Summary:

- Apple reported Q2 results that beat estimates.

- Sales and profits were down compared to the previous year’s quarter, however.

- For a company that is trading at a pretty high valuation, such as AAPL, these results aren’t good enough, I believe.

Shahid Jamil

Article Thesis

Tech giant Apple Inc. (NASDAQ:AAPL) reported its fiscal Q2 earnings results on Thursday afternoon. While the company beat estimates slightly, results were weaker compared to the previous year’s quarter. I believe that this does not warrant the pretty high valuation AAPL trades at right now, as that would be more suitable for a high-growth company.

What Happened?

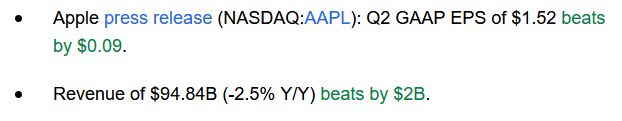

Apple Inc. announced its most recent quarterly results after the market closed on Thursday. These are the headline numbers:

Seeking Alpha

The company beat estimates on both lines, which naturally is positive. That being said, results weren’t great in absolute terms — the company’s sales pulled back by 3% versus the quarter one year earlier, despite the high inflation we have experienced over that time frame.

In real terms, i.e., accounting for the decline in the value of each dollar over the last year, sales dropped at a high-single-digits rate. While that happens from time to time with companies that are dependent on discretionary consumer spending, such as Apple, which is mostly a hardware tech player, declining sales and profits aren’t great when a company is priced for perfection – also like Apple.

Still A Hardware Tech Player

When it comes to tech companies, differentiating between hardware companies and software companies makes sense, I believe. The former oftentimes have cyclical revenues, as consumers and enterprises buy new equipment from time to time, while not spending money in between. For software companies, especially when their offerings are subscription-based, revenues are less lumpy, less cyclical, and more predictable. At the same time, software companies generally have higher margins and benefit more from operating leverage, as selling one additional copy of their software comes with very little additional costs. That’s why software companies, especially those with subscription models, oftentimes trade at higher valuations than hardware companies.

While Apple is active in different areas, it still is mostly a hardware company: Its biggest source of revenue, by far, is the iPhone franchise, which is clearly both a hardware business and somewhat cyclical and seasonal on top of that. Apple’s Mac business, its iPad business, its wearables business, and so on are also hardware-based. While Apple’s services business is software/subscription-based, that makes up a rather small portion of the company’s overall sales in relative terms, although the number still is impressive in absolute terms, at around $20 billion per quarter. Still, for a company with hundreds of billions of dollars in revenue per year, which is valued at close to $3 trillion, that’s only a minor business unit — the more important Apple units are the hardware franchises.

Hardware tech companies, especially those that are primarily selling their products to consumers, are dependent on the strength of the economy. When consumers aren’t willing to spend on discretionary consumer goods, hardware companies mostly can’t grow their sales. And that’s what happened during the most recent quarter: Apple, with its hardware focus, has seen its sales decline, despite a solid services revenue growth rate – the drop in hardware sales was more impactful.

That’s not really surprising, as consumers that are worried about a recession or that feel their spending power is crushed by high inflation can easily forego the purchase of a new tablet, smartphone, PC, and so on – after all, most consumers already own older versions of these products and can use these for a little longer. Apple’s Mac business was especially hard-hit during the most recent quarter, as revenues dropped by more than 30%, but the tablet business saw a double-digit sales decline as well.

Of course, declining revenues aren’t great for a company’s profitability — fixed costs still have to be covered, but they are distributed over a lower total revenue number. This oftentimes causes margin pressure, and that’s exactly what happened to Apple during the second quarter: While AAPL’s sales declined by just 3%, operating leverage worked against the company and resulted in a 6% operating profit decline. Net earnings dropped a little less than that but were down as well, and that happened despite the fact that Apple benefitted from a lower tax rate, relative to one year earlier. Since Apple’s tax rate will likely not drop forever, that’s only a short-term tailwind — at constant tax rates, Apple’s net profit would have declined more than it did.

When it comes to the company’s earnings per share, the company, again, benefitted from a lower tax rate, but its buybacks also had a positive impact. Buybacks will continue, thus this will be a long-term growth driver. But despite buybacks and the benefit of a lower tax rate, earnings per share did not grow compared to one year earlier.

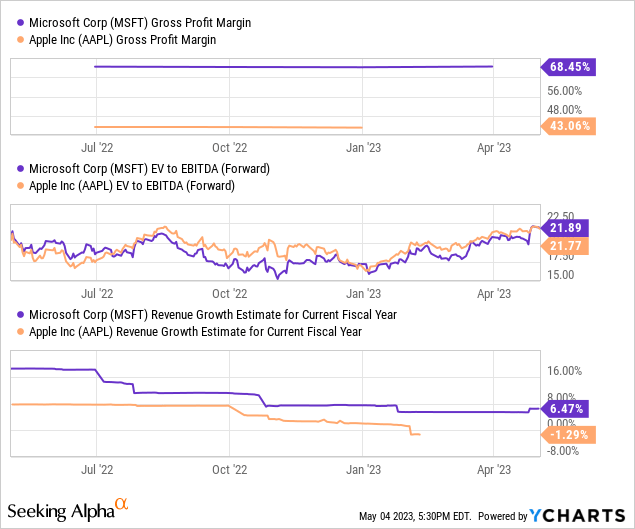

I don’t fault Apple Inc. for this performance – the state of the economy and the high inflation consumers suffer from aren’t caused by Apple. Many other (hardware) tech companies experience similar headwinds. But I believe that investors shouldn’t ignore these facts, and I also believe that a hardware tech company should be priced accordingly. A comparison between Apple and Microsoft Corporation (MSFT) shows that Apple could be trading at a too-high valuation right now:

Microsoft, which is mostly a software tech company, naturally generated much higher margins than Apple, and that will, I believe, never change. On top of that, since Microsoft generates a large amount of subscription-based revenue, and since customers aren’t as free to decide whether to spend money on its products during tough times, Microsoft has a better growth performance. It’s forecasted to grow this year, while Apple is forecasted to decline, and MSFT also easily outperformed Apple growth-wise during the most recent quarter, when its sales jumped by 7%.

The fact that Microsoft is exposed to the cloud computing megatrend, while Apple doesn’t really benefit a lot from that, also helps explain MSFT’s better growth performance. And yet, both companies trade at almost exactly the same valuation of 22x EBITDA. One can argue whether MSFT should trade at a valuation this high, but due to the cyclicality and recession vulnerability, the margin difference, and the different growth outlook, I believe that it makes little sense for Apple and Microsoft to trade at the same valuation.

They aren’t the same – Apple is a high-quality hardware company, but it’s still a hardware company that faces problems that are typical for hardware companies. It thus shouldn’t trade at a valuation that is more appropriate for a more resilient, faster-growing, higher-margin software giant like Microsoft.

Shareholder Returns And Valuation

Apple announced new shareholder returns during the quarterly call, but there weren’t any major surprises there. The dividend has been increased by 4%, but with a forward dividend yield of 0.6%, Apple isn’t attractive for dividend investors – it would either have to offer much higher dividend growth, or a much higher dividend yield to be an attractive income pick.

Apple also announced a new $90 billion buyback program. That’s massive in absolute terms, but equal to just 3% of Apple’s market capitalization. And that’s just the gross amount, which will be partially offset by the issuance of new shares to management and employees. Apple’s share count should continue to decline going forward, but despite the absolutely massive size of the new program in absolute terms, it won’t lower the share count drastically.

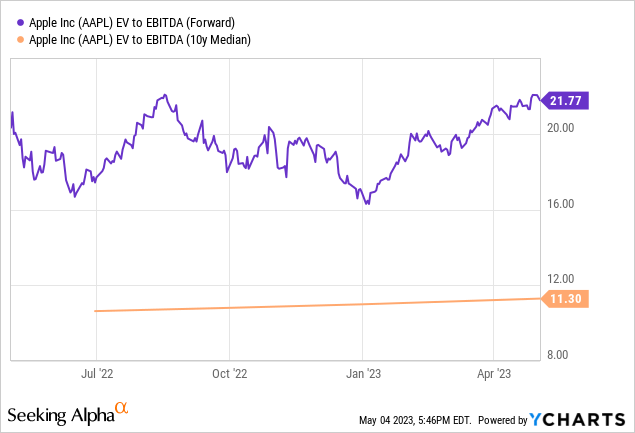

Apple is a high-quality hardware company with an attractive brand and relatively loyal customers, but that doesn’t mean it’s a buy at any price. Today, Apple trades at around twice the historic valuation:

That would make sense if Apple Inc.’s growth would be way higher than it was in the past, but that is clearly not the case – the company is shrinking right now. Apple’s margins didn’t double, either, nor did its shareholder yield double. I thus believe that the current Apple Inc. valuation is not justified, relative to the underlying performance. Or, in other words, for a company that is as expensive as Apple Inc., the quarterly earnings that were just released aren’t good enough. I thus do not believe that Apple Inc. stock is an attractive buy at current prices.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!