Summary:

- Apple Inc.’s quarterly earnings results were ahead of estimates, but the company’s performance is not impressive for its expensive valuation.

- Apple’s revenue growth has been stagnant, struggling to find new businesses that can significantly contribute to its revenue.

- Compared to its peers, Apple’s sales decline of 1% shows it is lagging behind in terms of business growth. The high valuation and vulnerability to a potential recession make it an unattractive investment.

Scott Olson

Article Thesis

Apple Inc. (NASDAQ:AAPL) reported its most recent quarterly earnings results on Thursday afternoon. While the company saw its profits come in ahead of estimates, results weren’t great. For a company that is trading at an expensive valuation, Apple hasn’t performed well enough, I believe.

What Happened?

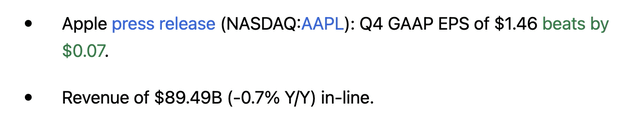

Apple Inc. has announced its most recent quarterly earnings results, for its fiscal fourth quarter, on Thursday following the closing of the market. The headline numbers can be seen in the following screenshot from Seeking Alpha:

The market did not like these results too much, as Apple headed lower in after-hours trading, although the move wasn’t dramatic at all — at the time of writing, Apple is down $1.50.

Apple’s Results: Growth Is Hard When A Company Is This Big

Apple Inc. is a giant company in terms of market capitalization and enterprise value, but the company is also pretty large in terms of revenue generation. With almost $90 billion in sales during the most recent quarter, or more than $350 billion annualized, Apple truly is a giant.

This has advantages: Apple can do business all around the world, everyone knows its brand, and so on. But being one of the largest revenue generators in the world also means that the company has to add many billions of dollars in sales even if it wants to achieve a revenue growth rate of just 5% — that would require finding an additional $15+ billion per year in revenue. A 10% growth rate would require adding more than $30 billion per year in revenue.

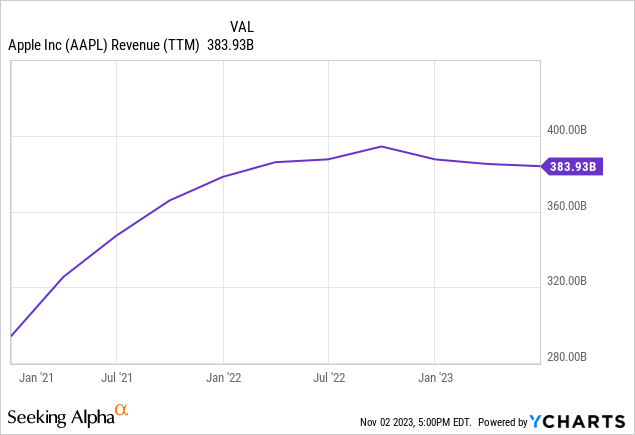

Building out additional franchises is not hard, but building out additional franchises or adding new products that are large enough to move the needle for a giant like Apple is pretty hard. The company has not had a lot of success in growing its business in the recent past:

While revenues expanded nicely during the first stage of the pandemic, when consumers were locked down at their homes and when they thus spent more cash on electronics such as new tablets, new phones, and new computers, Apple’s revenues have more or less been flat over the last two years. During the most recent quarter, revenues actually declined by 1% compared to the previous year’s period — in nominal terms. In real terms, i.e., accounting for inflation, sales were down even more sharply.

I don’t find this particularly surprising due to the aforementioned difficulty of finding new businesses that are large enough to move the needle for a gigantic company such as Apple. On top of that, many of Apple’s products are not consumer staples, but can better be described as consumer discretionary products: while almost everyone wants and needs a phone, most phone purchases are still discretionary decisions — people oftentimes buy a new phone because they want a new phone, not because their old phone stopped working. These purchases depend on the strength of the economy to some degree — when consumers have more spending power, they are more eager to replace their phones, tablets, and so on. When times are tougher, some consumers decide against an upgrade and will use their old phone a little longer.

These factors explain, I believe, why Apple has not achieved any business growth over the last year — in fact, the company experienced a small business contraction over the last year in nominal terms and a more substantial one in real terms.

Compared to other the other “Magnificent 7”, Apple performed particularly poorly:

– Microsoft Corporation (MSFT) saw its sales expand by 13% over the last year.

– Alphabet Inc. (GOOG) (GOOGL) saw its sales expand by 11% over the last year.

– Meta Platforms, Inc. (META) saw its sales expand by 23% over the last year.

– Tesla, Inc. (TSLA) saw its sales expand by 9% over the last year.

– NVIDIA Corporation (NVDA) saw its sales expand by a gigantic 101% over the last year.

– Amazon.com, Inc. (AMZN) saw its sales expand by 13% over the last year.

Contrast this growth with the growth Apple has achieved, a 1% sales decline, and it is pretty clear that Apple is lagging behind its more magnificent peers for now. That being said, this does not mean that all of the other “Magnificent 7” are great investments today, either. But at least they are generating meaningful sales from very attractive business growth, unlike Apple.

Of course, sales are not the only thing that counts for a company. We should thus also take a look at Apple’s profit performance. The company saw its margins expand compared to one year earlier, with price increases and product mix playing a role. A higher ratio of iPhone sales, which are generally seen as higher margin compared to other hardware products from Apple, helped Apple in growing its profits. iPhone sales were up slightly year-over-year, while revenues for products such as the iPad or Apple’s Mac lineup were down by double-digits. At a constant product mix, i.e., without a growing portion of iPhone revenues, profits would likely have been smaller.

On a per-share basis, earnings growth was also positively impacted by Apple’s buybacks. The company has been buying back shares for many years, and this has resulted in a meaningful share count reduction over the years. Over the last year, Apple’s diluted share count declined by 450 million, or close to 3%. While that decline rate was a little smaller compared to what Apple has managed to achieve in previous years, the impact on its reported earnings per share growth has still been positive, helping Apple to record a 13% earnings per share increase compared to the previous year’s quarter.

Is Apple A Good Investment?

Of course, a 13% earnings per share growth rate is far from bad. However I do not believe that it justifies Apple’s current share price, nor does it mean that Apple is a great investment at the current price of close to $180. After all, Apple is trading for a hefty 29x this year’s net profits today. This is a much higher valuation compared to the valuations many of its tech hardware peers trade at, and it also represents a substantial premium compared to how some other “Magnificent 7” stocks are trading: Alphabet and Meta, for example, which are growing at substantial rates, unlike Apple, are trading for 22x net profits each. When a strong tech company with double-digit revenue growth and strong earnings per share growth is being offered for 22x net profits, then Apple, with declining revenues, looks comparatively bad at a valuation of 29x net profits. Compared to the broad market, which is valued at around 18x forward net profits, Apple looks quite expensive as well, trading at a premium of more than 50%.

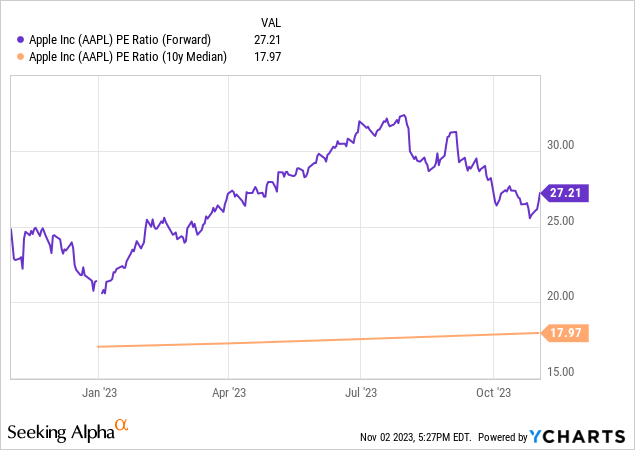

Last but not least, we should also compare Apple’s valuation today to its valuation in the past, as this can tell us whether right now is an opportune time to enter or expand a position or whether that is not the case. Apple’s long-term median earnings multiple looks like this:

Over the last decade, Apple’s earnings multiple averaged 18. That means that Apple is currently more than 50% more expensive compared to how the company was valued, on average, in the past. Over the last decade, interest rates were at or near zero for most of the time. Today, they are much higher — generally, higher interest rates should result in a lower valuation for equities.

While investors could buy into Apple at an earnings yield of more than 5% for many years while interest rates were near zero, the earnings yield that is available from Apple today is just 3%. Yet, at the same time, zero-risk treasury yields (US10Y) have risen to around 5%. I believe that this shows that Apple is a far less attractive investment today compared to the past. Buying Apple at an earnings multiple in the teens in the past has worked out very well for investors. But that does not at all mean that Apple is a similarly attractive investment today at an earnings multiple of close to 30. Sales have topped out for now and are declining slightly, without the U.S. or the world being in a recession. In case we enter a recession next year, sales declines could accelerate.

I believe that this combination of factors — a high valuation both historically and compared to faster-growing tech mega-caps, the absence of business growth, and the vulnerability versus a potential recession — means that Apple stock is not a great buy today. At a much lower valuation, I would re-enter the stock, but at close to 30x net profits, I’m staying on the sidelines.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!