Summary:

- Berkshire Hathaway has recently sold a large stake in Apple.

- Buffett still believes Apple is a wonderful business.

- When questioned, Buffett explained that he sold partly for tax reasons and partly because cash is ‘attractive’.

- My analysis suggests that Apple is overvalued.

Chris Stein

Berkshire Hathaway has been reducing its stake in Apple Inc. (NASDAQ:AAPL), selling 119 million shares in the last quarter. During the last annual meeting (May 4, 2024) the first question put to Warren Buffett was directly about his views on Apple. “[Has your] view of the economics of Apple’s business or its attractiveness as an investment changed since Berkshire first invested in 2016?” In the past, Buffett has been open that Apple is a wonderful business. This question is asking whether Buffett has changed his view. His answer Here’s part of what Buffett said:

No, we have sold shares. I would say that at the end of the year it would be extremely likely that Apple is the largest common stock holding we have… We own American Express, which is a wonderful business; we own Coke which is a wonderful business and we own Apple which is an even better business. We will [continue to] own Apple…we will have Apple as our largest investment. But I don’t mind at all, under current conditions, the cash position. When I look at the alternative available in the equity markets, we find [cash] quite attractive…. We don’t mind paying taxes at Berkshire. We’re paying a 21% federal rate on the gains we are taking on Apple. It wasn’t that long ago we were paying 35%… I don’t think you’ll mind that we sold a little Apple.

Selling a little Apple, eh? The Oracle of Omaha has been selling big time. He has reduced the Berkshire stake from 789 M shares to 400M from 789M, netting around $88 billion. There are three takeaways from Buffett’s answer which help us as investors.

1. Apple is Still a Wonderful Business

It was a surprise in 2016 when Buffett first bought shares in Apple, but he has repeatedly said that it is a wonderful business with a durable competitive advantage, and he still maintains this position. And Apple is a wonderful business. The company is massive but continues to grow its business with high margins. It has an extremely strong brand, and technical prowess, and is an integral part of modern life. Apple will continue to grow its earnings over the long term.

2. Buffett sold, Likely Partly For Tax Reasons

Apple shares were trading around $23 in 2016. This has been a 10X return in ten years. The initial portion of the 389 M stake would have cost around $8.9 B, so the profits are about $79 B, a CAGR of 27%.

Buffett mentions capital gains tax as a main consideration for the sale. At 21% the tax comes in at $16.6B. However, at his cited 35% the tax would have been $27.7 B.

In the answer, Buffett talked about how it is good for companies to pay taxes, but he made it clear that he believes that the corporate tax rate is likely to go up in the coming years. He sold this stake now, in part because the capital gains taxes were relatively low, making it an opportune time to sell a huge gain.

3. Buffett may see Apple as Overvalued

In Buffett’s eyes, there is a difference between the price and the value of a business. Buffett only briefly mentions this in his answer, but he says that in current conditions he likes holding cash. That is, I believe he is more comfortable with the relative gains offered by cash than by stocks in general. In the context of the question, he implies that cash may be better than Apple stock in the short term.

Currently, the 5-year T-Bill rate is around 3.65%. My read on this is that in the current market, Buffett isn’t confident that Apple will outperform the T Bill, and he thinks that there is downside potential.

Is Apple Overvalued?

So there are two reasons that Buffett sold Apple. First, he wanted to lock in a low tax rate for capital gains. This first reason gives little reason for any investor to stay away. Second, he thinks that cash may be more attractive than Apple shares. This second reason is the reason for caution and leads to the natural question: is Apple overvalued? My analysis suggests that a fair value for Apple is around $150.

Apple’s Growth Rate

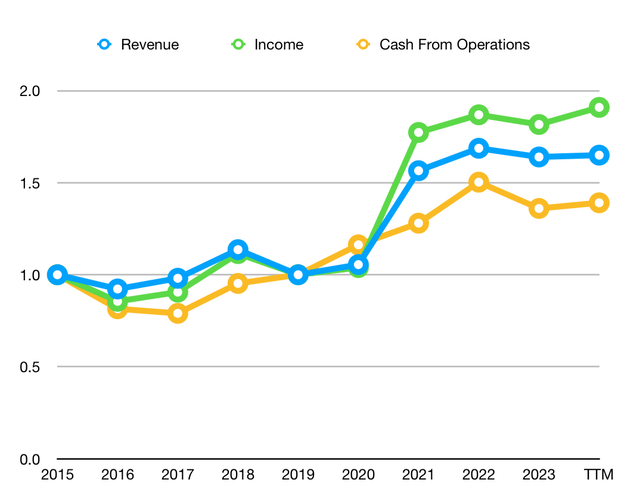

To begin we need to figure out Apple’s growth rate. Apple has consistently grown revenue, income, and cash from operations over time.

Here are the 5 and 10-year CAGRs.

| 5-Year CAGR | 10-Year CAGR | |

| Revenue | 8.1% | 6.4% |

| Income | 11.9% | 7.7% |

| Cash from Operations | 9.8% | 4.5% |

Analysts estimate earnings will grow 9.5%, 10.9%, and 12.8% in the years 2024, 2025, and 2026.

Apple Earnings Estimates (Seeking Alpha)

I see that given Apple’s earnings have grown at 11.9% in the last five years, it is reasonable that the company would grow at least 9%. Let’s use 10% in our model, to get a feel for Apple’s price.

I use three evaluation methods, taught by Phil Town and Rule #1 Investing.

Margin of Safety

The first method is about the earning power of a business. A business with a durable competitive advantage will be able to grow its earnings over time. You need to have a sense of what their earnings growth rate has been and what it will likely be in the future, which requires understanding the business. Once you can estimate the earnings growth rate, you can grow the earnings ten years out.

Apple currently has an EPS of $6.58. If we grow this for one year by 10% and then for ten years, the future EPS will be $7.69 in 2035. Apple is currently near a PE high, of 35. In the future, we will be able to find a time when the PE is 30. The share would be fairly valued in the future at $230.68.

Discounting this by a rate of 10% today gives a ‘fair value’ of $88.94.

Payback Time

The second method is called Payback Time. This method looks at the free cash flow growth over time. You think of yourself as owning the business. If you owned it, how much FCF would you get per year? You add up the growing FCF over the years. Town argues that eight years is considered a ‘fair’ amount of time to get your investment returned. If an investment can ‘pay you back’ in eight years in FCF, then it’s a good investment.

Apple currently produces $6.86 FCF/share. If we grow this by 10% and add up this cash, each share will produce $71.24 in eight years, which is the ‘buy price’ for PBT. The fair value in this view is double the buy price at $142.47.

Ten Cap

The third method is called the Ten Cap. In this lens, we imagine the business is like a rental property that we own. Each year there is cash coming off the property, which may not be growing, but is a dependable stream of income. However, we need to pay for maintenance fees. This is like Warren Buffett’s concept of Owner Earnings. Phil Town does a similar calculation to FCF, but he takes cash from operations and subtracts only the maintenance Capex, which is a proxy for depreciation, and adds back to the tax benefit. This is the annual owner earnings. If a property pays 10% of its invested capital back a year, it is called a ten cap. Anything that is a ten cap or higher is a good investment.

(In billions) the operating cash flow of Apple is $113; the depreciation is $11.2; the tax benefit is $18.9. These numbers yield owner earnings of $120.8 billion, or $7.95 per share. If you held these shares for ten years, they would throw off $79.45, which would be a ‘good deal.’ This evaluation implies a fair value of $158.91.

Summary of Evaluation

All three evaluation methods suggest that Apple is overvalued. I think that the MOS analysis probably underplays the price, but my analysis suggests a fair value of about $150.

Conclusion

It makes sense to me that the shares of Apple would be overpriced. The momentum of the magnificent seven has been driven by excitement over AI, as well as excellent results. There has been a ‘flight to quality’

This does not mean that Apple will crash anytime soon. The stock is well-loved and has great momentum. I would not put a short position on this.

History has shown us that Buffett builds cash positions before a crash. He claims that he doesn’t predict the market, but he does have an opinion on ‘current conditions,’ which leads him to hold onto cash for extended periods. In general, he will build cash positions for years.

To me, Buffett’s sale isn’t a warning to go screaming for the hills. The company is still wonderful. However, his sale is a caution that the shares might be overvalued and there may be a better entry point in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.