Summary:

- Apple is historically a fiscally sound company with an extensive range of consumer-oriented technology products and services.

- A slowdown in hardware sales due to a softening macroeconomic environment has resulted in contracting revenue streams.

- The huge bull run YTD was driven by speculation and came on the heels of the firm’s worst Q1 and Q2 in almost 20 years.

- Shares are currently excessively pricey compared to their intrinsic value, making it difficult to advocate investing at current prices.

- Any drop in pricing levels towards a fairer valuation would present a great opportunity to invest in a high-quality company.

EKIN KIZILKAYA

Investment Thesis

Apple (NASDAQ:AAPL) is one of the most historically profitable and fiscally sound companies in the world. Their extensive range of attractive consumer-oriented technology products and services harbor the firm an almost impenetrable economic moat.

Unfortunately, poor 2023 fiscal performance combined with a bull-run based on market sentiment and speculation have led to shares becoming excessively pricey compared to the firm’s present intrinsic value.

This makes advocating building a position in the firm at current prices impossible. Nonetheless, any drop in pricing levels towards a fairer valuation would present a great opportunity to invest in a truly high-quality company.

Company Background

Apple is an American MNC headquartered in Cupertino, California. The influence Apple holds from both fiscal and societal perspectives is truly unrivalled in the technology industry.

Most of Apple’s revenue arises from their physical technology sales with primary sales coming from their iPhone lineup, Mac personal computer range or from the host of other technological accessories such as smartwatches the brand pursues. All of Apple’s products occupy the luxury end of personal technological devices. Significant diversification into the services industry has positively contributed to the firm’s overall revenue streams and signals a slight pivot in their business strategy.

The firm is trying to shift away from being just a device manufacturer and become a more integrated, unavoidable requirement in most peoples’ daily lives through the provision of a wide range of entertainment, financial and health services,

The company still has the highest valuation of any company currently being publicly traded. Their current market cap of around $2.81T. This figure is truly astronomical and most definitely not supported by intrinsic value calculations in my view.

Economic Moat – Q3 FY23 Update

I conducted a full in-depth analysis of Apple’s economic moat back in February 2023 which I still believe holds validity in today’s market environment. For a more in-depth analysis check-out that article here: “Apple: The Right Company At The Wrong Price”.

I will conduct another quick update here to sum up the company’s core business model along with the changes that have affected Apple’s key moatiness drivers.

Apple hosts an incredibly broad moat when compared to most other personal electronic device manufacturers. The primary drivers for their moat is their incredibly valuable brand image, extensive proprietary product portfolio and the growing set of services accompanying these physical products.

Apple.ie | Homepage

Apple remains the undoubted market leader when it comes to the manufacture and sale of luxury personal electronic devices. Their iPhone, iPad and Mac lineups of phones, tablets and personal computers are easily differentiated from the homogenous competition through incredibly refined user experiences and high-end physical design.

This focus on creating technology which appeals to more qualitative and subjective purchase criteria in consumers helps increase the ‘stickiness’ of their marketing and brand appeal. In-turn, this creates a sentiment among consumers where purchasing an Apple product is an aspirational goal.

Apple.ie | One

These high-quality devices are complemented by a huge portfolio of Apple designed applications and services such as Apple TV, Music, Card and Health. These proprietary designed online products are incredibly well optimized to work within the Apple ecosystem which translates to a highly intuitive user experience.

Once more, Apple has taken extreme care in engineering services which work seamlessly with their own products to make the more universally compatible competition from Windows, Android or third-party designed apps function to an inferior level relatively speaking.

This creates increased switching costs for consumers looking to change away from the Apple ecosystem as such a decision would require the adoption of a whole new raft of applications and devices.

Apple.ie | Newsroom

Regarding Apple TV, the company’s recent push to significantly increase the availability of live sports on the platform through Major League Soccer (MLS) and Major League Baseball (MLB) season pass agreements acts to attract a whole new category of consumers to the platform.

Apple.ie | Newsroom

While these television rights are not unique to Apple TV, the potential for such a shift to occur in the long run seems quite likely given the rapid adoption rates of streaming services and disposal rates of cable subscriptions.

Apple.ie | Newsroom

The Apple Card savings account offered jointly with Goldman Sachs has seen explosive growth with over $10B being secured in deposits since the accounts launch in April of this year. The tight integration with Apple services and technologies provides customers with superior insight and analysis into their savings while Goldman Sachs has struck a deal with Apple to offer these customers an almost unrivalled APY of 4.15 percent.

While many criticized and were cautious of Apple’s move into the financial services sector, I believe it to be one of the smartest decisions made by the company yet. This pivot signifies an overarching transition to becoming a much more holistic services provider and helps cement their position in the daily lives of consumers.

However, there seems to be some small cracks forming in Apple’s almost impenetrable economic moat. Apple’s hardware sales have continued to decline with iPhone, iPad and Mac sales continuing to decline as we move through 2023.

Mac and iPad sales have been particularly hard hit with shipments having fallen 9% and 26% respectively YoY in Q3 of 2023.

The recent WWDC 2023 may have been one of the most influential Apple events we have seen in a long time as the presentation included the launch of an entirely new computing solution: the Apple Vision Pro.

Apple.com | Vision Pro

Vision Pro is an augmented reality computing headset designed to replace a user’s computer, monitor, TV and Cinema setup. While this device is no-doubt revolutionary and has the potential to completely change the way in which we interact with computational technology, defining what degree of moatiness this brings the company is difficult.

Vision Pro could bring about a seismic shift in the way in which consumer interact with computational technology. However, the timeline required for Vision Pro not only to become profitable for Apple but to enact this proposed paradigm shift is unclear.

Therefore, it is difficult to assign any significant increase in moatiness at present time to Apple’s moat derived from the Vision Pro headset.

When considering the company as a whole, it is clear Apple still possesses an unrivalled brand image which permits the firm to charge consumers significant premiums for their products.

The company has developed a unique formula which utilizes tight vertical integrations to ensure any new consumer in one element of their product and service ecosystem is enticed to become fully integrated in their brand.

However, while their software solutions continue to drive an increased economic moat for the firm, the continued weakness in hardware sales results suggest the company is not as immune to global economic trends as some investors believed.

The very real probability of a recession could hurt Apple just as much as any other global tech giant which means prudence and care must be utilized when making an investment decision.

Still, I rate Apple as having a very wide economic moat which provides the company a tangible competitive advantage for at least the next 15 years.

Financial Situation – Q3 FY23 Update

Apple FY23 Q3 Press Release

Apple’s FY23 Q3 results were not what the tech giant needed to maintain their astronomical valuations in mid-2023. Once we cut through the marketing jargon present in their Q3 press release and examines their 10-Q SEC filing, the situation in Cupertino looks a little more concerning.

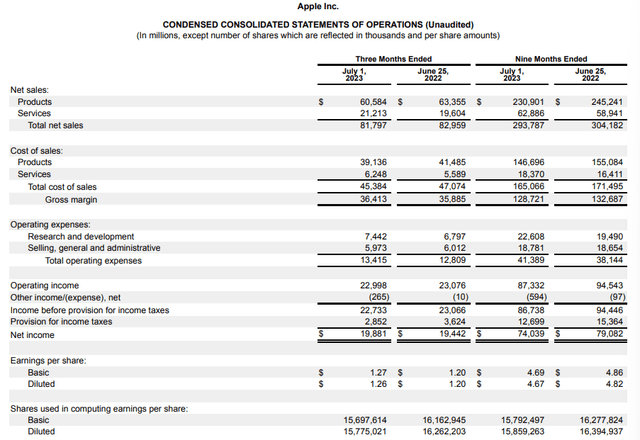

Total net sales (TNS) for Q3 declined 1.4% YoY with H1 2023 results showing a slightly more pronounced 3.4% drop YoY. This was primarily due to significant weakening hardware sales of iPhone, iPad and Mac sales.

Apple’s services segment actually helped elevate their TNS figures as the business segment saw revenues grow 8% in Q3 YoY.

Apple FY23 Q3 10-Q

Notably, Apple also managed to increase their gross margins in Q3 FY23 by 1.3% YoY thanks to a decline in the COGS for their products segment. While margins did increase which illustrates an efficiency gain in their overall business processes, it is highly unlikely that these improvements were made in their hardware supply chains.

Most likely, the increasing proportion of COGS generated by their services segment along with a decline in variable costs associated with more metered hardware production and the higher margins present within their services business segment are responsible for the overall margin expansion.

I still view this improvement in margins positively as it illustrates the even greater margin expansion potential present at Apple as they continue to increase the overall size of their services business segment.

Some positive news from the press release includes the slight 2.1% YoY quarterly growth in net income the company was able to achieve. This was primarily due to a decreased provision of income taxes in Q3 FY23.

Seeking Alpha | AAPL | Earnings

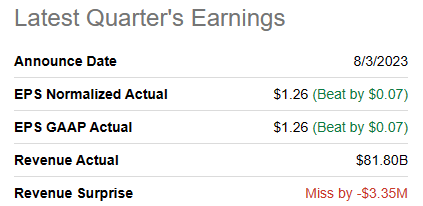

Diluted EPS increased $0.06 YoY to a quarterly total of $1.26. This beat analyst expectations by $0.07. However, the overall revenue miss combined with slowing hardware sales created an atmosphere of caution among investors.

Apple FY23 Q3 10Q

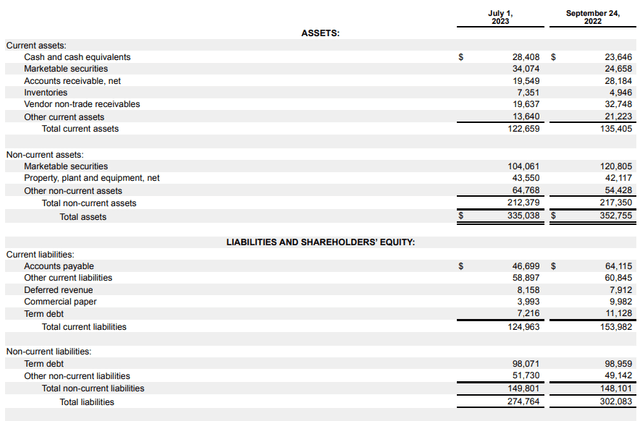

From a balance sheet perspective, the most notable changes in Q3 are the significant decreases in both assets and liabilities. Total current assets dropped 9.7% YoY due to a sharp decline in vendor non-trade receivables, accounts receivables and other current assets.

This drop in receivables combined with inventory growth of almost 100% compared to Q3 FY22 is to be expected given the softening demand for their hardware products. While this is to say that I am not surprised by this change, I am still not particularly thrilled as it illustrates quite an acute decrease in sales compared to the company’s expectations for the quarter.

Furthermore, given the almost inevitable nature of a late 2023/early 2024 recession in the U.S., I believe this slowdown in sales will continue due to the luxury nature of Apple’s products and the ensuing increased disposable income elasticity to demand these products hold.

Nonetheless, total liabilities have also decreased YoY by 9.3% thanks to a decrease in current-liabilities of term debt, accounts payables and commercial paper. Apple has not seen any material change in their long-term non-current liabilities with repayment schedules and obligations remining constant.

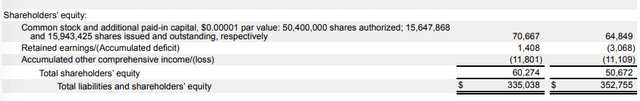

Apple FY23 Q3 10Q

Apple’s continued share buybacks have resulted in the firm’s total shareholders’ equity increasing 19%.

I believe the $90 billion worth of share repurchases illustrates an over-optimistic attitude which is aimed at soothing any souring sentiment among investors. I do not believe the repurchases were warranted given the highly elevated share price.

Apple remains an incredibly cash-rich business which is optimized at generating real income for shareholders and the firm alike. While their long-term profitability is not at risk thanks to their robust economic moat, a short-term decrease in fiscal performance seems almost unavoidable.

Regardless, I still believe that the key issue currently facing shareholders is not the short-term slowdown in sales, but Apple’s truly incomprehensible valuation.

Valuation

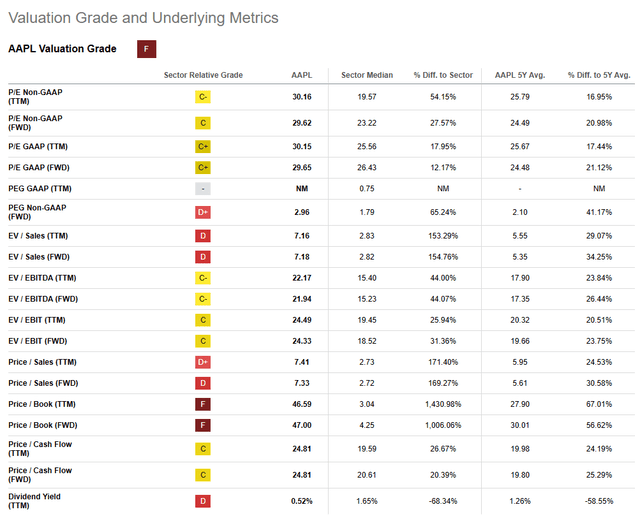

Seeking Alpha | AAPL | Valuation

Seeking Alpha’s Quant has assigned Apple with an F Valuation rating. Unfortunately, I believe this assessment represents a realistic evaluation of Apple’s current share price. Bear in mind, these figures are already including the 8% selloff that ensued post Q3 results.

The firm is currently trading at a P/E GAAP FWD ratio of 29.65x and a P/CF TTM ratio of 24.81x. When considered against a FWD Price/Book ratio of 47.00x and an EV/Sales FWD of 7.18x, it is clear to me that the current share price represents a significant intrinsic overvaluation of the firm.

Seeking Alpha | AAPL | Summary Chart

From an absolute perspective, Apple shares have risen 41% YTD. This hype-driven bull run came on the heels of Apple’s worst Q1 and Q2 results in almost 20 years. As the firm’s fundamental profitability decreased, Vision Pro hype and a “this time it’s different” sentiment overruled.

Unfortunately for many, such a sentiment driven market can only last so long.

Instead of focusing on market sentiment and news stories, I believe the decision to continue to focus on traditional valuation metrics is most prudent especially given the convoluted macroeconomic backdrop shrouding today’s economy.

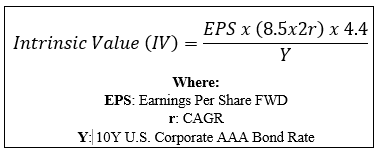

By accomplishing a simple financial valuation based on the calculation below and using the estimated 2023 EPS of $6.06 a realistic r value of 0.09 (9%) and the current Moody’s Seasoned AAA Corporate Bond Yield of 4.66x, we can derive a base-case IV for Apple of $152.00.

The Value Corner

When using this realistic CAGR value for r, Apple appears to be overvalued by around 17%. By using a more pessimistic worst-case 2023 growth estimate (which aims to replicate a late 2023 recession softening iPhone and Christmas sales) CAGR value of 0.07 (7%), shares are valued at around the $128.00-mark, 37% lower than currently.

Therefore, I believe Apple is currently modestly overvalued. Both an absolute comparison to historic share prices combined with an intrinsic value calculation suggest the company’s shares are trading at a tangible premium to their real value.

Apple has historically been able to command a slight premium for its shares compared to their intrinsic value, but the pronounced 17%-37% overvaluation is difficulty to overlook. Furthermore, it was only as recently as December 2022 that Apple shares were available at a slight discount compared to their intrinsic value.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. While the slight market correction has already knocked $23 off shares, I believe the poor momentum and lackluster results will continue to drive prices lower.

Thereafter, much depends on the prevailing macroeconomic conditions and the severity of the recession now forecast for late 2023.

In the long term (2-4 years) I fully expect their position as a leader in the industry to become even stronger. Their unique product offerings combined with the undoubtable branding power places little doubt in my mind over the almost undoubtable returns the company should be able to provide to shareholders.

Nonetheless, the excessive valuations currently present in shares combined with a downward shift in momentum makes it almost impossible for me to advocate building a position in the firm.

Risks Facing Apple – Q3 FY 23 Update

Apple still faces the same risks of increased competition within the market, failed execution of products along with the negative social sentiment arising from anti-repair tactics. However, the company also faces the very real short-term risk of falling consumer discretionary income.

If consumers have less to spend on luxury goods, Apple’s core revenue driving product categories such as the iPhone, iPad and Mac lineups will see declining sales and popularity. This could definitely hurt FY23 results thus potentially leading to a pronounced market correction in the firm’s share prices.

This very real threat should not be underestimated given how hard it is to predict how markets will react to certain events. While the impacts of the U.S. banking crisis seem to have been relatively mute in wider equities markets, the underlying market fundamentals suggest a recession is very likely in 2023.

A late 2023 recession would negatively impact the usually strong iPhone sales in Q4 combined with the sales normally extracted during the holiday season. A soft Q4 for Apple could see the firm’s full-year results hampered significant compared to previous years.

Summary

Apple has had an incredibly impressive history from an investor standpoint. Their robust, premium business model, excellent operational efficiency and iconic brand reputation have allowed the company to become a true profit generation powerhouse.

Unfortunately, a significant YTD bull-run based on I think nothing more than rumor, news and hype has led to shares becoming significantly overvalued. Even the firm’s robust economic moat and strong pricing power cannot sustain such a pronounced double digit overvaluation in the long-run.

This makes advocating the proposition of investing in the firm essentially impossible at the current time. I want to stress that this sentiment is only rooted in the expected performance of the firm given traditional valuation and business analysis metrics. The forecasting of speculation-related price changes is impossible.

As a short-term investment, I believe there is too much volatility present in Apple which unfairly exposes investors to significant downside potential.

As a long-term investment I still fully believe their undeniable position as a market leader places Apple firmly in position to generate great shareholder value. At a better price, or even fair valuation, one could undoubtedly argue building a position in the tech giant.

The significant overvaluation combined with poor 2023 performance warrants a continuation of my Sell rating for Apple.

Still, to emphasize, I believe long-term value generation has not been compromised, short-term headwinds are too great to justify building a position at these prices. Once the right price comes along, I will be buying with greed.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.