Summary:

- Apple’s stock has been stagnant due to concerns about growth, challenges in China, and an antitrust lawsuit.

- The upcoming WWDC event in June is expected to reveal Apple’s AI strategies, but there is speculation that it could be a “sell the news” event.

- Warren Buffett’s sale of Apple shares and Apple’s heavy reliance on China are potential risks for the company.

chris-mueller

Apple (NASDAQ:AAPL) shares have been treading water for quite a while now due to many concerns about growth, challenges in China, the antitrust lawsuit, and more. Apple’s valuation is high, especially relative to its growth rate. The stock has jumped from recent lows over buyback headlines and also over excitement about AI announcements that could come in June during the Worldwide Developers Conference or “WWDC”.

My Previous Coverage On Apple

The last time I wrote about Apple was back in December 2012. In this article, I pointed out that I felt there was too much pessimism coming from some investors and some analysts, one of which said Apple products were no longer unique, and he set a price target that, I thought, was too low. Instead of listening to all of this negativity, I suggested investors continue to buy dips and that a stock split was likely. Subsequently, Apple ended up doing a stock split. When I wrote this article, Apple was trading for just about $20 per share on a split-adjusted basis, so it is up more than 8-fold and ignoring the negative sentiment that I saw around Apple stock was very rewarding for investors.

WWDC In June

The Worldwide Developers Conference is scheduled for June, and Apple is expected to update investors and customers with more details on what it plans in terms of AI strategies and other future plans. Apple has been viewed as being behind on AI strategy when compared to other mega-cap tech companies, so expectations are high for Apple to come out with some big news at this event. There is so much buildup to this event that I am thinking it could be a “sell the news” event whereby even if some positive strategic moves are announced, Apple shares still might drop during or just after this event takes place, on June 10, 2024. Because of this, I just sold my Apple shares as I think the upside is limited from here, and I see better opportunities to deploy this cash.

Q1 Results And A Buyback In My Opinion Is Not Meaningful Or Beneficial

For Q1 2024, Apple revenues came in at $90.8 billion, which was down about 4% year over year. iPhone sales declined by 10%, primarily due to weak sales in China. Earnings came in at $1.53 per share for the quarter. Apple announced a $110 billion share buyback and this is a massive number for most companies, but with Apple’s current market capitalization at nearly $3 trillion, it is only enough to buy between 3% to 4% of the outstanding shares. So, the $110 billion is a big number, but relative to Apple’s size in terms of market cap, it is not anything to get excited about. There are so many companies that have buyback plans that represent much more than 3% to 4% of the outstanding shares. This percentage of the outstanding shares is a bit of a rounding error and will not move the needle in terms of future earnings.

I’d prefer to see a tech company keep the cash to do something like an acquisition or for more R&D rather than only buyback 3% to 4% of the outstanding shares. Just keeping the cash on the balance sheet where it can currently earn over 5% in a money market fund is even looking like a better idea than buying back shares at nearly 30 times earnings.

Warren Buffett Is Taking Some Profits

Warren Buffett is piling up cash, which should be a potential warning sign to investors, since Warren Buffett has a very good track record when it comes to buying low and selling high. Last quarter, he sold about 13% of the Apple shares that his company owns. It will be interesting to see if he sells more shares when the next quarterly report comes out. It does seem like he will be selling some stocks because in this recent article about his sale of Apple shares, it also says he intends to raise his cash levels from $189 billion to over $200 billion by the end of the second quarter.

The Ecosystem

Apple has an unrivaled ecosystem. It also has a balance sheet that is loaded with cash. With Apple’s ecosystem, and cash, it can make or buy just about any product. When you combine this ecosystem with Apple’s cash hoard, there is the potential for huge opportunities. But, recent new product introductions have fallen flat and Apple has not recently been willing to deploy cash to acquire companies that could be an ideal component to add to the ecosystem.

Some Takeover Target Ideas

Apple has significant potential to create another must have product, even though it has not done so recently. I have no doubt they are working on some high potential product ideas. I was somewhat disappointed to hear that Apple decided to shelve plans for Project Titan, which could have brought an Apple car to market. But, maybe this was a good move, and it could open up other new possibilities. Apple has not been acquisitive, but that could change. Apple did buy Beats in 2014, for about $3 billion, and that was the last major deal. Perhaps Tim Cook will warm up to acquisitions if the company does not successfully develop new products fairly soon that actually move the needle. Or, perhaps we will have to wait for Tim Cook to retire, which is something that there has been some speculation about.

If there is a major acquisition in Apple’s future, it’s possible that the cancellation of Project Titan has paved the way for an acquisition in the EV/auto sector. I believe Rivian (RIVN) would be a great fit with Apple, and there has been speculation about a deal between these companies. In terms of other sectors, there has also been speculation and even actual discussions that Apple could acquire Disney (DIS). Maybe Apple will move to acquire Rivian or Disney someday or maybe not, but the point is, this company has the cash to make a big acquisition, so I would not rule it out. I think it would make much more sense, and it could be far more accretive to buy a company like Disney, which is currently trading for about 19 times 2025 earnings estimates, instead of buying Apple shares for nearly 30 times earnings. A buyout of Disney or Rivian could expand the Apple ecosystem far more than Apple share buybacks.

Humanoid Robots Are Possibly Coming

Humanoid robots could be the next big thing, and I mean really big. With AI, we are finally getting to the point where “intelligence” can finally converge with hardware and give us a humanoid robot that is more than just a novelty. Humanoid robots could fold laundry, walk our dogs, help in a move, vacuum, do yard work, and so much more. Plus, a humanoid robot could perform so many tasks in a work environment, and this could be transformative for many businesses.

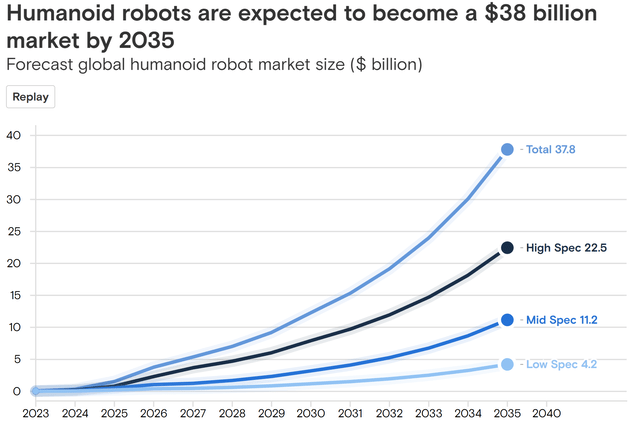

When you see who wants in on the humanoid robot business, that’s when you realize how huge this opportunity must be. Apple is looking into personal robots. Tesla is also working to develop the Optimus humanoid robot, which Elon Musk said could be the biggest product for Tesla in the future. There is also a company called “Figure AI”, which is being funded by Amazon’s founder Jeff Bezos, as well as Jensen Huang at Nvidia (NVDA). When you see that the biggest tech companies and the richest people in the world are showing major interest in humanoid robots, it indicates that this will be a huge market opportunity. What’s important is not just that Jensen Huang, Elon Musk, and Jeff Bezos are some of the richest people in the world, it is that these people are visionaries in terms of technology and building businesses, and they clearly see the importance of humanoid robots. Analysts at Goldman Sachs (GS) have forecasted that humanoid robots could be a $38 billion industry by 2035, as shown below:

China Is A Major Risk

One big potential risk factor is Apple’s heavy reliance on China, in terms of both the amount of production that is dependent on China and the number of revenues Apple derives from selling products in China. When you see major Chinese tech companies trading for single digit PE multiples, which is in part due to concerns about the ongoing trade war and even the outright ban of certain products, it has been surprising that Apple investors have seemed to shrug off this risk. If you consider how dependent Apple is on China for product sales and for production, you might even think it was a Chinese company.

Apple seems to be recognizing the risk of all this dependence on China, especially now that there have been reports of China discouraging the use of Apple products or even banning them in some cases. Apple sees this dependency on China as a risk that needs to be mitigated, and the company is moving swiftly to increase production in India. According to a CNBC article, 14% of Apple’s iPhones are made in India now, and the company plans to increase it to 25%. This is a smart move because if China makes a move on Taiwan in the future, it would likely be catastrophic for companies that are deeply connected to China.

The Chart

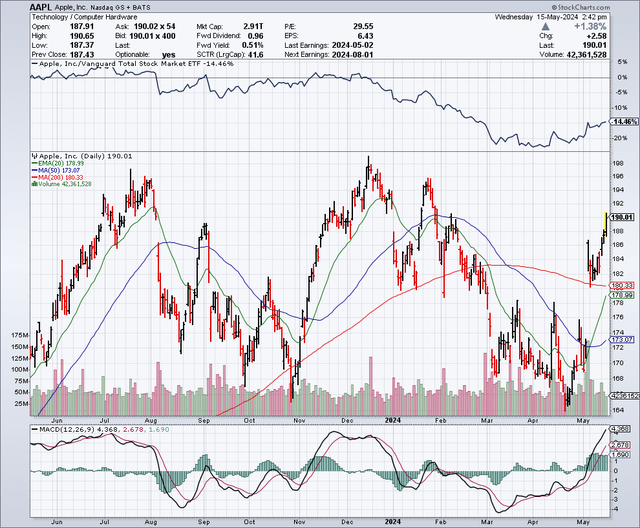

As the chart below shows, Apple shares have jumped from the $160 range to a current price of around $190 per share. This stock is overbought, and the 50-day moving average is just around $173, and the 200-day moving average is about $180. If the response to the WWDC falls flat or is a sell the news event, Apple shares could easily head back down to these 50-day or 200-day moving averages.

Potential Downside Risks

Apple shares have had a big run-up lately, and buying shares when a stock is overbought is a significant potential downside risk. The hype and expectations over WWDC are part of the recent run-up, and this could easily unwind if there are no earthshaking AI developments.

The tensions over trade and Taiwan between the United States and China only seem to be getting worse. President Biden just announced new tariffs against China, and China is likely to respond in kind at some point. The response from China could impact Apple. I believe Apple shareholders are far too complacent in addressing the huge downside risks that exist from Apple being so reliant on China for manufacturing and for revenues.

Apple has not been able to grow rapidly in the past couple of years, and yet the stock trades for nearly 30 times earnings, which is a level that is usually for premium growth companies. If Apple can’t get back to growing at a more significant rate, and relies on financial engineering such as the $110 billion share buyback, the premium valuation that Apple currently trades at could subside, which is another downside risk to consider.

In Summary

Apple is an amazing company, but valuation matters. It concerns me that Apple seems to think that buying back Apple shares at nearly 30 times earnings is the best use of $110 billion. I also see Warren Buffett’s recent and substantial sale of Apple shares as a potential signal to sell as well. Apple has a very significant amount of risk in terms of China, and I don’t think this is adequately priced into the stock at current levels. I also worry that much of the good news about AI that could come from WWDC, is probably already priced into this stock. I feel that buying Apple suppliers like Jabil (JBL) which is trading for about 11 times 2025 earnings estimates, is a better way to play Apple right now due to the huge disparity in valuations, as I point out in this article. My other reason for selling my Apple shares is just because I can also buy higher growth companies with AI exposure like Alphabet (GOOGL) for a more reasonable valuation.

I am neutral at current levels for the long term, but I am bearish in the short term due to the big rally in the past couple of weeks. I would be more bullish if Apple follows through with humanoid robots; however, Project Titan had the potential to move the needle for Apple in terms of revenues, but those hopes appear to be dashed, and the same could happen with humanoid robots. My strategy is to lock in profits thanks to the recent rally in this stock. As for a price target where I would buy back into Apple, it would have to be somewhere close to or below the 50-day moving average of around $173 per share or below. This represents about a 10% drop from current levels, and I believe it is a more reasonable level in terms of risks and rewards.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, JBL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.