Summary:

- Apple reported Q4 2024 results that slightly beat estimates and provide some relief at face value following mixed reports about the iPhone 16 launch.

- China’s performance has improved, but continued to underwhelm, and it remains questionable where a growth spurt could come from.

- At a PEG of 3.5x, AAPL stock remains incredibly expensive. There are defensible qualities that have value, but I cannot reach a fair value above $215.

Justin Lambert/DigitalVision via Getty Images

As those who follow my account will know, I generally stay clear of writing on mega-caps. That’s largely due to my desire to offer readers unique value in my writings, and most mega-cap stocks have already been analyzed to infinity. The one exception has been Apple Inc. (NASDAQ:AAPL), which I’ve written about in May’s “Jump The Shark” article along with a July follow-up “New Reasons To Be Bearish.”

These were bearish forays, and based on submission time, I ended October 2024 (Oct. 31 market close) underwater ~19% from my initial article, and positive by a few percentage points from July’s write-up. However, given my fondness for playing the options market on Apple due to its typically low-ball implied volatility, I’ve definitely claimed some profits along the way, especially when AAPL shares collapsed about 15% between mid-July and Aug. 5.

My July article pointed to today’s Q4 2024 earnings release and the accompanying Q1 2025 guidance as a likely inflection point, notably within a week of the U.S. Presidential Election. Before discussing Apple’s investor release after the markets closed today, I wanted to summarize the existing drivers of my bearish view.

Elements Driving My Bearish View On Apple

- Most evidently, a >30x P/E multiple against a sub-10% revenue growth profile for as far as the eye can see.

- Apple’s recent effort (in my view) to unnecessarily boost investor morale with a historic $110 billion buyback program.

- The rarely discussed reality that Apple is a net-debt company vs. its earlier history of maintaining a fortress balance sheet. Interest expense began exceeding interest income a couple of years ago, and rates have risen.

- In China, not just increased competition, but the competitive dynamic of six smartphone makers maneuvering for a lead position.

- Apple’s role as a purchaser of the latest technological breakthrough (Artificial Intelligence), instead of being the owner/developer of it.

- The fact that OpenAI, with whom Apple has a collaboration, appears to be pursuing distribution above all else, which it can achieve through Apple and non-Apple channels. Apple also isn’t being paid by OpenAI, in contrast to its distribution deal with Alphabet Inc. (GOOGL) (GOOG), for example (Apple earns tidy sums for defaulting Google search).

- My doubts are that Apple can maintain such a large gross margin premium vs. competitors as time passes and smartphones and related services become more commoditized.

- There were signs of a weakening consumer a few months ago. Those fears appear to be quelled for now, though.

Microsoft’s and Meta Platform’s Oct. 30 Warnings

Both Microsoft Corporation (MSFT) and Meta Platforms, Inc. (META), two mega-caps expected to reap the rewards of the AI revolution, delivered warning shots to investors when both companies reported their latest quarterly results on Oct. 30 (Note: it was Q3 2024 for Meta, and Q1 2025 for Microsoft). Officially, the day before Halloween is called “Mischief Night,” and indeed a mischievous surprise was delivered. The two companies saw their stocks fall in the 5% range during October’s last day of trading, following their results.

Fears erupted over the costs of the integration of AI technology into products and services.

“….we expect a significant acceleration in infrastructure expense growth next year as we recognize higher growth in depreciation and operating expenses of our expanded infrastructure fleet”

-Source: Meta Platforms, Q3 2024 Conference Call

Kash Rangan (Analyst, Goldman Sachs)

That’s, to your point, that you invest now and you can get the growth later, even if you slow down the capex, right, that’s what you’re trying to tell us?

Amy Hood (CFO)

That’s the cycle that is important to understand.

-Source: Microsoft, Q1 2025 Conference Call

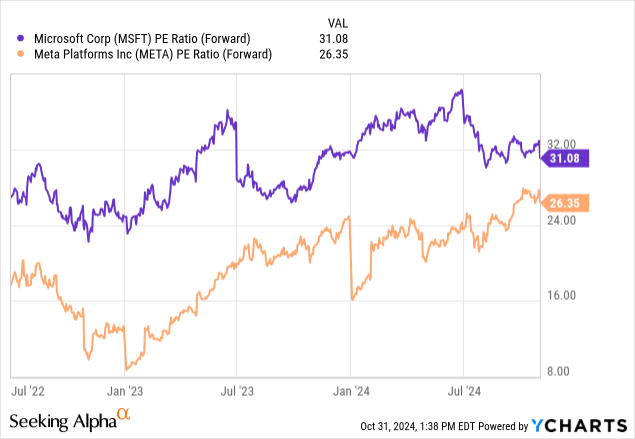

While the benefits from the infrastructure spending are expected to be realized later on, the short-term cost issues provide investors with a good excuse to take profits on both stocks that are trading at historically premium valuations.

While I’m not at all surprised that investors took AAPL shares to its session low into the Oct. 31 close (-2%), I figured that the market would dent Apple stock even more than it did in Thursday’s regular session. Apple not only possesses an even higher valuation (~35x forward P/E) along with lower growth than both MSFT and META, but in my view the company is even more highly dependent on adopting AI solutions from other companies to achieve that low growth.

Apple’s Q4 2024 Results

For Apple’s final fiscal quarter of 2024, which ended on Sept. 30, the company realized revenues of $94.93 billion vs. $89.49 billion for the same quarter in 2023, for growth of +6.1%. Revenues came in about 5% higher than the $94.42 billion analysts were expecting.

GAAP EPS of $1.64 was ~12% higher than the $1.46 reported a year ago. The street was expected to see the company post $1.60 in earnings, so the company reported a small beat.

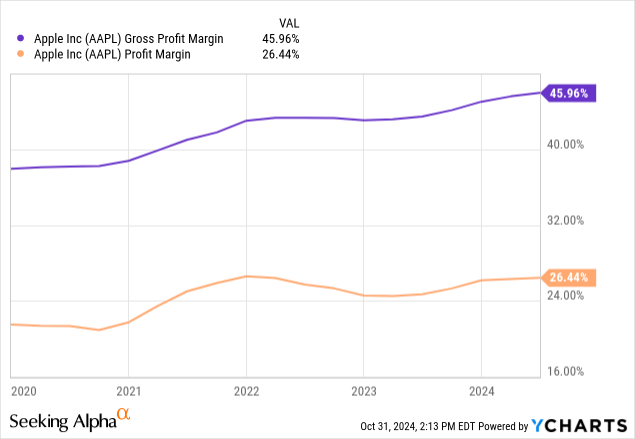

Amid meandering growth over the past several years, Apple has counted on margin expansion to keep earnings moving forward, and I’ve been incredibly skeptical about the sustainability of those margins.

For Q4, we saw gross margins tick up a bit higher to 46.2%, but this can be attributed to the high-margin Services business continuing to represent a larger and larger part of the overall company. Hardware margins have been slipping, and came in at 36.3% for the quarter, approximately flat.

Apple Q4 Revenue Splits

|

Unsurprisingly, the Services segment continues to generate the best and most consistent growth. While Services’ overall share of Apple’s revenues continues to increase (now up to 26.3%), and generates nearly twice the gross margin, investors remain primarily focused on iPhone volumes in assessing the company’s health.

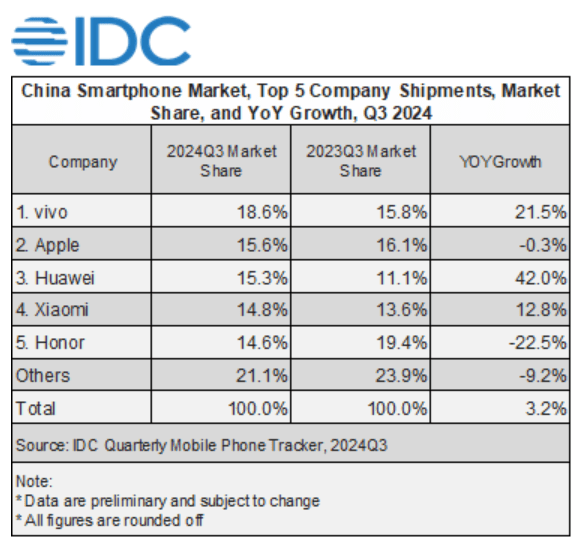

In May, after the company filed its Q2 2024 report, CEO Tim Cook’s comments led many to hope that iPhone demand would be improving after some poor comps, especially in China. Revenues for that geographic market still fell -6.5% y/o/y for Q3, but that marked an improvement from a nearly -11% y/o/y decline for H1. In today’s Q4 report, sales from China were only down a few ticks (-0.3%) from last year. That’s an improvement but not substantially so when considering the new iPhone 16 release in the second week of September.

In other geographic markets, for Q4 the Americas segment saw +3.9% growth, Europe saw a terrific +11% increase, Japan reported a +7.6% gain, and the “Rest of Asia” zone which has been posting the best growth of a low base for some time now, saw a +16.6% revenue jump.

Future Growth

In recent weeks, Apple has, unusually, become somewhat of a battleground stock. Wedbush recently declared “a renaissance” for iPhone China sales, while Morgan Stanley described Apple’s situation as “challenging,” and both KeyBanc and TF International Securities cited iPhone volume concerns. KeyBanc in fact downgraded AAPL stock to “underweight” with a $200 price target. On the flip side, Wedbush analyst Dan Ives has repeated calls for Apple to reach a $4 trillion market cap.

I remain firmly in the doubters’ camp, and recent news that Apple returned to the top-5 in China market share seems like a small comfort for the once supremely dominant smartphone maker. That 15.6% market share is still lower than a year ago, which pales in comparison to third-place Huawei which saw more than 40% growth in share. Meanwhile, Xiaomi remains a fierce competitor who appears to be closing the gap on Apple’s historical moat. It’s worth noting that Apple’s iPhone 16 only saw about three weeks of sales for Q3, but normally, you’d expect sales to be front-end loaded, and those sales didn’t spur a market share gain for the quarter.

IDC

Apple Conference Call/Guidance

Apple’s Q1 2025 guidance was critical to my bearish thesis, post-iPhone 16 launch, alongside potential election jitters. I listened to the call, and while CEO Tim Cook rattled through a number of incremental features that could improve iPhone users’ lives, none of these seemed like game-changers for demand, in my view. A more comfortable watch band, or sleep apnea detection, aren’t likely to drive new adopters.

Long-time CFO Luca Maestri spoke on what will be his final conference call with Apple, as he is set to depart in the next couple of months. He spoke fondly of Apple’s Services business, which he should, but led me to wonder whether the hardware sales outlook was destined to disappoint. Q1, as everyone knows, is Apple’s most influential quarter, and it usually represents a little more than 30% of annual revenues.

Shares of AAPL were trading slightly lower in the post-market, but then dipped as Maestri provided the company’s forward guidance. There was nothing presented to augment optimism. The company is expecting mid-single digit growth and 46-47% margins, which is slightly incremental and again linked to a growing Services segment. Rolling out new features will be necessary and result in increased capex, but the executive team made no specific commitments.

Valuation and Conclusion

Today’s Q4 2024 results were a bit better than I expected, but all-in-all doesn’t change my view that the company (and stock) is walking a precarious line, especially at a PEG ratio in the ~3.5x range. Furthermore, I believe that Apple is essentially paying for that growth through mandatory capex. I think any so-called “renaissance” in iPhone growth will come at the expense of Apple’s unparalleled margins, crimping the bottom line.

Had Apple reported its Q4 2024 numbers absent the iPhone 16 launch, I’d be upgrading my AAPL stock rating from Strong Sell to Sell. However, I won’t be able to do that today. The challenges in Apple’s space led me to project a “Bull Case” value of $215, based on a 29x forward P/E ratio using the pre-Q4 earnings release consensus 2025 EPS estimate of $7.42 per share. I’m not expecting any significant movement in analyst estimates following the Q4 results.

Risk

I think it’s undeniable that Apple holds a premium valuation mostly due to the company’s perceived defensive qualities. It’s almost bond-like. Apple has a long track record of delivering results, and investors consciously acknowledge that. In major financial or geopolitical turbulence, AAPL shares can be expected to draw a strong bid. Apple stock is like that old warm blanket on a cold night, and given a growing number of unknowns (beginning with next week’s U.S. Presidential Election), many investors will continue to find comfort in holding the shares despite a questionable economic reality.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.