Summary:

- Based on some of my favorite momentum-trend oscillators of price, Apple appears to be due for a drop from $165.

- Using past instances of overbought conditions during the 2021-23 bear market in Big Tech names, a -10% to -15% price drawdown may be next.

- I have an initial selloff target back to the 200-day moving average in the $150 area. Otherwise, investors should wait for quotes around $120 for better growth/value buy support.

Nikada

The short-term Apple (NASDAQ:AAPL) price outlook for share trading is not very bullish, after reviewing and considering its recent overbought condition on the charts. My current rating view is $165 has drifted into Sell territory from my last Hold mention during January here. In fact, I am maintaining my buy zone of $120 a share for a “fair” valuation, based on high inflation and interest rates, and much slower company growth caused by its raw world-leading size at $2.6 trillion in equity market capitalization.

Not Much Value or Growth to Support Shares

My biggest gripe against buying Apple stock at $165 is its valuation still does not make any common sense to own. Sure, price has held up stronger than other Big Tech names since the late 2021 peak. But, Apple’s valuation setup is very, very extended vs. its own history trading the last decade. Below is a quick review of the fundamental backdrop.

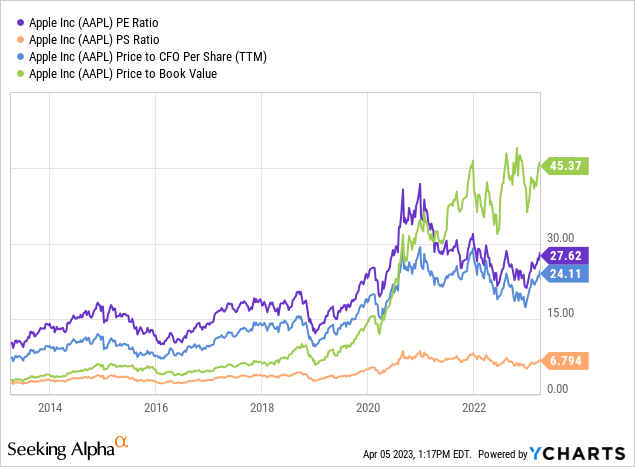

First, looking at price to trailing results, Apple is not remotely cheap compared to the last 10 years of trading. A P/E of 27x, sales ratios of 6.8x, cash flow of 24x, and book value of 45x, means shares are priced in the upper 10% to 20% of its long-term average range.

YCharts – Apple, Price to Trailing Fundamentals, 10 Years

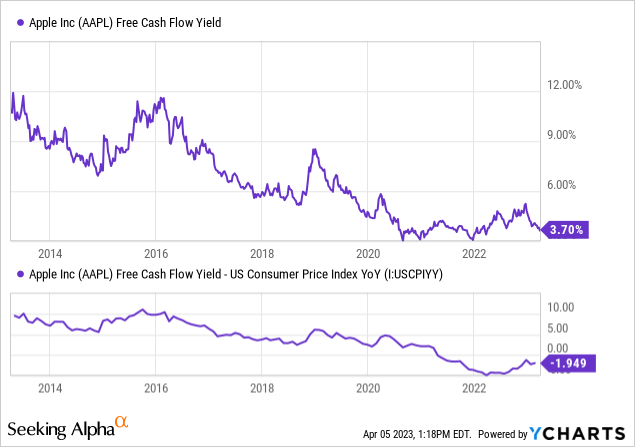

Plus, “free” cash flow or earnings generation compared to underlying inflation rates are actually horrible. Why do I want to own 3.7% in free cash flow vs. 5.7% YoY CPI inflation rates? I am locking in a return that is not keeping up with basic cost-of-living adjustments. During 2014-16, free cash flow generation on the stock quote was a positive +10% vs. inflation, not today’s negative -2% number. As an investor, you want to at least beat inflation for a cash return when you own a business. You are kind of shooting yourself in the foot long term, when putting money into a negative adjusted real-return number off the bat.

YCharts – Apple, Trailing Free Cash Flow Yield to CPI Inflation Rates, 10 Years

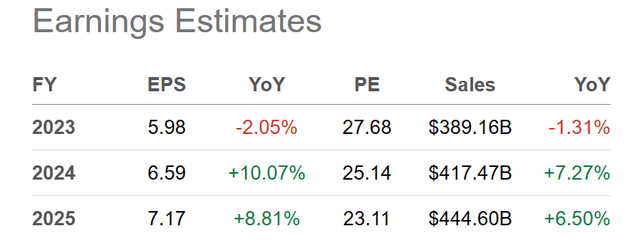

The only logic you might consider an upside-down real return upfront would revolve around outstanding growth projections. Alas, Apple is so huge in size, outsized growth is now mathematically impossible. Current Wall Street forecasts are hoping for single digit growth between 2023-25. In addition, this projection does not include a major recession destroying demand for Apple’s gadgets and subscriptions, or production/sales issues in problematic China.

Seeking Alpha Table – Apple, Analyst Estimates for 2023-25, Made on April 4th, 2023

Technical Chart to Avoid

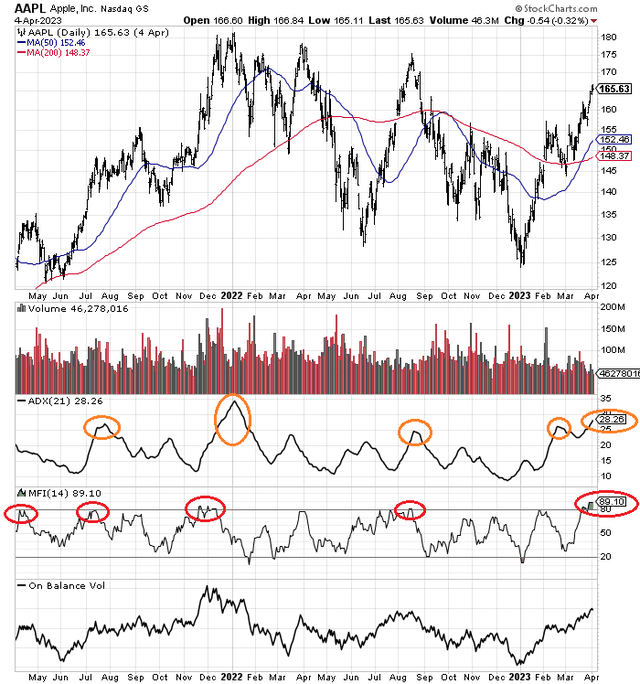

If honest growth and value characteristics are absent from the Apple investment equation, what does the chart pattern suggest? Actually, the short to intermediate-term outlook for share trading is quite bearish, in my opinion.

Why? Because a sharp gain from $125 at the beginning of the year to $165 on Tuesday (April 4th, 2023) has become quite overbought. If sound reasons do not exist for this +35% price gain, I lean toward selling the spike, not buying it.

On the 2-year chart below of daily price and volume changes, I have circled the 21-day Average Directional Index scores above 25 (in orange), alongside the 14-day Money Flow Index readings above 80 (in red). Both have been excellent indicators of an impending turn lower in price, at least over the next 4-8 weeks. I would interject the present overbought momentum setup closely resembles the December 2021 topping period best.

Hence, a downgraded view to Sell can be my only reaction, taking all the technical and fundamental variables into consideration.

StockCharts.com – Apple, Daily Price & Volume Changes, Author Reference Points, 2 Years

Final Thoughts

I remain in the bearish camp for the overall U.S. equity market also. Projecting a -10% or-15% decline in Apple is something of a “normal” expectation against a similarly-sized projected drop in the S&P 500 sooner or later during 2023. The main reason I am waiting for better stock market pricing is a recession has not really been discounted into equity pricing yet. Trust me, when the recession hits corporate earnings (already stressed my rising labor wages and soaring interest rates on debt), a 20% to 50% decline in business profitability will wipe the shine off Wall Street’s early 2023 equity advance.

Unfortunately, the Federal Reserve cannot lower interest rates appreciably until the stock market drops appreciably. If they do ease too aggressively too soon, the dollar exchange rate may tank, reigniting inflation. I discussed this Catch-22 situation back in January here. And, my worries regarding a recession and continued bear market in stocks have only become more pronounced over the last few months.

For Apple specifically, I don’t understand the upside story right now. Talk to me again at $120, if it happens in coming months. To buy shares at $165, you have to believe in a “goldilocks” soft-landing scenario, where inflation and interest rates decline, while the economy and consumer/business demand for Apple products hold up well. Then, you have to hope and pray American/Chinese government relations improve from the rotten setting in early 2023. With most of Apple’s production originating in China (and a good chunk of sales also), upset relations could quickly descend into trade embargos and new taxes on cross border trade. An approaching TikTok decision to remove/ban this popular application from America could telegraph real problems for the Apple business model soon (outsourcing production to Asia).

I now rate shares a Sell, with an expectation I will upgrade my outlook back to Hold around the 200-day moving average at $150. Until then, I would avoid putting money into shares, patiently waiting for this pullback, at a minimum. Again, serious buying should wait for $120 or lower quotes, where the growth and value story sits, at least using the regular financial math that existed before 2019 on Wall Street.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. When investing in securities, investors should be able to bear the loss of their entire investment and should make their own determination of whether or not to make any investment based on their own independent evaluation and analysis. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but the author’s opinion written at a point in time. Opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.