Summary:

- Apple will provide capital return update at Q2 earnings report.

- I expect management will continue to favor share repurchases.

- Dividend increase expected to be a token amount.

We Are

If you think time flies, well, we are already into April this year. For most large cap technology names, this means earnings season is just around the corner. For industry giant Apple (NASDAQ:AAPL), however, the March ending fiscal Q2 report is more than just a view at three quarters of results and how the current period is looking. The report expected later this month is when management and the board detail the latest update on the company’s capital return plan, which I’d like to preview today.

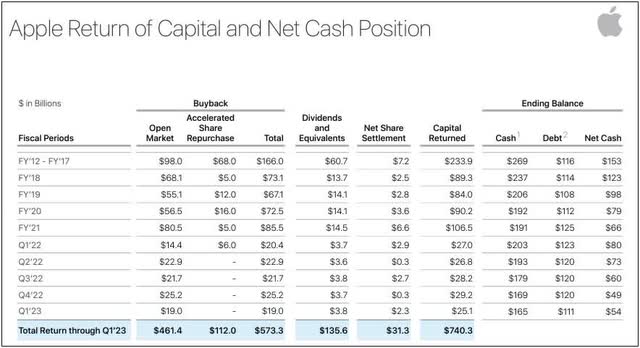

Over the last decade or so, Apple has had the greatest capital return plan of any US company. As the graphic below shows, almost three quarters of a trillion dollars had been returned to shareholders through the end of the December 2022 fiscal period. Most of this was through the stock buyback plan, as management has worked to significantly reduce the outstanding share count (adjusted for two stock splits over this time).

Apple Capital Returns (Company IR Page)

I don’t know too many investors who are buying Apple just because of the dividend. To be fair, this isn’t a name with like a 5% yield that investors are purchasing for its income potential. The rise in fixed income interest rates has also made the dividend much less important if that is your investment goal. However, Apple still paid out about $15 billion in cash dividends during the last calendar year, and over $135 billion since the quarterly payment was reinstated as the graphic above shows.

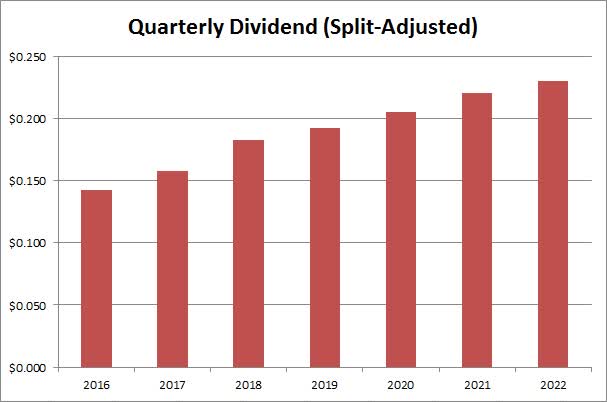

The quarterly dividend for Apple has been steadily increasing over the years, even if we haven’t seen many major raises. Still, the last six years’ worth of dividend increases have resulted in the split-adjusted payout rising by more than 61% as the chart below shows. Last year, the increase was just a penny, which could be a trend that we see moving forward.

Apple Recent Dividend History (Seeking Alpha)

Apple is able to return all this capital to shareholders because of its tremendous free cash flow generation. Even in a down holiday period this year due to product supply constraints, Apple generated more than $30 billion in free cash flow. The company could report $100 billion or so of cash flow during this September ending fiscal year, and management continues to work towards a cash neutral position.

Apple finished that December 2022 period with a net cash balance of about $54 billion. Even with all the dividends and buybacks, that number only came down by about $25 billion over twelve months. In the last year or two, Apple has been running around $20 billion a quarter for share repurchases. Unless something dramatically negative happens soon, that’s a pace that could continue for quite some time just to get the cash position towards net zero.

Last year, the company’s board announced a $90 billion increase to the share repurchase plan. The majority of that will have been used, but there likely will be a little bit left over. As the most recent 10-Q filing details, there was $48.3 billion left on the current authorization at the end of that December period. Using the roughly $20 billion run rate, that would leave about $28 billion or so left at the end of the March quarter.

With that much left on the current plan, it wouldn’t surprise me if Apple’s board doesn’t announce as much of an increase this year. Hiking the buyback by say $75 billion would still put the total authorization remaining around $100 billion or so, which is more than enough to get through the next 12 months. As I always say though, the amount of the buyback program isn’t the most important item, but rather the pace and timing of said buyback. Apple, like any company out there, could easily announce a trillion dollar buyback this month. However, if a plan like that takes decades or more to go through for example, then the trillion dollar number just would seem like an effort to grab a flashy headline.

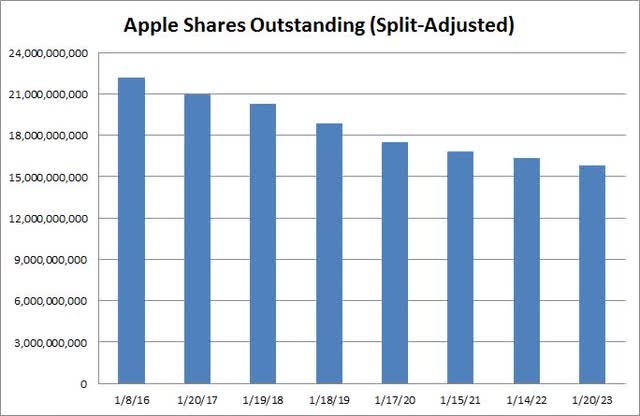

There are a few obvious benefits to keeping the buyback plan going at a brisk pace. First, it’s a sign that management and the board believe in the long term future of the company. Second, it improves reported earnings per share for a given level of net income. Finally, it reduces the number of shares outstanding in the market, which can help push the stock up over the longer term. The split-adjusted share count topped out around 26 billion or so when Apple started the buyback around a decade ago, and the chart below shows how much progress has been made in recent years.

Apple Shares Outstanding (Company Filings)

The last roughly 12 month period shown above, which is based on quarterly report filing dates so it won’t always be exactly a year, saw a 3.05% decrease in the share count. That was about 25 basis points more than the previous year, although still a bit below the longer term average. Most of the reason the decline has come down is because Apple has gotten so large, as even $80 billion or so a year doesn’t make a major dent when your market cap gets to more than $2.5 trillion. Still, even 3% or so a year certainly adds up over time as shown above.

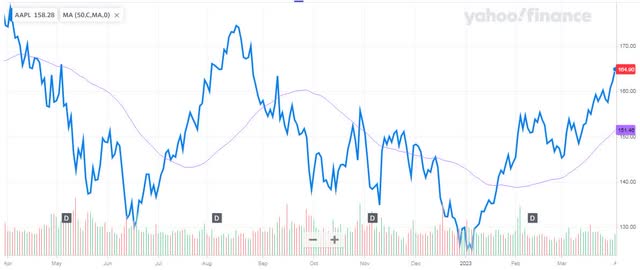

As for Apple shares, they’ve been on a strong run so far this year as the chart below shows. I still believe in the long term story here, but there are a few reasons why I wouldn’t be adding right now. First, the average price target is less than $5 from Friday’s close, implying that the street sees the name as pretty fairly valued now. The second reason is the potential for a US recession during 2023 to knock down consumer sales a bit. Finally, the stock is quite a bit above its 50-day moving average (purple line below), which generally has not been the best time to add to this name.

AAPL Last 12 Months (Yahoo! Finance)

In the end, Apple is expected to provide an update on its capital return plan at the upcoming fiscal Q2 earnings report. That means we should be hearing about a dividend raise and increase to the buyback plan. As the company continues to generate tremendous cash flow, I expect the current status quo will remain. That means that a small dividend hike will come, with the main focus being on share repurchases that have averaged about $20 billion a quarter recently. The capital return plan is a great reason to be a long term holder of Apple shares, but there are a few reasons to be cautious about the stock in the short term after such a large run recently.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.