Summary:

- Nvidia recently surpassed Apple in market cap, as the Jensen Huang-led company demonstrated its AI growth inflection.

- Apple’s reliance on iPhone-driven growth has faced challenges as the supercycle thesis faces delays.

- Apple’s services business should mitigate weaknesses in its hardware segments, but is that enough to justify its expensive valuation?

- Going bearish on AAPL doesn’t seem to make much sense, although turning bullish seems overstated. Remain on the sidelines.

hapabapa

Apple: Market Cap Surpassed By Nvidia Recently

Apple Inc. (NASDAQ:AAPL) investors have held on robustly to their positions, even as Berkshire Hathaway (BRK.A) (BRK.B) CEO Warren Buffett has reduced the conglomerate’s stake in AAPL. While still Berkshire’s most valuable stake, accounting for about 23% of its public equities portfolio, the reallocation from the Cupertino company hasn’t been unnoticed.

In my previous AAPL update, I sounded a word of caution on the pre-order estimates for its iPhone 16 launch. Given the structural headwinds in China and expectations of the Apple Intelligence-driven supercycle, AAPL’s high valuation seems increasingly challenging to justify.

As a result, I’m not surprised by the market euphoria driving Nvidia (NVDA) to a new high in November 2024, surpassing Apple’s market cap along the way. Accordingly, the Jensen Huang-led company has snagged Apple’s crown as the world’s most valuable company by market cap, as the King of AI dominated the market’s optimism. Despite that, AAPL has performed admirably relative to the S&P 500 (SPX) (SPY) since my last article, underscoring the market’s confidence in its bullish thesis.

Apple’s iPhone Growth Remains Robust

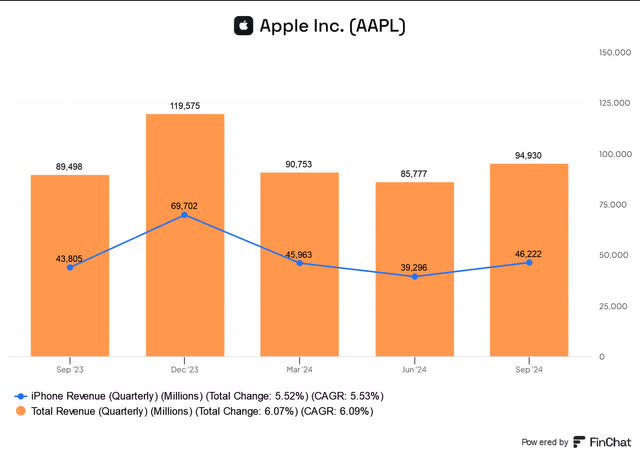

Apple iPhone revenue (FinChat)

In Apple’s recent earnings release, investors were likely heartened as its iPhone segment surpassed Wall Street’s expectations, notching a 5.5% increase in revenue growth. A solid earnings performance by Qualcomm (QCOM) underscores the cyclical bottoming thesis in smartphone sales, justifying the market’s optimism in Apple’s iPhone segment. It remains the company’s most critical revenue driver (nearly 50% of its total revenue base). Therefore, investors must continue paying close attention to the latest developments on its anticipated AI-driven supercycle growth inflection.

However, the market’s optimism has likely been tempered as Apple management guided to a more tepid outlook for its December calendar quarter. Accordingly, it represents a potential deceleration to its iPhone segment, as Wall Street adjusted Apple’s estimates downward. Accordingly, the staggered Apple Intelligence launch cadence has lowered the market’s expectations of a near-term iPhone supercycle until next year, driving up uncertainties in AAPL. Given its expensive valuation, Apple relies heavily on its AI growth thesis to drive a more robust upgrade in its most pivotal revenue driver.

Could Apple Intelligence Bolster Services Growth Further?

Apple’s ability to leverage Generative AI without spending significantly on AI CapEx is expected to keep investors more assured about the need to spend aggressively on AI infrastructure investments. These challenges have hampered bullish sentiments on Microsoft (MSFT) stock as investors reassess the AI monetization opportunities for the Redmond-based company. Apple’s ability to drive broader adoption across its ecosystem should help maintain the steady uptick in its active installed base. Hence, investors are likely confident that the company has the necessary ecosystem to monetize AI effectively without committing to aggressive AI growth CapEx.

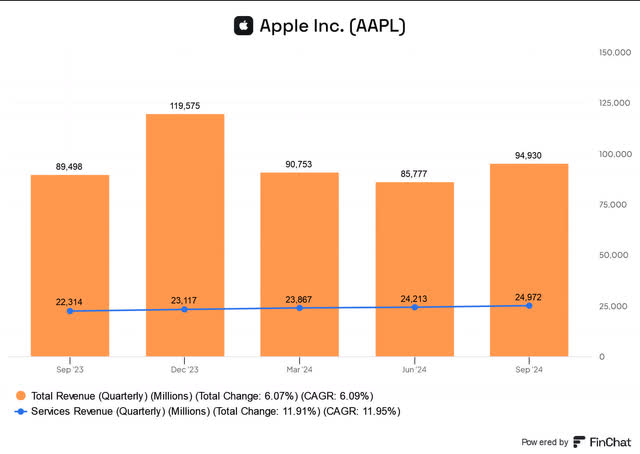

Apple services revenue (FinChat)

In addition, Apple’s ability to deliver a 12% YoY revenue increase in its services segment has mitigated the market’s concerns over its less robust forward outlook. The Cupertino company has demonstrated its walled garden capabilities, attributed to the continued growth in its active installed base. Bolstered by over 1B in paid subscriptions, I assess that Apple has convinced investors about its ongoing diversification into higher-margin services revenue, justifying AAPL’s premium valuation.

The company has also committed to integrating better with the launch of Apple Intelligence, which is expected to drive improved engagement and utilization of services. Hence, investors are urged to focus on the accretion of its cash flow capabilities, as it delivered an operating cash flow of nearly $27B in the recently reported fiscal quarter.

Management highlighted there could be “shifts” in its CapEx outlook due to AI-related investments. However, I’m assured of Apple’s commitment to maintaining its free cash flow discipline and optimizing capital return to shareholders. Accordingly, the company delivered more than $29B in share buybacks and dividends in the recent quarter, helping to keep investors on board. Therefore, Apple’s ability to clarify its CapEx outlook has likely bolstered the market’s confidence in its cash flow projections, anchoring its recent bullish sentiments.

Investors must also consider the potential impact of additional tariffs against Apple under the incoming Trump administration from January 2025. While Apple has navigated the headwinds pretty well in the previous Trump administration, Apple’s manufacturing base in China will likely attract intense scrutiny. Although Apple has diversified its exposure to India, its manufacturing operations will take time to scale, affecting Apple’s ability to mitigate the impact of significant tariffs.

Is AAPL Stock A Buy, Sell, Or Hold?

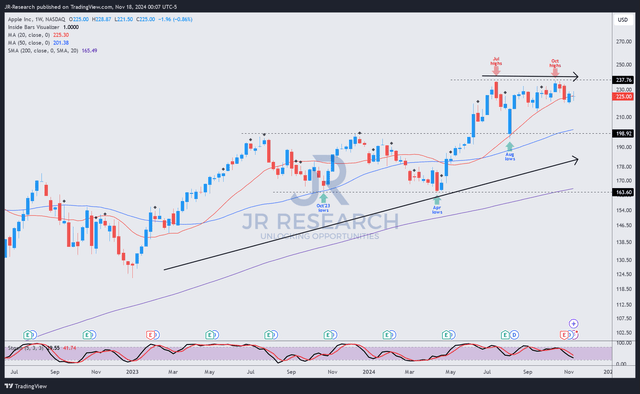

AAPL price chart (weekly, medium-term, adjusted for dividends) (TradingView)

AAPL’s bullish momentum has remained steadfast despite its upward bias stalling under the $235 resistance zone since July 2024. As a result, buyers have been unable to muster further buying advances since then.

AAPL’s forward adjusted PEG ratio of 3 is over 60% over its tech sector (XLK) median. Hence, I believe the market’s caution over the uncertainties of its AI-driven supercycle has held back the stock’s progress. Given NVDA’s more concentrated exposure and potential revenue upside attributed to the $1T AI infrastructure thesis, the momentum is expected to remain with CEO Jensen Huang and his team.

I don’t expect AAPL to reverse into a bearish decline. Its robust momentum (“B” momentum grade) underpins my conviction that the market has confidence in its AI growth thesis. However, given its stalling advances and expensive valuation premium, I’m less convinced about upgrading AAPL’s rating. Therefore, investors should consider staying on the sidelines as we observe its recent consolidation further.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, NVDA, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!