Summary:

- Apple Inc. shares are down 4% after being sued by the Department of Justice in a major antitrust case.

- The lawsuit alleges that Apple has violated the Sherman Act by limiting competition and functionality on its iPhone.

- The outcome of the lawsuit is uncertain, but if Apple loses, it could face a hefty fine and potential brand damage.

alfexe

Article Thesis

Apple Inc. (NASDAQ:AAPL) shares are under pressure on Thursday due to news about the company being sued by the United States Department of Justice in a major antitrust case. While the outcome of this lawsuit isn’t known yet, it is a potential major issue for Apple. Since Apple doesn’t look especially compelling at current prices anyway, I believe, due to a rather high valuation considering the meager growth, staying on the sidelines until we know more about the DOJ lawsuit could make sense.

What Happened?

At the time of writing, Apple is down 4% on Thursday. For a behemoth like Apple Inc., that’s a pretty large share price movement — it equates to a huge $110 billion market capitalization move, after all.

The reason for the large movement in Apple’s share price is the fact that the company is being sued by the Department of Justice. Seeking Alpha reports:

The Justice Department filed the civil suit in a New Jersey federal court alleging Apple has violated the Sherman Act by using its iPhone to prevent other companies from offering competitive services such as digital wallets. The suit also alleges Apple limits the functionality of hardware and makes it difficult for users to switch to and communicate with competitive devices, such as Android phones.

What the Department of Justice criticizes isn’t new. In fact, these allegations or observations have been made in the past by many users, companies, and so on. Some have noted that Apple has favored its own music service over competing offers such as Spotify’s (SPOT) music service, for example. Communication between two iPhones also is easier compared to communication between an iPhone and an Android phone such as a Samsung (OTCPK:SSNLF) smartphone — that isn’t really new.

Apple and other major tech companies have been sued in the past as well, including by the European Union, in cases that have sometimes resulted in billion-dollar fees. Just a couple of weeks ago, for example, Apple was fined around $2 billion in a lawsuit from Spotify with rather similar accusations compared to what the DoJ is claiming today: The EU ruled that Apple had engaged in anti-competitive behavior and that it was abusing its monopoly status to hurt competing offerings, such as favoring its own music app over Spotify’s music app.

What Does Apple Say?

In a statement to Seeking Alpha (see link above), Apple said the following:

This lawsuit threatens who we are and the principles that set Apple products apart in fiercely competitive market. If successful, it would hinder our ability to create the kind of technology people expect from Apple—where hardware, software, and services intersect. It would also set a dangerous precedent, empowering government to take a heavy hand in designing people’s technology. We believe this lawsuit is wrong on the facts and the law, and we will vigorously defend against it.

It is not surprising that Apple argues that it did nothing wrong, and that’s a good thing for shareholders, of course. After all, it is possible that Apple will win the lawsuit and come out unscathed.

One can, of course, agree with Apple’s argument about government powers and that the state shouldn’t intervene too much when it comes to the tech products people buy and use.

On the other hand, monopoly laws exist for a reason, and when a single entity becomes too powerful, markets may not function properly — that’s why Standard Oil had to be broken up, for example. Whether that is applicable for Apple is up for debate, and will, it seems, be ultimately decided in court. But the recent EU ruling suggests that there is at least some truth to the Department of Justice’s claims about Apple engaging in anticompetitive behavior. If that turns out to be true, then the company has to be (and will be) fined for that.

What Could The Impact On Apple Look Like?

For now, we don’t know what courts will ultimately decide. But it seems clear that the best-case scenario for Apple shareholders is that Apple wins — in that case, Apple should be able to continue doing business the way it has done in the past. There would be no fine that would hurt the cash position and balance sheet. In other words, the best-case scenario is that “nothing happens” and things go on as they did.

If Apple loses in court, however, the company could be negatively impacted in several ways. First, the company would face a potentially hefty fine. While Apple has the cash position to pay a major fine, the cash position would still shrink, all else equal, potentially reducing the pace of Apple’s buybacks. As buybacks have been an important source of earnings per share growth in the past, that would be a negative outcome for Apple. If Apple loses in court, there could also be some brand damage. Apple would, I believe, retain a still very strong brand, but some (potential) customers might think worse about the company in a scenario where Apple loses this lawsuit.

Also, a potential lawsuit loss could force Apple to open up its ecosystem. In that case, users might be more prone to combine an iPhone with a Samsung smartwatch, or they might feel more comfortable using competitors’ apps on Apple’s hardware devices. Services revenues could be negatively impacted if Apple is forced to “play nice” with outside app developers and users could have an easier time combining hardware products from different companies.

The moat around the Apple ecosystem would be less pronounced in that case. The strong ecosystem and huge moat around it are beneficial for Apple today, thus if the company is forced to make changes going forward, these benefits might be less pronounced in the future. Apple would still be highly profitable, of course, but it might see its margins decline to some degree.

When the best-case outcome of this lawsuit can be described as “nothing changes” while the worst-case scenario is meaningfully negative for Apple, then the lawsuit naturally is a considerable risk factor for Apple, which is why the negative share price reaction to this development isn’t surprising. One can argue whether a $110 billion market capitalization hit is justified, but it makes sense that Apple’s shares pull back on this news.

Is Apple A Good Investment?

While this new lawsuit is a headwind for Apple, we have to consider other things as well, of course. Right now, Apple is valued at 26x to 27x forward earnings, which makes for an earnings yield of a little less than 4%. That is not necessarily a high valuation for a fast-growing company, but Apple isn’t growing fast.

For the current year, analysts are predicting revenue growth of just 1%, which is significantly less than the rate of inflation. In other words, Apple is shrinking in real terms — which doesn’t justify a high valuation.

Recent news out of China suggests that Apple is struggling in the country, which is a major problem, as China has been one of the markets fueling Apple’s growth in the past.

Last but not least, Apple seems to be behind its big tech peers when it comes to benefitting from the current AI mega-trend. Microsoft (MSFT), Alphabet (GOOG, GOOGL), Meta Platforms (META), and, of course, Nvidia (NVDA) are better positioned to capitalize on the AI theme. Maybe Apple is working on something big that is AI-related, but at least for now, it looks like it has missed this trend to some degree.

While Apple is a quality company with a strong balance sheet, an earnings yield of less than 4% for a company that is facing a major DoJ lawsuit and that is shrinking in real terms isn’t a great deal, I believe. At least for now, I am staying on the sidelines — not because Apple is a bad company, but because it is still too expensive for my taste. Not too many years ago, Apple stock was trading at a mid-teens earnings multiple, after all.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

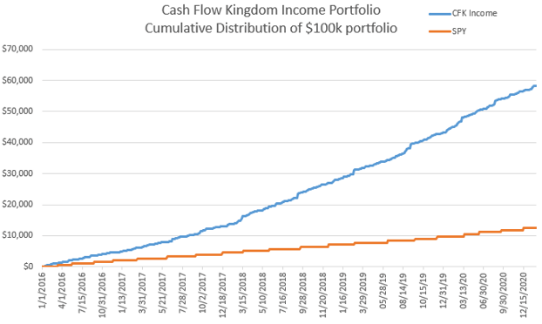

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!