take form in three different performance variants – the “Donan” entry-level; “Brava” advanced level; and “Hidra” top-end processor. Further detail on NPU integration for Mac silicon would be sufficient to solidifying AI as Apple’s “next big thing,” and catapult its capture of emerging AI PC opportunities. It would also reinforce investors’ confidence in the durability of Apple’s technology moat and competitive advantage, in our opinion, and reverse some of the near-term multiple compression risks for good.

Fundamental Considerations

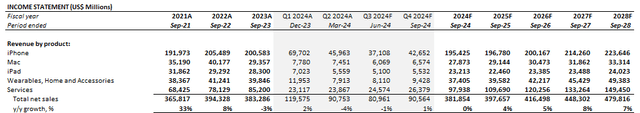

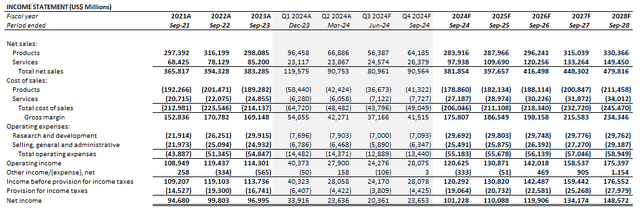

Adjusting our previous forecast for Apple’s actual March quarter results and forward expectations, the company is expected to keep revenue largely flat at $381.9 billion in fiscal 2024. Despite potential for a pickup in core iPhone sales demand exiting fiscal 2024 amid the highly anticipated release of an AI-enabled iPhone 16 fitted with the next-generation A18 silicon, broad-based China weakness remains a stiffening headwind. Meanwhile, services will remain the key lifeline to expanding monetization of Apple’s massive, yet slow growing, devices installed base. We expect the high margin segment to grow 15% y/y in fiscal 2024 towards $97.9 billion in revenue.

The favorable sales mix with increasing high margin service revenues is expected to maintain Apple’s pace of profit expansion in absolute terms over recent quarters. This will be key to overshadowing margin compression risks observed during the March quarter due to weak product sales. Robust growth in the higher margin services revenue stream will also be critical for offsetting anticipated non-recurring headwinds stemming from recent project cancellation and severance costs, as well as incremental growth investments through R&D.

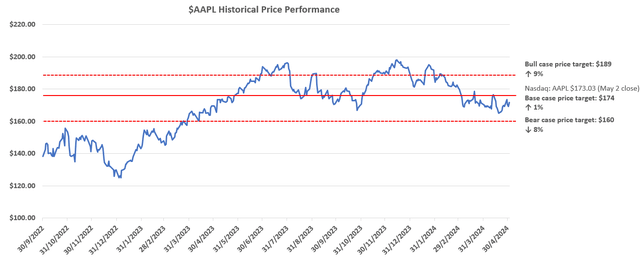

Price Considerations

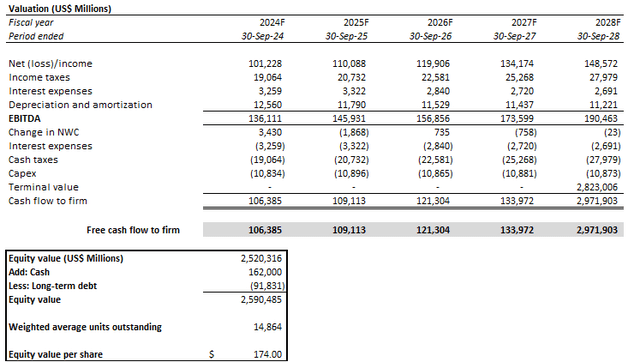

Given increasing uncertainties to how Apple plans to restore growth acceleration and expand its TAM following the recent cancellation of high-profile projects, we expect volatility to remain the stock’s near-term theme. In light of Apple’s March quarter underperformance and lack of near-term growth resurgence factors, we are revising our base case price target to $174 (previously $180).

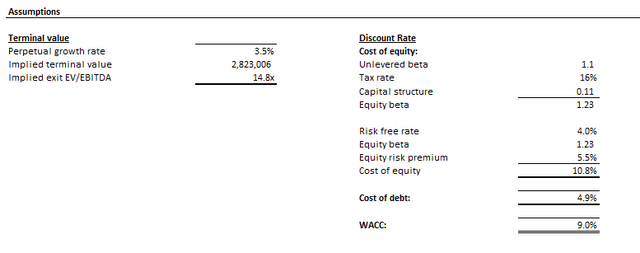

The price is derived under the discounted cash flow approach. The DCF analysis considers cash flow projections taken with the fundamental forecast discussed above. We apply a 9% WACC to the analysis, which is consistent with Apple’s cash-abundant capital structure and its risk profile. The analysis also considers a 3.5% implied perpetual growth rate to determine Apple’s terminal value, which is consistent with the anticipated pace of economic growth across its core operating regions. We have also adjusted the diluted share count of 15.5 million for the anticipated support from Apple’s $110 billion in authorized additional buybacks to compute our price target.

We believe the implied perpetual growth rate makes a key valuation assumption in gauging Apple’s near-term valuation prospect. Specifically, limited respite in its near-term revenue growth outlook is likely to heighten focus on profit margins and cash flows underpinning the stock’s potential.

As such, in the upside scenario, we apply a 4% implied perpetual growth rate to the analysis while keeping all other cash flow growth and valuation assumptions unchanged from the base case. The upside scenario implied perpetual growth rate represents an incremental premium to the anticipated pace of economic growth across Apple’s core operating regions. The premium also represents expectations for the company to remain a key industry driving force under the upside scenario. The combination of upside scenario assumptions is expected to yield a price of $189 apiece, and would likely materialize when Apple demonstrates sustained growth reacceleration to accompany consistent margin expansion.

Meanwhile, in the downside scenario, we apply a 3% implied perpetual growth rate to terminal cash flows, while keeping all other valuation assumptions unchanged from the base case. The relatively modest growth assumption would reflect anticipation of Apple’s maturing business outlook. The downside scenario is expected to yield a price of $160 apiece, and could materialize if Apple continues to exhibit an extended product demand slowdown. We believe Apple can find support at the $160 level in the near-term, given its consistent preference for continued share buybacks with its robust balance sheet.

Conclusion

Despite persistent weakness in Apple’s near-term outlook, several levers remain for which it can pull to reverse the growth slump. AI remains a key focus area, which Apple can explore through the development and integration of proprietary LLMs and in-house silicon. Apple also continues to exhibit unmatched balance sheet strength, which reinforces support for its foray in said growth initiatives.

After a streak of high-profile project cancellations, Apple faces a clean slate for next-generation developments. Yet, we remain cautious of growing execution risks, as Apple’s AI strategy falls further from peers who are already starting to enter the scaled deployment phase for solutions developed over the past year. Paired with the ongoing demand slump in Apple’s key product categories, we see limited near-term respite for the stock and expect persistent multiple compression risks ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!