Summary:

- Apple’s shares declined by almost 5% after reporting revenue misses for key products and weak guidance for the current period.

- Revenues for fiscal Q3 were roughly in line with estimates, but the sales figure was down 1.40% compared to the prior year period.

- AAPL’s September quarter revenue performance is expected to decline over 1%, contrary to street expectations of a slight increase.

BeritK

Last Friday, one of the biggest losers in the market was Apple (NASDAQ:AAPL). The technology giant saw its shares decline by almost 5%, after the company reported fiscal third quarter results for its June quarter. This loss of more than $143 billion in market cap was based on a number of revenue misses for key products, along with somewhat weak guidance for the current period. With a potential major headwind coming in the US in a few months, investors may need to completely reset their expectations for the stock over the next couple of quarters.

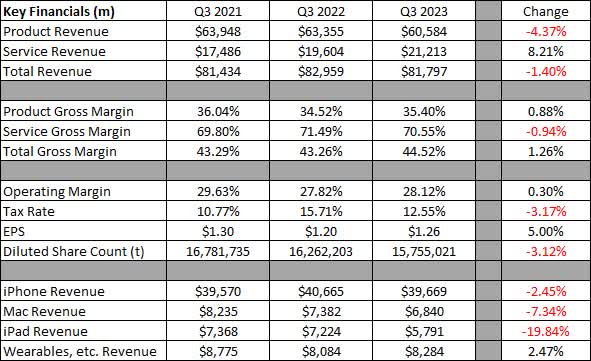

For fiscal Q3, Apple reported revenues of $81.8 billion, roughly in line with street estimates. This was the second year in a row where the June period did not show a major top line beat, and the sales figure was down 1.40% over the prior year period. In the graphic below, you can see how this quarter’s results compared to the prior two Q3 periods. The change column is the year over year move compared to Q3 2022, except for changes on the margin and tax rates that are the actual numerical percentage movement.

Q3 2023 Earnings Summary (Company Earnings Reports)

Apple missed street estimates when it came to the iPhone, iPad, and Wearables, etc. segments. While the street cheered Services revenues coming in better than expected, the grow rate still dropped from over 12.1% in the prior year period. The last four fiscal Q3 periods saw Services revenue growth of more than 12%, so even though Apple is working off higher base numbers, growth has certainly decelerated a bit. Let’s not forget that the total analyst revenue estimate average came down by over $2.5 billion since the company’s previous earnings report back in May, so this was not a great result overall.

Analysts seemed to cheer gross margins coming in about 30 basis points above their estimates. While the total margin figure was up over 1.25% over Q3 2022, this was partially due to the revenue mix shifting more towards Services. While the Services segment does generate higher gross margins, there’s a lot of spending here on the operating side, which is why the company’s operating margin only rose by 30 basis points year over year. Apple’s 7 cent bottom line beat was also driven a bit by the substantial decline in the company’s tax rate, along with the continued help from the buyback. Pre-tax net income was actually down 1.44% over the prior year period, a decline slightly above the one we saw on the top line.

When it came to looking at the September quarter, Apple management on the conference call said revenue performance should look similar to the June period. That would imply a decline of more than 1%, while the street was looking for a slight increase of about 0.34%. Going into Thursday’s report, the street was also looking for a nearly 7.5% year over year revenue increase in the December quarter. This sharp acceleration in expected growth was mostly based on the final calendar period of 2022 having a negatively impacted number due to the China coronavirus shutdowns that limited iPhone production and thus sales.

However, one must also consider that last year’s important holiday period contained 14 weeks instead of the usual 13 due to the way the calendar fell. Thus, Apple has less sales time this year, which offsets some of the sales loss in last year’s period. The other thing to watch is that rumors have suggested the Pro versions of this year’s iPhone launch will get a price raise, perhaps up to $200. While that is good for average selling prices, it might also hurt unit sales for the smartphone. Apple likely is trying to further differentiate the Pro versions from the entry level ones, but this could also be the weakest iPhone lineup that we have seen in years, assuming the chipset split that started last year continues. Lower unit sales could also pressure Services revenues if you aren’t bringing as many new customers onto the platform.

Apple also faces a potential material headwind this fall in the US as student loan repayments start. Tens of millions of borrowers owed nearly $1.8 billion as of Q1 2023, and monthly repayments could be in the hundreds of dollars per borrower. That could potentially mean $10 billion or more a month goes to student loan repayments and not to other consumer spending. A company like Apple that is heavily reliant on product sales could see a material impact, as consumers perhaps push off that smartphone upgrade or buying a new tech device. We also could see weaker consumer spending if Friday’s weaker than expected jobs report is a sign of things to come.

Even after Friday’s drop, Apple still has an elevated valuation. A year ago, the stock traded at just over 25.5 times expected fiscal 2023 EPS. As of right now, it goes for about 27.7 times expected fiscal 2024 EPS. I would argue that Apple’s growth profile looked a lot better twelve months ago, so you are definitely paying a premium here. The valuation is also towards the upper end of its multi-year range, as going into the pandemic this was a name that quite often traded in the teens on a forward P/E basis.

Between the growth concerns and stretched valuation, I continue to rate Apple shares as a hold right now. It also worries me a bit that the stock lost its 50-day moving average on Friday (purple line) as you can see in the chart below. I am very interested to see if the stock will test and / or hold the 100-day (orange line), because if it doesn’t, the 200-day (red line) is in play, and that’s more than $20 below Friday’s close. If Apple doesn’t rebound soon, the 50-day line could easily roll over, which could provide upside resistance for the stock.

AAPL Last 6 Months (Yahoo! Finance)

In the end, Apple investors may need a complete reset of expectations after last week’s discouraging earnings report. The company was only able to meet reduced revenue estimates for Q3, while issuing a current quarter forecast that was less than ideal. The bottom line saw a major benefit from a lower tax rate, and gross margin improvement wasn’t as impressive when you get further down the income statement. If US consumer spending slows this fall as student loan repayments resume, the all-important holiday quarter may not live up to the hype. That could limit potential upside for the stock that’s already trading at the higher end of its multi-year valuation range, so while Apple is still a good long term hold, I would not be adding more right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.