Summary:

- Apple shares have surged by 30.8% in a short period, driven by the launch of Apple Intelligence at the Worldwide Developers Conference.

- Despite revenue and profit declines, Apple’s closed technology platform and AI developments are seen as valuable, but shares are becoming expensive.

- Apple faces challenges in global markets and competition from other smartphone manufacturers, but remains within fair value range for investors.

ozgurdonmaz

The last few months have been a wild time for shareholders of technology behemoth Apple (NASDAQ:AAPL). In early April of this year, I wrote an article that took a rather neutral stance on the business. I talked about some of the weak points the company was experiencing, such as pain in certain markets like China. Ultimately, I argued that the long-term outlook for the firm would be positive. However, because of how shares were priced, I ended up rating the company a ‘hold’.

In the short window after that article was published, shares skyrocketed, soaring by 30.8% at a time when the S&P 500 is up only 5.6%. This is truly monumental upside for a company of its size. Generally speaking, the larger a business becomes, the weaker its growth prospects become. It would be a different story if the overall fundamental health of the business was improving. However, revenue is down year over year while the most recent profit figures provided by management have also contracted. But because of the hype surrounding AI, investors are throwing caution to the wind. This has caused shares to become rather expensive. At some point, if this continues, the company will warrant a bearish outlook. But I’m not quite to the point of pulling that trigger just yet.

Buying the hype

Against all odds, 2024 is looking to be a rather positive here for market participants. But for much of the year, technology behemoth Apple has severely lagged the competition. From the end of 2023 through June 10th, for instance, shares of the company barely budged, rising by only 0.6%. That is after factoring in the paltry distributions that shareholders get as well. By comparison, the S&P 500, inclusive of distributions, was up 13% over the same window of time. The NASDAQ was up slightly more than this at 13.4%. But from June 10th through the time of this writing, shares of Apple have shot up by 14.1%.

It may seem that I am cherry picking the date of June 10th. But the fact of the matter is that it was on that day that the company revealed a long-awaited and, to many, overdue, push into the AI revolution when it announced, at its Worldwide Developers Conference, the launch of Apple Intelligence. Odds are if you’re reading this article, you already know a good deal about exactly what Apple Intelligence offers. While some may be unimpressed with its features, I found them to be particularly attractive. Their generative AI capabilities centered around drawing and ideation should appeal to many users. The enhanced Siri capabilities will also be a big draw for many consumers. In short, I think that the company has a winner here. In the event that you did not see those details yet, you can check them out here.

My problem with a lot of what is going on with AI right now is that I don’t believe much of the value is in the models themselves. Rather, it’s about owning the ecosystem that those models play in. The good news for Apple is that its largely-closed technology platform is one of the most massive and most valuable on the planet. While I have no doubt the company will find ways to easily monetize some of these developments, I imagine that the real value will be in creating additional stickiness with existing users and luring in new ones. The problem, though, is that the easy replicability of AI features will eventually commoditize functionality. And that could turn what is currently an exciting suite of features into a ‘me too’ situation.

This is not to say that value does not exist in this market. According to one source, the global AI market was responsible for around $196.6 billion in revenue in 2023. From 2024 through 2030, this number is expected to grow at an annualized rate of about 36.6%. That should take the market up to $1.81 trillion. I suspect that many of the larger technology companies like Apple, Google parent Alphabet (GOOG) (GOOGL), Meta Platforms (META), and Amazon (AMZN) will be major beneficiaries on the service side. However, it is important to note that a big portion of this increase in revenue opportunity will come on the hardware side of things. So some of this market will certainly be captured by firms like NVIDIA (NVDA). Considering the size of the market and the players involved, it’s difficult to imagine Apple capturing a large enough portion of this market to justify the $660 billion increase in market capitalization the company achieved since I last wrote about it just three months ago.

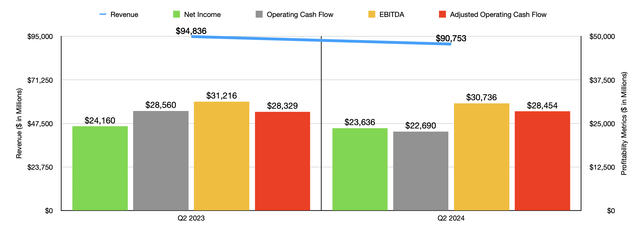

Even though, in my last article, I stated that investors should not worry about short term concerns, there is no doubt that recent financial performance should weigh on the company. In the chart above, for instance, you can see financial results covering the second quarter of the 2024 fiscal year. You can see how those figures stack up against the same time of 2023. Year over year, revenue for the company fell by 4.3%, dropping from $94.84 billion to $90.75 billion. Net income dropped and two of the three cash flow metrics that I look at for the company also declined.

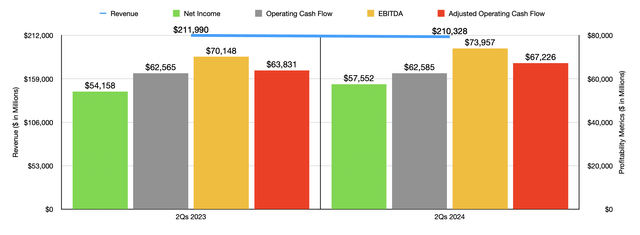

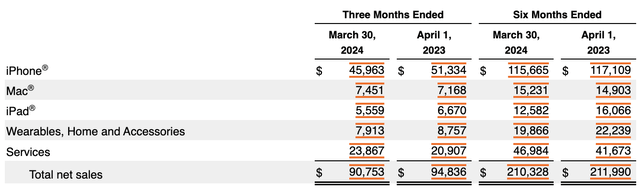

In the next chart above, you can see results for the first half of 2024 relative to the first half of last year. In this case, the picture does look a bit better. Revenue is still down year over year, but profits and cash flows are still up across the board. This means that a lot of the weakness the company went through has come since I last wrote about it in April. In the image below, you can see some of the financial results for the company broken up by product category. iPhone sales, for instance, dropped by 10.5% year over year, falling from $51.33 billion to $45.96 billion. Management is quite vague in its feedback to investors. All they said was that this was because of lower net sales of Pro models. The declines involving the iPad, as well as the firm’s Wearables, Home, and Accessories segment were also rather painful to see. The only real bright spot for the company involved its Services segment, which saw revenue jump by 14.2% year over year because of higher net sales from advertising, as well as from cloud services and the App Store.

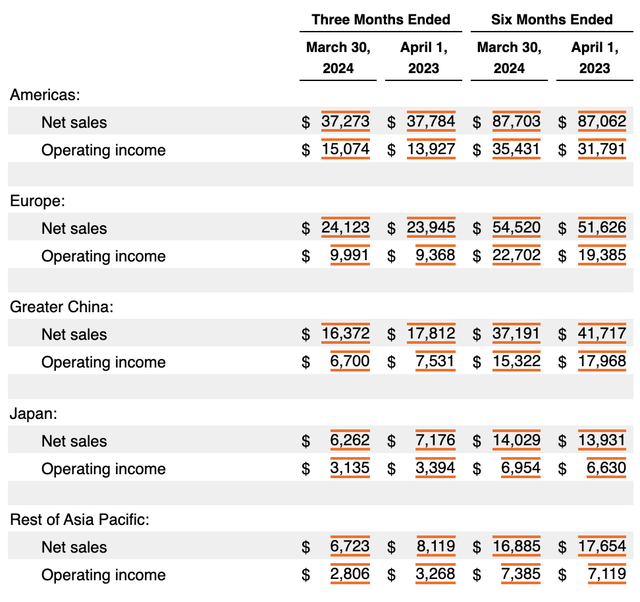

Geographically speaking, Apple’s results have been uneven. As you can tell in the image below, with the exception of Europe, the firm saw weakness across every geographical region that it provides data for. In Greater China, as well as throughout Japan and other parts of the Asia Pacific region, the firm saw a great deal of weakness. I touched on some of this in my last article that I already linked to earlier in this piece. When it comes to the global picture, the good news is that Apple is not exactly alone.

Globally, the firm is the second largest smartphone manufacturer with a market share of 17.5%. This compares to the 20.1% stake in the market controlled by Samsung. Both of those firms, in their first quarters of 2024 (second quarter data is not yet available from this third-party source), reported a year over year decline in shipments. But this comes at a time when global shipments are actually up 11.8% year over year. The fact of the matter is that other players, such as Xiaomi and Transsion, are performing exceptionally well. This doesn’t change my overall assessment of Apple for the long haul. But it is to point out that the company continues to face some issues they need to eventually be resolved.

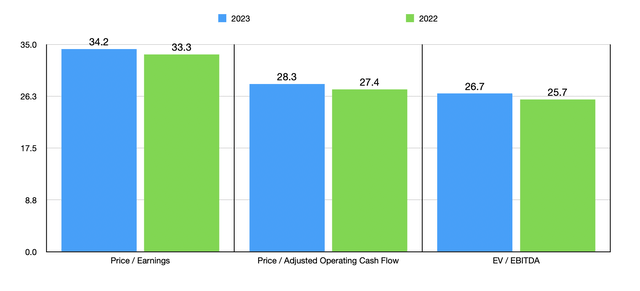

If shares of the company were trading on the cheap, I would be bullish. But those days are long over. In the chart above, you can see how shares are priced using data from both 2022 and 2023. For most companies, I would place this in the overvalued category. But for a business that is as high quality as Apple and that has a rather large chunk of its core market, we are still looking at a firm that is within the fair value range. Admittedly, it’s at the higher end of that range in my view. But it’s within the range all the same.

Takeaway

At this point in time, there is a lot of hype surrounding Apple and what the company is working on. Its efforts will certainly create value for shareholders down the road, though I would argue that the increase in value is probably being overvalued by the market when reflected in the company’s share price. Even though I maintain my previous opinion that investors should not worry about short term issues, it’s hard to imagine shares rising so much at a time when revenue, profits, and cash flows, are all seeing weakness. As a whole, this makes me a bit wary. At some point, I may end up downgrading the stock to a ‘sell’ if fundamentals worsen and/or if the stock rises much further from here. But for now, keeping it rated a ‘hold’ seems appropriate.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!