Summary:

- Apple continues to post resilient fundamentals, especially on a constant currency basis.

- Yet the stock appears richly valued when assessed against consensus estimates for forward growth rates.

- There are reasons to hope for an acceleration in growth rates over coming quarters.

- I explain why this is a thesis on multiple expansion and why the stock may see incessant growth over the long term.

Shahid Jamil

This is the “year of efficiency” or if you ask others, the year of artificial intelligence. Apple (NASDAQ:AAPL), the largest company in the US stock market, has surprisingly been left out of this excitement as management has given little indication that they intend to release an AI offering of their own. This is a company which is seeing decelerating growth amidst a tough macro, yet has a stock still trading at generous earnings multiples. Many investors may be puzzled by that backdrop and may even assume that a bearish stance is warranted. While patience is needed, I remain of the view that long term investors may appreciate the ever-increasing moat being built around the Apple ecosystem.

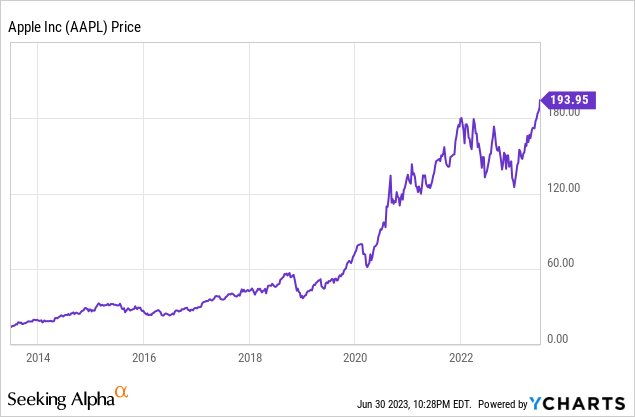

AAPL Stock Price

AAPL stock is trading at all-time highs. It is clear that AAPL is a stock in which Wall Street has shown a great willingness to look to the long term.

I last covered AAPL in March where I explained why I, as a former bear, was throwing in the towel after having a “eureka” moment and was turning bullish. Despite lukewarm financial results, the stock is up around 21% since then, but this is a rare stock which I can continue recommend buying in spite of a lofty earnings multiple.

AAPL Stock Key Metrics

In its most recent quarter, AAPL saw revenue decline 3% YOY but due to its famously aggressive share repurchase program, earnings remained unchanged at $1.52 per share. Investors may have been disappointed by the tepid 5.6% services revenue growth, but as management pointed out on the conference call, the tough macro has greatly affected digital advertising, and the company is also lapping tough pandemic comps in mobile gaming. Revenue was most greatly affected by the 31% decline in Mac sales which was blamed on a tough comp due to the previous year seeing a “launch of the completely reimagined M1 MacBook Pros.” Eventually, AAPL will move past those tough comps and this headwind may even become a tailwind. Management noted that foreign exchange generated a roughly 500 bps headwind. The company would have generated some top-line growth excluding such headwinds. With these three line items now accounted for, AAPL’s revenue numbers might instead be viewed as showing great resiliency in spite of a tough macro environment. I should also point out that AAPL may see some geographic tailwinds moving forward, first from China’s reopening following the pandemic as well as likely benefit in Europe from any resolution of the Russia-Ukraine war.

AAPL ended the quarter with $166.4 billion of cash versus $109.6 billion of debt and management reiterated expectations to bring their balance sheet to a leverage neutral position over time. The share repurchase is a less meaningful catalyst as compared to prior years due to the stock’s relative valuation, but at the very least there is the implication that AAPL should be able to provide a shareholder yield in excess of its earnings yield for the near future. The company also announced an additional $90 billion share repurchase program, which while nominally large, represents a small fraction of the current market cap.

Looking forward, management has guided for similar revenue growth (decline, rather) numbers in the next quarter, which incorporates expectations for a similarly tough macro environment as well as a slightly reduced 400 bps headwind from foreign exchange. Rather critically, management expects Services revenue growth to remain pressured, again due to the same digital advertising and mobile gaming headwinds discussed above.

Is AAPL Stock A Buy, Sell, or Hold?

With financial results that are OK, at best “good,” and by no means “very good,” investors may be surprised to see the stock trading at around 32x forward earnings.

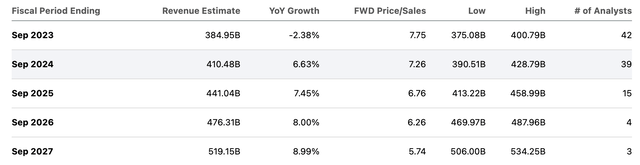

Consensus estimates for mid-single-digit revenue growth moving forward do not help materially to justify that valuation.

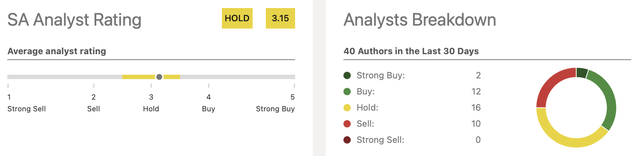

It appears that my peers are beginning to downgrade the stock, largely due to valuation.

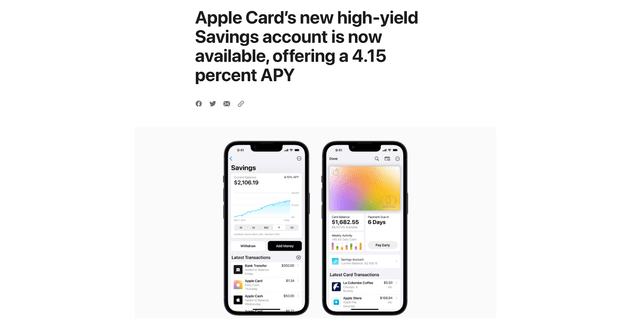

It would be dangerous to short the stock due to valuation, especially without considering exactly why the stock trades so richly. AAPL has built a very unique ecosystem in which the company has end-to-end control ranging from supply chain to distribution. The current profits mainly come from selling the physical products, but the valuation multiple reflects the nearly inevitable profit growth from this engaged ecosystem. AAPL continues to take market share due to having great brand loyalty and reputation. Unlike in the Android market in which consumers might switch from manufacturer to manufacturer quite often, AAPL stands to earn all the profits over an iOS user’s lifetime. AAPL can sell additional ecosystem products like computers or watches which only help to increase the switching costs. I realize that most investors have heard that thesis already – but I suspect that it is being overlooked nonetheless. The real profit opportunity comes over the long term, as AAPL may be able to continually expand its ecosystem even beyond what is apparent today. AAPL has already made waves in growing its advertising business. While AAPL has earned some headlines for its entrance into the virtual reality market, I am not yet including much benefit from that segment in the ecosystem as I remain skeptical on near term adoption. As I detailed in my prior report, AAPL may also be able to create its own search engine in the future, something I would expect to prove highly successful from the get-go, and it might not even need an AI-chat bot to do so. Yet we are already seeing AAPL exercise its brand power with the announcement of its new high-yield savings account.

Over time, I see AAPL using its dominant smartphone position to become a bigger and bigger part of the economy. I can see the company eventually selling TVs and other electronic equipment, starting from those with the greatest profit potential. It makes sense that AAPL is starting with banking as that may prove to be a high-margin opportunity in an industry long-due for disruption. I do not expect this transformation to happen overnight. But I can see these developments helping the company sustain 3% to 5% revenue growth over the long term, which in turn should lead to roughly 4% to 6% earnings growth (prior to the effect of share repurchases). If we now frame AAPL as being a wide-moat stock trading at 32x earnings with 4% to 6% long term earnings growth, then the valuation appears much more understandable, especially as it is compared to the consumer staples sector which typically commands rich valuations with weaker balance sheets than seen here. One can compare AAPL’s valuation to that of real estate investment trusts (‘REITs’) or any other consistent growers which might even trade at higher price to earnings growth ratios (‘PEG ratio’) when factoring in the likelihood that growth rates in the near term may hover more around the 6% to 8% level.

That said, I can admit that the current earnings multiple is definitely at the high end of my fair valuation range as the stock might be able to deliver only market-returns from here. The lack of obvious multiple expansion potential is why I am slightly downgrading from “strong buy” to “buy.” Buying AAPL here is more of a quality play than one about growth due to the high valuation and low forward growth rate. That is admittedly not my typical investment strategy as I tend to favor stocks trading with both multiple expansion and high-growth potential. This is a stock in which I can see delivering solid growth and trading within a valuation range of 22x to 35x earnings, but that remaining multiple expansion upside might not occur so quickly without a decline in interest rates. But the key point here is that the stock can justify and sustain its high earnings multiple due to the high confidence that the market places on the company’s ability to grow over the long term (for now, that growth may be powered in the near term by services, but as stated above I expect the company to continually add new products to its ecosystem) and to do so without needing the same “breakthrough” innovation that had previously driven some other releases (like the iPhone). Instead, I see the company using its name brand to enter new industries (as evidenced by the Apple-branded bank account and Apple Pay) in what undoubtedly marks a transition away from the innovation-heavy team previously led by Steve Jobs. I am among the many who have at some point blamed the company for the lack of breakthrough innovation since first delivering the iPhone, but my point here is that future growth – and therefore shareholder returns – may not need such innovation at all, helping to support the high earnings multiple.

Risks and Conclusion

What are the key risks? The most important risk is that of valuation. AAPL stock appears very richly valued relative to mega-cap tech peers on a growth adjusted basis. If sentiment deteriorates regarding the quality of the business model then I could see the stock underperforming solely due to multiple compression. AAPL faces great macro risk and there is a slim risk that a tough economy shifts consumer preference toward cheaper android models. It is possible that AAPL is forced to reduce its 30% app store fees over time, which may pose considerable headwinds to the services revenue growth rate. There is also the possibility that my long term view of the company is misplaced – it is always possible that management possesses no such long term view and is instead “milking the cow” and too focused on near term profits. In particular, I am of the view that external M&A should be preferred over share repurchases given the rich valuation of the stock price today. That point is especially true considering the valuation reset in the tech sector over the past several years and continues to be true even today after a substantial rally from the lows. Still though, I can understand the desire to return all of free cash flow to shareholders as this is typically the playbook of a consumer staples company seeking to earn a rich valuation multiple, but my opinion is that it may represent over-management of the stock price. I rate the stock a buy in spite of the rich valuation because there appears to be great positive momentum towards increased confidence in the ecosystem and thus further multiple expansion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!