Summary:

- The App Store is a major growth driver for Apple Inc., with revenues expanding at a 21% CAGR from 2017 to 2022.

- The App Store commission contributes significantly to Apple’s earnings, likely accounting for about 35-40% of total.

- Apple’s App Store is facing regulatory scrutiny due to concerns of anti-competitive behavior (duopoly with Google Play).

- Google’s most recent legal defeat against Epic may be the most significant warning signal yet that global app store practices are exposed to business model risk.

- Reflecting on the App Store risk, paired with Apple’s rich valuation, I continue to argue that it would be wise for investors to take some chips off the table.

ymgerman

The High Importance Of The App Store…

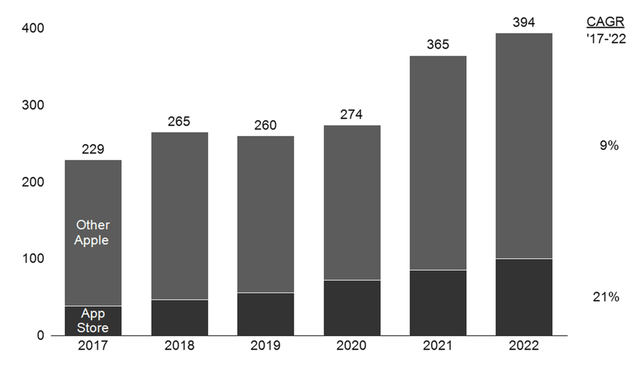

The App Store is perhaps Apple Inc.’s (NASDAQ:AAPL) single largest growth driver, with installed device base for the iPhone and the iPad having reached close to full market penetration. On that note, I point out that Apple’s revenues coming from the App Store have expanded at a 21% CAGR from 2017 to 2022, compared to a CAGR of only 9% for Apple’s business excluding the App Store. According to Statista, it is estimated that App Store revenues reached $85.1 billion in sales in 2021; which would imply about $100 billion in sales in 2022 on a projected 17% YoY growth rate. To give one last metric of interest, I also highlight that the App Store accounts for about 25% of Apple’s overall top line volume.

Statista; Apple Financials; Author’s Projections

But the story of the App Store’s independence does not end with revenues: investors should consider that the App Store commission is a high margin product for the company. I estimate that for every Dollar spent on the App Store, about 40-50 cents will directly flow to Apple’s net operating income. According to my calculations, this would imply that the App Store is responsible for about 35-40% of Apple’s earnings.

…Comes At High Risk For Business Model Disruption On Regulatory Scrutiny

Referencing the numbers presented above, the bad news for investors is that Apple’s App Store business is increasingly coming under regulatory scrutiny, mostly due to antitrust/ monopoly reasons.

The App Store has faced antitrust scrutiny due to several factors that suggest anti-competitive behavior. One key aspect is Apple’s control over the distribution and payment systems within its ecosystem. By mandating that all apps on iOS devices go through the App Store and enforcing strict guidelines on app developers, Apple effectively holds a monopoly over the distribution of apps on its platform.

This control allows Apple to impose fees on app developers, typically taking a 15% to 30% commission on app sales and in-app purchases. Critics argue that these fees are exorbitant and limit developers’ ability to compete fairly, especially for smaller developers who might find it challenging to absorb such high costs.

Additionally, Apple’s restrictions on app developers regarding communication with users about alternative payment methods outside the App Store ecosystem, have been seen as anti-competitive. The prohibition of directing users to make purchases or subscriptions outside of Apple’s payment system limits competition and prevents developers from offering potentially better deals to consumers.

Lastly, Apple’s own apps often have preferential treatment within the App Store, appearing prominently and sometimes competing directly with third-party apps. This perceived advantage for Apple’s own apps raises concerns about fair competition within the platform it controls.

Regulators are well-aware about Apple’s position to leverage its enormous control over the App Store for presumably anti-competitive actions, as reflected in Apple’s long history of legal disputes with government authorities and other business entities like Tencent’s Epic:

2010-2012: The DOJ’s investigation into eBook price-fixing resulted in settlements between Apple and the publishers involved. Apple denied wrongdoing but settled the case.

2015: European Union Antitrust Investigation: The investigation into Apple’s App Store practices continued for several years. In 2021, the European Commission formally charged Apple with antitrust violations regarding the App Store, and the case remains ongoing.

2019: Supreme Court Allows App Store Lawsuit: The Supreme Court’s decision allowed the lawsuit against Apple to proceed. In 2021, the case reached a settlement, with Apple agreeing to pay $100 million to developers as part of the settlement, though the App Store’s fundamental structure remained unchanged.

2020: Congressional Antitrust Hearings: The hearings led to increased scrutiny of major tech companies’ dominance in various markets, including the App Store. While no immediate regulatory action resulted from these hearings, they raised awareness and discussions around potential antitrust concerns.

2020: European Commission Opens Investigations: As of the latest update, the investigations initiated by the European Commission are ongoing, with no final resolution announced yet.

2021: Legal Battles with Epic Games: The legal battle between Epic Games and Apple had several outcomes. While Apple won on some counts, a federal judge ruled against Apple’s anti-steering provisions, allowing developers to inform users about alternative payment methods outside the App Store. However, the case is still being appealed, and the case’s full impact on App Store policies is yet to be fully determined.

Google’s Legal Defeat Against Epic May Be The Most Significant Warning Signal Yet

On December 11th, news broker that Epic Games’ has scored a landmark victory against Google (GOOG) in an antitrust court battle, which ruled that Google’s Play App Store and Play Billing practices are deemed anticompetitive. In that context, the Epic’s trial is interesting as the plaintiff didn’t pursue monetary damages but aimed for broad policy changes, rendering the App Play Store more “democratic.” With the App Store operating on an almost identical business model as Google’s Play Store, the ruling clearly poses a significant threat to the structure of Apple’s most important revenue and profit growth driver.

Notably, while Apple secured a win in a similar case against Epic in 2021, the Google ruling is quite different in nature: The Apple/ Epic case in 2021 was decided by a single judge, whereas the Google lawsuit was decided by actual consumers, which should resonate more profoundly with global policy makers. In fact, I argue that this trial outcome, which was deliberated on by the jury unanimously in less than 4 hours, is poised to supercharge the mounting pressure on app store policies, possibly prompting reevaluation and regulatory challenges that may jeopardize Apple’s practices.

Investors Are Likely Too Complacent About The App Store Risk

Whether Apple’s App Store practices will be regulated more aggressively remains uncertain. Moreover, estimating the extent of the regulation and the corresponding impact on Apple’s fundamentals is also clouded by uncertainty. Despite this uncertainty, however, I think it is fair to say that Apple investors are likely way too complacent about the pending risk.

As I have presented earlier in the article, Apple’s App Store business has grown to be a highly attractive growth and profit engine for the business. According to my simulation, a drop in Apple’s App Store commissions from 30% to 20% could spark an earnings loss for the company of about $15 billion. On a $3 trillion market capitalization and an implied P/E ratio of 30x, this would translate into a 15% price drop for Apple shares (taking $450 billion from the company’s market cap). In addition, a weaker App Store business would likely also compress Apple’s stock multiple, as both the growth outlook for the company, as well as the competitive moat assessment, would need to be revised downwards.

Overall, reflecting on the App Store risk, paired with Apple’s rich valuation, I continue to argue that it would be wise for investors to take some chips off the table, reducing exposure to Apple stock. Recommend “Underweight.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.