Summary:

- Berkshire Hathaway’s reduced exposure to Apple may be due to portfolio repositioning and lower concentration risks, not necessarily a negative outlook on Apple.

- Apple’s stock performance has improved in 2024, boosted by a stronger Q2 and Q3 report, positive investor sentiment after WWDC event and strong demand outlook.

- Apple’s AI strategy for the iPhone, combined with strong demand signals, is expected to drive revenue growth and margin expansion, supporting a Buy rating.

Nodokthr

Investment Thesis

Like most avenues in the market, Apple’s (NASDAQ:AAPL) investors have been on a rollercoaster ride since the stock finally broke out of its months-long relatively lagging performance on the stock market in May this year.

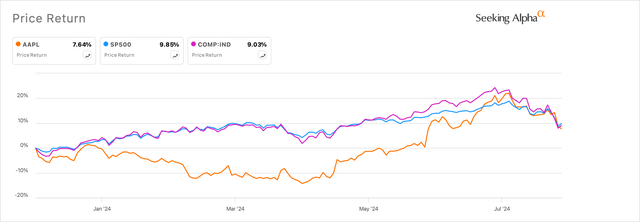

Apple’s WWDC event in June did enough to build back investors’ confidence that the Cupertino, CA-based company had hit the right notes with its AI strategy for the iPhone, which is due to launch later this year. That pushed the company’s stock to beat the S&P 500 on a year-to-date basis, as seen in Exhibit A.

Exhibit A: Apple’s pullback last week still sees the company at par with the broader market. (Seeking Alpha)

However, a mountain of macro data points over the past two weeks have rattled markets, including Apple, culminating with two key events: One was the Yen carry-trade unwinding in the markets over the week, and two, Berkshire Hathaway massively cut its stake in Apple last week.

While I view the Yen carry-trade risk as a near-term risk, I believe investors would be wrong to hyperfocus on Berkshire’s reallocation of its portfolio with lower Apple exposure. The demand outlook for Apple’s iPhones and other devices has improved over the past few months, while management still has a towering share buyback program in place, delivering strong revenue-backed margin expansion and incremental shareholder capital.

With these levers in Apple’s outlook remaining intact, I am now upgrading my outlook on Apple to a Buy.

Concerns In Apple About Berkshire Cutting Stake Is Misplaced

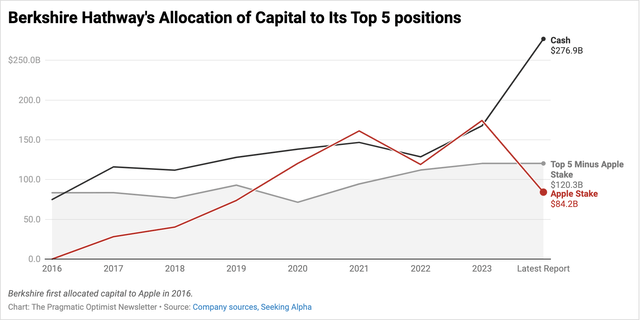

Over the weekend, Berkshire Hathaway (BRK.B) announced their second quarter earnings, which pointed to a significantly reduced exposure to Apple’s stock. Per the company’s latest 10-Q filing, Berkshire Hathaway cut its fund allocation to Apple by more than half, which now stands at ~$84.2 billion, down from ~$177 billion a year ago. Naturally, investors took the reduced exposure as a sign that the Oracle of Omaha was souring on his outlook on Apple. This comes after Warren Buffett’s Berkshire Hathaway had already trimmed its exposure in May, as I had explained in my previous research on Apple.

However, I believe some context setting is important here. In the illustration below, one can see how Apple has been the single most important position for Berkshire Hathaway since 2016, when Berkshire first allocated capital towards the iPhone maker.

Exhibit B: Berkshire Hathaway’s Top 5 holdings versus cash since 2016 (Berkshire Hathaway’s filings)

While tax implications are one side of the story, fund concentration and portfolio positioning could be two other interrelated reasons why I believe Berkshire Hathaway has cut its Apple stake. With rising macro-uncertainties bubbling globally, coupled with higher geopolitical risks, I believe Buffett & team may have decided to act on repositioning the long-term course of their portfolio in a manner that can be consistent with the risk appetite of Berkshire’s shareholders.

This is not something that is immediate in the near term or even in the midterm, but rather over the long term. Here is an excerpt from Buffett’s 1988 annual letter that characterizes their fund management style, something that is even followed today:

When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever. We are just the opposite of those who hurry to sell and book profits when companies perform well but who tenaciously hang on to businesses that disappoint.

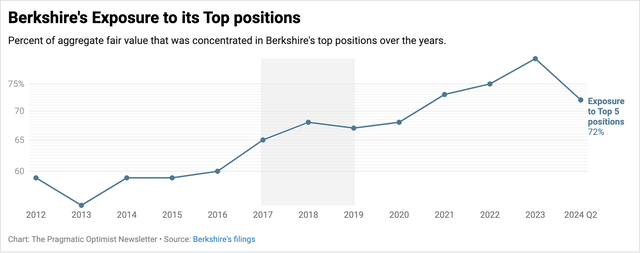

On a related note, the repositioning of fund assets also means lower concentration risks for the portfolio. Per the most recent 10-Q filing, Apple is still Berkshire’s largest holding, but the reduced exposure implies ~72% of aggregate fair value concentrated in the top 5 stocks, down from the nearly 80% aggregate fair value concentration in its top 5 stocks last year. Berkshire’s reduced exposure to Apple allows the portfolio to match the aggregate fair value concentration in the top 5 positions, which usually would be ~66–68% before the pandemic.

Exhibit C: Berkshire Hathaway’s concentration in its top holdings over the years has become extremely focused on a few names (Berkshire Hathaway’s filings)

Hence, I believe investors should not read too much into Berkshire trimming its shares since the demand outlook remains elevated for Apple’s products, especially for the iPhone.

AI is Apple’s Best Shot at Reviving iPhone Sales

There are two converging trends here that I believe will eventually play to Apple’s favor.

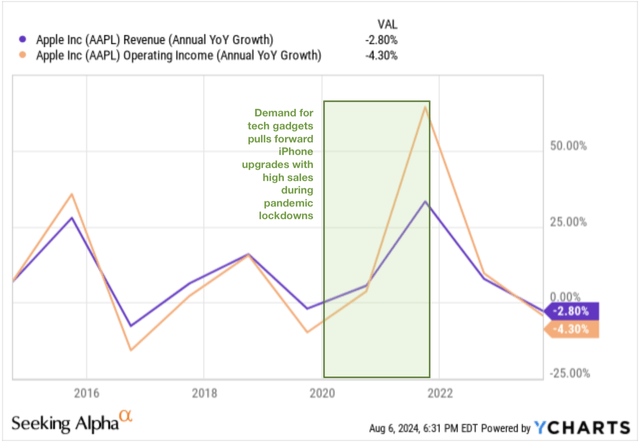

First, despite the Apple Intelligence feature, upgrade cycles were already pointing to 2024–2025 being the next year of iPhone upgrades. Last year’s data strongly indicates that users were pushing out their upgrade cycles from every 1-2 years before the pandemic to 3 or more years after the pandemic. A lot of this was due to inflationary pressures but also to the pull forward in demand seen during 2020–2021, when sales of digital devices skyrocketed during the pandemic. Some of that demand from upgrade cycles should start to be seen starting with the iPhone 16.

Second, Apple Intelligence should only exacerbate that demand, as seen in recently collected survey data about users looking to upgrade to the iPhone 16 due to Apple Intelligence features. Another example of user demand for AI phones can also be seen in Samsung’s sales of its flagship Galaxy smartphones, which saw a positive reversal in mobile phone shipments in Q1 and that momentum continued in Q2, staying in the 19–20% range.

I believe Apple can easily build on the strong single-digit revenue growth momentum it posted last quarter and deliver another 5–5.5% y/y of revenue growth in the upcoming Q4 quarter as well.

Exhibit D: Apple’s revenue & operating income growth rates (YCharts)

With demand signals staying intact, I expect Apple to deliver ~1.7–1.8% of top-line growth in FY24. This should also translate to 7–7.5% revenue growth through FY26, an increase from the ~6% growth I was initially forecasting per my previous coverage on Apple.

Valuation Points to Upside in Apple

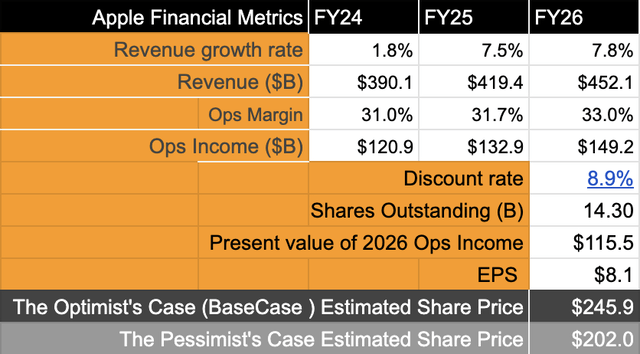

The point of this valuation exercise is to highlight Apple’s risk/reward along with price targets in each scenario.

I have already established that I expect Apple to grow its revenues by 7.5% CAGR through FY26 in the previous section. The expansion in top-line growth as well as Apple’s Services revenue will boost its margins. Revenue from the App Store, Apple Pay, and subscriptions should continue to boost margins.

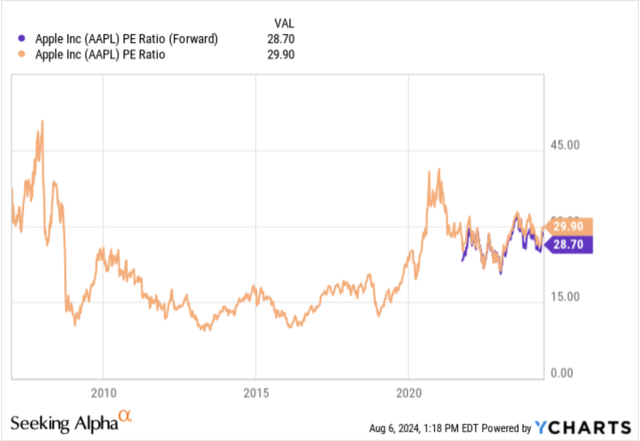

Through FY26, I estimate 12.3% CAGR growth in Apple’s operating income. What will also help the company’s per-share earnings is its largest ever buyback program, worth ~$110 billion. Using a discount rate of ~8.9%, I believe that Apple’s valuation multiple will stay elevated at ~29-30x due to the growth in its income relative to the S&P 500’s long-term growth rates.

Exhibit E: Apple’s valuation metrics over time (YCharts)

Even if I assume that overall market conditions further deteriorate on a seasonal basis, I still believe a forward multiple of 25x can be applied in the short-term pessimistic case. This still points to enough upside in the mid- to long-term for my optimistic base case, as pointed out below.

Exhibit F: Apple’s risk/reward metrics are skewed towards reward based on its valuation (Author)

Risks & Other Factors to be Aware of

The market is currently trying to wean itself out of the turmoil arising from the Yen carry trade, which could impact markets in the immediate near-term as most margin trades get unwound and washed from the system. I explained the details of this carry trade in a recent post on Bitcoin, and I believe volatility will normalize once those margin trades are squared off.

Recently, the DoJ won an antitrust lawsuit against Alphabet’s Google (GOOG) that ruled that the ubiquitous search engine exploited its dominant market share to have its search engine as the default search app on devices, including Apple’s iPhones. Google paid Apple a royalty fee that amounted to ~$20 billion two years ago. More than impacting revenue, I believe this would be a headwind to Apple’s operating income. The timing and dollar volume of the impact are not known at this time. Plus, Google plans to appeal the case, which will lengthen the process, but for now, there seems to be no impact yet.

Takeaway

Apple looks to be in a strong position as it cycles through H2 of 2024, with robust demand signals outweighing other concerns that arise from global developments or from the idiosyncratic position the company finds itself in due to Berkshire unloading a major part of its Apple stake. I do not see any fundamental cause for concern here, and any pullbacks can be bought.

I have upgraded my rating on Apple to a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.