Summary:

- Apple has finally entered the generative AI race with significant updates coming to their next iPhone releases.

- The company has generated stable product revenues in a tough market, while still showing double-digit services revenue growth.

- I value the stock on a sum of the parts basis.

- I reiterate my buy rating ahead of the generative AI supercycle.

Justin Sullivan/Getty Images News

Apple (NASDAQ:AAPL) has finally confirmed its entrance into the generative AI war, and its stock is moving sharply higher. That might be because the company might not be facing any opposition in its generative AI ambitions, leading me to suspect that the company has already won the “war” before it began. This may culminate in an iPhone upgrade supercycle, as well as jump starting growth rates for services revenues and bolstering pricing power. The path for more upside continues to center around the high quality of the business model. I reiterate my buy rating for the stock.

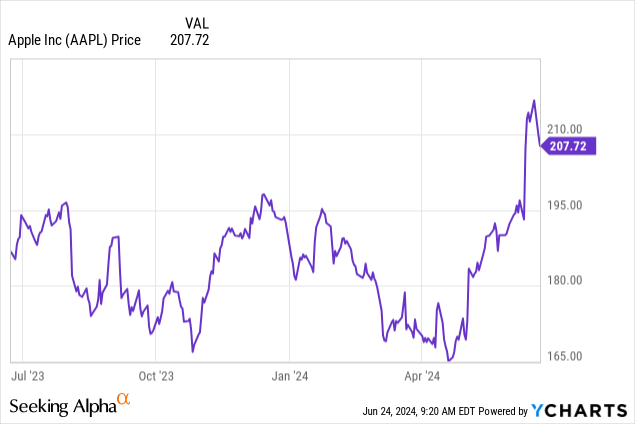

AAPL Stock Price

I last covered AAPL in March where I explained why I was rating the stock a buy in spite of the DOJ antitrust lawsuit, as I anticipated a future generative AI supercycle. That time is here.

The stock has climbed 21% since then, trouncing the returns of the broader market. Estimates still look low as I expect a warm reception to generative AI-enabled devices.

AAPL Stock Key Metrics

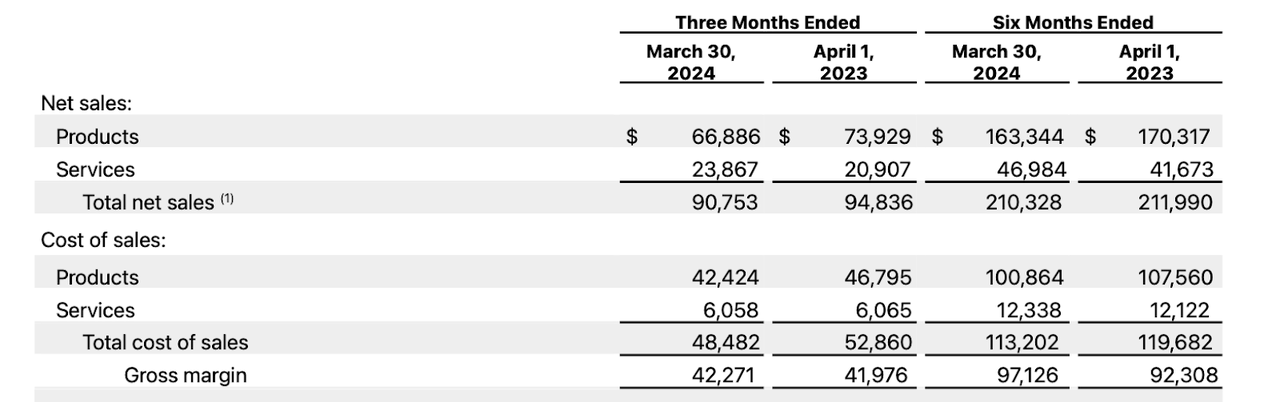

In its most recent quarter, AAPL delivered financial results which need some perspective. Revenues declined by 4% YoY, with gross profits rising slightly YoY due to increasing contribution from high margin services revenues.

2024 Q2 Press Release

Some investors might be wondering why AAPL deserves a 30x earnings multiple with stagnant top line growth, but that is missing the point. The macro environment remains very difficult given the higher interest rate environment. The fact that AAPL is able to maintain product revenues with great stability while continuing to grow services revenues at a double-digit clip is remarkable.

The company saw Mac sales being the lone bright spot, as the company continues to lap easy comparables.

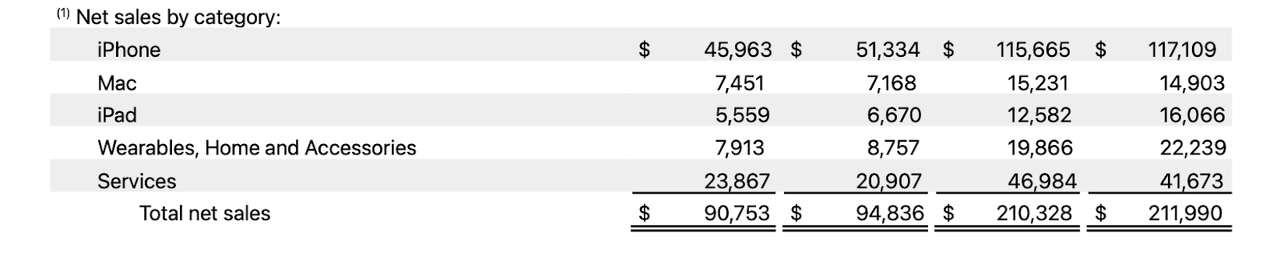

2024 Q2 Press Release

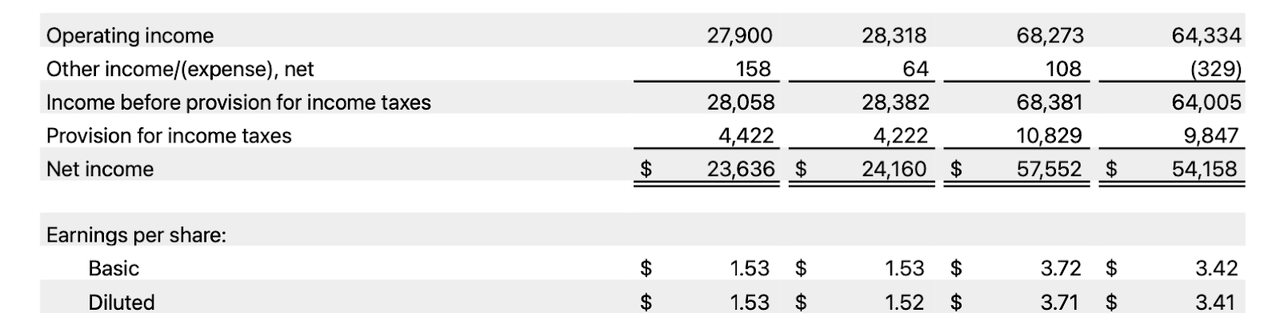

Net income was quite stable after accounting for increased operating expenses and a higher income tax rate, with earnings per share actually growing due to the famous share repurchase program.

2024 Q2 Press Release

AAPL ended the quarter with $162.4 billion of cash versus $104.6 billion in debt, representing a fortress balance sheet. The company returned $27 billion to shareholders through $3.7 billion in dividends and $23.5 billion in share repurchases.

On the earnings call, management noted that iPhone sales growth was impacted due to tough comparables, as the year-ago quarter saw the company benefit from “significant pent-up demand from the December quarter COVID-related supply disruptions on the iPhone 14 Pro and 14 Pro Max.” Management noted that absent that line-item, iPhone sales would have grown. Again, I would not focus so much on year-to-year fluctuations in iPhone sales as I view iPhones as merely the introductory product to the more valuable income stream in services revenues.

Management noted a strong reception to its Apple Vision Pro, with “more than half of the Fortune 100 companies” having purchased units. In this respect, I remain a skeptic but am willing to be disproven with future results.

Management guided for the next quarter to see low single digit revenue growth even after factoring about 2.5 percentage points of foreign exchange headwinds. Management expects a similar services revenue growth rate as “the first half of the year,” implying around 12.7% YoY growth and some deceleration from the 14% mark of this most recent quarter.

The CFO notably stated that they would re-examine the “optimal capital structure for the company” once a neutral leverage position is reached, seemingly expressing openness to taking on net leverage. With interest rates so high, I would not factor in debt-fueled share repurchases as a significant part of the bullish thesis.

Is AAPL Stock A Buy, Sell, Or Hold?

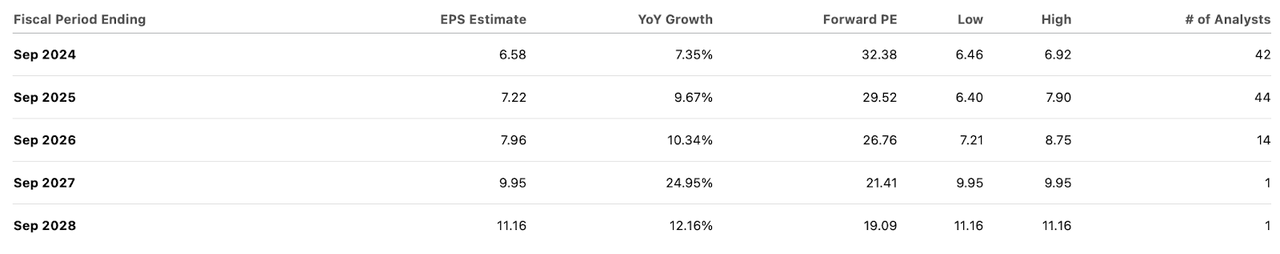

This has been a tumultuous quarter for the stock. First there was news of Warren Buffet’s Berkshire Hathaway (BRK.B) cutting their stake in the company. Then the ongoing DOJ lawsuit revealed that Alphabet (GOOGL) has been paying around $20 billion annually to be the default search engine in Safari. For reference, the company generated around $97 billion in GAAP net income in the last fiscal year. But these items all pale in comparison to what really matters. AAPL revealed a slate of planned upgrades, including generative AI capabilities in the next batch of iPhones. I think it’s fair to say that most investors must have known this was inevitable, but the timing has been confirmed. I see some important takeaways here. First, AAPL’s decision to work with OpenAI to enhance Siri might indicate a potential new competitor for search in the future – perhaps alleviating the assumed risk to the $20 billion payout from GOOGL. Generative AI enabled iPhones is arguably something that is worth upgrading for, and isn’t the typical “incremental improvement” that Apple lovers (and skeptics) have grown used to. AAPL generated around $200 billion in iPhone sales annually over the last two years. Assuming a 20% jump and 60% gross margins, AAPL might see as much as a $1.50 per share boost to earnings estimates over the next year. That might imply the company may earn around $8.72 in EPS in fiscal 2025, with the stock trading at 25x those estimates.

Seeking Alpha

Then looking beyond just the near term, AAPL might be able to sustain higher profit margins from iPhone sales due to a higher end mix, as well as see an acceleration in services revenue growth. It is notable that AAPL might not see the same deterioration in margins reported by cloud companies due to generative AI, as that burden might fall into the app-creators. These suggest that consensus estimates for high single-digit top line growth over the coming years looks achievable at the very least.

Seeking Alpha

I see AAPL as deserving of a 30x earnings multiple long term. That multiple might be better understood when viewing the stock on a per-parts basis. I value the services business at 20x sales, representing a 40x long term earnings multiple and 50% long term net margin assumptions (the company generated a 67% operating margin based on gross profits last year). I justify that valuation based on both the highly recurring nature of the income stream as well as the long term secular growth tailwinds. I value the products businesses at 20x earnings, which based on a 40% net margin assumption equates to 8x sales. On a sum of the parts basis, that equates to a $3.5 trillion valuation, or $227 per share. I note that this estimate does not factor in any benefit from a supercycle.

AAPL Stock Risks

It is possible that the company fumbles the ball on generative AI, which steers consumers towards android products. It is possible that generative AI enthusiasm is less meaningful than feared and does not lead to a supercycle. It is possible that the company eventually loses market share in China, which made up nearly 20% of overall revenues last year. I find this unlikely, as the company still has the majority of its factories in China which may imply that the company can at least compete on an even playing field (unlike Google or Facebook, which are not accessible in that country).

AAPL Stock Conclusion

Some investors might be wary of chasing AAPL stock as it rises, but I do not think it is too late. The stock looks attractively valued even without assuming a supercycle. As services revenues continue to grow and become a larger proportion of overall revenues, I expect there to be further valuation support given the rent-like nature of that income stream. A supercycle appears to be the most obvious near term catalyst. I reiterate my buy rating for the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOGL, BRK.B either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!