Summary:

- Despite challenges in the iPhone sales, Apple’s strong brand loyalty and ecosystem continue to support robust earnings performance.

- While Apple’s valuation remains generous, secular challenges, particularly in the Chinese market, pose potential risks to sustained growth.

- Apple’s strategic pricing power and financial strength, including substantial cash reserves and stock buybacks, provide a buffer against market uncertainties.

nayuki

My thesis

My neutral call on Apple (NASDAQ:AAPL) with a Hold rating, shared in late July, has held up reasonably well. I think so because the stock has not outperformed the S&P 500 thus far. As I forecasted in the previous analysis, AAPL delivered solid earnings for the previous quarter, but investors remain cautious due to some fundamental risks. The new earnings release is expected soon, and it is a good time to update my AAPL analysis.

There are some secular challenges for Apple, as evidenced by the declining iPhone market share in China in Q3, 2024 and likely weak iPhone 16 sales dynamics. Nevertheless, I believe that Apple’s unmatched ecosystem and brand power will allow it to exercise strong pricing power in Services, which will help drive revenue and EPS growth. The valuation is still quite generous, and I am not buying the stock. On the other hand, I am not trimming my position either, which makes AAPL a Hold before the upcoming earnings release.

AAPL stock analysis

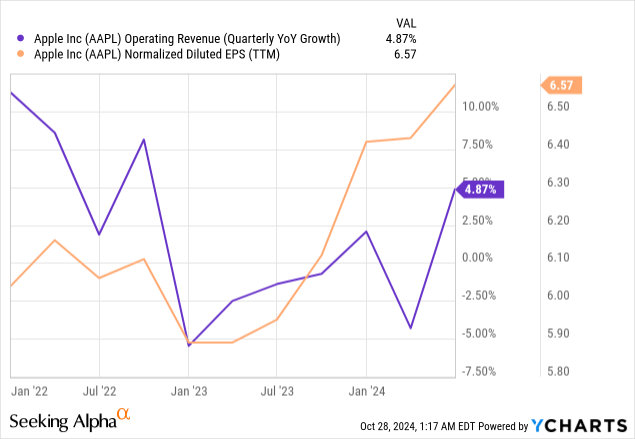

Apple is expected to reveal its fiscal Q4 earnings on October 31. In my previous analysis, I described that Apple’s unmatched ecosystem and strong brand loyalty are crucial for profitability expansion, as they support strong pricing power. Apple’s generous stock buyback plans are also widely known. These three factors help the company to improve EPS almost every single quarter, despite revenue growth stagnating not very far from zero over the last nine quarters.

For the upcoming earnings release, Wall Street analysts anticipate further EPS expansion in light of modest revenue growth. According to quarterly estimates, YoY revenue growth is expected to be quite modest at 5.38%. EPS growth is expected to be about 50 basis points slower, but please remember that the above chart shows EPS has grown almost exponentially since early 2023.

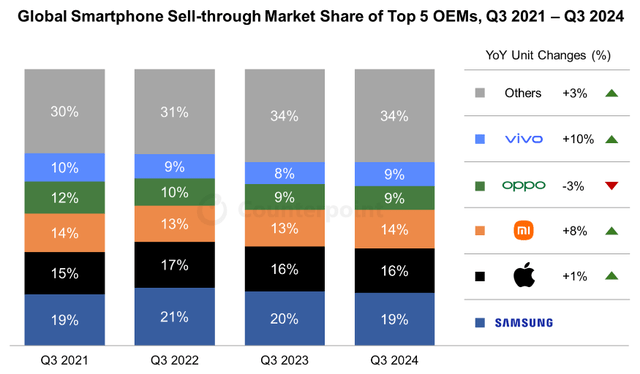

Considering the quite modest revenue and EPS growth expectations from consensus, I am optimistic about the company’s ability to beat estimates. From an industry perspective, recent trends appear quite positive. Since the majority of the company’s revenue comes from iPhone sales, it’s important to consider the global smartphone market. According to Counterpoint, global smartphone sell-through rose 2% YoY in Q3 2024, marking the first year-over-year growth in a Q3 since 2018. Apple’s global smartphone market share was stable at 16%. The company missed EPS estimates only once over the last twenty quarters, further bolstering the optimism.

Furthermore, Apple ended the previous quarter with almost $62 billion in cash. The company is able to generate tens of billions in free cash flow every quarter, which also helps in accumulating financial reserves. Therefore, it is highly probable that AAPL might also announce new expansion to its buyback plans, which will also be a positive catalyst for the share price.

Having shared all the above information, I can now move to a broader perspective beyond the upcoming earnings release. Apple’s business strength largely relies on its strong brand loyalty. I reckon such a strong fanbase was established during the Steve Jobs era and has been skillfully maintained over the years by Tim Cook’s leadership. However, there are signs that Apple might be steadily losing its loyal fanbase.

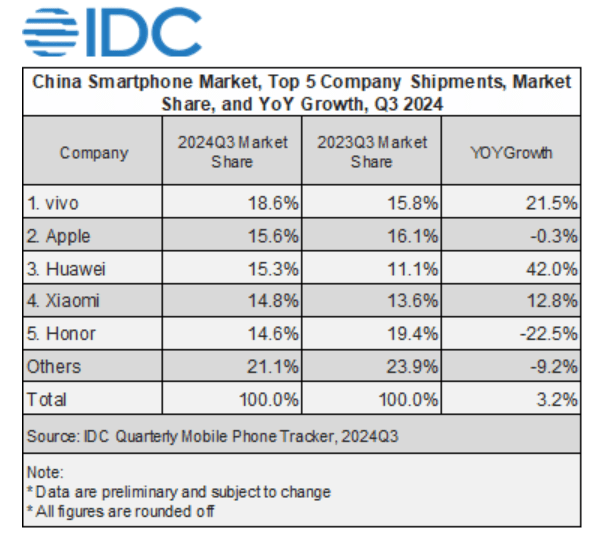

IDC

According to IDC, Apple’s smartphone market share in China decreased YoY once again in Q32024. Meanwhile, Huawei has significantly expanded its domestic market share YoY. If this trend continues, Apple might lose its second spot in the Chinese market by the end of this year, which would make for quite an unfavorable headline.

Another factor suggesting that brand loyalty is likely deteriorating is quite negative information about the new iPhone 16 sales. According to the analyst from TF International Securities, there was a notable iPhone 16 orders cut. This is quite disappointing, especially considering the new iPhone was expected to have compelling AI features. When I see order cuts, it appears that Apple was not quite successful in persuading customers that the AI features are indeed worth upgrading for. This might be because some of the company’s employees believe that Apple is two years behind in AI development.

Having said all the above, I think that Apple is very likely to deliver another solid quarter. Expectations about the revenue and EPS growth are modest, and they look achievable, particularly considering Apple’s pricing power. On the other hand, there are apparent unfavorable signs that Apple might be losing its appeal.

Intrinsic value calculation

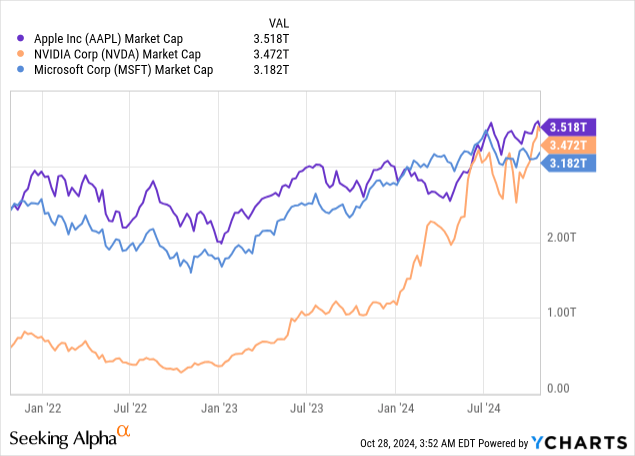

Despite Nvidia (NVDA) aggressively gaining market share, Apple remains the world’s most valuation company, with a slightly above $3.5 trillion market cap. Microsoft (MSFT) is slightly “cheaper”, but is also in the “$3 trillion club”.

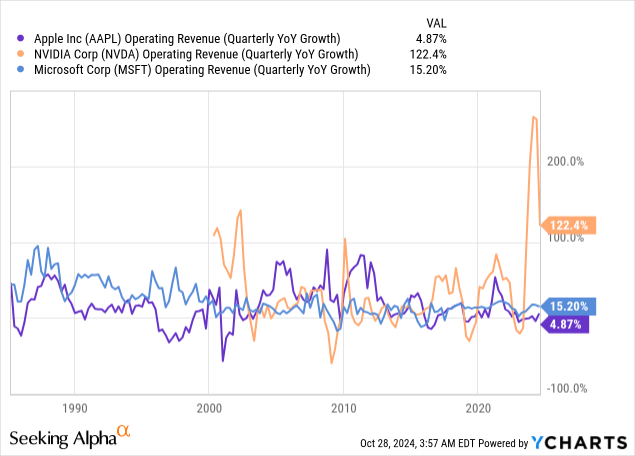

If we compare TTM levered free cash flow of these three companies, Apple looks cheap. The company’s TTM levered FCF is $86 billion, while Microsoft’s is around $57 billion, and Nvidia’s is $33.7 billion. Therefore, from the perspective of the current FCF in absolute terms, Apple is extremely cheap. On the other hand, the current market cap is the present value of future cash flows, meaning that the growth factor is crucial. We see below that Apple is demonstrating very modest revenue growth compared to its “$3 trillion club” peers.

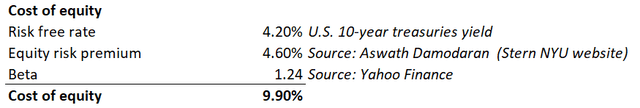

Thus, future growth potential must be considered in determining the stock’s intrinsic value. The discounted cash flow (DCF) approach helps to solve this problem. Apple’s total debt is $100 billion, which is almost nothing when compared to a $3.5 trillion market cap. Therefore, using cost of equity instead of WACC looks like a fair option. The cost of equity is 9.9% and calculations are outlined in the below working.

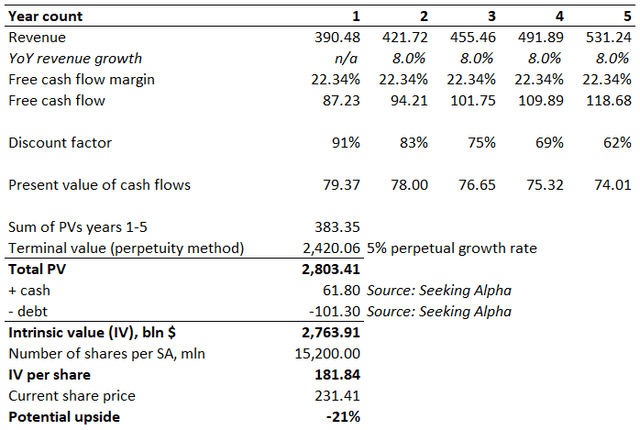

According to consensus, revenue growth is expected to accelerate from single digits to 12.6% in FY2027. I consider this as a risky assumption due to secular issues I have described above. Therefore, I take an 8% “rule of thumb” revenue CAGR for my DCF because it aligns with consensus projections for the next two fiscal years (a sample of more than 40 Wall Street analysts). The levered FCF margin is 22.34%. I expect it to remain flat due to the aforementioned secular issues. To balance out my cautious stance for years 1-5, I am factoring in an optimistic 5% perpetual growth rate. The intrinsic value (IV) per share is close to $182, 21% lower than the current share price.

What can go wrong with my thesis?

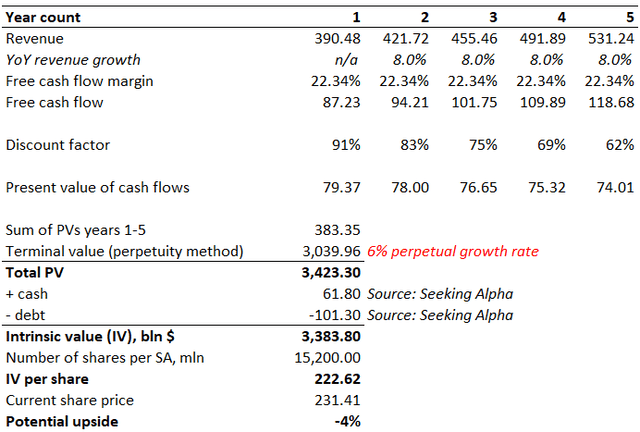

Despite my DCF model indicates that AAPL is about 21% overvalued, it is important to demonstrate a scenario where the IV per share is close to the current share price. I think that revenue and FCF assumptions for years 1-5 are well-balanced, and I should better pay attention to the perpetual growth rate. I have simulated various scenarios, and it appears that the market currently prices a 6% perpetual growth rate.

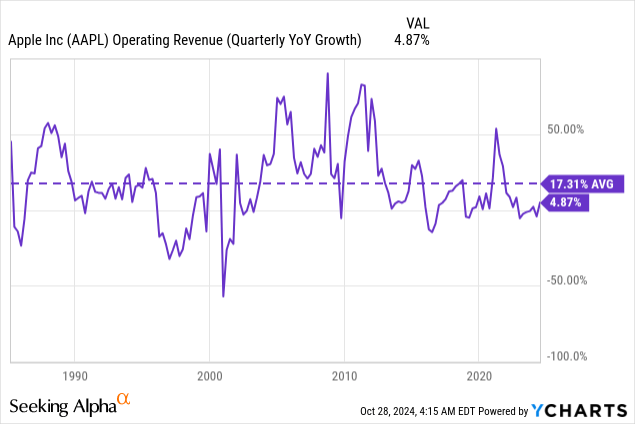

I believe that even a 5% perpetual growth rate is too aggressive, if we take into account secular challenges and Apple’s scale ($385 billion TTM revenue). On the other hand, Apple’s historical revenue growth suggests that a 6% perpetual growth rate is far from being called “impossible” for the company. Despite all the ups and downs in the company’s history, its revenue CAGR over the last four decades is 17.31%.

Since Apple is one of the richest tech companies in the world, it has enough financial power to hire the best talent globally, and its $30 billion TTM R&D spending is large enough to potentially develop a new bestseller. Therefore, I might be too cautious, and the challenges related to the iPhone 16 and China may be just temporary.

Summary

I expect Apple to deliver strong fiscal Q4 earnings, but I see some secular challenges. The valuation is generous, which is why I am not buying the stock. On the other hand, I am not selling either, since Apple is always Apple, and there is always the potential for a new awe-inspiring product release that could unlock a powerful new wave of growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.