Summary:

- Apple Inc. walks away from its strongest quarter of the year with another close brush with year-over-year declines. Despite the double-beat on modest expectations, demand risks are prevailing.

- Apple’s increasing exposure to external impacts on its core consumer end-market, spanning macroeconomic, geopolitical and regulatory challenges, have continued to worsen with limited near-term respite.

- Increasing execution woes ahead remain an overhanging multiple compression risk for the stock.

Ake Ngiamsanguan

Apple Inc.’s (NASDAQ:AAPL) trailing in market cap to big tech peer Microsoft Corporation (MSFT) in the new year is a telling tale of weakening investors’ confidence. Despite Apple’s unmatched check-book and balance sheet strength, its relatively weaker growth outlook to peers basking in the surge of AI opportunities is adding pressure to the stock’s performance. This is corroborated by Apple’s latest fiscal Q1 2024 results. Although they outperformed market’s expectations, Apple barely escaped a second consecutive year of holiday quarter declines. The results continue to highlight Apple’s struggles in accommodating diverse consumer market dynamics in the face of lingering macroeconomic uncertainties at home, emerging China-specific headwinds, and regulatory challenges in Europe.

The tepid December quarter results also diverged from Apple’s historical trends, where devices benefited from a loyal, price-inelastic fanbase eager for upgrades, while services complemented monetization of its massive installed-base. Specifically, iPhone 15 sales remained moderate relative to its predecessor, with in line sequential growth as in prior holiday seasons despite pent-up demand in the December quarter stemming from supply constraints during the series’ debut in September.

Although Apple emerged as the top smartphone seller globally for the first time in 2023, full-year iPhone shipments only grew by a tepid 3.7% y/y. And in the core Chinese market, where Apple faces acute competition and repercussions from souring U.S.-China relations, its crown came from a smaller relative decline in annual shipments, rather than sustained growth. The combined data continues to point to weakness ahead in the demand environment for Apple’s marquee product. The tepid outlook for Apple product sales is also exacerbated by consistent weakness in Mac and iPad sales, despite the M3 silicon refresh in October.

As previously discussed, the services segment remains a key lever for Apple in compensating for increasing risks of weakness in product sales. This is corroborated by stable growth in the segment during the December quarter, which was a bright spot amid a weak demand outlook for iPhones. But looking ahead, the critical lever to sustaining Apple’s growth, albeit modest, is likely to succumb to stiffening regulatory challenges. The upcoming App Store changes rolling out in March with the iOS 17.4 update to comply with the EU Digital Markets Act (DMA) is expected to adversely impact a portion of the 25% revenue share from the region. But more importantly, the said rule changes harbinger a similar fate for Apple’s most lucrative services revenue source in other operating regions when respective regulatory bodies follow suit.

Apple’s delay in rolling out proprietary AI solutions is another risk of losing market share to key hardware and software rivals like Samsung (OTCPK:SSNLF), Microsoft, and Google (GOOG) (GOOGL) – all of which are touting their respective opportunities in AI-enhanced smartphones and generative AI productivity software. Taken together, 2024 looks to be a tough year for Apple in restoring investor confidence, which risks durability to the stock’s premium at current levels.

A Protracted Cyclical Downturn for Apple Devices

Apple faces a flurry of both cyclical and company-specific challenges across its core product segments in the year ahead. The combination of global macroeconomic uncertainties, heightening competition, and geopolitical implications – particularly in the juggernaut U.S. and Chinese markets – remain pervasively evident headwinds to all of Apple’s key product categories. And adding to the turmoil are additional company-specific struggles. They include a lengthened upgrade cycle on the iPhones, given improved technology but limited generation-over-generation changes; a confusing Mac, iPad and accessories line-up; and ongoing patent disputes in the Apple Watch’s push into health and fitness.

iPhone

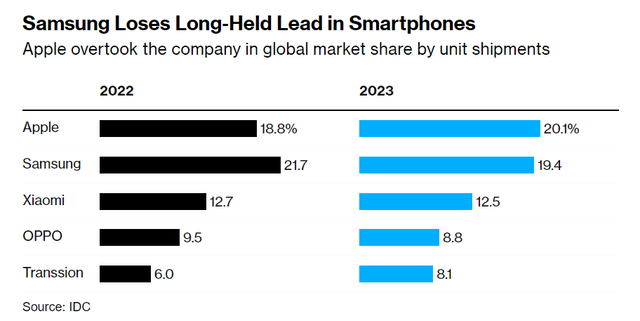

Apple bested long-time rival Samsung as the top global smartphone seller for the first time in 2023. Despite the softening demand environment for smartphones, Apple shipped more than 235 million iPhones last year, representing almost 4% y/y growth from 226 million units shipped in 2022. This took the iPhone’s global market share to more than 20%, which comfortably outpaces rival Samsung’s 19%.

Bloomberg News, with data from IDC

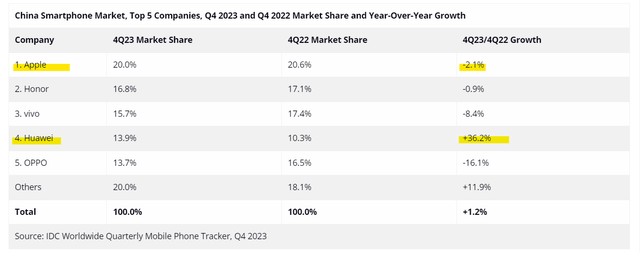

In China, the iPhone also took the crown for best-selling smartphone in the region. While this has, on the surface, assuaged growing concerns of challenged iPhone sales in the region, a deeper look into the details flash underlying weakness. Specifically, Apple’s iPhone win in China was driven primarily by a lesser extent of declines relative to local rivals, instead of sustained organic growth. The company shipped 2% less units in 2023 compared to the previous year.

Yet the results were still better than the “overall 5% fall in shipments” of smartphones in China due to a persistently weak post-pandemic recovery in the region. Although the iPhone’s emergence on top in China alleviates immediate concerns of stiffening local competition, consumer weakness, and geopolitical challenges, the declining shipments trail emerging rival Huawei’s by wide margins. Specifically, Huawei’s surprise introduction of the Mate 60 series smartphones, equipped with competitive advancements, on the heels of the iPhone 15 release had triggered a surge in patriotism-driven buying. The development took Huawei back into the top five ranks of China’s best-seller during calendar Q4, underpinned by shipment growth of 36% YOY versus the iPhone’s -2.1% YOY.

In addition to stiffening competition, Apple also faces broader macroeconomic challenges to iPhone demand in both of its core operating regions, namely China and the U.S. This is further exacerbated by the implications on ongoing geopolitical tension between Washington and Beijing.

Specifically, much of the downturn in China smartphone sales through 2023 were driven by a deteriorating post-pandemic economy, worsened by an extended property slump in the region. And while U.S. sales have remained resilient, as evidenced by maintained sequential growth observed during the December quarter, recent consumer data points to continued uncertainties ahead. The mixed combination of relative strength in the labor market, dwindling pandemic-era savings, rising debt and delinquency rates, alongside robust retail sales provide a difficult gauge to how the consumer end-market critical to iPhone sales will fare through 2024. Although inflationary pressures have eased, with an impending Fed policy pivot seemingly set in stone, the extent of which capital costs would come down also depends on the economy’s strength. Greater cuts are unlikely unless recessionary risks increase, which we believe remains a lingering cause for caution.

While macro-related challenges could be cyclical and prove transitory, the geopolitical implications appear more structural. The iPhone continues to find itself stuck in the middle of a crossfire between the U.S. and China. The latter has now banned the use of Apple’s best-selling smartphones in state-backed and government agencies, citing national security concerns. Meanwhile, the U.S. has called this a retaliatory move against Washington’s implementation of tightened export restrictions levied on advanced semiconductor technologies to China.

The entire combination continues to spell a dire outlook for iPhone demand this year. In addition to the typical seasonal drop-off in March quarter sales, management’s latest earnings commentary also suggests an amplified exposure to China weakness ahead. This is consistent with commentary from key supplier Qualcomm (QCOM) during its latest earnings. The chipmaker has provided a conservative outlook on near-term demand, citing “flat to up slightly” smartphone shipments through 2024. Uncertainties ahead are further corroborated by industry checks that suggest a decline of as much as 15% in iPhone shipments this year, following resilient December quarter sales.

Mac and iPad

Apple’s Mac and iPad product categories also face a similar plate of demand risks exposed to the iPhone. The iPad had failed to recapture lost share from supply chain constraints experienced during the pandemic-era buying frenzy. And the segment has since struggled to regain momentum given the yearslong PC slump. Meanwhile, Mac performance has proven to be a rollercoaster ride.

The in-house silicon refresh across the Mac line-up, paired with the pandemic-era buying frenzy, had fueled a resurrection of double-digit growth in the segment for years before the significant drop-off experienced through fiscal 2023. Specifically, Apple’s Mac sales were largely viewed as more resilient compared to rival PC makers when the demand slump emerged in calendar 2022. Yet that trend might backfire now, as extended Mac demand observed through the initial phase of the cyclical downturn in PC demand might imply a delayed recovery and upgrade cycle. The emerging risk is corroborated by modest sequential growth in Mac sales during the holiday shopping season, despite the October M3 refresh and gradual recovery in PC market sales.

We believe Apple also faces a company-specific setback, as the increasingly confusing line-up of Macs and iPads are likely another culprit to deteriorating sales. It has become difficult to keep up with the lineup anymore. What had used to be just the MacBook, MacBook Pro, and MacBook Air, and each with their different display size and memory options – a level of simplicity that matches the iOS user experience – is now complicated. In addition to size, there is now also a variety of in-house silicon to choose from, with each variant offering an array of memory/storage capabilities. And the same goes for the iPads.

While selection is good to cater to different consumer preferences, Apple’s go-to-market strategy for the Mac and iPads have become overwhelming. This has potentially deterred some of consumers’ interest, adding pressure to the difficult demand backdrop induced by macroeconomic uncertainties. This also risks countering prospects for an upgrade-induced buying cycle, as complexity often reverts consumers’ focus back to pricing.

We believe Apple’s recent introduction of different variants to its computing line-up is to gear up its appeal to more complex enterprise use cases, particularly in content creation and developers’ end markets. This matches Apple’s breakthrough into commercial forays in recent years. The rise of iPad deployment in commercial end-markets observed during the early post-pandemic era has now become more pervasively observed across vendors like Starbucks (SBUX). However, the consecutive quarters of underperformance in Mac and iPad sales shows Apple has yet to find a balance between its product roadmap and mitigating exposure to the cyclical downturn.

Wearables, Home and Accessories

The ongoing patent dispute pertaining to the Apple Watch’s blood-oxygen monitoring capability is another large overhang for the wearables, home and accessories segment. The Apple Watch remains the largest revenue source for the wearables, home and accessories segment, generating an estimated $17 billion in sales during fiscal 2023.

Admittedly, taking the Apple Watches off the rack in stores and online across the U.S. to comply with patent infringement rules was a short-lived stunt. And subsequently resuming sales without the blood-oxygen monitoring feature accordingly mitigates Apple’s exposure to risks of permanent revenue loss. However, given increasing consumer price sensitivity amid ongoing macroeconomic uncertainties, selling the latest Apple Watches without their updated health and fitness feature might deter some purchases, nonetheless.

Meanwhile, the Vision Pro is unlikely to offer material respite to the segment’s near-term growth prospects either. We are optimistic that the device represents a breakthrough in VR/AR developments, despite expectations for further improvements with the continued build-out of a supportive operating system and application ecosystem. Solid initial uptake during pre-orders also underscores interest from less price sensitive early adopters.

But economically, the device’s go-to-market strategy is unlikely to make a sufficient contribution to Apple’s fundamentals and compensate for impending risks of weakness in the broader products segment. This is in line with the mixed demand environment for AR/VR headsets, with the products’ annual shipments on a consistent decline for two consecutive years. Continued uptake and adoption will likely hinge on the further build-out of use cases, which remains challenged due to the speculative nature of the technology. Incremental competition and regulatory implications are also thwarting said developments required for bolstering consumer uptake. This is consistent with key entertainment providers YouTube, Spotify (SPOT), and Netflix’s (NFLX) recent decision against building a visionOS-compliant app. They are also not allowing their respective iPadOS apps from having dual compatibility with the Vision Pro.

Services Lifeline Takes a Hit

Apple’s services segment has played a mission critical role in compensating for plateauing products growth, especially in recent years. Yet tightening regulatory constraints facing the App Store – a key revenue source within the services segment – risk severing this critical link.

It is estimated that the App Store generates about $20 billion in quarterly revenue, or more than 80% of quarterly services sales. And the EU’s recent implementation of the DMA represents the first regulatory threat to penetrate Apple’s longstanding App Store commission policy. Specifically, Apple is pressing forward with plans for an overhaul of its EU region App Store policies with the iOS 17.4 update coming March to comply with the DMA.

Changes include permission for third-party app stores, alternative payment systems for processing in-app purchases, the use of Apple tap-to-pay technology for external apps, and switching up default browsers with ease. The financial implications include a reduction of Apple’s usual 15% to 30% commission fee for certain apps to 10% to 17%. The company is also expected to see an impact on the share of revenue from Apple Pay transactions, as third-party apps gain democratized access to the proprietary tap-to-pay technology.

As part of the overhaul, Apple will instead require apps that sell through third-party stores to go through a review and approval process for security purposes. Apple will also be charging all in-app purchases facilitated through its payment system a 3% “billing fee.” Developers that receive 1+ million downloads a year will also be charged an additional €0.50 for each app install, regardless of whether it was facilitated through the App Store or a third-party store.

On a net basis, Apple expects the majority of EU region developers to see a decline or no change in fees paid to the company. This means that a portion of the 25% revenue share generated from the EU region will be adversely affected. And more headwinds of a similar regulatory nature away. In the U.S., the Justice Department is nearing completion of building an antitrust case against Apple. The scrutiny is in line with complaints raised by companies like Epic Games and Spotify in recent years. All of which have cited Apple’s unfair grip on how external developers carry out business on iOS devices, thwarting effective competition in the marketplace.

In addition to intensifying regulatory scrutiny and ensuing implications, Apple also trails its big tech peers in AI developments by wide margins. This could also represent another emerging challenge to Apple’s share of services opportunities in the longer-term when the adoption of AI solutions becomes increasingly pervasive. AI integration has been viewed as a key source for ensuring economic and technological competitiveness. Yet Apple had been late to the party, and is not expected to debut its proprietary Large Language Model, or LLM, currently codenamed “Ajax,” until its WWDC keynote in June.

Admittedly, Apple has not always been a trendsetter, typically waiting for a speculative innovation to gain user feedback before rolling out its own perfected version capable of dominating market share. But sentiment appears different this time around. Apple’s initial caution against the rapid development of AI has now quickly shifted to acknowledging the mission critical role of the nascent technology in preserving the company’s moat. The catchup game suggests how generative AI integration across Apple’s offerings may serve more as a growth preservation tool rather than an accretive factor to its longer-term fundamental prospects.

By the time of Apple’s planned deployment of Ajax use cases in fiscal 2025, the company would be two years behind the blockbuster debut of OpenAI’s ChatGPT. And between now and then, Apple also risks losing out on relevant opportunities to big tech rivals like Microsoft, Google and Amazon (AMZN), which have already been monetizing the technology. Apple’s delayed integration of generative AI solutions across its slate of products and services effectively introduces risks of market share erosion in our opinion. Meanwhile, its big tech peers continue to partake in the relevant total addressable market, or TAM-expanding tailwinds, leaving Apple further away from regaining its competitive advantage in the intensifying AI race.

Fundamental Considerations

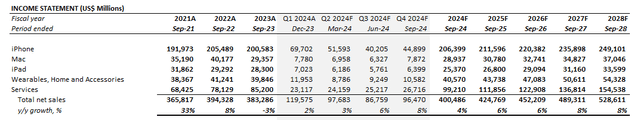

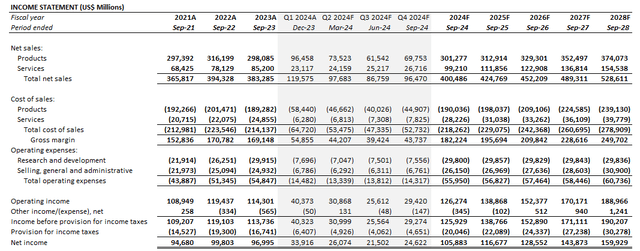

As risks of weakening growth that have been brewing over the past year become an increasingly prominent challenge to Apple’s business, we expect another year of tepid fundamental prospects. Adjusting our previous forecast for Apple’s actual F1Q24 performance, management’s commentary for the year ahead, as well as considerations in the foregoing analysis, we forecast 4% y/y revenue growth in fiscal 2024 to $400.5 billion.

Specifically, we expect product sales to remain relatively flat from fiscal 2023. This would be primarily driven by a tepid year for iPhone uptake, offset by persistent weakness in Mac and iPad demand before exiting fiscal 2024 with relative strength on the back of seasonal demand. Meanwhile, services revenue is expected to reaccelerate with growth of 16% y/y to $99.2 billion. Despite near-term regulatory headwinds in the EU and uncertainties to Apple’s AI roadmap, the services segment is expected to benefit from the full year impact of recent price increases implemented across paid subscriptions.

The increasing mix of higher margin services revenue is expected to improve Apple’s longer-term profitability. But in the near term, the lack of scale observed in core products segment sales, alongside incremental ramp-up costs pertaining to the Vision Pro’s gradual go-to-market strategy could pressure Apple’s bottom-line.

Apple_-_Forecast_Financial_Information.pdf.

Valuation Considerations

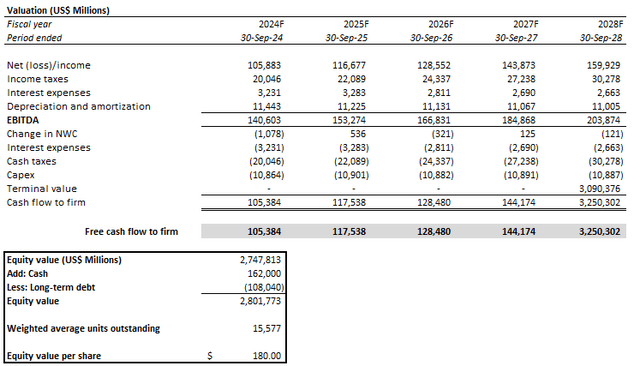

Admittedly, Apple’s strong balance sheet remains the cornerstone of its valuation. However, we believe extended weakness in its fundamental outlook could erode some of the stock’s premium at current levels.

We are setting our base case price target for Apple at $180. The price considers Apple’s tempered growth prospects given its continuous limited slate of TAM-expanding long-term growth drivers, as well as ongoing uncertainties in its core consumer end-market.

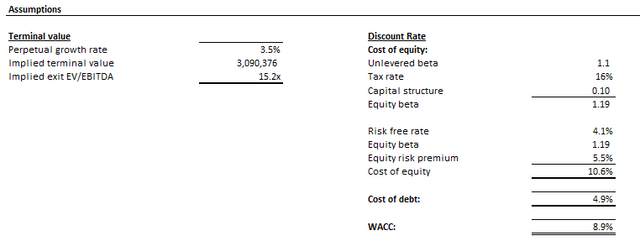

The base case price target is computed based on the discounted cash flow approach. The analysis considers cash flow projections taken in conjunction with the fundamental forecast discussed in the earlier section. A WACC of 8.9% in line with Apple’s capital structure and risk profile is applied. The analysis also assumes an implied perpetual growth rate of 3.5% to terminal cash flows, which is consistent with the anticipated pace of economic growth across Apple’s core operating regions.

The Bottom Line

Admittedly, Apple’s capital returns program has been key to buoying the stock’s valuation premium. The company currently boasts net cash of about $50 billion still, which management hopes to revert to cash neutral over the longer-term. Although much of this net cash is expected to be deployed towards long-term growth investments, a portion would likely be used towards bolstering Apple’s capital returns program. This suggests potential for continued buyback-induced valuation gains in the near-term to keep the stock levelled at the current range.

In addition to quarterly dividends and share repurchases made under the remaining amount approved by the Board, Apple had also introduced a “$5 billion accelerated share repurchase program” last summer. This led to the retirement of an additional 22 million shares during the September quarter, highlighting how Apple’s net cash position remains a cushion for the stock’s exposure to near-term volatility. This is further corroborated by the $27 billion returned to shareholders through quarterly dividends and share repurchases made during the December quarter alone, up from $25 billion (ex-accelerated share repurchase program) in the preceding three-month period.

However, buyback-induced valuation gains are typically not sustainable without consistent improvements to the underlying business’ fundamentals. Considering the challenges that lay ahead for Apple and the limited near-term respite in place, we expect weakening durability to the stock’s premium at current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!