Summary:

- Apple Inc. delivered an all-round fiscal Q2 beat that was supported primarily by the iPhone and stronger-than-expected margins.

- The outlook for fiscal Q3 was also encouraging, as the modest recovery seen in the most recent quarter should continue through the summer.

- Apple looks like a relatively safer bet, as I believe that only a severe global recession could meaningfully hurt the company’s P&L.

Kevin Frayer/Getty Images News

Apple Inc. (NASDAQ:AAPL) traded 2% higher in after-hours activity following a top- and bottom-line fiscal Q2 beat.

To be fair, there wasn’t much about the company’s numbers that I believe will thrill investors. But given a wobbly macroeconomic environment and volatile market (especially in certain corners of it), Apple’s “boring” results that included a better-than-expected recovery in the crucial iPhone segment should be more than enough to keep positive momentum going for Apple shares.

Below is my summary of Apple’s fiscal Q2 results along with my investment thesis on the stock following the solid earnings print.

All about the iPhone

For better or worse, the Cupertino company remains heavily dependent on the success of the iPhone. Not long ago, the segment was a source of concern as revenues declined by as much as 8% in the shopping season last year. This time, the pendulum swung in investors’ favor.

After being hurt in the holiday quarter by supply chain disruptions and unfavorable FX movements, iPhone revenues increased YOY by a modest 1.5%. While this number may not seem exhilarating at first, it: (1) topped my expectations for a decline of similar magnitude; and (2) represented a healthy annualized growth of over 13% since the comparable quarter in a pre-pandemic 2019.

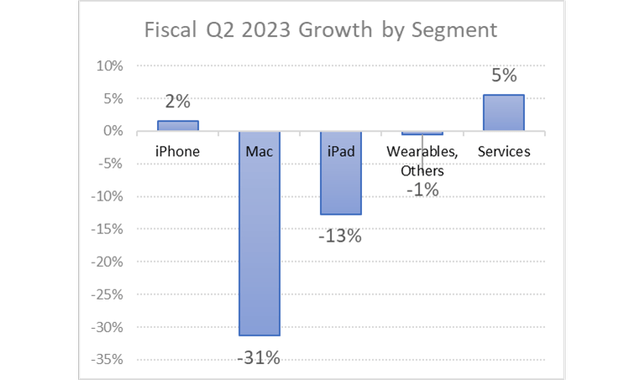

Luckily, the pieces of Apple’s product portfolio that looked the worst in fiscal Q2 are arguably the least relevant for most investment theses. The Mac and iPad were shaping up to have a weak quarter, and Apple delivered just that. Mac sales, specifically, were down an eye-popping 31% YOY, the most in the past 22 quarters at least, following another gut-wrenching decline of 29% posted as recently as fiscal Q1.

Impressive margins, decent outlook

While the iPhone single-handedly pushed total company revenues above Wall Street’s expectations, the nine-cent EPS beat was greatly supported by margins that continue to impress.

Gross margin of 44.3% nearly reached the top-end of management’s guidance. It was also the largest margin that I have ever seen Apple post in its history, despite currency that was a negative factor in the quarter. For comparison, gross margin in fiscal Q2 of 2019 was nearly six percentage points lower.

As a reminder, Apple’s cost structure is extremely lean, and COGS represents nearly 80% of the company’s total expenses. The company’s pricing power and ability to squeeze cost out of manufacturing, therefore, have had a significant impact on earnings. I estimate that, at Apple’s pre-pandemic gross margin levels, EPS in fiscal Q2 would have been a whopping 22%, or roughly 33 cents, lower than what was actually delivered.

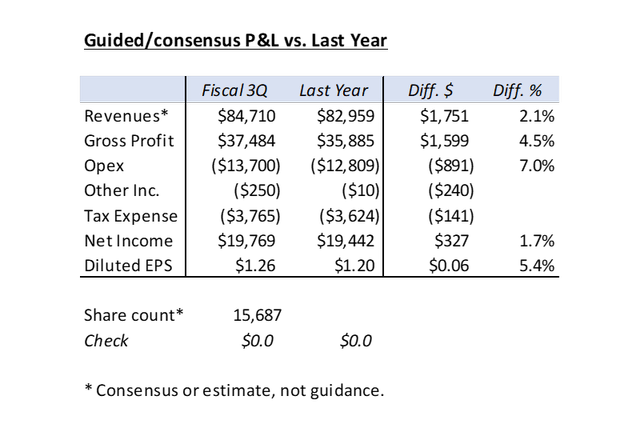

Lastly, the outlook shared by Apple’s CFO during the Q2 earnings call was also a modest positive for the stock and for investor sentiment. Talks of supply chain and FX headwinds seem to have all but ceased, and the slow recovery seen in fiscal Q2 is expected to continue in the summer months. The table below summarizes what Apple’s fiscal Q3 might look like, using a combination of guidance and consensus: a four-cent beat on EPS estimate of $1.22.

“Boring” AAPL stock is a buy

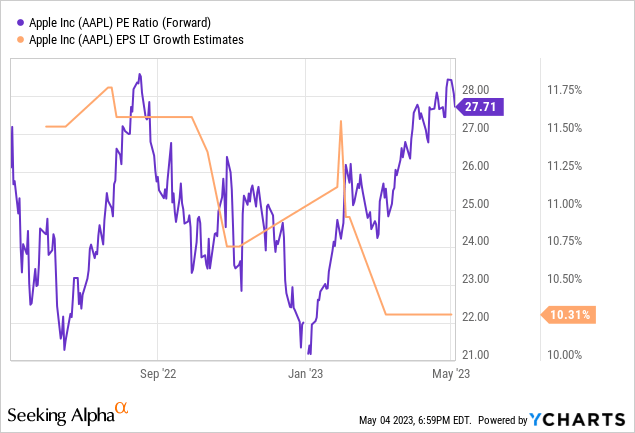

Mac down 31%, iPad down 13%, once-fast growing services up only 5%, iPhone barely growing, EPS flat YOY. I can certainly understand why some might not be very excited about Apple’s recent results, especially given the stock’s forward P/E of nearly 28x and PEG of about 2.7x (see below) that are far from discounted.

But Apple continues to provide evidence that it can execute well even amid an economic environment that looks more unfavorable by the day. While the company continues to battle tough pandemic comps and challenges that are mostly outside its control (namely supply chain constraints and FX), the Cupertino company seems to be doing a wonderful job at what it can control: recapturing demand, driving margin improvements, generating cash and returning it to shareholders.

I continue to think that an impending period of economic deceleration has rarely been so evident. The financial system may be facing a crisis of unknown magnitude, as the interest rate environment (think of the yield curve inversion) remains a concern. Given this backdrop, Apple Inc. looks like a relatively safer bet, as I believe that only a severe global recession could meaningfully hurt the company’s P&L.

Therefore, and despite valuations that are admittedly rich today (but arguably for a good reason), I remain an Apple Inc. bull.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join EPB Macro Research

EPB Macro Research is a thriving community of investors seeking better risk-adjusted returns, while optimizing their portfolios to benefit from the next economic cycle. I invite you to join EPB, where you can read more about multi-asset diversification and participate in the discussions about the markets, the economy and investment strategies.