Summary:

- Apple shows investors why it’s well-primed to enter the generative AI race.

- AAPL stock reached a new high this week, as the market likely priced in an upgrade “supercycle.”

- Apple defines generative AI on its terms, focusing on privacy and user personalization.

- AAPL stock is arguably expensive, but that doesn’t mean you should bet against Apple.

- I argue why AAPL has likely broken out to resume its uptrend bias. But, waiting for a pullback makes more sense now.

ozgurdonmaz

Apple Intelligence Is Well Received

The moment that every Apple Inc. (NASDAQ:AAPL) investor has arguably been waiting for finally arrived, as Apple unveiled its take on generative AI. Apple CEO Tim Cook reminded investors that artificial intelligence isn’t new to the Cupertino company. Accordingly, Apple has been working with AI for a long time and is integrated into its devices and software. In a post-WWDC interview with Marques Brownlee or MKHBD, Cook emphasized Apple’s thoughtful approach to its decision to unveil its GenAI strategy: Apple Intelligence. Cook also indicated that it was partly to satisfy the market’s curiosity about Apple’s view on GenAI.

The initial post-WWDC market reaction was adverse. However, the market finally woke up to the strategic growth opportunities potentially benefiting Apple in the near and medium term. As a result, AAPL stock surged to a new high this week before settling down to close at the $212 level. The potentially decisive breakout vindicates my optimism in March 2024, as I upgraded my AAPL thesis. I urged investors to capitalize on the pessimism surrounding AAPL’s then relative underperformance. I also explained why AAPL is well-positioned to enter the GenAI race, underscoring my belief that AI hype is finally reaching Cupertino.

Astute investors have likely positioned their allocation well ahead of Apple’s WWDC. I have assessed robust dip-buying momentum, returning at a critical moment in April 2024 above the $165 level. Therefore, if you waited until Apple clarified its AI strategy this week, you would have missed highly attractive opportunities to potentially outperform the S&P 500 (SPX) (SPY).

Apple Defines Generative AI On Its Own Terms

Apple’s deliberate approach to launching Apple Intelligence shouldn’t be understated. In a recent opinion piece, Prof Scott Galloway of NYU Stern School of Business highlighted why “the second mouse often gets the cheese.” Galloway also added, “Apple is a second mouse the size of a blue whale.”

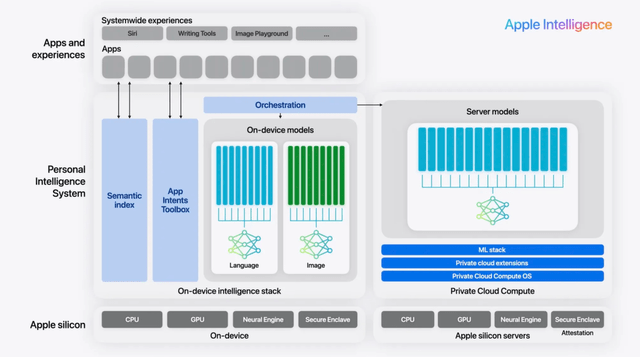

Apple Intelligence architecture (Apple filings)

As a result, I’m not surprised by Apple’s boldness in shaping the trajectory of the GenAI race on its terms. As a reminder, Apple Intelligence is expected to be mainly based on Apple’s on-device GenAI capabilities (about 3B parameters) and augmented by Apple’s private cloud compute (about 70B parameters). The architecture is designed primarily for privacy and user personalization.

In other words, Apple Intelligence remains focused on safeguarding Apple’s approach that “privacy is a fundamental human right.” Also, Apple believes AI should be contextualized to benefit the user first. As a result, Apple has been cautious about making sure that Apple Intelligence is designed to bring out the best in GenAI to benefit Apple users on daily tasks while reducing the potential harm associated with GenAI.

OpenAI’s ChatGPT is “recruited” to help supplement complex or real-time queries that Apple Intelligence cannot handle effectively. However, Apple has also clarified that it is ready to integrate with other LLMs in the market. With Apple not paying OpenAI with cash, the Sam Altman-led company must convince Apple users to sign up for premium services. At the same time, Apple can also benefit from sales linked to Apple users who sign up within Apple’s walled garden based on its take rate. Hence, I believe the deal is highly astute for Apple, benefiting from the competition that AI companies vying for a bite of Apple’s 2.2B active device base.

With Apple’s server architecture not requiring expensive Nvidia (NVDA) AI chips, Apple has set itself apart by aiming to run GenAI more efficiently. Moreover, just an estimated 5% of iPhone users own Apple Intelligence-compatible devices. Therefore, it has opened up the potential for Apple to benefit from a “supercycle.” As a result, I expect revenue and earnings estimates to be revised upward, suggesting why AAPL’s recent surge is likely justified.

The market is confident that Apple Intelligence’s introduction can potentially drive a faster hardware upgrade cycle across its product ecosystem. In addition, Apple is expected to promote the development of high-margin subscription services linked to premium AI offerings, benefiting the growth of its services stream. If a company has demonstrated its ability to integrate consumer hardware and software “seamlessly” over time, Apple comes first to my mind.

AAPL Stock Is Undoubtedly Expensive

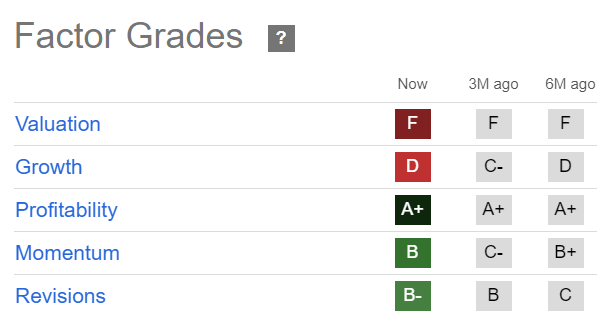

AAPL Quant Grades (Seeking Alpha)

There’s little doubt that AAPL’s valuation is expensive. Seeking Alpha Quant assigned it an “F” valuation grade. AAPL’s forward PEG ratio of 3.4 is over 50% above its sector median. Therefore, the recent surge in AAPL has likely baked in the potential of a “supercycle,” intensifying the execution risks for Apple to deliver.

While AAPL boasts an incredible “A+” profitability grade, showcasing its fundamentally strong business model, questions must be asked about its valuation.

I have not assessed the need for investors to significantly reduce their exposure to AAPL. However, I’m cautious about adding more AAPL shares after the recent surge.

Is AAPL Stock A Buy, Sell, Or Hold?

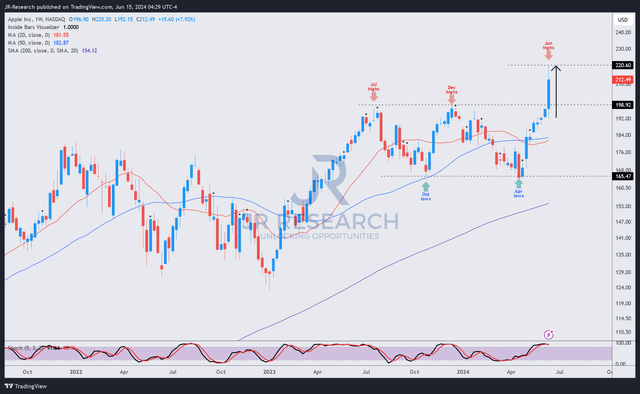

AAPL price chart (weekly, medium-term, adjusted for dividends) (TradingView)

AAPL’s price chart indicates a potentially decisive breakout above the previous resistance zone at the $200 level. Taking out this level is pivotal toward AAPL’s resumption of its uptrend bias, which has stalled since July 2023.

Some profit-taking was assessed after AAPL reached the $220 level this week. However, I’ve not assessed anything sinister, as there is no bearish reversal signal. Despite that, most of the gains from AAPL’s April 2024 lows were made before this week’s WWDC, suggesting why it’s more important to anticipate.

While I expect AAPL’s uptrend bias to be maintained, I believe the time to turn more cautious on AAPL is apt. AAPL’s expensive valuation behooves Tim Cook and his team to execute robustly to drive upgrades and leverage the potential of Apple Intelligence. AAPL stock has also demonstrated tendencies in the past to suffer downward volatility after sharp surges.

Therefore, I don’t expect AAPL to move up in a straight line, suggesting investors should remain patient and wait for a potential pullback before adding.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!