Summary:

- We reiterate our sell-rating on Apple Inc. post Q3 2023 earnings results; we continue to see macro headwinds impacting its product sales in 2H23.

- Consistent with our expectations, Apple is not immune to year-over-year smartphone total addressable market contraction in 2023; we estimate 2023 smartphone TAM to be -5-15% YOY revised down from 0-5%.

- We think a higher risk profile exists for its service revenue growth amid the worsening macro backdrop in China, the rest of Asia, and Europe.

- The stock is up 44% YTD, outperforming the S&P 500 by around 26%; we expect its financial performance to moderate further toward 2H23 as macro headwinds accelerate.

- We recommend investors take profits at current levels and revisit the stock once the stock risk-reward becomes more favorable.

Drew Angerer/Getty Images News

We continue to be sell-rated on Apple Inc. (NASDAQ:AAPL) post Q3 2023 earnings. Our expectations in May about weaker smartphone demand impacting iPhone sales are playing out, and we expect near-term macro headwinds to continue to weigh on Apple’s product sales further into 2H23. We expect the company’s financial performance to moderate further in the back end of the year as macro headwinds accelerate. We recommend investors explore exit points at current levels as the stock’s risk-reward profile is not attractive in the near-term.

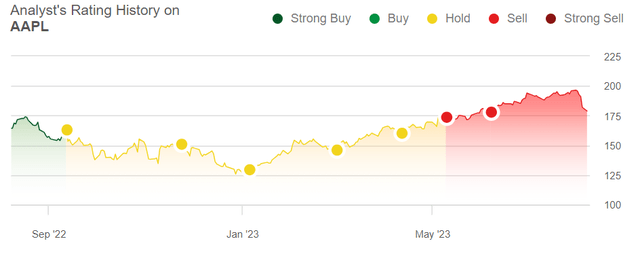

The following chart outlines our rating history on Apple.

SeekingAlpha

Apple stock is up 44% YTD, outperforming the S&P 500 (SP500) by around 26%. The stock declined nearly 6% after announcing Q3 2023 earnings results earlier this month, and we don’t think the downside risk is over. Management noted on the call that the “smartphone market has been in decline for the last couple of quarters in the United States,” which is Apple’s strongest revenue by geography.

We don’t think the softer demand is limited to the Americas, as we see a worsening macro backdrop in China, the rest of Asia, and Europe as well. We now estimate the 2023 smartphone TAM to be -5-15% Y/Y to 1.10-1.23B, revised down from our earlier expectation of 0-5% Y/Y to 1.23-1.29B. We think the industry is very visibly facing a smartphone slowdown, and despite Apple expanding its smartphone market share in 1H23, we don’t believe the company is immune to the slowdown.

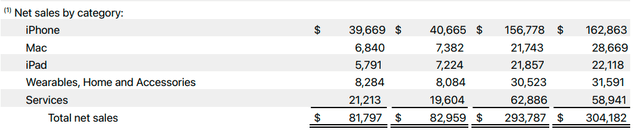

This quarter, Apple reported product sales of $60,584M, down from $63,335M in a year ago quarter and $73,929M last quarter. The lower product sales are largely driven by lackluster iPhone and iPad sales, down 2.5% Y/Y and 19.8% Y/Y, respectively. The larger weight is on iPhone sales, which reported revenue of $39,669M, down sequentially from $51.33B last quarter and missed estimates of $39.91B. While we speculated that iPhone sales will decline but may be more resilient to the downturn in the smartphone industry due to the company’s installed base and softer consensus estimates given the macro backdrop, this quarter’s results show just how bad the slowdown is. We’re constructive on the company’s market opportunity in India as the world’s second-largest smartphone market, after opening the first two Apple stores this quarter, but we expect this to be more of a longer-term growth driver rather than anything that will materially salvage sales from the current slowdown.

The following chart outlines Apple’s revenue by category this quarter.

3Q23 Earnings press release

Services were a notable positive this quarter, reporting revenue of $21,213M, up 8.2% Y/Y and growing sequentially from $20.9B last quarter. We continue to see service revenue achieving higher-digit revenue growth in 2H23 but don’t see service revenue offsetting the macro weakness impacting product sales. Management expects the “September quarter Y/Y revenue performance to be similar to the June quarter, assuming that the macroeconomic outlook doesn’t worsen from what we are projecting today for the current quarter.” We think management is finally facing the music: the smartphone industry is facing a slowdown.

Additionally, we expect the iPhone 15 performance, scheduled for release in mid-September, to be lackluster due to macro weakness; we think fewer consumers will opt to upgrade their devices amid a worsening macro backdrop as discretionary spending tightens. Unlike previous major rollouts, whose features often sell the product, we believe Apple will have to intentionally convince consumers to upgrade. We think the next-generation product launch will help gauge consumer spending, and given the current macro backdrop, we expect it’ll be somewhat disappointing.

Valuation

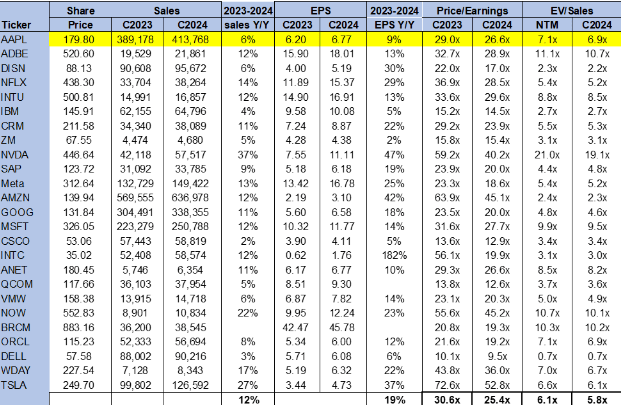

Apple is trading above the peer group average. On a P/E basis, the stock is trading at 26.6x C2024 EPS $6.77 versus the peer group average of 25.4x. The stock is trading at 6.9x EV/C2024 Sales versus the peer group average of 5.8x. We don’t think the macro headwinds have been priced into the stock and recommend investors exit the stock at current levels and revisit at more favorable entry points.

The following chart outlines Apple’s valuation against the peer group.

TSP

Word on Wall Street

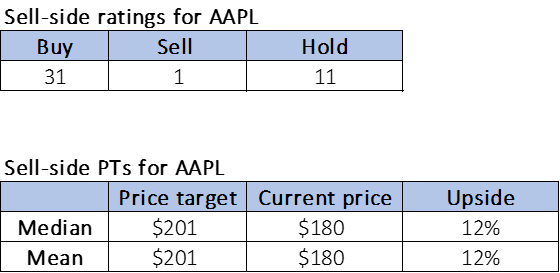

Wall Street is overwhelmingly bullish on the stock. Of the 43 analysts covering the stock, 31 are buy-rated, 11 are hold-rated, and the remaining analysts are sell-rated. We attribute Wall Street’s bullish sentiment to a longer-term outlook on the stock rather than an assessment of near-term headwinds that will likely impact earnings in 2H23. The stock is trading at $180 per share. The median and mean sell-side price targets are set at $201, with a potential 12% upside.

The following charts outline Apple’s sell-side ratings and price-targets.

TSP

What to do with the stock

We maintain our sell rating on Apple, as we see a less favorable risk-reward profile for the stock further into H2 2023 due to macro headwinds weighing on product sales. We’re constructive on Apple’s outperformance in 2024 but see financial performance moderating in the near-term as Apple faces a likely fourth straight quarterly sales decline. Hence, we recommend investors count their profits and explore favorable exit points at current levels, if not to cut full exposure, at least to rebalance and revisit once the macro weakness has priced into the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2 week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2 week free trial so we hope to see you in our group soon.