Summary:

- Insiders have sold over $40 million in shares of Apple since 3/22/2023.

- Apple’s largest supplier, Foxconn, reported a 21% decrease in sales and stated that sales would continue to decrease through Q1.

- Low demand for VR headsets across market leaders gives a poor outlook for Apple’s anticipated VR headset.

- Apple is lagging in the AI race compared to Google and Microsoft.

- Rising interest rates makes tech stocks less appealing for several reasons.

Shahid Jamil

Investment Thesis

Apple (NASDAQ:AAPL) has seen over $40 million in insider sales as of 3/22/2023. I think the increase in insider selling is due to the company’s poor economic outlook. Foxconn, Apple’s largest supplier, reported earnings yesterday and displayed a 21% decrease in sales in March. Additionally, the VR market is seeing much lower than expected demand for VR headsets and could prove to be a hard sell when Apple rolls out their VR headset. Lastly, Apple is lagging in the AI race while interest rates continue to rise and hurt tech stocks.

Insider Selling

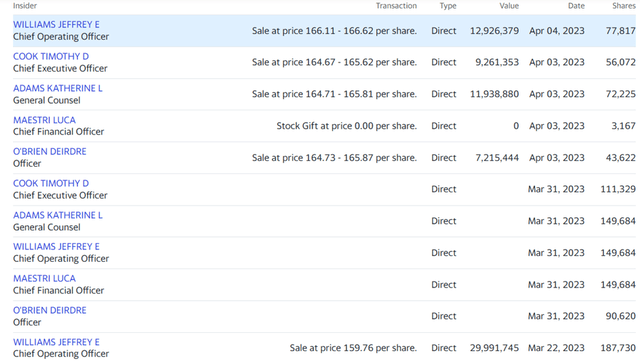

As of 3/22/2023, Apple insiders have sold over $40 million in shares of stock as seen below.

Additionally, the members who are selling are key members of the management team such as Tim Cook (CEO) and Luca Maestri (CFO). Furthermore, this is Tim Cook’s first sale of Apple stock in over two years. Usually when you see insiders selling at this high of an amount and this quickly, especially being the CEO and CFO, management’s outlook for the stock has significantly deteriorated and you can assume the top may be in for Apple’s stock for the time being.

Foxconn Performance

Foxconn is Apple’s largest supplier, dubbed “iPhone City” by those familiar with the company. Since Foxconn has earnings ahead of Apple’s earnings, Foxconn’s earnings can provide us with valuable insight into the demand for Apple’s products and overall demand for the industry. Foxconn reported earnings on 4/5/2023 and saw a 21% decrease in sales in March. Additionally, Foxconn’s forward guidance is continued decreases in sales through Q1 2023. As Foxconn is the largest supplier of iPhones, a 21% decrease in sales gives some insight into potential decreased demand from Apple’s customers. Additionally, Apple stopped giving forward guidance regarding its stock, so the information from Foxconn saying continued decreases can be expected can give us insight to demand from Apple customers since about 50% of Foxconn’s revenues come from Apple alone. What I can gather from Foxconn’s earnings is that Apple iPhones should see a continued decrease in demand into the next quarter as sales slow further.

Rumored Virtual Reality Headset

Tim Cook has teased customers with a VR headset in September of 2022, although not all of the details are confirmed yet. Multiple source say the Apple VR headset is going to be more expensive than other VR headset brands, coming in as high as $3,000. One of Apple’s VR competitors is Meta’s Quest Pro, whose original listing price was $1,500. Additionally, Meta had to drop the price to $1,000 to try to spur demand due to lower than anticipated sales since release. Additionally, Sony cut its PS VR2 production by 20% and Pico (China’s Premier VR Brand) shipments were 40% less than expected. Apple rolling out their own VR headset right now cold prove to have a negative impact on the firm’s bottom line.

Lagging in AI race

The hot topic as of lately in the tech space has been Artificial Intelligence. The most popular of the AI programs to come out lately has been ChatGPT, who is partnered with Microsoft. Other large tech companies have come out with AI applications, such as Google’s Bard. Apple has been mostly quiet regarding the AI boom, having no comments on the subject to date. According to Precedence Research, the AI industry has the potential to be $1.59 trillion by 2030. Lagging in the AI race among competitors like Google and Microsoft can have Apple missing out on a very large emerging industry in tech.

Tech and Interest Rates

Tech stocks and interest rates are negatively correlated, as interest rates rise tech stock prices tend to decline. This can be seen in the chart below when prices fell from $360 to $274 after the first two rate hikes.

As the Fed continues to raise interest rates, money becomes more expensive and loans that would have been taken out to expand operations may be delayed due to increased costs. Additionally, since interest rates have increased, fixed income starts to look more attractive when compared to risky equity investments.

Risks

Apple’s stock is building lots of momentum as of recently, with their stock being up ~32% YTD. With tech stocks starting to show signs of recovery from rising interest rates, Apple’s stock could continue this upward trend and increase in value.

Additionally, Apple maintains one of the most impressive balance sheets amongst all public companies in terms of cash totaling $51.3 billion. A large safety net such as this can provide the company with the funds they need during a period of declining sales and profit.

The market has been predicting the Fed to pivot for quite some time now. If the Fed were to pivot and keep interest rates flat or start to decrease them, I would expect this Tech crash to turn into a tech rally and tech stocks like Apple to increase in value.

Conclusion

Overall, I believe Apple is a “hold” as of now given the current circumstances surrounding the stock. With the CEO, CFO, as well as other notable employees selling over $40 million worth of stock in a matter of 2 and a half weeks is startling for any investor to see. I believe this change in managements perspective of Apple’s future performance can be attributed to a couple of things; such as Foxconn’s 21% decline in revenue, unanticipated decreases in VR demand, Apple lagging in the AI race, as well as rising interest rates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.