Summary:

- The stock of Apple is up just a tad over 20% in 2024, inline with the performance of the S&P 500.

- From a valuation perspective, the stock is in uncharted territory using many traditional valuation measures.

- We look at the ‘tale of the tape’ on Apple from several historical valuation metric comparisons in the paragraphs below.

t_kimura/iStock Unreleased via Getty Images

I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.” — Warren Buffett

Today, we put the largest company by market capitalization in the spotlight. Apple (NASDAQ:AAPL) has enjoyed a just over 20% return so far in 2024, much like the S&P 500. And like this index, based on historical comparisons and key valuation metrics, the stock of the tech giant from Cupertino is quite ‘stretched‘ from a valuation point of view. The equity has surpassed a $3.5 Trillion with a T market capitalization, which is more than the annual GDP of the United Kingdom!

Investors appear to be betting that things are truly different this time in regard to the economy, longer term global growth prospects, and that traditional valuation parameters no longer apply to Apple and its fellow mega caps in the market like Amazon (AMZN). Are they right? Let’s take a look at some of Apple’s key valuation metrics.

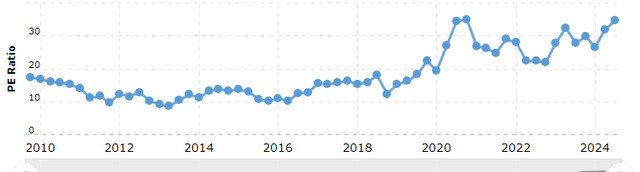

Apple’s historical price to earnings ratio (Macrotrends)

Let’s start with the traditional P/E ratio. As can be seen above, AAPL is trading at 35 trailing earnings. That is a slight premium to the overall S&P 500 which is changing hands at just over 30 trailing earnings (A tad above the index’s P/E ratio just before the Internet Boom turned into the Internet Bust in early 2000 for those market history buffs out there). It is also right at very ceiling of where Apple has traded based on this metric in recent memory.

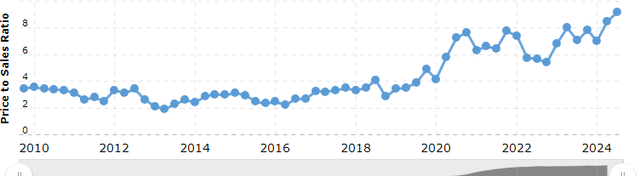

Apple’s historical price to sales ratio (Macrotrends)

On a price to sales ratio, AAPL is enjoying even more rarified air. The stock is trading at north of nine times revenues, a level that the equity has never touched before. Prior to the Covid, AAPL traded for approximately half that level as a point of comparison. Finally, from a Price to Free Cash Flow basis, AAPL also is in uncharted territory.

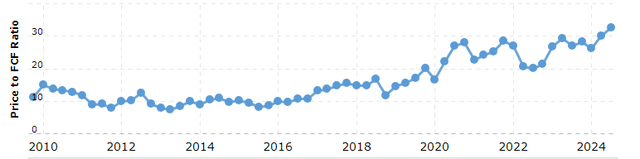

Apple’s historical price to free cash flow ratio (Macrotrends)

Apple currently has a free cash flow yield of just a tad over three percent. The yield on the ‘risk free‘ 10-Year Treasury currently hovers around 4.1%. The stock pays a pittance of an annual dividend (.43%), which does little to enhance the yield of AAPL.

The good news is sales growth is returning after a couple of years of being largely stagnant. The current analyst firm consensus sees sales growth of nine percent in FY2024 and eight percent in FY2025. They also project earnings growth of just over 16% this fiscal year and 12% in FY2025. Given earnings a CAGR of 14% over the two fiscal years. That also means at its current valuation, AAPL’s PEG ratio is 2.5.

I have no problem paying a 1.5 PEG for a good company churning out consistent 10% annual increases in earnings and revenues. A 2 PEG ratio could be more than appropriate for a great company delivering consistent sales and profit growth in the high teens or 20s. Apple is more the former than the latter, so I would like AAPL at $140 (21 times FY2024E EPS of $6.67 a share). If I believe AI was truly going to boost Apple’s earnings and earnings growth significantly in the coming years, I could maybe stretch to slapping a 2 PEG on AAPL. This would get me to $187 a share (28 times FY2024E EPS of $6.67 a share).

However, AAPL trading north of $235 a share is simply a no-go for me given where the stock is changing hands at using its historical valuation metrics. To give in to FOMO at this point would be to believe that ‘things are different this time‘. And after 40 years of investing, I have found these are five of the most dangerous words in the English language for investors.

AAPL Stock Price – Seeking Alpha

Ending on a non-valuation point, the stock appears to be at a potential short-term resistance level from a technical view. Now, given how irrational the overall market has become from a valuation viewpoint, which I covered in this recent article, AAPL could well break through this resistance on this go around. If the stock fails again at this level, it could become a headwind along with the overall valuations’ levels of the stock. For those investors that short stocks, it might make a good entry point for a short term trade if resistance holds again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.