Summary:

- At a time of peak recessionary fears, AAPL continues to maintain its outperformance against the market-wide destruction thus far, against the FAAMG stocks and the S&P 500 Index.

- While it remains to be seen if AAPL is “recession-proof”, the stock’s support level has been more than stellar, particularly from Berkshire Hathaway and retail investors alike.

- We think this trait alone is naturally worth a premium, despite the company’s decelerating growth, elevated valuations, and deteriorating balance sheet.

- We shall discuss this further.

Fugacar/iStock via Getty Images

We previously covered Apple (NASDAQ:AAPL) here. The impact of the Digital Markets Act in the EU was discussed then, which might force AAPL to allow third-party app stores and alternative payment methods in the iOS walled garden. After careful deliberation, we concluded that the new regulation might have a less-than-expected impact on the company’s top and bottom lines ahead.

For this article, we will focus on AAPL’s double misses in the FQ1’23 earnings call and the irrational rally in its stock price afterward. It appears that there may be a notable disconnect between the company’s expanding NTM Price/ Sales valuation and the decelerating top-line growth, particularly with the deterioration of the company’s balance sheet over the past few years. However, with the stock continuing to defy the stock market’s pessimism at a time of peak recessionary fears, we reckon the stock deserves its premium to a certain extent.

The Premium Investment Thesis

The AAPL stock still commands an elevated NTM Price/ Sales valuation of 6.04x at the time of writing, notably elevated compared to its 3Y pre-pandemic mean of 3.38x. While this normally points to higher forward growth, we are uncertain if the company’s performance thus far supports this number.

Pre-pandemic, AAPL reported a top-line CAGR of 6.45% between FY2016 and FY2019, with the pandemic bringing forth a stellar number at 11.28%. However, analysts’ forward estimates are less impressive, with a projected revenue CAGR of 3.8% through FY2025. This does not quite suggest a high-growth stock in our view.

While its EPS growth has been excellent at a CAGR of 12.7% pre-pandemic and 27.1% during the pandemic, things are expected to decelerate moving forward at a CAGR of 4.8% through FY2025.

We must also highlight that part of AAPL’s EPS improvement was also attributed to the declining share count by -12.9% from 18.59B in FY2019 to 16.18B by the latest quarter. However, this feat had cost the smartphone giant an eye-watering sum of $94.05B over the last twelve months [LTM], one that had continued to grow tremendously at a CAGR of 10.5% from $69.71B in FY2019.

While the company reported excellent Free Cash Flow generation of $97.49B over the LTM, expanding at a CAGR of 18.30%, much of its robust cash flow had been diverted toward its growing share repurchase programs. As highlighted by Bloomberg, it “had shelled out more than $550B buying back its own shares over the past decade, more than any other US company.”

Notably, AAPL’s balance sheet has also drastically deteriorated to net debts of $48.27B by the last quarter, compared to FY2019 levels of -$8.75B and FY2020 levels of $7.72B. While the company’s long-term debts have remained stable at ~$98B over the past few years, the cash/ short-term investments have significantly declined by -48.9% from $100.55B in FY2019 to $51.35B by FQ1’23.

On top of that, its dividends were a measly $0.92 per share over the LTM, yielding a mere 0.6% against its 4Y average of 0.84% and sector median of 1.44%. This points to its unlikely prospects of being a rewarding dividend stock as well.

Naturally, we are not here to bash AAPL, since we personally own the stock as part of our retirement plans. For one, the stock has the most crucial trait for any investor’s portfolio, namely its historical and future prospects in outperforming the wider market.

Future performance is not guaranteed by past performance. However, the AAPL stock generated a 5Y stock price return of 256.7% and a 10Y stock price return of 847.49%. This was stellar, against the S&P 500 Index’s 51% and 169.14%, respectively.

Meanwhile, it is no secret that we are in the middle of an economic downturn, as the Fed hikes interest rates to the highest levels since 2007. With the projected terminal rates of up to 5.1% by mid-2023 and a potential pivot only from 2024 onwards, the elevated interest rate pain may not ease anytime soon.

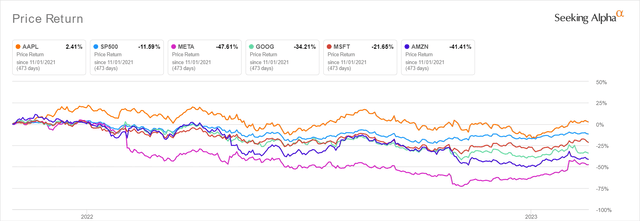

FAAMG Stock Performance Since November 2021

So, how has the stock been affected thus far? Well, it is apparent that AAPL stock is the only one of the FAAMG stocks in the green after the drastic normalization of post-hyper-pandemic levels.

At the time of writing, the stock reported 2.41% of price returns since November 2021, with the rest of the FAAMG stocks in the red, particularly Amazon (AMZN) at -41.41% and Meta Platforms (META) at -47.61% thus far, with the S&P 500 Index similarly declining by -11.59% at the same time.

The stock market’s pessimistic pull constantly dragged the AAPL stock down from the heights in the $170s in 2022 and $150s over the past few months, preventing its attempts at breaking out from these resistance levels. This was naturally attributed to the peak recessionary fears and Foxconn headwinds over the past few months. Its financial performance and balance sheet left something to be desired as well, due to the maturing nature of the business.

Nonetheless, the AAPL stock’s outperformance has also been defying the market correction to a certain extent, which demonstrates the incredible support it enjoyed from institutional and retail investors alike. The stock comprised 42% of Berkshire Hathaway‘s (NYSE:BRK.B) (NYSE:BRK.A) portfolio worth approximately $299B, clearly signifying Warren Buffett’s conviction buy. It was unsurprising then that the stock had continued to bounce off the $120s to $130s support level, despite the multiple headwinds over the past few months.

While it remains to be seen if AAPL may be recession-proof, the stock’s outperformance has been more than stellar. This is especially true since most stocks in our portfolio have underperformed during these uncertain times. That feat alone deserves a certain premium, in our opinion, which is why we continue to nibble on the stock at most dips. Naturally, the question is how much is this redeeming quality worth?

So, Is AAPL Stock A Buy, Sell, or Hold?

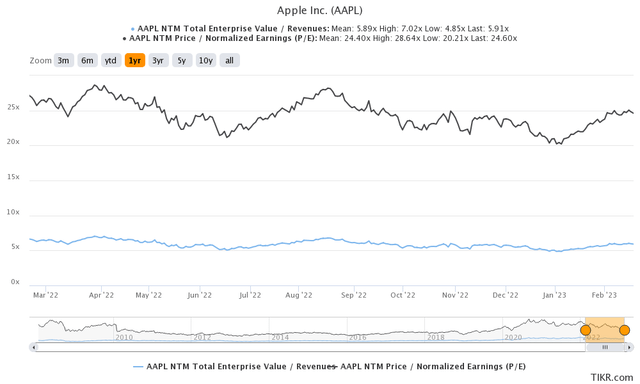

AAPL 1Y EV/Revenue and P/E Valuations

AAPL is currently trading at an EV/NTM Revenue of 5.91x and NTM P/E of 24.60x, higher than its 3Y pre-pandemic mean of 2.87x and 15.62x, respectively. Otherwise, it is relatively in line with its 1Y mean of 5.89x and 24.40x, respectively.

Based on its projected FY2024 EPS of $6.57 and current P/E valuations, we are looking at a moderate price target of $161.62. This suggests minimal upside potential from current levels indeed.

AAPL Stock Price

This is not surprising, due to AAPL’s notable 18.7% recovery to $148.48 from the January 2023 bottom of $125.02. However, we reckon the optimism may be moderately digested ahead, attributed to the hotter-than-expected January 2023 CPI. The latter has stoked more concerns about the Fed’s next meeting in March 2023, with 81.9% of analysts expecting another 25 basis points hike then.

In addition, AAPL’s forward guidance is underwhelming, with “March quarter YoY revenue performance to be similar to the December quarter.” We infer that FQ2’23 revenues may also be impacted with a -5.5% YoY decline to $92.2B, partly due to a forex impact of up to -5 percentage points.

On one hand, the management guided improved next quarter gross margins of between 43.5% and 44.5%, suggesting a potentially improving Cost of Goods Sold across its product offerings, against FQ1’23 levels of 43% and FQ2’22 levels of 43.7%.

On the other hand, AAPL’s guidance in operating expenses of up to $13.9B implies rising inflationary pressure on labor costs and accelerated investment in R&D by +10.4% YoY. While the latter may suggest long-term efforts in future product launches, such as the reported mixed-reality headset by 2023, foldable iPad by 2024, and Apple Car by 2026, we reckon these may trigger more bottom-line headwinds in the short term.

We had seen a similar impact in FQ1’23 as well, with the smartphone giant reporting top and bottom line misses by -3.8% and -3.7%, respectively, despite the lowered consensus estimates by -8% due to forex and Foxconn headwinds.

Therefore, long-term investors may be well advised to wait for another pullback to the November 2022 support level in the low $130s, for an improved margin of safety to our price target. Do not chase this rally.

Interestingly, Warren Buffett had similarly done so by buying more AAPL at an average price of $129.93 sometime in early 2023, based on Berkshire Hathaway’s latest 13F filing.

Disclosure: I/we have a beneficial long position in the shares of AAPL, META, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.