Summary:

- Apple completely missed the consensus when it reported its latest financial results, but it was not as bad as the headline numbers might indicate.

- I believe Apple still has an impressive moat and plenty of growth potential remaining through product innovation, penetration of emerging markets, and growth in services.

- Yet, some serious issues like weak consumer spending, a lack of innovation, and high exposure to China are reasons to be careful and keep a close eye on any developments.

- I expect growth to moderate compared to previous years as it becomes hard for Apple to keep growing without the developments of additional revenue streams.

- Despite my enthusiasm about the company and its products, I do believe the current premium valuation does not leave much upside potential for investors, making it hard to recommend buying.

Shahid Jamil

Introduction

Is Apple (NASDAQ:AAPL) stock still the no-brainer investment that it was over the last decade? For a little over a year, opinions seem to be all over the place when it comes to this question. Over the last year, economic weakness, inflationary issues, dependence on production in China, and weak consumer spending exposed several weaknesses in the business. Whereas the company seemed to be unstoppable and untouchable over the last decade (aside from some weak periods), it now seems this is no longer the case. Apple has been lowering its rate of innovation and hasn’t launched a groundbreaking product that is able to generate significant cash flows for many years now. Every iPhone that it launches seems to be a copy of the previous one, so one might fear consumers getting fed up with paying $1000+ for the same phone.

That doubts about the future and strength of the company are starting to occur is also reflected in the ratings from Wall Street analysts. Apple always was among those few companies that only received buy ratings from analysts for many years, but this has now shifted with the presence of an occasional hold or even rare sell rating. The same can be seen when looking at the Apple page on Seeking Alpha where sell and buy ratings are taking turns and Apple does not seem to be a no-brainer any longer. Yet, the stock price is only down by 2% over the last year after it has rebounded strongly so far in 2022, despite somewhat disappointing financial results.

Now, with opinions all over the place, I thought it was about time for me to take a deep dive into the company to find out whether Apple is still a good buy today for the long-term-oriented investor. So, without further ado, let’s dive in, starting with its most recent financial results.

Apple’s third quarter was not as bad as it looks

Apple reported its 1Q23 results back on February 2 and completely missed the analyst consensus. Revenue was $117.15 billion, down 5.5% YoY, and missed the consensus by a whopping $4.5 billion. EPS was not much better with Apple reporting EPS of $1.88, down 10.5% YoY and missing the consensus by $0.07.

CEO Tim Cook discussed three leading factors that impacted the revenue numbers for this quarter during the earnings call. The first one of these was the impact of FX headwinds as the strength of the US dollar impacted the revenue number by 800 basis points, meaning that if we exclude the FX headwind, Apple would have seen positive revenue growth YoY. This difference is quite significant due to Apple deriving over 50% of its revenues from outside of the US, resulting in Apple suffering quite heavily from the strengthening of the US dollar. Of course, about 3% growth is still not massive, but a lot easier to accept for investors considering the current economic circumstances. A growth slowdown was inevitable.

Revenue split by region (Statista)

The second factor impacting the revenue number reported by Apple was the struggles Apple reported in November 2022 regarding supply chain issues in China. These issues were caused by continued covid lockdowns in the country that made it difficult for Apple and manufacturer Foxconn to make its production goals for the iPhone Pro models. The fact that the company was not able to push out maximum production meant that Apple could not deliver as many of these high-end iPhone models, impacting revenue. With covid measures now out of the way in China, this problem should be solved.

But then there is also the macroeconomic environment that is not benefitting Apple in any way. Tim Cook said the following about this:

A challenging macroeconomic environment as the world continues to face unprecedented circumstances, from inflation to war in Eastern Europe, to the enduring impacts of the pandemic. And we know that Apple is not immune to it.

And indeed, even mighty Apple is not immune and still needs consumers to buy its very expensive technology products. And while this will keep hurting the company in the near term, it is important to consider the fact that this headwind is only temporary and this alone should be no reason for long-term investors to sell their Apple shares. Apple still generates excessive amounts of free cash flow so a short-term slowdown will not hurt the business in any way. The same goes for the FX headwind the company is facing. Again, this is temporary and should dissipate over the next couple of years, once most of the economic worries have also disappeared. Of course, the China supply chain problem is also mostly solved for now, but I view this one as a much more long-term weakness for Apple, but more on this later.

Moving to the bottom line and we can see that Apple reported a gross margin of 43% which is still highly impressive for a (primarily) hardware company. This was even up 70 basis points compared to last quarter due to a somewhat better revenue mix. This resulted in a net income of $30 billion or EPS of $1.88. Operating cash flow was $34 billion, showing the cash generation capabilities of Apple are still very strong.

Overall, I believe the quarter was not as bad as the top-line numbers indicate it was. Near-term headwinds have a significant effect on the numbers reported by Apple, but fundamentally, there do not seem to be any issues complementing this slowdown. And while this does not fully justify the huge earnings miss, investors should not get overly worried by these numbers.

An unparalleled moat gives it plenty of growth opportunities and stability

A strong moat might be one of the key elements of a good investment. A business moat can come in different forms, such as strong brand recognition, a proprietary technology or process, a large network effect, or high switching costs for example. A strong business moat can help a company build sustainable competitive advantages, protect its market position, and maintain profitability over the long term.

As of the latest quarter, Apple confirmed it had now crossed the 2 billion active devices mark, hitting an all-time high during the latest quarter. Just let that sink in for a moment… 2 billion active devices which is also double what it was 7 years ago.

Therefore, there is still no reason to doubt the strength of Apple as a business and a brand. These numbers do not lie. Apple sees incredible customer loyalty which allows it to keep growing its presence in people’s lives by offering new products, services, or accessories. And while the business might have been struggling over the last year or so, the fact that its user base keeps growing illustrates that the company is not losing any strength among consumers. Growth is still coming from all geographic regions and while its European and North American regions might be quite saturated today, strong double-digit increases in emerging markets such as Brazil, Mexico, India, Indonesia, Thailand, and Vietnam show that there is still plenty of growth left for Apple by increasingly penetrating these emerging markets.

And while I expect Apple to drive meaningful growth through the further penetration of these emerging markets and continued market share gains in already highly penetrated regions like Europe and the US, it is its moat and product ecosystem dominance that allows it to drive even more meaningful growth through other verticals which should also further increase business stability – primarily through its services.

But this does not mean its moat is untouchable and that Apple has a great growth outlook. In fact, I believe Apple has the majority of its growth years behind it now. The law of large numbers is also finally reaching Apple as its incredible penetration in primarily Europe and the US will now start working against it. Also, a lack of innovation over the last several years means the company is not generating any additional revenue streams to boost growth as it has shown in the past with successful product releases like the MacBook line, iPads, or wearables. This is one of the issues many investors are having with the company nowadays and I can completely understand where they are coming from. Ever since the great and innovative updates from the iPhone 8 to the iPhone X to the iPhone 11, every single iPhone has looked the same. And I know that the saying “never change a winning team” often turns out to be a good one to follow, but this does not seem to be the right strategy in technology as you will be quickly overtaken by your competition. Apple so far has not seen deteriorating numbers following its lack of innovation due to its strong brand recognition, but this is not something it should rely on. Of course, I am not saying Apple is on the brink of losing its dominance, far from it even. Apple is still at peak performance if u ask me, but its lack of innovation does look worrying. With the much-talked-about reality headset from Apple still nowhere to be seen, this is not increasing my confidence in the company.

Now, to summarize this piece, I do not expect Apple to release any new products that will move the needle. This means the company will continue to heavily depend on its iPhone which accounts for over half of total revenue, and which is expected to see somewhat lower growth due to a tough macroeconomic outlook and already incredibly high penetration in the largest markets, meaning growth will primarily have to come from developing countries. And whereas this all is not overly worrying to me today, I believe this is something to keep an eye on for the foreseeable future as history has shown businesses can quickly lose their dominance. Still, Apple is in a good position today with its moat largely unchallenged. Its wide ecosystem of products is sticky and by adding more and more services to its offering, it makes it harder for consumers to switch. I speak out of experience here. All in all, as long as Apple can maintain its moat, there might not be any reason for investors to sell their shares. A great moat generates a lot of business stability and offers a multitude of ways to grow the business as discussed above. But if Apple were to show a deterioration of its strength and starts losing to competitors in a more significant way, then the investment thesis changes and Apple could rapidly lose its strong market position. With more challengers emerging and Apple bringing down its rate of innovation, the business is increasingly exposing itself to these risks. Still, for investors, there is nothing to worry about today and Apple is still a global leader in many aspects. Its moat is strong, giving it impressive pricing power and downside protection. From this standpoint, I believe Apple is a safe value stock that could be a great addition to one’s portfolio, but I would no longer expect a market outperformance as we have seen over the last decade. Going forward, the success of the iPhone will be crucial still.

Apple can continue growing its very important iPhone revenue

Revenue from its iPhone product in 1Q23 was $68.8 billion or 59% of total revenue for the quarter. Despite the release of a load of new products over the years, the iPhone continues to be the leading product for Apple and with it representing almost 2/3 of total revenue, Apple is also quite dependent on the product. During the latest quarter, this product segment saw revenue decline by 8% YoY.

Still, according to Phone Arena, Apple reached its highest ever market share in the December quarter with it reaching 25% of all smartphone shipments. This was despite the fact that Apple was suffering from production shortfalls after problems in the Foxconn China factories. The main reason for Apple gaining this much market share, despite a lower-than-anticipated output, is the global drop in smartphone shipments. Smartphone deliveries declined by 17% to less than 1.2 million units for the three months from October through December 2022. With the Apple brand as strong as it is and a new iPhone having been released at the end of September, Apple did not suffer from such a large drop in demand.

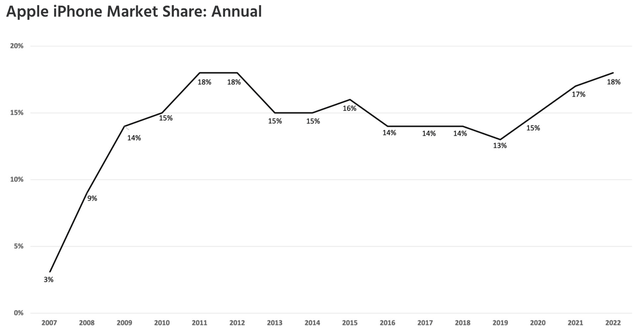

According to research by Counterpoint Research, Apple has seen its market share of worldwide smartphone shipments hover between 15% and 18% over the last decade (on a yearly basis), with it gaining share over the last 4 years as illustrated below. This shows some recent strength in the brand and its products, despite my statement in the introduction regarding the lack of innovation in the iPhone product over the last several years. This is in part due to the brand also gaining strength in developing countries, but it is in larger part due to Apple’s popularity among Gen Z. Many young people value the Apple logo on the back of their phone over the actual phone, making the need for innovation much less important.

Apple iPhone market share (Counterpoint Research)

I do expect Apple is reaching the top in market share this year. With consumer spending under pressure, many people are postponing these large expenses. The Apple brand strength lets it surface as a winner which is why I expect it to report a market share of around 19% for 2023. For the years until 2026, I expect Apple to see its market share drop back to the similar range it has been at for the last decade. Apple might even feel increasing pressure from lower-priced Chinese brands that are taking away market share in the global smartphone industry, particularly in Asia. At the same time, Apple is well positioned to increase its penetration in developing countries which could give an additional boost to its iPhone revenues. This was also visible last quarter as indicated by management:

In emerging markets, in particular, the installed base grew double digits, and we had record levels of switchers in India and in Mexico. Our customers continue to love their experience with our products with the latest survey of U.S. consumers from 451 Research indicating customer satisfaction of 98% for the iPhone 14 family.

China is also a key market for Apple with a lot of potential still on the table. The iPhone managed to increase its market share in China in 2022 to 16%, almost double that of 2019. A very positive sign!

With the global smartphone industry expected to keep growing at a solid 7.3% CAGR until 2029, I believe Apple should be able to keep growing its iPhone revenues at a similar pace and I project this segment to grow revenues between 4-8% yearly. Indeed, not the growth rates we have gotten used to over the last decade, but we might have to stop looking at Apple as a growth focused company and more as a value opportunity. With the iPhone still increasing its global presence by reaching all-time highs across every single geography, I do not think investors have much to worry about regarding this product. While product innovation is below what we are used to from Apple, I think Apple has found a sweet spot in a way that its product is just good, reliable, and a statement. As long as it manages to distinguish itself from the competition through either software, hardware, ecosystem, brand, etc., I think the company will be able to keep growing iPhone revenues at a decent clip.

Is there then nothing to worry about at all? Of course, there is. In the short-term Apple might be gaining market share in the smartphone industry, but the industry decline is expected to be stronger in 2023. I expect iPhone revenues to remain under pressure during 2023 and continue to decline as well. I also believe this will be temporary and the smartphone industry will rebound once economic worries and inflation are easing off. Additionally, there are also the production issues Apple has been facing primarily for its iPhone. The dependence on China seems to be having quite a negative impact on the company and could pose to be a headwind and difficulty over the next couple of years.

Services revenue will be key to future growth and moat preservation

With already 2 billion active devices, the company has a massive user base that it can convince into using more services and products. In fact, the large user base allows Apple to monetize each new iPhone, iPad, and Mac user, developing a recurring revenue model through services. These services offered by Apple are crucial to the investment thesis today and this is due to the recurring nature of these revenues which makes it less sensitive to economic downturns. Also, this should make it much less reliant on its iPhone hardware revenues. And whereas using multiple Apple devices makes it quite hard to leave the ecosystem, using services offered by Apple makes it even tougher for consumers to make the switch, creating a lock-in effect. Some examples of these services that lock in consumers and create solid recurring revenue are Apple TV, iCloud, Apple Music, the Appstore, and Apple Pay.

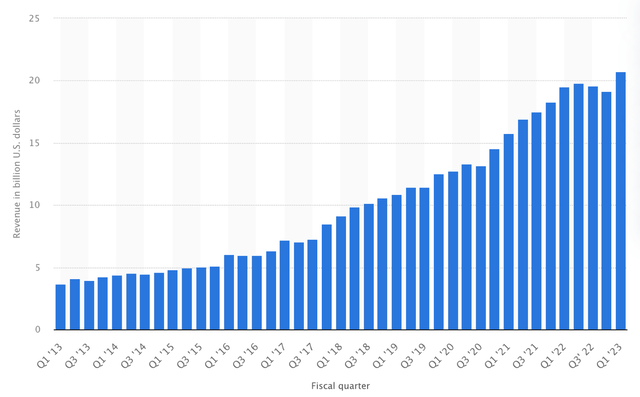

In the latest quarter, Apple derived $20.8 billion in revenues from its services segment which means it now represented almost 18% of total revenue. Services revenue had dipped slightly over the last year as consumers were monitoring their expenses, but the latest quarter showed a significant boost to a new quarterly record as shown below. Key to this was Appstore revenue which increased by double digits YoY, resulting in a total of 935 million paid subscriptions, 4x more than 5 years ago.

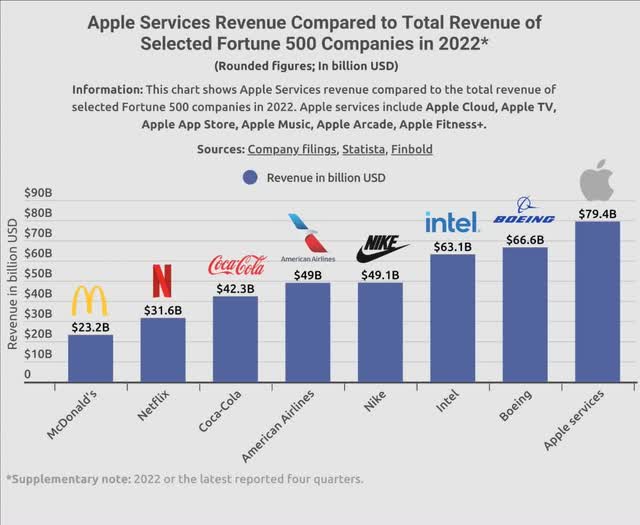

Apple services revenue (Statista)

And whereas services are already very important to strengthen the stickiness of the Apple ecosystem and create a reliable revenue stream, this segment also sees a very impressive gross margin of 70.8% which makes it quite crucial to the bottom line as well. The segment was responsible for 33% of the gross profit for FY22 and according to analysts at Goldman Sachs, this will increase to over 40% by 2027. The services segment is a monster which brought in over $79 billion in revenue in 2022, more than several of the largest fortune 500 companies while maintaining very impressive margins. Again, the result of an impressive moat and user base.

The services segment still has a long runway of growth ahead for Apple and could be seen as the most pronounced growth driver for the next decade. With a huge, committed user base, Apple is perfectly positioned to benefit through these additional services, if well executed.

Production issues could very well be a long-term problem

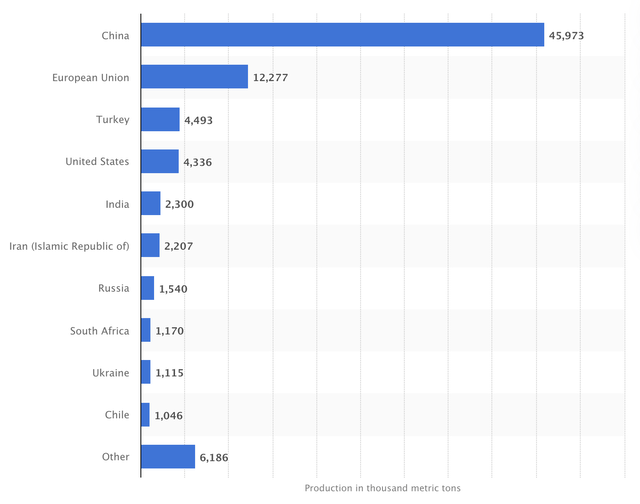

A leading subject over the last year was the issues Apple was facing regarding its production, primarily in China. The covid lockdowns in the country heavily impacted the ability of Apple and manufacturer Foxconn to meet the production goals which eventually meant that it had to bring down the production of the iPhone Pro models. And whereas this issue now seems to be solved as indicated by management, this last year has shown just how dependent Apple is on this highly unpredictable country. The graph below paints a similar picture.

Apple production by country (Statista)

Apple has acknowledged the problem and it is working on diversifying its production spread by focusing on other Asian countries like India or Vietnam. Apple was aware of this problem long before the covid-19 pandemic hit and exposed these weaknesses. This is illustrated by the fact that Apple already reduced its percentage of China manufacturing from 44-47% in 2019, to 36% in 2021.

But despite these efforts, China in 2022 was still responsible for 98% of the iPhone production, making it quite a tough task for Apple to move the whole supply chain which then leaves it depending on China. According to Bloomberg Intelligence, it could take as long as 8 years to shift just 10% of the production in China to other regions. In addition to this, JPMorgan believes Apple will move 5% of the iPhone production to India in the first half of 2023 as Foxconn already has the factories in place here. This should be followed by a total of 25% of the iPhone production by 2025, giving Foxconn some time to expand its factories.

Apple is putting a lot of effort into shifting its supply chain away from China with India and Vietnam looking like the best low-priced alternatives. Foxconn already has multiple factories in both India and Vietnam, but none of those can start producing iPhones on a large scale right away. Foxconn is increasing its investments in India as reported by CNBC. The company is ramping up these investments outside of China to meet customer demand and lower the reliance on China for hardware manufacturing. But again, it will take some time to boost production capacity in these alternative countries and lower reliance on China.

It is not just Apple that is looking to diversify, but many US companies are moving away from China after the last several years have exposed real weaknesses in its economy and leadership that can significantly impact production output – Apple lost $1 billion a week in potential revenue when riots at Foxconn, driven by covid measures, hit production output. The current Sino-U.S. trade friction is not contributing to any confidence for production in China either, so Apple might need to pick up on its move away from the country if it wants to avoid possible significant issues.

All in all, it will still take many years for Apple to decrease its reliance on China despite significant efforts by both Apple and Foxconn to move production to other Asian countries. This means Apple will remain heavily exposed to the country for at least the rest of the decade. And whereas this is not causing any issues (anymore) today, it does create a high level of uncertainty for iPhone production in particular and could impact revenues if things take a turn for the worse, requiring investors to keep a close eye. Even more, for investors that want as little exposure to China as possible, Apple might be a stock to avoid.

Dividend and Share Repurchases

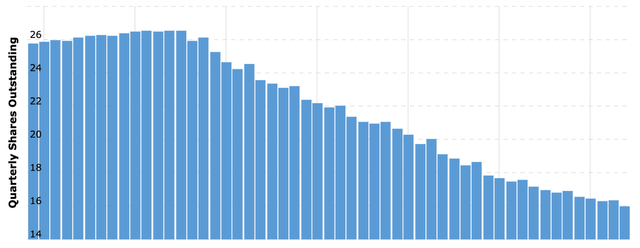

Apple is a cash flow machine, even during difficult times. This results in an excellent balance sheet and plenty of cash to return to shareholders. Apple has been paying and growing a dividend for 9 straight years now and has been growing it at a solid 8% CAGR over the last 5 years. The current forward dividend yield stands at 0.59%, yet with a payout ratio of just 15% there is still a lot of upgrade potential for Apple on this front. Continued dividend hikes of at least 8-10% over the next several years seem like a certainty considering the growth in the business, excellent cash generation, and very low payout ratio, making it interesting to dividend growth investors.

And with Apple trying to burn through its current cash reserves without committing to an overly high dividend, share repurchases also play a significant role. Apple has spent a whopping $550 billion on share repurchases over the last decade retiring a massive amount of shares. Back in 2013 the company still had about 26.5 billion shares outstanding and has brought this down to a little under $16 billion as of the latest quarter. Just last quarter the company returned $25 billion to shareholders without endangering its balance sheet health. Apple still ended the quarter with $165 billion in cash and marketable securities on the balance sheet. After paying down $1.4 billion in debt last quarter, Apple still has $111 billion in debt, but considering its large cash position, this is nothing to worry about. Apple even aims to be cash-neutral and hold a net debt position of $0 instead of its current net cash position.

Apple shares outstanding (MacroTrends)

Investors should expect continued share buybacks from Apple which will lower the total share count and increase investor value. As long as Apple sees no better place to put this cash, I believe this is the best way to use it. In addition to this, investors should expect Apple to keep increasing its dividends by about 8-10% a year.

Outlook & Valuation

With everything discussed in this article, it is about time to make some forward projections and see what management itself expects to report. Yet, management stated the following during the earnings call:

Given the continued uncertainty around the world in the near term, we are not providing revenue guidance, but we are sharing some directional insights based on the assumption that the macroeconomic outlook and COVID-related impacts to our business do not worsen from what we are projecting today for the current quarter.

Apple did give some directional insights that can help us paint a picture for next quarter and this includes the expectation from management to see similar growth as reported for the December quarter, which means they expect to report a revenue decline of around 5%. And with the dollar having gained strength over the last couple of weeks, I don’t expect any positive surprises.

Services and iPhone sales are expected to report positive sequential growth, but this will be offset by significant declines in both iPad and Mac revenues as these benefitted from product releases last quarter, but this quarter will be hit by a decline in shipments following the slowdown in consumer spending. Both these segments are expected to decline by double digits. In addition to this, the gross margin is expected to be between 43.5% and 44.5%, negatively impacted by FX, but slightly higher than last quarter.

Based on these estimates from management, Wall Street analysts now guide 2Q23 revenue of $93 billion, a decline of 4.4%. This is combined with EPS of $1.43, down around 6% YoY.

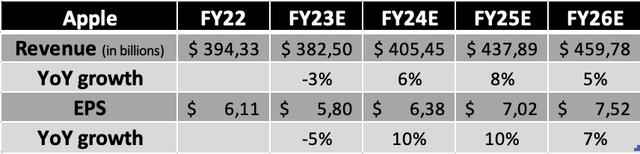

Now, following my deep dive into the company and all the aspects laid out above, I arrive at the following financial expectations for the years until FY26.

Shortly explaining these estimates, I expect Apple to see a slight decline for this year driven by ongoing FX headwinds and the impact of lower consumer spending and economic uncertainty. Services will be able to slightly offset the decline in product revenue but will not be able to completely offset this. I also expect Apple’s fiscal FY24 to still be impacted by these economic worries which will keep it from rebounding in revenue. EPS will be able to grow much faster as services revenue increases in importance while driving up the margins. Continued buybacks will also have a positive contribution to this.

I expect similar growth rates for the following years as Apple will see somewhat slower revenue growth due to an already very high penetration in its primary markets and growth will have to come from services revenue, new product innovation, and the penetration of emerging markets. Please do note that these are my own projections based on research and these are heavily exposed to ongoing economic and business-specific events. Of course, I will try to update these expectations every quarter.

So, how do these compare to the analyst consensus? Well, they are not far from each other as can be seen below.

Revenue consensus (Seeking Alpha) EPS consensus (Seeking Alpha)

We can see that the analyst consensus for this year is slightly better than my projection, but I expect Apple to keep struggling this fiscal year and expect them to miss the current consensus for next quarter as analysts seem too positive. If we look at the revenue expectation for FY26, I am slightly below the average consensus available on Seeking Alpha, illustrating my expectations for slower growth ahead. Yet, my EPS estimate is slightly higher as opposed to the analyst consensus, although still significantly below the top end of the consensus.

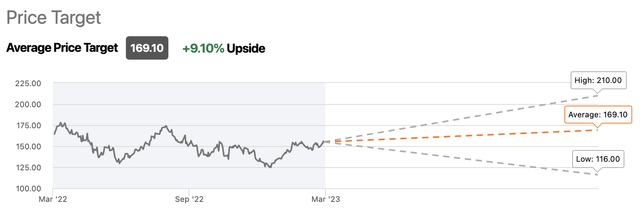

As for the valuation, Apple is expensive and there is simply no denying it. Yet, I do believe a business with a moat as strong as Apple deserves to be valued at a premium. At a forward P/E of 25.9x right now, the stock is valued almost 11% higher than its 5-year average, and considering the expected somewhat moderated growth outlook, I believe we should look for a P/E of 24/25x as fair value for this business. Based on my FY24 EPS estimate of $6,38, I calculate a target price of $160, based on a 25x P/E. With a current share price of $155, this leaves investors with a very meager 3% upside potential.

As for comparison, 44 Wall Street analysts currently calculate an average price target of $169, combined with a buy rating.

Wall Street’s price target (Seeking Alpha)

My Decision (Conclusion)

There have been a lot of negative news headlines highlighting the weaknesses of the Apple business. But to be honest, after researching the company over the last several weeks, I do not quite understand where all of these worries are coming from. Yes, I can understand some of them, but there is not much that should scare away long-term investors as the business and its moat are still incredibly strong and largely unchallenged today. Warren Buffett seems to think the same as his Berkshire Hathaway (BRK.B) also increased its Apple position over the previous quarter. So why all the negative headlines and sell ratings?

I believe this stems from the near-term issues Apple is facing like high inflation, lower consumer spending, dependence on China, and some regulatory scrutiny. And considering all these headwinds, I agree that when your time horizon is no longer than a year, then indeed Apple might not be the right choice today as it will continue to struggle with these issues and a high valuation. Yet, for those with a multi-year horizon, these issues do not seem to be so important. Most of them will ease off once the economic situation improves and Apple is financially strong enough to come out of this without any financial damage. Some issues like the dependence on China and a lack of innovation do worry me as a shareholder, and require me to keep a close eye on the developments. Yet, it is no reason to sell.

With the shares currently trading at a significant premium, I do believe it is best to wait out before initiating or adding to an existing position. Even more so when considering the fact that there is quite a high chance of Apple missing the consensus when it reports its 2Q23 results which might then result in a better entry point. Based on a target price of $160, I believe investors should be looking for price levels around $144 per share before considering buying.

Based on these estimates and all positives and negatives discussed, I rate Apple a hold right now due to its premium valuation, but I do believe Apple is still a great company to own today when you are in it for the long term.

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.