Summary:

- Apple’s launch event last week unveiled several new products, with the iPhone 16 as one of the highlights.

- However, investors should look beyond its hardware updates (not only with iPhones, but also with iPad, iMac, etc.) and focus more on software and subscription growth.

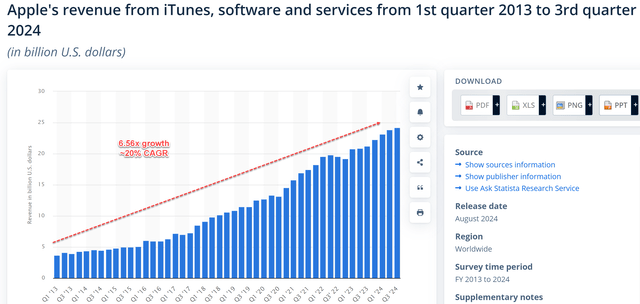

- Apple’s service revenue, now its second-largest income stream, has grown impressively, with a 6.56x increase since 2013, and continues to expand.

- Go forward, I expect its AI and subscription-based services to not only drive EPS growth but also expand margins.

Sjo/iStock Unreleased via Getty Images

AAPL stock: Previous thesis and new developments

I recently wrote an earnings review about Apple (AAPL). The article was titled “Apple Q3: I Disagree With Bears’ Interpretation Of Berkshire Divestiture” and was published on Aug. 9, 2024. As you can already guess from the title, the article was motivated by Berkshire’s holdings changes since the release of its FY Q3 financial results. More specifically, the article argued that:

Many analysts issued bearish ratings on AAPL following Berkshire’s divestiture and iPhone sales data reported in its Q3 earnings. These concerns overstated the risks or are simply misplaced, in my view. The prevailing interpretation of BRK’s divestiture ignored some basic facts. For example, the remaining position is still ~30% of its equity portfolio and BRK enjoys cash deployment options inaccessible to individual investors.

Since then, there have been a few new developments around the stock, and the most significant one was Apple’s launch event last week. At the event, AAPL showcased several new products, and as usual, its new iPhones (iPhone 16) grabbed the attention of analysts the most. On the Seeking Alpha platform alone, several authors have reviewed the events with a focus on the new iPhones. In my view, the rollout of AI-related functionalities (see the next figure below) is likely to catalyze another upgrade cycle in the near term and create long-term opportunities.

Source: Apple.com

However, the discussion thus far has mostly focused on the hardware aspects of Apple’s new devices. Thus, my goal here is to switch perspectives and discuss the software ecosystem surrounding the companies, especially the subscription-based services. My past investing and consulting experiences have taught me that software often creates a wider and more durable moat than hardware. Judging by the features of AAPL product’s new features and recent financials, I believe AAPL is progressing on this front rapidly.

AAPL: Focus on subscription and services

Let me start with a broader picture to prime the discussion before I dive into specific examples. The Services category is now the second-largest income stream for AAPL already. Its topline increased 14%, to $24.2 billion, also an all-time high in the past quarter. The chart below provides a visual representation of Apple’s service revenue growth in the past decade (including iTunes, software, and services). Starting at a relatively low point in the first quarter of 2013 ($3.69 billion), Apple’s service revenue has steadily increased over the years. As a highlight of its impressive growth, the revenue from the segment experienced a 6.56x growth in this period, translating into an annual growth rate (CAGR) of about 20%.

Statistica

Looking ahead, I believe the company is on course to keep such strong growth rates in the years to come. Apple’s installed base of active devices is at record levels in all geographic regions. And I expect this to keep growing thanks to platform updates announced recently. Apple Intelligence – AI – is a notable example. It incorporates OpenAI’s ChatGPT across its operating systems. According to its release, a personal intelligence system is embedded in the iPhone 16 to help users “write, express yourself, and get things done effortlessly.” I expect such features to evolve into a subscription-based revenue model quickly, like other Apple services. The growth of the software/service ecosystem does not stop with AI. Elsewhere, Apple continues to add immersive content to Vision Pro, such as concerts, films, and series. Even the AirPods have potential on this front (e.g., as part of a health monitoring plan). Shortly after its launch event, news also broke that Apple had gained FDA approval for its software to use AirPods as hearing aids. More specifically,

Seeking Alpha News: The U.S. has granted Apple (NASDAQ:AAPL) approval for software that will allow for AirPods Pro to be used as over-the-counter hearing aids. The approval is for the Hearing Aid Feature medical app intended for use with certain compatible models of AirPods Pro. It’s set up through an iPhone or iPad. A user can adjust settings without the need for a hearing professional.

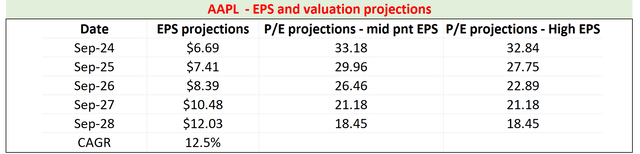

AAPL stock: EPS growth outlook

Admittedly, sales of its flagship iPhone have been slowing recently. In its FY Q3, for example, iPhone sales decreased 1% (although the growth is still positive on a constant currency basis). However, I expect the software/service growth to more than offset this. As a reflection of such potential, the following consensus estimates expect its EPS to grow from $6.69 in this fiscal year to over $12 in five years, translating into a CAGR of 12.5% in this period, a remarkable rate for a multi-trillion-dollar company.

More importantly, I will explain next that the EPS growth rate is only one benefit from the software expansion. I also anticipate the expansion of its profitability.

Author

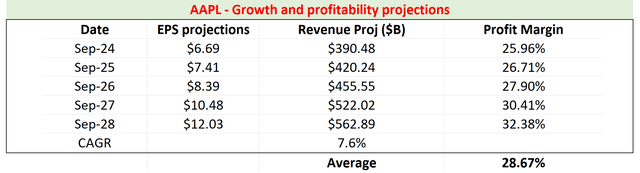

AAPL stock: Margin expansion potential

In the table, I combined its EPS estimates with the consensus revenue estimates to compute its profit margin. As seen, consensus estimates expect AAPL’s revenues to grow from $390B in this fiscal year to $562 in five years. Such an increase implies an annual growth rate of 7.7% in CAGR terms. If you recall, the earlier chart shows that its EPS growth rate is projected to be about 12.5%. Such a difference points to the expansion of its profit margin. As a simple (and crude) guesstimate shown in the table, A) I assumed its number of outstanding shares to remain constant at the current ~15.1 billion shares, and B) calculated the net profit margin implied by the above consensus EPS and revenue projections. The bottom line is that AAPL’s net profit margin is projected to expand significantly from 25.96% in FY 2024 to an average of ~28.7% in the next few years.

Author

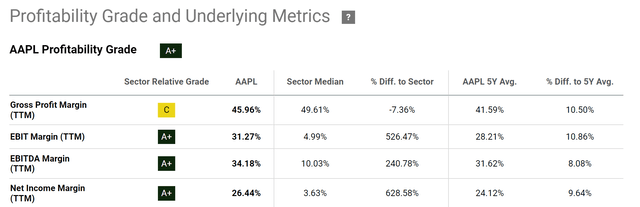

Similar to my thoughts on the EPS growth outlook, I believe that such an expansion of its net profit margin is highly possible. Software and services tend to recur much more reliably than hardware sales and enjoy far better margins. I could not find the data necessary to compute its segment net profit margins (please leave a comment if you know how/where to find such data). But I think gross margin can provide some insights already at a company-wide level, AAPL’s gross margin is about 46% as shown (and 41.6% on average for the past 5 years). As of FY Q3, the gross margin from its service segment was close to 74% in comparison. Based on the catalysts mentioned above, looking ahead, I anticipate the contribution from its services/software to keep increasing in AAPL’s income mix and thus pushing the margins up in tandem.

Seeking Alpha

Other risks and final thoughts

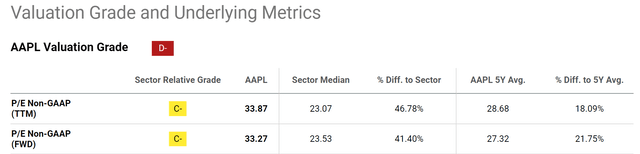

In terms of downside risks, its current valuation is at an elevated level and entails some valuation risks as its stock price hovers around all-time highs. If you recall from an earlier chart, its FY1 FWD P/E currently is about 33.2x at the price as of this writing. Even considering the variation of consensus estimates and assuming its EPS reaches the upper end of their estimates, the FWD P/E is still close to 33x. Such a level is not only far above the sector median (by more than 40% as seen from the chart below) but also above its own historical average by about 20%.

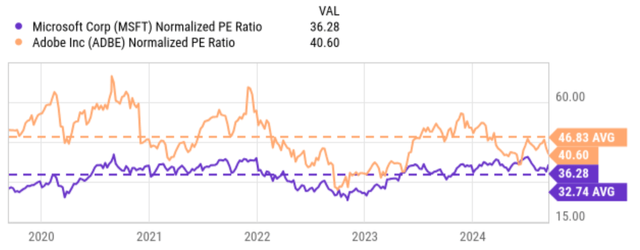

However, my view is that such a comparison of AAPL’s P/E to the sector median or its past average should be taken with a grain of salt. As the company derives an increasing portion of its income from software and subscription services, a benchmark against only this particular type of company makes more sense to me. Microsoft (MSFT) and Adobe (ADBE) are the two examples that come to mind, given their heavy reliance on such revenue generation. As seen, both companies have traded at P/E far above 33x for extended periods in the past. Specifically, ADBE’s P/E ratio has exceeded over 60 and MSFT’s exceeded 40x many times in the past five years. The average P/E ratio for ADBE during this period is 46.8x and MSFT’s average is about 33. I don’t see AAPL’s current valuation as too alarming when benchmarked this way.

Overall, I see a favorable return potential in the next few years despite the potential for near-term valuation risks. Going forward, I urge investors to look past the growth of its hardware (not only with iPhone, but also with other things such as iPad, iMac, etc.) and pay more attention to its software ecosystem. I anticipate the growth potential on this front to more than offset any slowing down on the hardware front given its installed basis. This would not only catalyze earnings growth, but would also further improve the quality of its earnings in terms of stickiness and margins.

Seeking Alpha

Seeking Alpha

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.