Summary:

- AAPL may have perfected the strategy of complying with regulators, while discouraging the migration of applications and payments from its platform.

- The same has been observed in the Self-Service Repair Program, which proved to be oddly complicated and impractical against AAPL’s ethos of the simple and user-friendly.

- Assuming a similar move for the mandated third-party app store and payment platforms, we may see a reduced impact on AAPL’s top and bottom-line growth indeed.

- While we may see impacted FQ1’23 earnings due to the Foxconn riot, the headwinds are already baked into AAPL’s valuations, suggesting minimal to moderate volatility ahead.

J Studios/DigitalVision via Getty Images

We have previously covered Apple (NASDAQ:AAPL) here as a post-FQ4’22-earnings article in November 2022. It was previously discussed in depth that the Foxconn riot might be an indication of temporary top-line headwinds, which may subside due to the intensified diversification to Vietnam, Thailand, and India. The company’s robust financial performance has also helped to temper some of the market’s pessimism, triggering minimal corrections to date.

For this article, we will be focusing on the impact of the Digital Markets Act in the EU, which may force AAPL to allow third-party app stores and alternative payment methods moving forward. The same has been observed in its Self-Service Repair Program, which was attributed to the FTC’s enforcement against tech companies that previously required electronic repairs performed only by authorized vendors. After careful deliberation, the new regulation would likely have a moderate to minimal impact on the company’s top and bottom lines ahead. We’ll discuss this further.

The Fine Balance Of Regulatory Compliance While Maintaining Consumer Behavior

AAPL is reportedly considering third-party app stores to comply with the Digital Markets Act in the EU coming into force from March 2024 onwards, coinciding with the release of iOS 17 by early 2023. Morgan Stanley has suggested that this decision may potentially decrease the smartphone giant’s annual revenue by -1% and EPS by -2.5%. These estimates were optimistic indeed, since we have previously projected a revenue impact of up to -8.3%, based on an aggressive -30% haircut on the company’s reduced commission and alternative payment methods.

Naturally, these are merely speculation, since it is unknown whether AAPL will allow alternative payment methods on third-party app stores as well. Furthermore, these numbers are contingent on app developers opting to receive payments outside the company’s platforms, despite the attractive -30% discount in commission rates. The App Store continues to maintain the largest market share in the global mobile application at $64.9B, or the equivalent of 67.1% in the first three quarters of 2022, primarily attributed to the higher monetization rate through in-app purchases and premium apps.

Furthermore, Bloomberg has reported that AAPL may charge a fee to verify these third-party apps, potentially circumventing the loss in revenue. However, assuming that the US similarly imposes a similar move, we may see a significant impact on its top-line growth indeed, since the country is expected to record up to $42.31B of in-app purchases in 2022, growing by 13% YoY.

In the meantime, we have belatedly turned more bullish on AAPL, since the new regulations would likely have a moderate to minimal impact on the company’s top and bottom lines ahead. There are several reasons for this, including the interestingly poorer consumer experience from the Self-Service Repair Program thus far. Odd indeed, coming from a company that has always prized the simple mission and intuitive user-friendliness, as best quoted below:

AAPL’s Mission Statement

Therefore, we reckon that in this case, AAPL is introducing “the fine art of self-sabotage,” as coined by David Price, an editor from Macworld:

Sometimes you’re officially selling a thing, but secretly, for whatever reason, you don’t actually want people to buy the thing. (Let’s not get into why, for now.) How do you accomplish your aims, without making it obvious what you’re up to? One approach you can try is a method known as selling ice cream in winter. Out you go into the snow, driving your ice-cream truck, playing your ice-cream music. How odd, you say, that nobody is buying my ice cream. It must be that people around here simply hate ice cream. (Macworld)

The Self-Service Repair Program has been reportedly intimidating and convoluted for regular retail consumers, especially with the recommended use of expensive and professional-grade tools befitting experienced technicians at Apple Stores. There have even been claims that the spare parts do not resemble genuine Apple materials at all. Most importantly, the cost and efforts involved were impractical, since renting the equipment and spare parts to replace the iPhone 12 battery cost $96, a notable increase of 39.1% from the retail charge of $69. Shakeel Taiyab, an independent phone repair technician in South San Francisco, said:

They set up the customer to fail. (The New York Times)

Naturally, these factors point to AAPL’s strategic plan of complying with the regulation while similarly discouraging retail consumers from repairing their own devices. These also come with the added bonus of validating the ease and affordability of repairs through authorized vendors. On the same note, the user experience on third-party app stores may prove similar to the company’s Self-Service Repair Program, with the platform potentially being less trustworthy and conducive for app downloads and payment.

Notably, key app developers, such as Alphabet (GOOGL) (GOOG), Disney (DIS), and Netflix (NFLX), may be less inclined to take part in third-party app stores, similarly protecting their own interests and user experience. Due to the immense costs involved, gaming partners may remain on the official platform as well, though the return of 30% commission from in-app gaming purchases may potentially entice some to migrate. However, this is also countered by the fact that up to 50% of iPhone users actively used Apple Pay as their primary digital wallet system in 2021. Integration with the iOS and other apps may be limited as well for security and compatibility reasons. As a result, the impact on revenue may eventually be less than expected.

In addition, multiple cyber-security incidents on iOS have occurred in 2022, despite AAPL’s strict censorship and robust platform security overview. The smartphone giant had to release an iOS 16.1.2 update in November 2022 to fix a zero-day vulnerability in its WebKit browser engine. The security flaw was actively exploiting older versions of iOS, allowing malicious codes to run on affected products. Naturally, a less secure application through third-party app stores may be more prone to hacking and malware, putting personal data such as location, passwords, and banking information at risk. According to the US FTC, fraud reports in 2021 had increased by 19% YoY to 5.88M, while financial losses expanded tremendously by 77% YoY to $6.1B at the same time. While Google may have allowed users to utilize third-party app stores and payment platforms in the EU since mid-2022, the company also went to great lengths to discourage it, with this quote:

Your phone and personal data are more vulnerable to attack by unknown apps. By installing apps from this source, you agree that you are responsible for any damage to your phone or loss of data that may result from their use. (Macworld)

On the other hand, depending on how the third-party app stores are regulated, we may see a resurgence of cloud gaming and restricted mature apps with sexual, religious, or political themes, which have been previously censored on AAPL’s platform. Similarly, dating apps with in-app purchases that were previously strictly vetted would benefit, as it provides an alternative method for reaching both new and existing audiences. Notably, Epic Games may likely take advantage of the opening up, due to the severe rift between the former and the duopoly of the App Store/ Google Play Store back in August 2020.

Then again, with the game company already offering cloud gaming in collaboration with Nvidia’s (NVDA) GeForce NOW, the migration may not be that significant after all. Combined with the hassle of maintaining multiple app stores, we may see more users returning to the official platform for downloading and payment security reasons after all. For now, AAPL is still expected to deliver robust top and bottom-line growth through FY2025 at a CAGR of 4.7% and 5.1%, respectively. Profit margins will also likely similarly expand compared to pre-pandemic levels, suggesting Mr. Market’s sustained confidence thus far. Only time will tell how the situation develops.

So, Is AAPL Stock A Buy, Sell, or Hold?

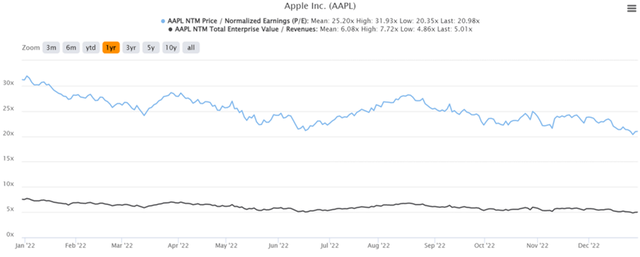

AAPL 1Y EV/Revenue and P/E Valuations

AAPL is currently trading at an EV/NTM Revenue of 5.0x and NTM P/E of 20.96x, higher than its 3Y pre-pandemic mean of 4.34x and 22.32x, respectively. Otherwise, lower than its 1Y mean of 6.03x and 25.01x, respectively. Based on its projected FY2025 EPS of $7.10 and current P/E valuations, we are looking at a moderate price target of $148.81. However, it is apparent that market analysts are more bullish, with a target of $179.70, suggesting an improved 38.64% upside potential from current levels.

AAPL 1Y Stock Price

Depending on individual investors’ risk tolerance and investing trajectory, most of the Foxconn riot pessimism is baked in, with the Zhengzhou plant already back to 90% of its production capacity by 02 January 2023 against the previous 20% in November 2022. These suggest minimal to moderate short-term volatility, depending on the results of AAPL’s upcoming FQ1’23 earnings call on 26 January. However, with the stock trading near its 52 weeks lows of $129.62 (at the time of writing) and P/E valuations of 20.96x, we reckon that these levels look attractive enough. Therefore, we are re-rating the stock as a Buy. Anyone attempting to time the market may be sorely disappointed, since investors may also miss these rock-bottom levels for the next decade’s portfolio growth and investing.

Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOG, NFLX, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.