Summary:

- The dust is beginning to settle after the recent launch of Apple’s Vision Pro with different views about the growth potential in this segment.

- We have heard about the VR/AR efforts of Apple for over 8 years and is likely that the eventual impact on Apple’s bottom line will not match the hype.

- The bill of material for Vision Pro is over $1500 which shows the staggering cost to build this device and the impact on margins.

- Apple has a poor record of competing with US-based tech giants like Amazon and Google in segments like home devices, smart speakers, music streaming, video streaming and others.

- The overall impact on the bottom line of Apple due to VR will be marginal or negative depending on the resources it allocates.

Nikada/iStock Unreleased via Getty Images

Apple’s (NASDAQ:AAPL) management had hyped its VR efforts for several years. The recent launch of Vision Pro showed some good features which might help Apple’s ecosystem of products and devices. However, the short to medium-term impact of VR on Apple’s top line and bottom line will likely be negligible. One of the most talked about aspects of Vision Pro was its price which should give a sticker shock to most customers. However, the bill of materials, BOM, to make this device is equally high. According to third-party estimates, the BOM of Vision Pro is over $1500.

Apple will need to compete against lower-priced Meta (META) devices and we could also see other big tech giants jump into this category. Apple has a poor record of competing against Amazon (AMZN) and Google (GOOG)(GOOGL) in segments like home devices, smart speakers, streaming, and others. The upside potential of this device in the near term is quite low. On the other hand, if Apple decides to allocate massive resources in VR similar to Meta, we could see a decline in overall margins and EPS. As mentioned in a previous article, we are already seeing strong declines in Services growth numbers which was seen as a key growth business for the company.

Apple stock is trading at its peak valuation while the company is seeing headwinds due to tougher comps, inflation, and other macroeconomic challenges. This can cause a correction in the stock in the near term as Wall Street prepares for a possible recession.

Was the hype justified?

The jury is still out on whether the hype around Apple’s VR efforts was justified. We have seen articles published in 2015 that mention the possible growth potential of VR. Recently, a very detailed analysis shows that Apple’s Vision Pro could be the start of a new computing paradigm. It is still quite early to gauge the reaction of customers to this device. The pricing of the device has certainly caught everyone’s attention. At $3499, it is one of the most expensive items launched by the company. Apple has been able to turn high-tech products in mass market items which has allowed the company to deliver better margins than competitors. But it would be difficult to attract a significant customer base at that price level.

Another major challenging factor for Apple is that it will be directly competing with Meta. We have seen Meta invest billions of dollars in its VR business and the company has a good head start over Apple. In the past, Apple has not performed well when it was in competition with big tech companies.

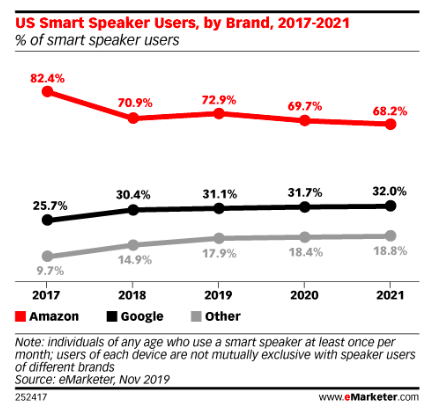

Apple’s products in the home speaker business have not gained a significant market share. The original HomePod was labeled as too expensive. Apple was forced to lower the price and launch HomePod mini to better compete with Amazon’s Echo and Google’s Nest. CIRP has mentioned that Amazon’s Echo has a two-thirds market share, Google has a quarter while Apple’s HomePod has only 6% market share.

eMarketer

Figure 1: Market share trend in smart speaker segment. Source: eMarketer

Earlier report by eMarketer also pointed to a trend where Amazon and Google were able to maintain their market share in this segment. Meta’s Zuckerberg has put a lot of resources into developing the VR customer base. It is unlikely that Meta will easily give up market share to Apple, even if it requires giving higher discounts on Quest products.

Apple has also not gained any pricing premium for Apple Music and is priced at the same level as Spotify (SPOT), Amazon Music, and others. This shows that customers are not going to pay a premium for every product or service launched by the company.

Apple TV+ is also having a hard time attracting and retaining customers. This service has the highest churn rate despite the low cost and the massive billion-plus devices that Apple has in its ecosystem.

Any serious mass-market VR product by Apple would need to be lower than $1,000. It would take some iterations before Apple might come out with cheaper devices. This should give Meta and other competitors enough time to change their strategy and build a better moat for their devices.

Vision Pro is expensive to build

The core issue is that Vision Pro has a very expensive bill of materials. Third-party estimates put the BOM at over $1500. Apple did not have much choice other than go for premium pricing in order to retain some margins in this device. It should be mentioned that Apple’s R&D cost has been increasing significantly. Apple has a long history of working with contractors to lower the BOM of its devices.

We could see some reduction in BOM once the supply chain becomes stronger. However, it is unlikely that Apple would be able to reduce the material cost by half or more without hurting the features of Vision Pro. This should result in higher pricing for Vision Pro in the next two or three iterations.

Another factor that works against Vision Pro is that it will be used indoors. Customers are usually ready to pay an additional premium for luxury products that are “socially visible”. Airpods, watch and other devices which are easily visible in the public have generally fared better than HomePod or other home devices launched by Apple.

Fall in Wearables segment

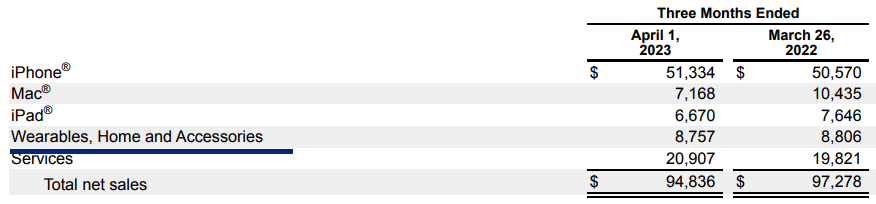

Apple reported another drop in revenue for its Wearables, Home and Accessories segment in the recent quarter. This segment reported revenue of $8.7 billion compared to $8.8 billion in the year-ago quarter. A part of this decline can be explained by the macroeconomic challenges faced by the company due to inflation, geopolitical tensions, and recessionary fears. However, the Wearables segment has also seen a gradual decline in growth rate due to a lower market share of smart home devices launched by Apple.

Company Filings

Figure 2: Segment revenues of Apple in the latest quarter. Figure: Company filings

The contribution of Vision Pro to Wearables segment and the overall revenue base would be quite low in the near term. Even if Apple is able to sell 5 million units of Vision Pro annually at an average selling price of $3,000, it would still have a revenue contribution of $15 billion. In the last fiscal year, Apple had total net sales of $394 billion and the Wearables segment alone had over $41 billion in net sales. Hence, the contribution of Vision Pro would be less than 5% to net sales.

As mentioned above, this is a very high price point and it would be difficult for Apple to find a mass market for this product. Customers have the option of choosing a good enough Meta Quest product at a significantly lower price. Meta is investing billions of dollars to build a better VR ecosystem and add new features. This should allow Meta to keep a good pricing advantage compared to Vision Pro for the next few years.

The unit economics do not work well for Apple unless it can sell a high volume of devices. It would be inevitable that Vision Pro sees a lower-priced option but higher bill of material could prevent Apple from pricing it significantly lower.

Impact on Apple stock

The hype around VR seems to be overplayed. It is still a number of iterations away from becoming a mass-market product. Apple will be facing a very strong competitor in Meta which has made a very bold bet on VR. Meta has the resources, first-mover advantage, ecosystem, and brand prestige to defend its market share. Even a lower-priced Vision Pro at close to $1,500 could find it difficult to compete with Meta’s products. We have already seen this trend in the home speaker market where Apple had difficulty gaining even double-digit market share from Amazon and Google.

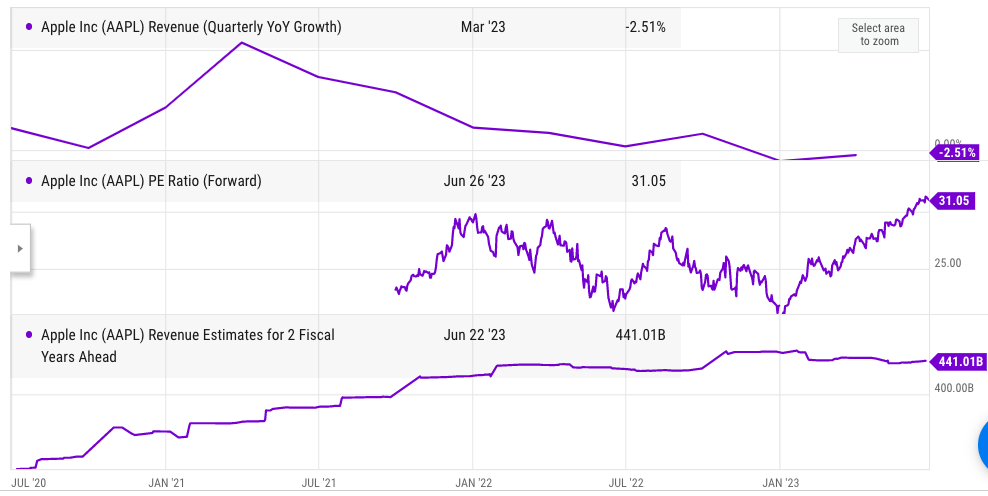

Ycharts

Figure 3: YoY revenue growth, forward PE ratio and forward revenue estimates of Apple. Source: Ycharts

Apple’s YoY revenue growth has been falling for the past few quarters. It has reported negative revenue growth for the past two quarters and it is very likely that the full fiscal year revenue growth will also be negative. At the same time, the forward PE ratio is at a historic high of over 30. Most of the recent bull run has been due to bullish momentum across big tech stocks. However, another few quarters of YoY revenue decline could lead to a big correction in the stock.

Apple does not have a rapidly growing segment similar to cloud business of Microsoft (MSFT), Google, or Amazon. Even Services segment of Apple grew by a mere 5% in the recent quarter. The Services segment is facing massive challenges due to new regulations in the App Store. Regulators are also looking at the licensing deal between Apple and Google if it creates a monopolistic system.

The VR segment has been overhyped by the management and the revenue contribution of this device in the next few iterations will likely be very modest. Investors should look closely at the current valuation of the stock and gauge the potential of a 20%-30% correction in the stock if the revenue continues to decline in the next few quarters.

Investor Takeaway

Apple’s VR entry has caught the attention of customers, especially for the staggering price point of the Vision Pro. Apple has not been able to gain a good market share in the past in a number of segments when it was competing with US-based Big Tech companies. This includes home devices, smart speakers, music streaming, video streaming, and more. Apple will be facing very strong competition from Meta which is investing billions of dollars to build the devices and ecosystem for its VR segment.

The high bill of materials and the sticker shock of Vision Pro can lead customers to opt for good enough products by Meta. The contribution of Vision Pro to Apple’s top-line and bottom-line growth will also be minimal in the next few iterations. At the same time, Apple’s forward PE ratio is over 30 which is twice the average PE ratio of Apple stock prior to the pandemic. A few more quarters of YoY revenue decline could deflate the current bullish run in the stock and lead to a major correction.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.